diff --git a/openbb_terminal/terminal_controller.py b/openbb_terminal/terminal_controller.py

index d532fb10c04f..50133a565999 100644

--- a/openbb_terminal/terminal_controller.py

+++ b/openbb_terminal/terminal_controller.py

@@ -21,7 +21,6 @@

from prompt_toolkit.completion import NestedCompleter

from prompt_toolkit.formatted_text import HTML

from prompt_toolkit.styles import Style

-from rich import panel

import openbb_terminal.config_terminal as cfg

from openbb_terminal.account.account_controller import (

@@ -501,16 +500,17 @@ def call_funds(self, _):

def call_intro(self, _):

"""Process intro command."""

- import json

+ webbrowser.open("https://docs.openbb.co/terminal/usage/basics")

+ # import json

- intro: dict = json.load((Path(__file__).parent / "intro.json").open()) # type: ignore

+ # intro: dict = json.load((Path(__file__).parent / "intro.json").open()) # type: ignore

- for prompt in intro.get("prompts", []):

- console.print(panel.Panel(f"[purple]{prompt['header']}[/purple]"))

- console.print("".join(prompt["content"]))

- if input("") == "q":

- break

- console.print("\n")

+ # for prompt in intro.get("prompts", []):

+ # console.print(panel.Panel(f"[purple]{prompt['header']}[/purple]"))

+ # console.print("".join(prompt["content"]))

+ # if input("") == "q":

+ # break

+ # console.print("\n")

def call_exe(self, other_args: List[str]):

"""Process exe command."""

@@ -705,11 +705,11 @@ def terminal(jobs_cmds: Optional[List[str]] = None, test_mode=False):

if first_time_user():

try:

- t_controller.call_intro(None)

+ # t_controller.call_intro(None)

+ webbrowser.open("https://docs.openbb.co/terminal/usage/basics")

# TDDO: Fix the CI

except EOFError:

pass

-

t_controller.print_help()

check_for_updates()

diff --git a/website/content/terminal/usage/basics/index.md b/website/content/terminal/usage/basics/index.md

index b492120fc8b4..67789c9d43c1 100644

--- a/website/content/terminal/usage/basics/index.md

+++ b/website/content/terminal/usage/basics/index.md

@@ -1,118 +1,316 @@

---

title: Basics

-description: The OpenBB Terminal is a modern investment research platform for everyone. It is a desktop application that allows you to access all the data and tools you need to make better investment decisions.

-keywords: [basics, installation, commands, menus, your own data, introduction, openbb terminal, explanation, basic usage, usage, how to, install, keyboard input]

+description: An introduction to the The OpenBB Terminal, a Command Line Interface (CLI) application. Functions (commands) are called through the keyboard with results returning as charts, tables, or text.

+keywords: [basics, commands, functions, features, menus, introduction, openbb terminal, obb, usage, how to, charts, tables, themes, styles, functions, data, sources, getting started]

---

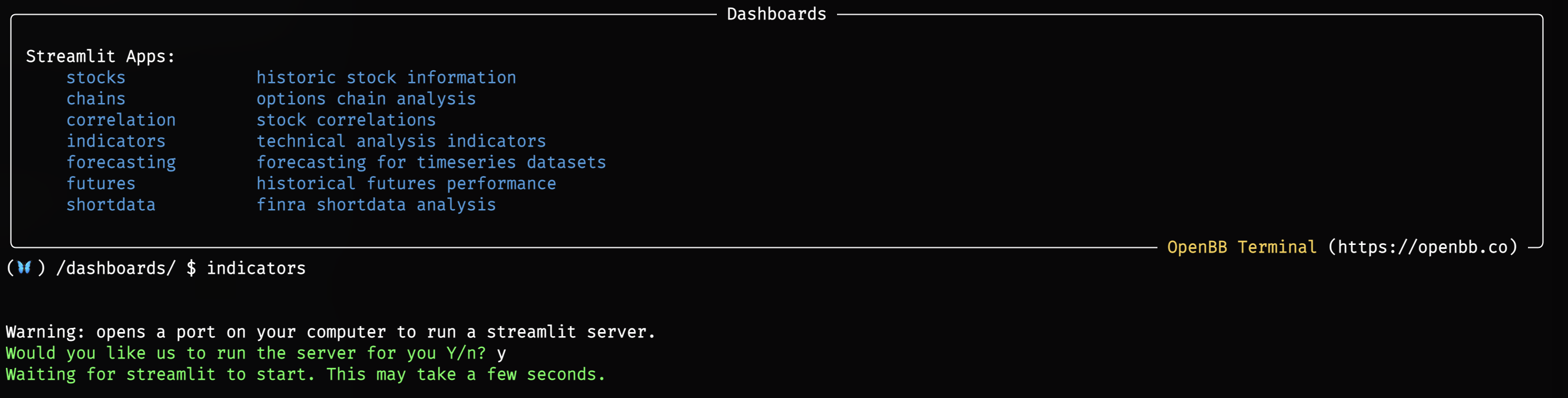

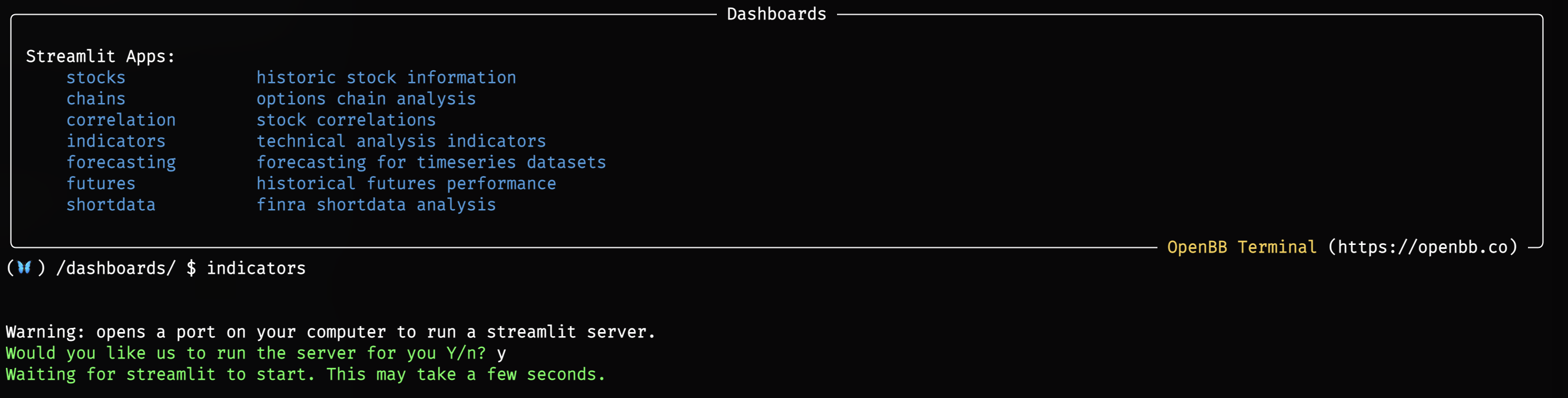

+## Overview

+

import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

-The OpenBB Terminal is based off the Command Line Interface (CLI)

-which is installed by default on every computer. By opening the application you have installed from the [Installation Page](/terminal/installation/windows),

-you are greeted with the following interface:

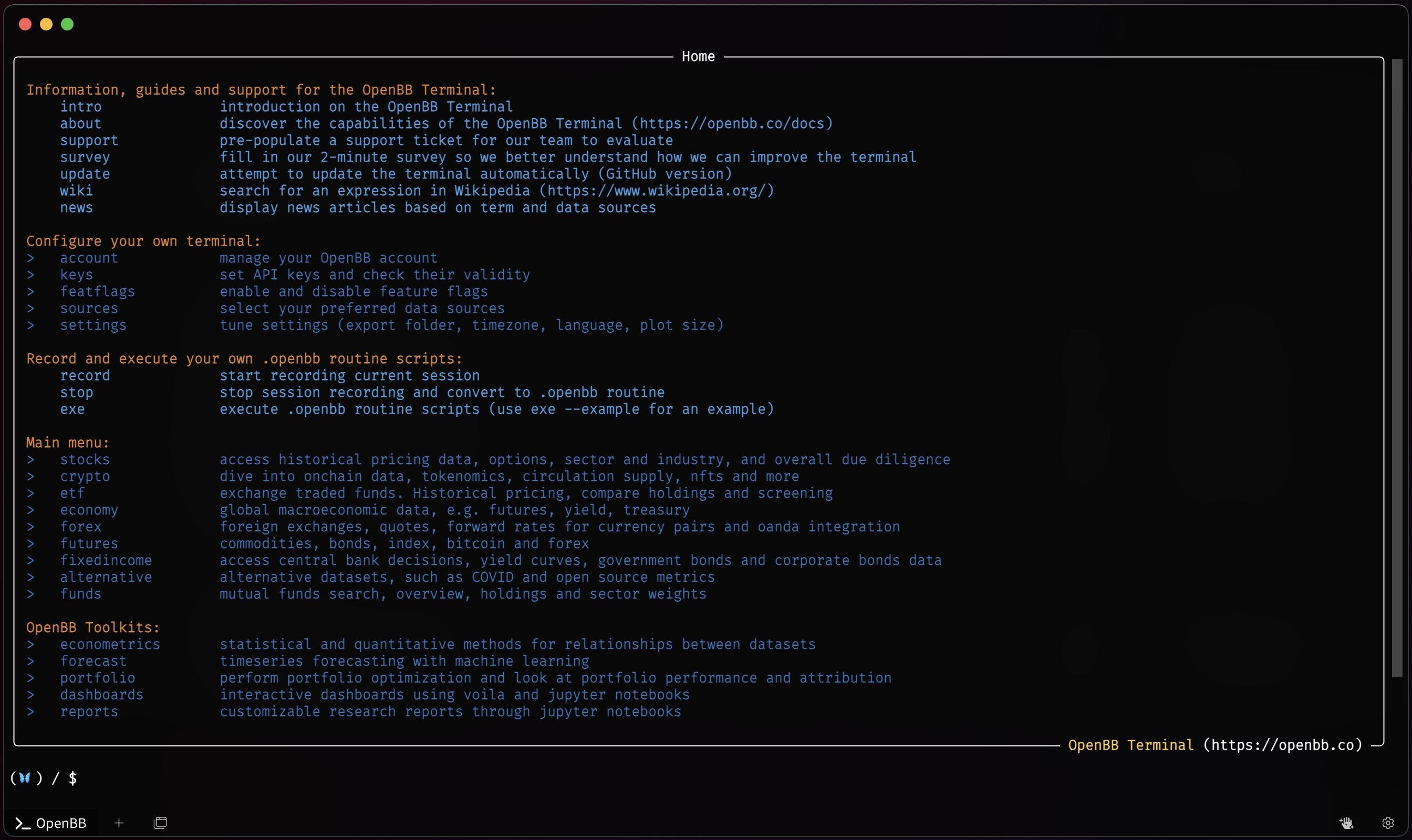

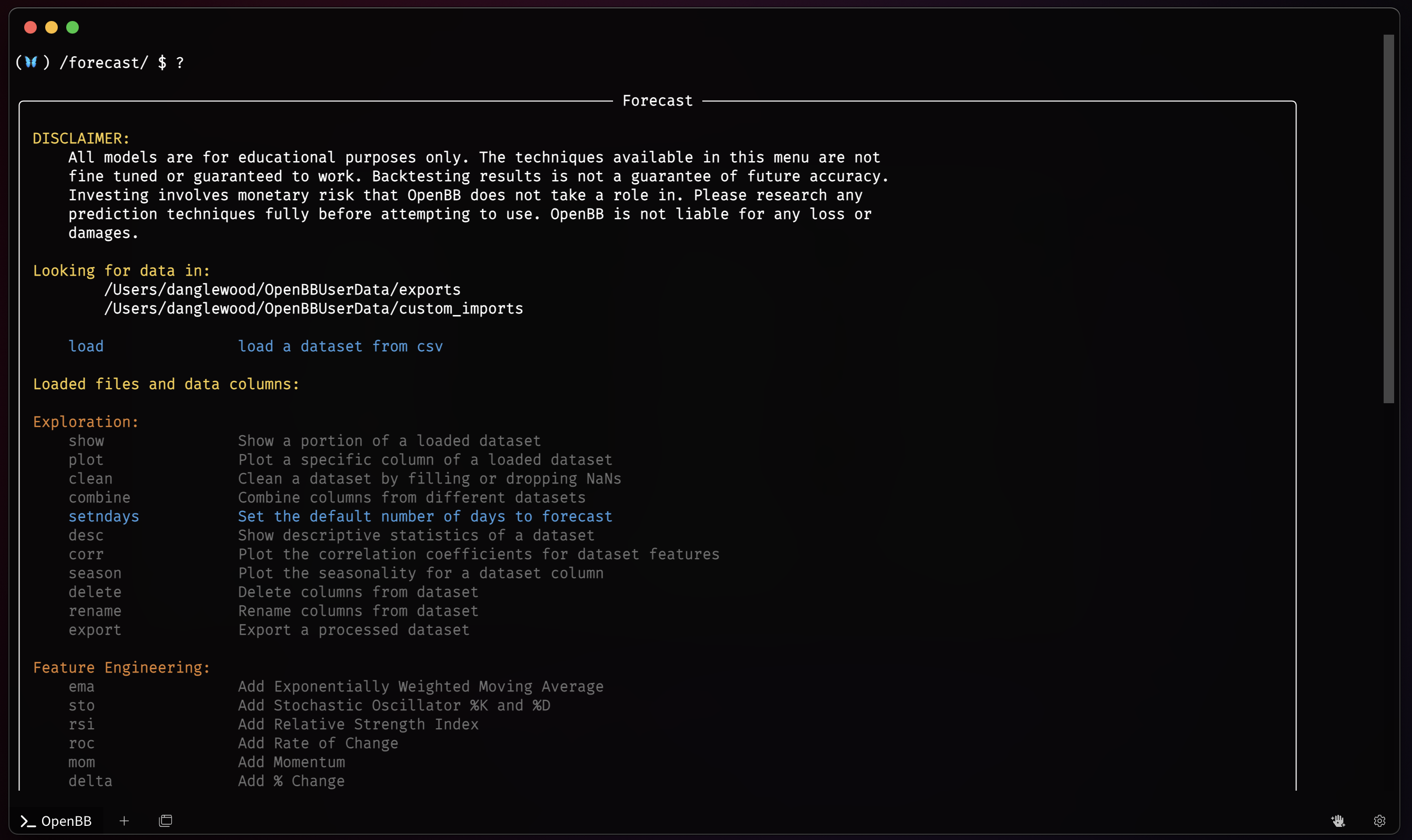

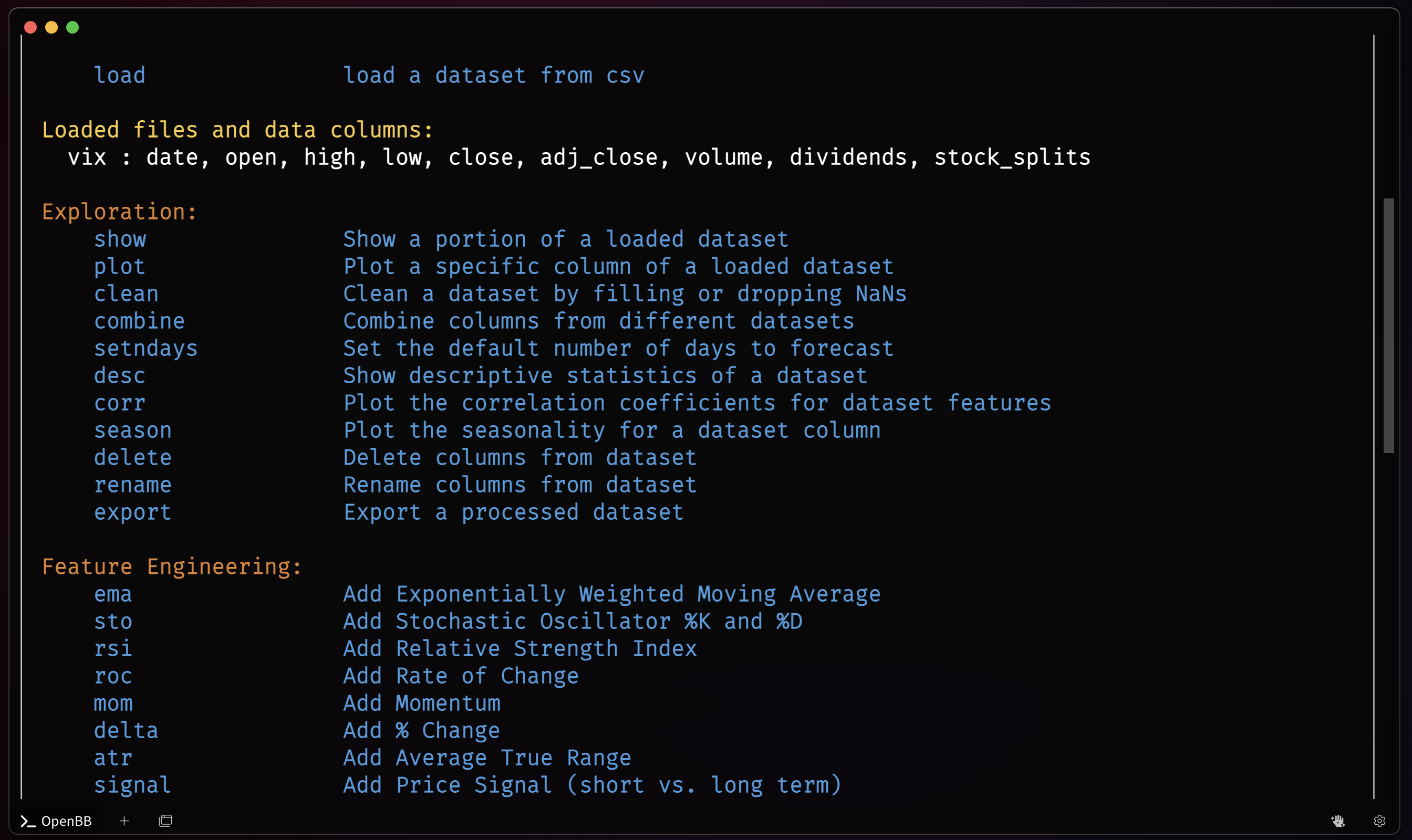

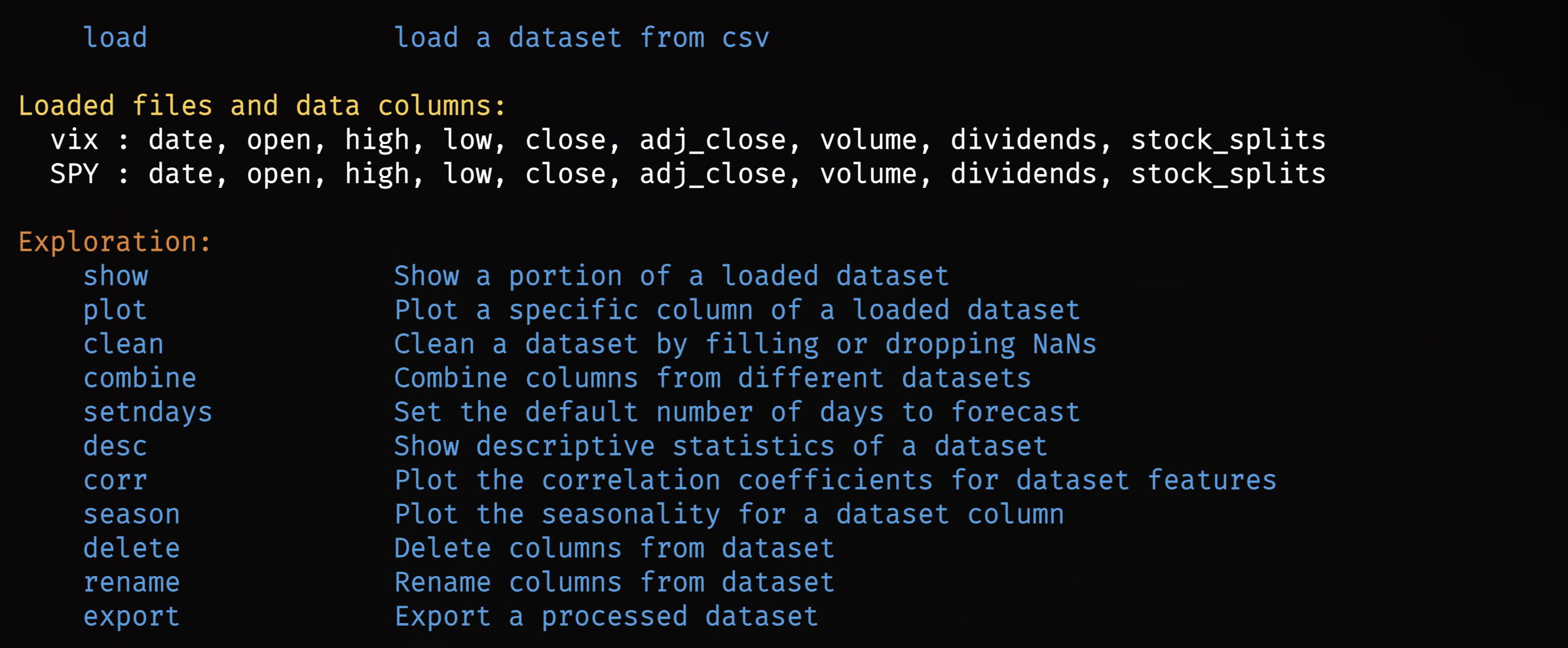

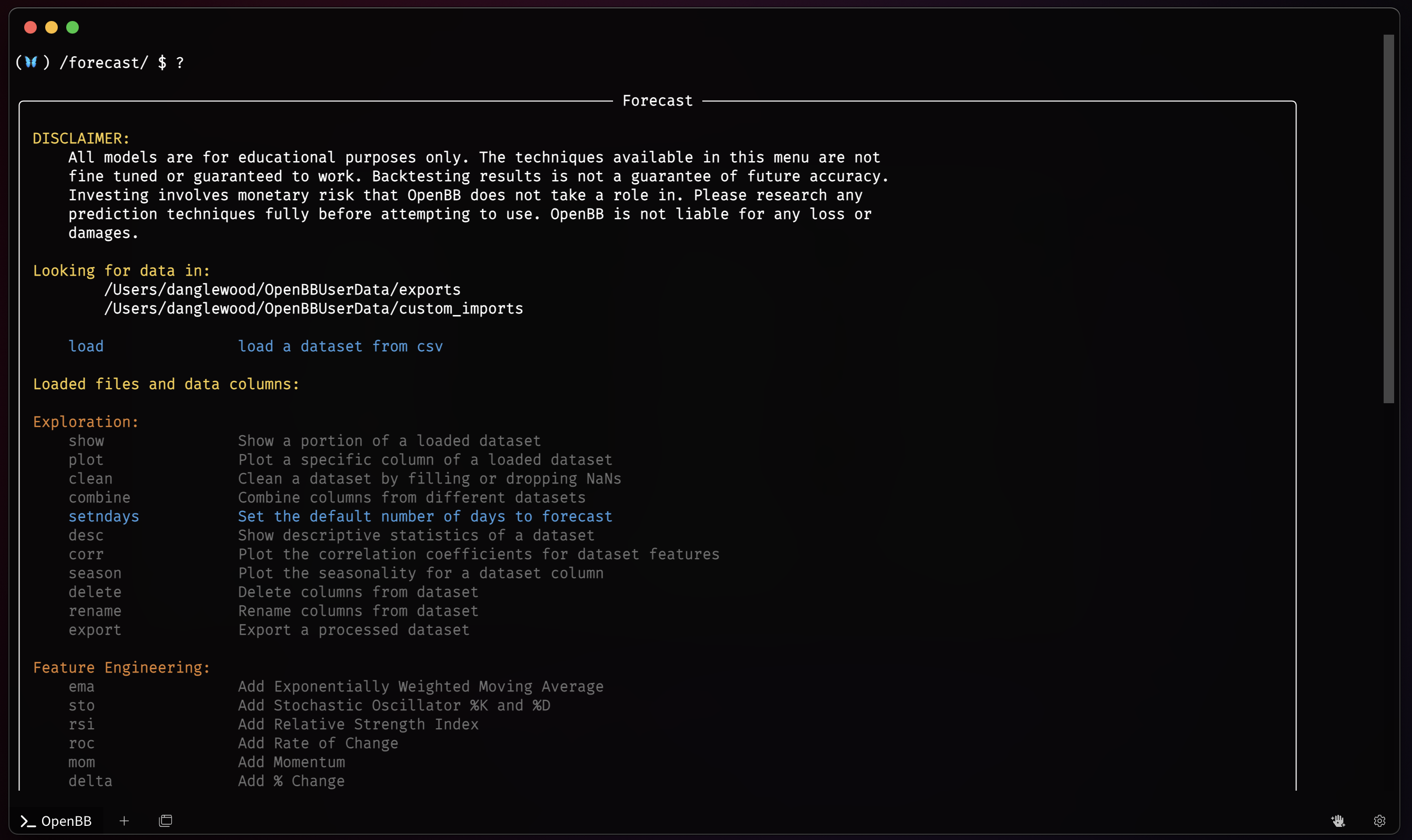

+The OpenBB Terminal is a Command Line Interface (CLI) application. Functions (commands) are called through the keyboard with results returned as charts, tables, or text. Charts and tables (if enabled) are displayed in a new window, and are fully interactive, while text prints directly to the Terminal screen. Commands are grouped into menus, with a menu or sub-menu being visually distinguishable from a function by the, `>`, on the far left of the screen. The color of the text can be altered under the [`/settings` menu](https://docs.openbb.co/terminal/usage/guides/customizing-the-terminal).

- +Navigating through the Terminal menus is similar to following down a path, or traversing folders from any operating system's command line prompt. The `/home` screen is the main path where everything begins, and the menus are paths branched from the main. Instead of `C:\Users\OpenBB\Documents`, it is, [`/stocks/options`](https://docs.openbb.co/terminal/usage/intros/stocks/options). Instead of, `cd ..`, two periods - `..` - returns to the menu one level back towards the home screen.

-The OpenBB Terminal is centered around keyboard input. To navigate and perform analysis you will have to type in the name of the command followed by an `ENTER` (⏎). If you wish to see information about the OpenBB Terminal you can do so by typing `about` and then press `ENTER` (⏎). As you are typing, you will notice that you receive suggestions, by using the `DOWN` (⌄) arrow and pressing `ENTER` (⏎) you can select the command and execute it.

+:::note

+Absolute paths are also valid to-and-from any point. From the [`/stocks/options`](https://docs.openbb.co/terminal/usage/intros/stocks/options) menu, go directly to [`/crypto`](https://docs.openbb.co/terminal/usage/intros/crypto). By itself, `/`, returns to the home level.

+:::

-Throughout the entire terminal, the same set of colors are used which all share the same representation. This is structured as follows:

+

-- Light Blue: represents commands.

-- Dark Blue: represents menus, also recognizable by the `>` in front.

-- Orange: represents titles and headers.

-- Yellow: represents descriptions of a parameter or variable.

-- White: represents text, usually in combination with a description that is in Yellow.

+## Auto Complete

-### Explanation of Menus

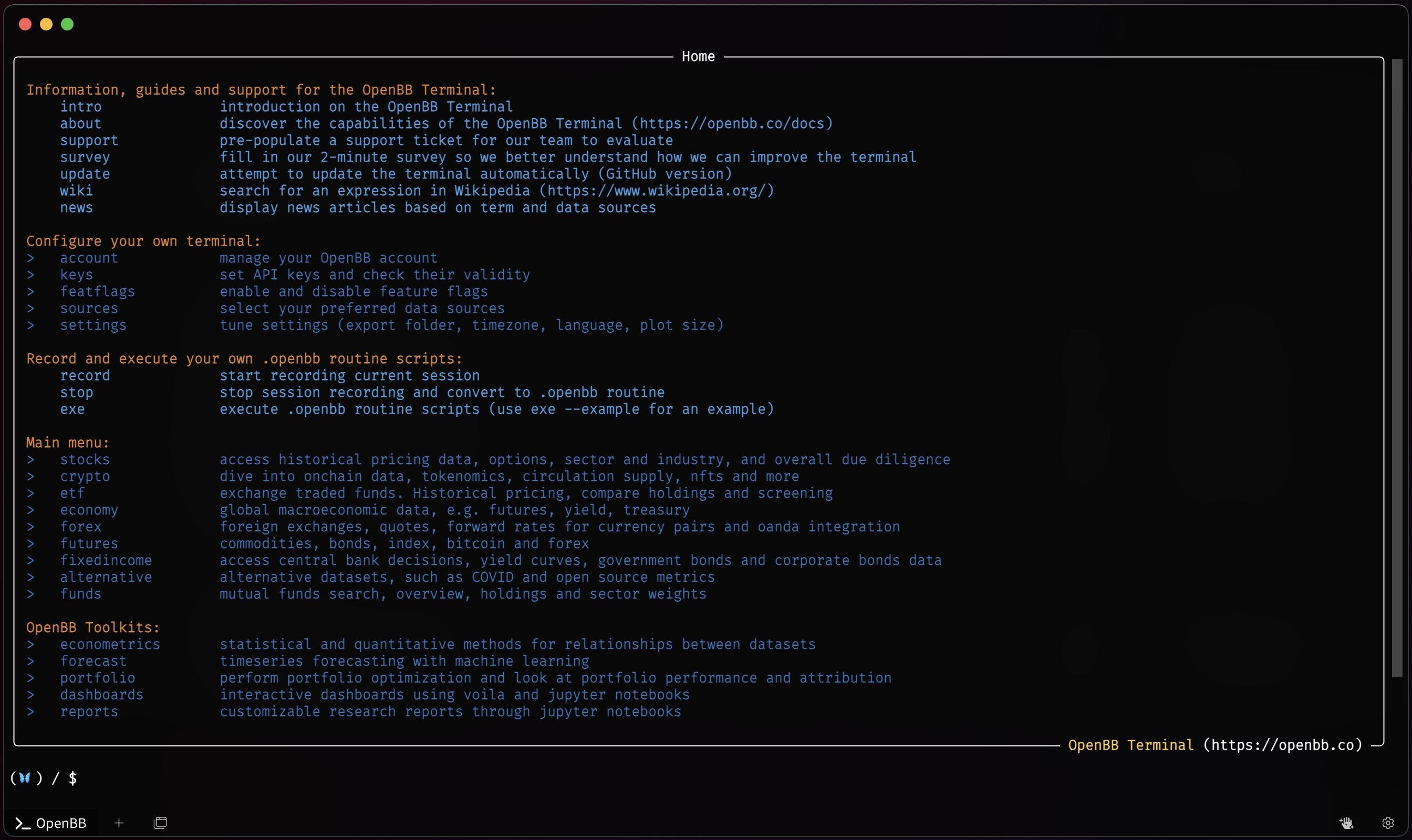

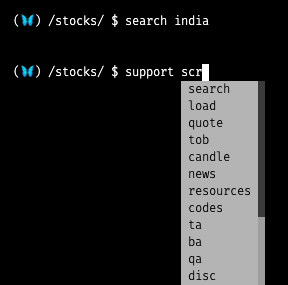

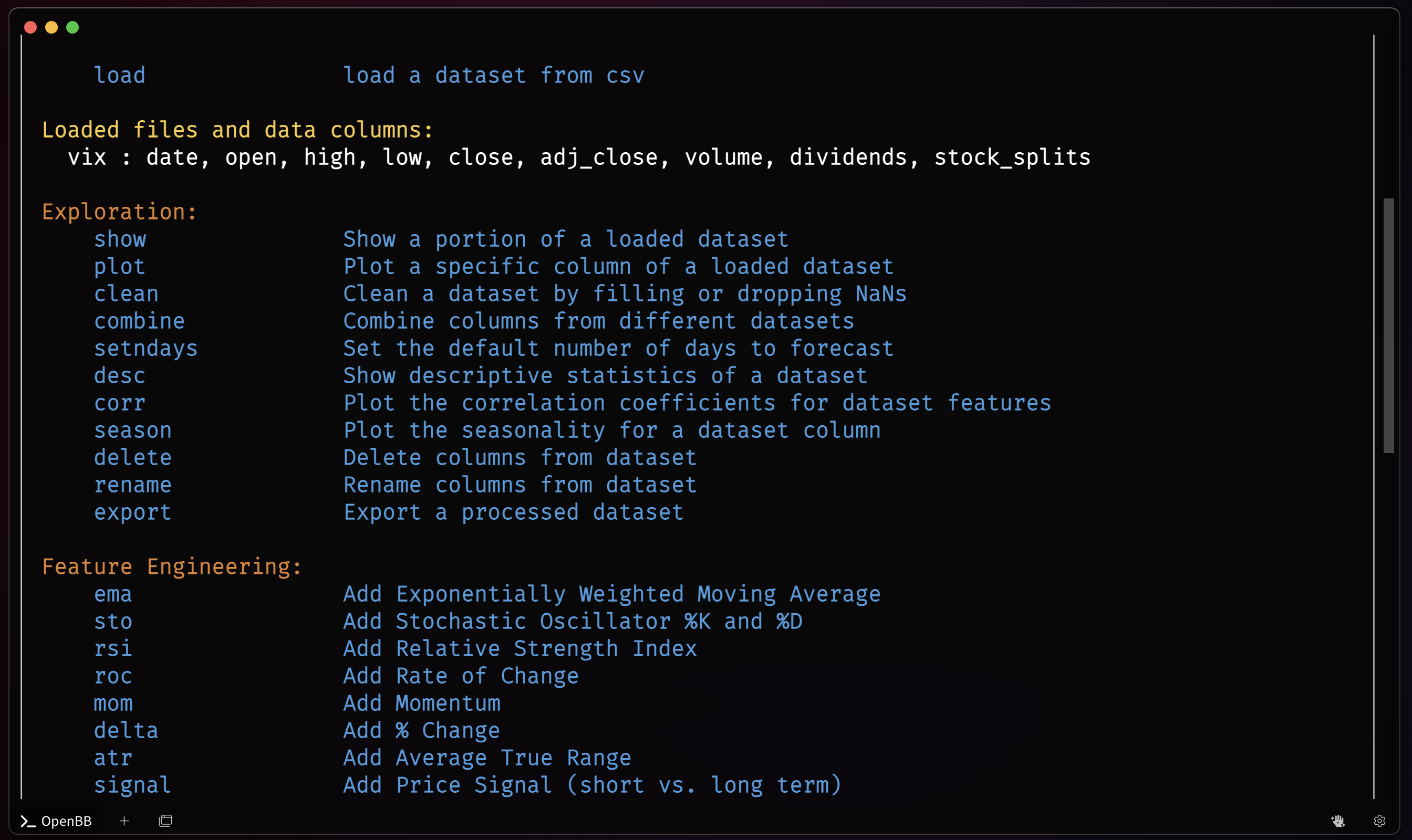

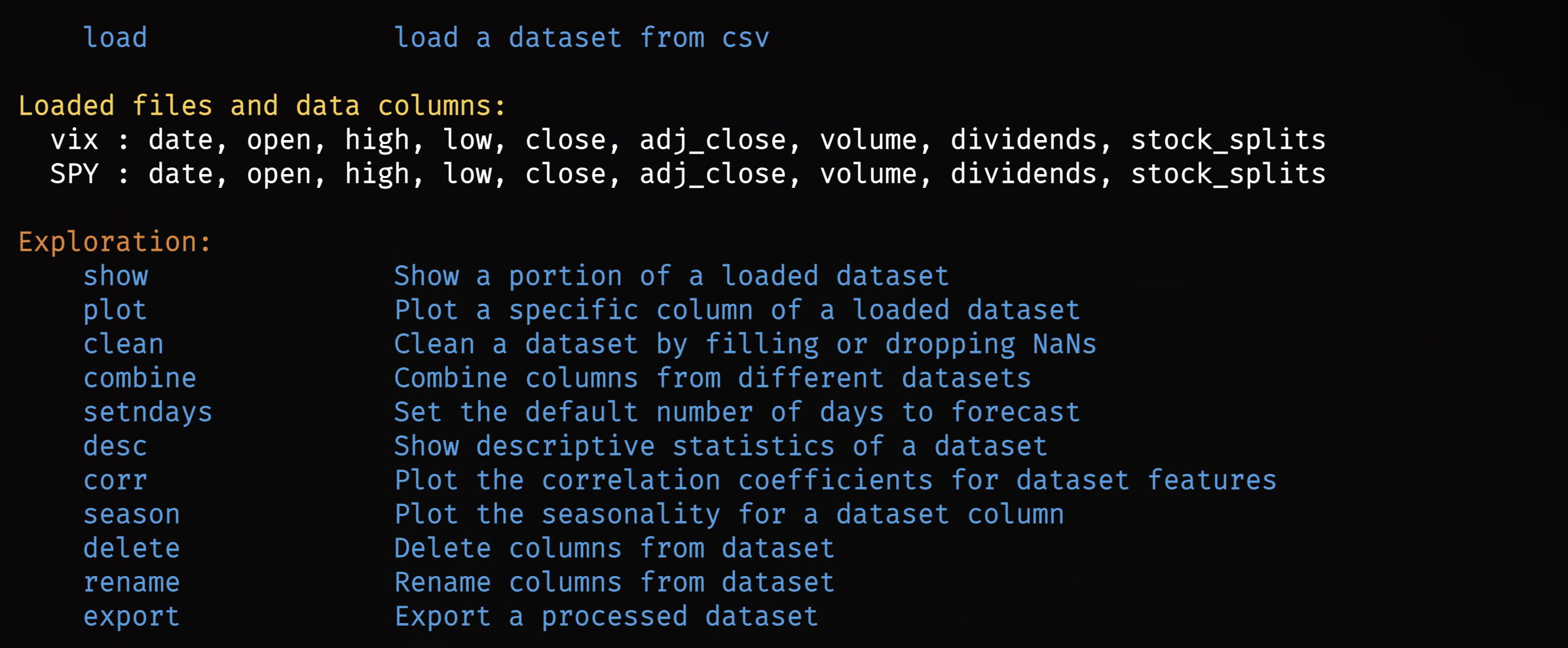

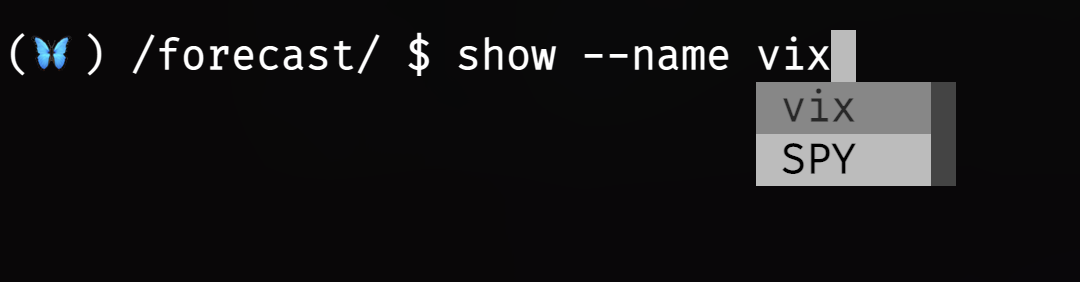

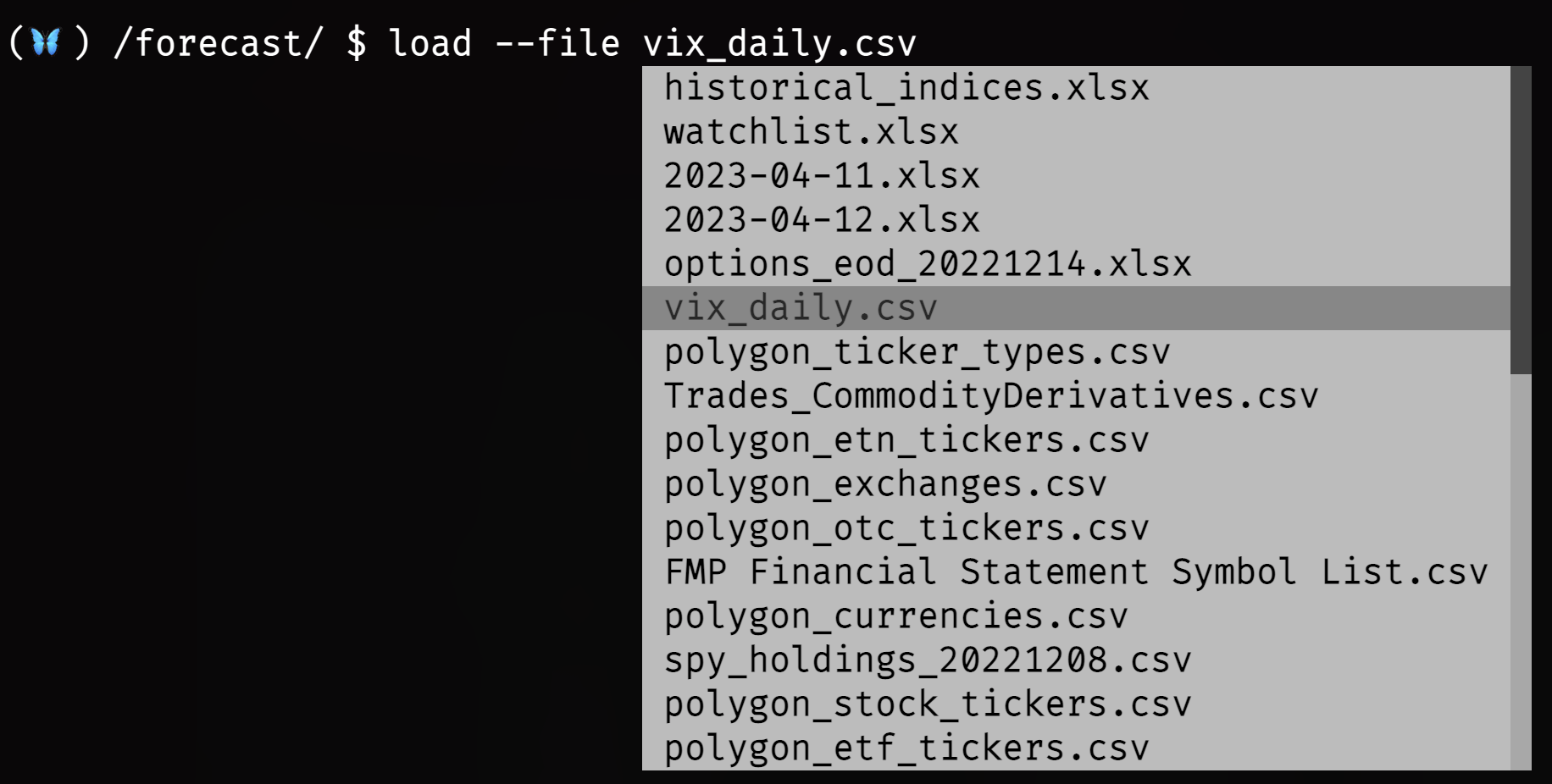

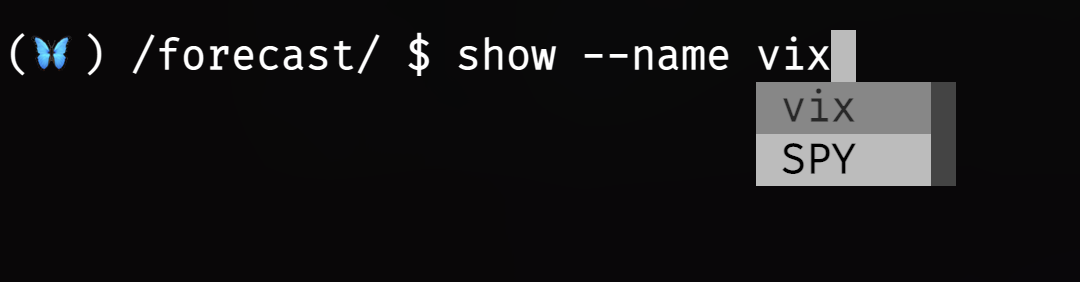

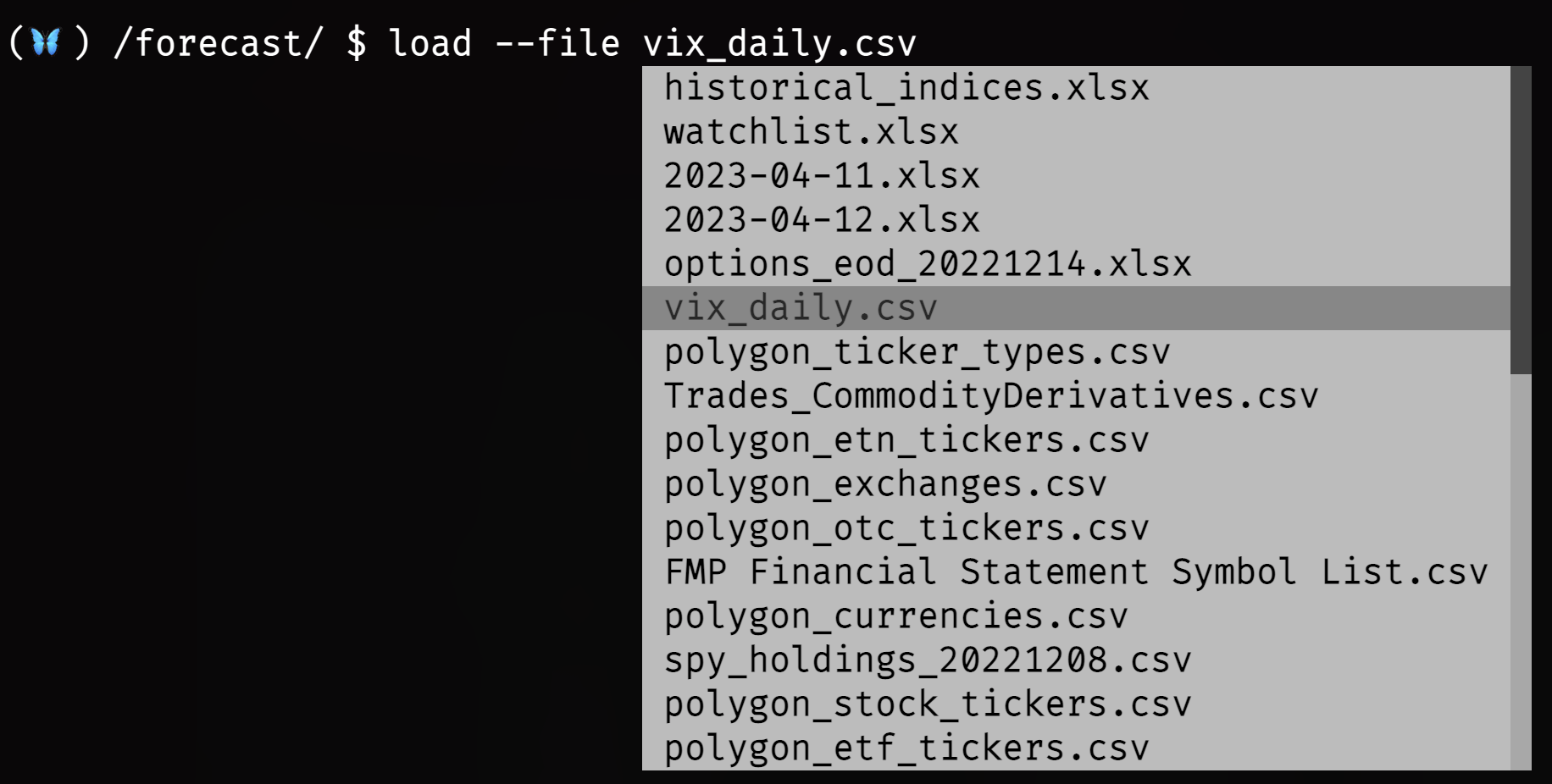

+The OpenBB Terminal is equipped with an auto completion engine that presents choices based on the current menu. Whenever you start typing, the prompt will appear. When the function contains arguments, pressing the `space bar` after typing the command will present the list of available arguments. This functionality dramatically reduces the number of key strokes required to perform tasks and, in many cases, eliminates the need to consult the help dialogue for reminders. Choices - where they are bound by a defined list - are searchable with the up and down arrow keys.

-Menus, depicted in Dark Blue, take you to a new section of the terminal referred to as a menu. For example, if you wish to view information about stocks, you can do so by typing `stocks` and pressing `ENTER` (⏎). This opens a new menu as depicted below.

+

-

+Navigating through the Terminal menus is similar to following down a path, or traversing folders from any operating system's command line prompt. The `/home` screen is the main path where everything begins, and the menus are paths branched from the main. Instead of `C:\Users\OpenBB\Documents`, it is, [`/stocks/options`](https://docs.openbb.co/terminal/usage/intros/stocks/options). Instead of, `cd ..`, two periods - `..` - returns to the menu one level back towards the home screen.

-The OpenBB Terminal is centered around keyboard input. To navigate and perform analysis you will have to type in the name of the command followed by an `ENTER` (⏎). If you wish to see information about the OpenBB Terminal you can do so by typing `about` and then press `ENTER` (⏎). As you are typing, you will notice that you receive suggestions, by using the `DOWN` (⌄) arrow and pressing `ENTER` (⏎) you can select the command and execute it.

+:::note

+Absolute paths are also valid to-and-from any point. From the [`/stocks/options`](https://docs.openbb.co/terminal/usage/intros/stocks/options) menu, go directly to [`/crypto`](https://docs.openbb.co/terminal/usage/intros/crypto). By itself, `/`, returns to the home level.

+:::

-Throughout the entire terminal, the same set of colors are used which all share the same representation. This is structured as follows:

+

-- Light Blue: represents commands.

-- Dark Blue: represents menus, also recognizable by the `>` in front.

-- Orange: represents titles and headers.

-- Yellow: represents descriptions of a parameter or variable.

-- White: represents text, usually in combination with a description that is in Yellow.

+## Auto Complete

-### Explanation of Menus

+The OpenBB Terminal is equipped with an auto completion engine that presents choices based on the current menu. Whenever you start typing, the prompt will appear. When the function contains arguments, pressing the `space bar` after typing the command will present the list of available arguments. This functionality dramatically reduces the number of key strokes required to perform tasks and, in many cases, eliminates the need to consult the help dialogue for reminders. Choices - where they are bound by a defined list - are searchable with the up and down arrow keys.

-Menus, depicted in Dark Blue, take you to a new section of the terminal referred to as a menu. For example, if you wish to view information about stocks, you can do so by typing `stocks` and pressing `ENTER` (⏎). This opens a new menu as depicted below.

+

- +## Help Dialogues

-Depending on the menu you are in, you are presented with a new set of commands and menus you can select. There are interactions in place between each menu. For example, when selecting a company within the `stocks` menu, the terminal will remember your selection when you visit the `fa` or `options` menu. See [Introduction to Stocks](/terminal/usage/intros/stocks).

+### -h or --help

-:::note **About Pipelines**

-You can quickly jump between menus by using a forward slash (`/`). For example, if I want to access the options menu, You can type `/stocks/options` to instantly arrive at this menu. You can do this from any location within the OpenBB Terminal!

-:::

+A help dialogue for any function at the current location is printed to the screen by typing `-h` after the command. The information returned contains a short description of the function and all accepted arguments. For an example, the `/news` function:

-### Explanation of Commands

+```console

+news -h

+```

-Commands, depicted in Light Blue, execute an action or task. For example,

-the commands that you are able to use from any menu in the terminal (see Explanation of Menus) are as follows:

+```console

+usage: news [-t TERM [TERM ...]] [-s SOURCES] [-h] [--export EXPORT] [--sheet-name SHEET_NAME [SHEET_NAME ...]] [-l LIMIT]

-- `cls`: clears the screen, by executing this command you are left with an empty screen.

-- `help`, `h` or `?`: displays the menu that you are currently on.

-- `quit`, `q` or `..`: allows for navigation through the menu. E.g. if you type `stocks` press `ENTER` (⏎) and then

- use `q` and press `ENTER` (⏎) you return to where you started. Validate this by typing `?` and pressing `ENTER` (⏎).

-- `support`: allows you to submit bugs, questions and suggestions.

-- `about`: this opens the related guide, linking to this website. It also has the ability to open a guide to a specific

- command. For example, within the `stocks` menu, `about candle` opens this guide.

-- `wiki`: search for a given expression on the Wikipedia without leaving the terminal.

+display news articles based on term and data sources

-Continuing with the example mentioned at `quit`, revisit the `stocks` menu and look at the commands. At the top you will see a command named load. To understand what this command can do, you can use `load -h` followed by `ENTER` (⏎). The `-h` stands for `help` and every command will have this feature. This will return the following:

+options:

+ -t TERM [TERM ...], --term TERM [TERM ...]

+ search for a term on the news

+ -s SOURCES, --sources SOURCES

+ sources from where to get news from (separated by comma)

+ -h, --help show this help message

+ --export EXPORT Export raw data into csv, json, xlsx

+ --sheet-name SHEET_NAME [SHEET_NAME ...]

+ Name of excel sheet to save data to. Only valid for .xlsx files.

+ -l LIMIT, --limit LIMIT

+ Number of entries to show in data.

+For more information and examples, use 'about news' to access the related guide.

```

-usage: load [-t TICKER] [-s START] [-e END] [-i {1,5,15,30,60}] [-p] [-f FILEPATH] [-m] [-w] [--exchange] [--performance] [-h] [--export EXPORT] [--sheet-name SHEET_NAME [SHEET_NAME ...]]

- [--source {YahooFinance,AlphaVantage,Polygon,EODHD,Intrinio}]

-

-Load stock ticker to perform analysis on. When the data source is yf, an Indian ticker can be loaded by using '.NS' at the end, e.g. 'SBIN.NS'. See available market in https://help.yahoo.com/kb/exchanges-data-

-providers-yahoo-finance-sln2310.html.

-

-optional arguments:

- -t TICKER, --ticker TICKER

- Stock ticker (default: None)

- -s START, --start START

- The starting date (format YYYY-MM-DD) of the stock (default: 2020-02-11)

- -e END, --end END The ending date (format YYYY-MM-DD) of the stock (default: 2023-02-15)

- -i {1,5,15,30,60}, --interval {1,5,15,30,60}

- Intraday stock minutes (default: 1440)

- -p, --prepost Pre/After market hours. Only reflected in 'YahooFinance' intraday data. (default: False)

- -f FILEPATH, --file FILEPATH

- Path to load custom file. (default: None)

- -m, --monthly Load monthly data (default: False)

- -w, --weekly Load weekly data (default: False)

- --exchange Show exchange information. (default: False)

- --performance Show performance information. (default: False)

- -h, --help show this help message (default: False)

- --export EXPORT Export raw data into csv, json, xlsx (default: )

- --sheet-name SHEET_NAME [SHEET_NAME ...]

- Name of excel sheet to save data to. Only valid for .xlsx files. (default: None)

- --source {YahooFinance,AlphaVantage,Polygon,EODHD,Intrinio}

- Data source to select from (default: YahooFinance)

-For more information and examples, use 'about load' to access the related guide.

+To search for news containing the term, "Federal Reserve", try this command:

+```console

+/news --term Federal Reserve

```

-This shows you all **arguments** the command has. These are additional options you can provide to the command. Each default value is also displayed which is used when you do not select this option. For example, if I would use the stock ticker of Amazon (AMZN, which can also be found with `search amazon`), I can use `load AMZN` which will return the following:

+### About

+

+`about` is a global function that opens a browser to the OpenBB documentation pages at the specific command or menu.

+```console

+/about stocks

```

-(🦋) /stocks/ $ load AMZN

-Loading Daily data for AMZN with starting period 2020-02-11.

+The command above will open a browser to [Introduction to the Stocks menu](https://docs.openbb.co/terminal/usage/intros/stocks).

-```

+### Support

-The default values you see within `load -h` have been inputted here. E.g. the starting period is 2020-02-11. I can decide to change these default values by calling the argument and inputting a different value.

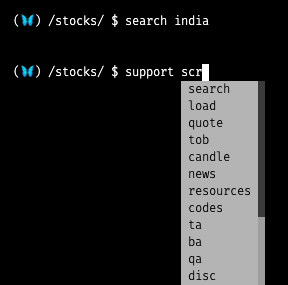

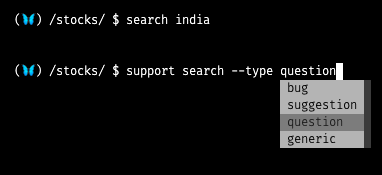

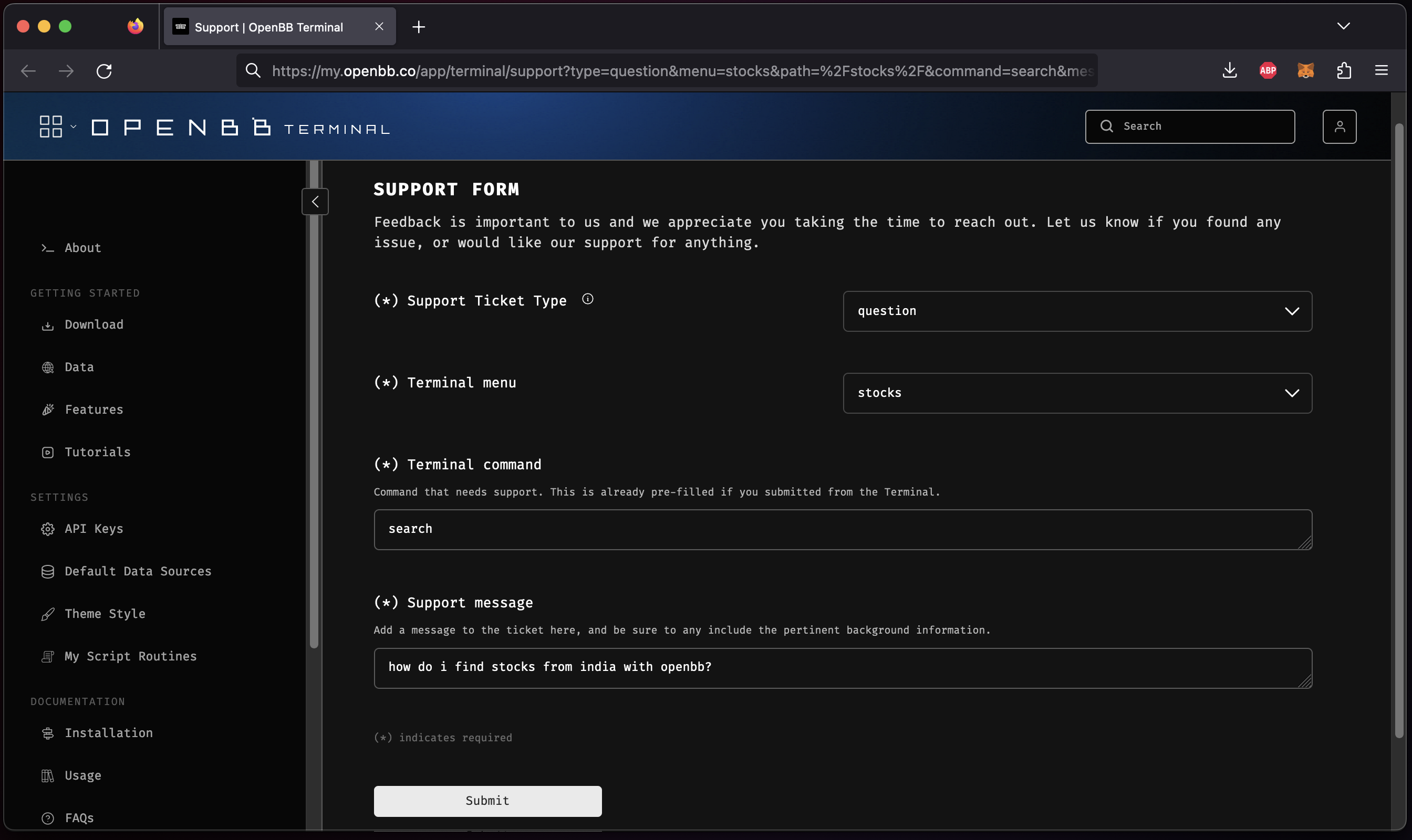

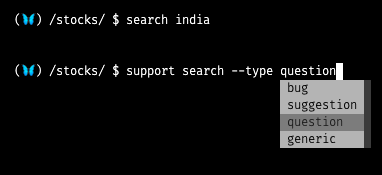

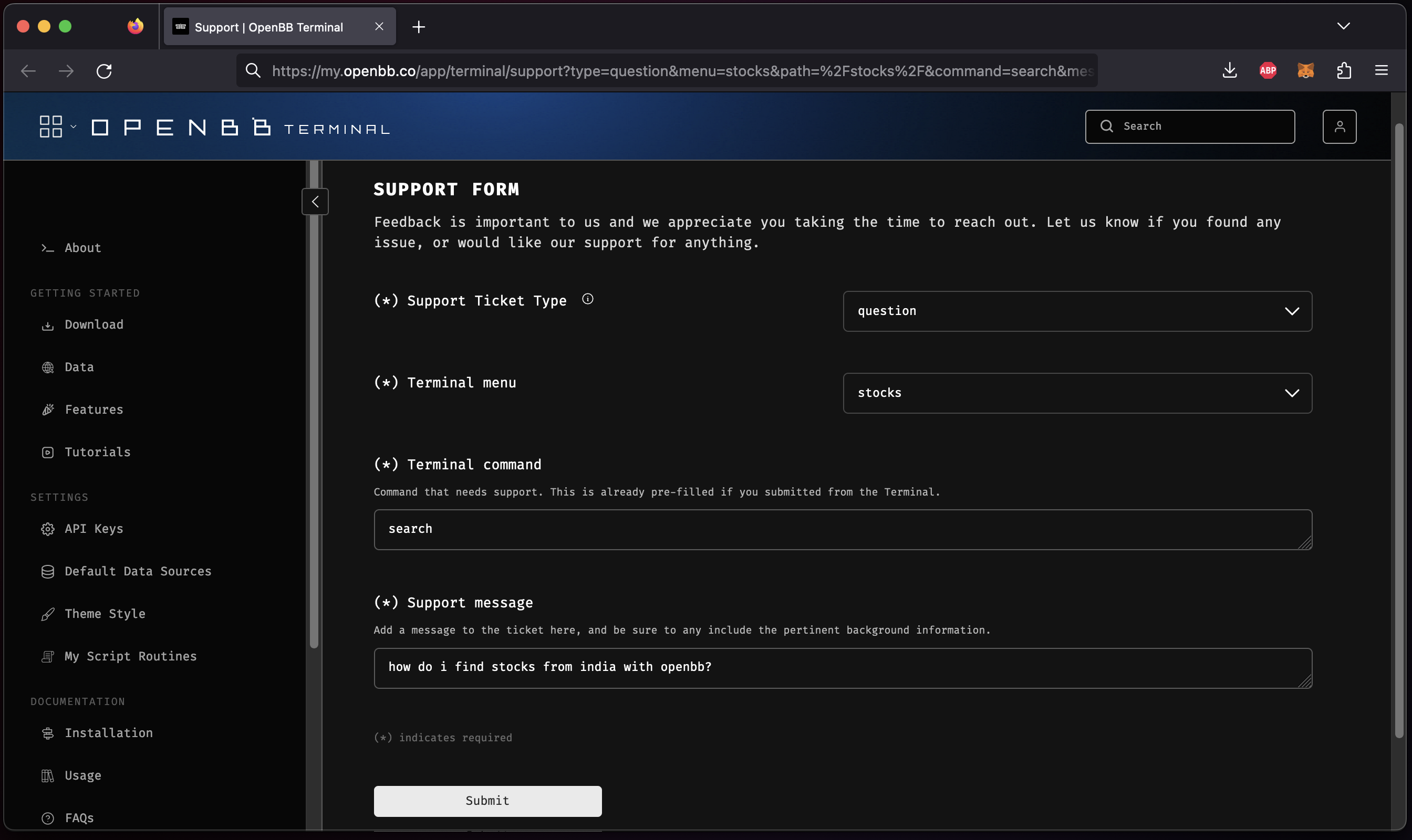

+`support` is a global function for submitting a new request for support, a general question, or a bug report. The command will pre-populate a form with key information, like the command or menu name specific to the issue. Use the up and down arrow keys to browse and select the appropriate item for the ticket. Naturally, this command has a help dialogue.

-Whenever you wish to apply an optional argument, you use the related shortcode, e.g. `-s` or `--start`. Then, if there is an additional word behind the argument (in this case there is, which is `START`) it implies the argument expects you to define a value. Within the documentation you can read that the format must be `YYYY-MM-DD` implying that `2010-01-01` will be valid. If there is not an additional word behind it, it is enough to write down `load AMZN -p` (which refers to the prepost optional argument)

+```console

+support -h

+```

-Let's change the starting and ending period of the data that is being loaded in by doing the following:

+```console

+Submit your support request

+options:

+ -c {search,load,quote,tob,candle,news,resources,codes,ta,ba,qa,disc,dps,scr,sia,ins,gov,res,dd,fa,bt,ca,options,th,forecast}, --command {generic,search,load,quote,tob,candle,news,resources,codes,ta,ba,qa,disc,dps,scr,sia,ins,gov,res,dd,fa,bt,ca,options,th,forecast}

+ Command that needs support (default: None)

+ --msg MSG [MSG ...], -m MSG [MSG ...]

+ Message to send. Enclose it with double quotes (default: )

+ --type {bug,suggestion,question,generic}, -t {bug,suggestion,question,generic}

+ Support ticket type (default: generic)

+ -h, --help show this help message (default: False)

```

-(🦋) /stocks/ $ load AMZN -s 2005-01-01 -e 2010-01-01

-Loading Daily data for AMZN with starting period 2005-01-03.

+

+```console

+support search --type question --msg "How do I find stocks from India with OpenBB?"

```

-We can check that this period has changed by looking into the candle chart with `candle`. This, again shares the same `-h` argument. This results in the following which indeed depicts our selected period.

+

+

+The command opens a browser window to a pre-populated form on the OpenBB website. If you are signed-in to the Hub, all that is left to do is click `Submit`.

+

+

+

+**An answer to this question is**: `search --country india --exchange-country india`

+

+:::note

+Tips for submitting a support request:

+- Tell us what version number is installed.

+- Tell us what operating system and version the machine has.

+- What is the installation type? Installer, Source, PyPi, Docker, other?

+- Tell us the command and parameter combination causing the error.

+- Tell us what symbol (ticker) is, or was trying to be, loaded.

+- Show us the complete error message.

+- Let us know any contextual information that will help us replicate and accurately identify the problem.

+:::

+

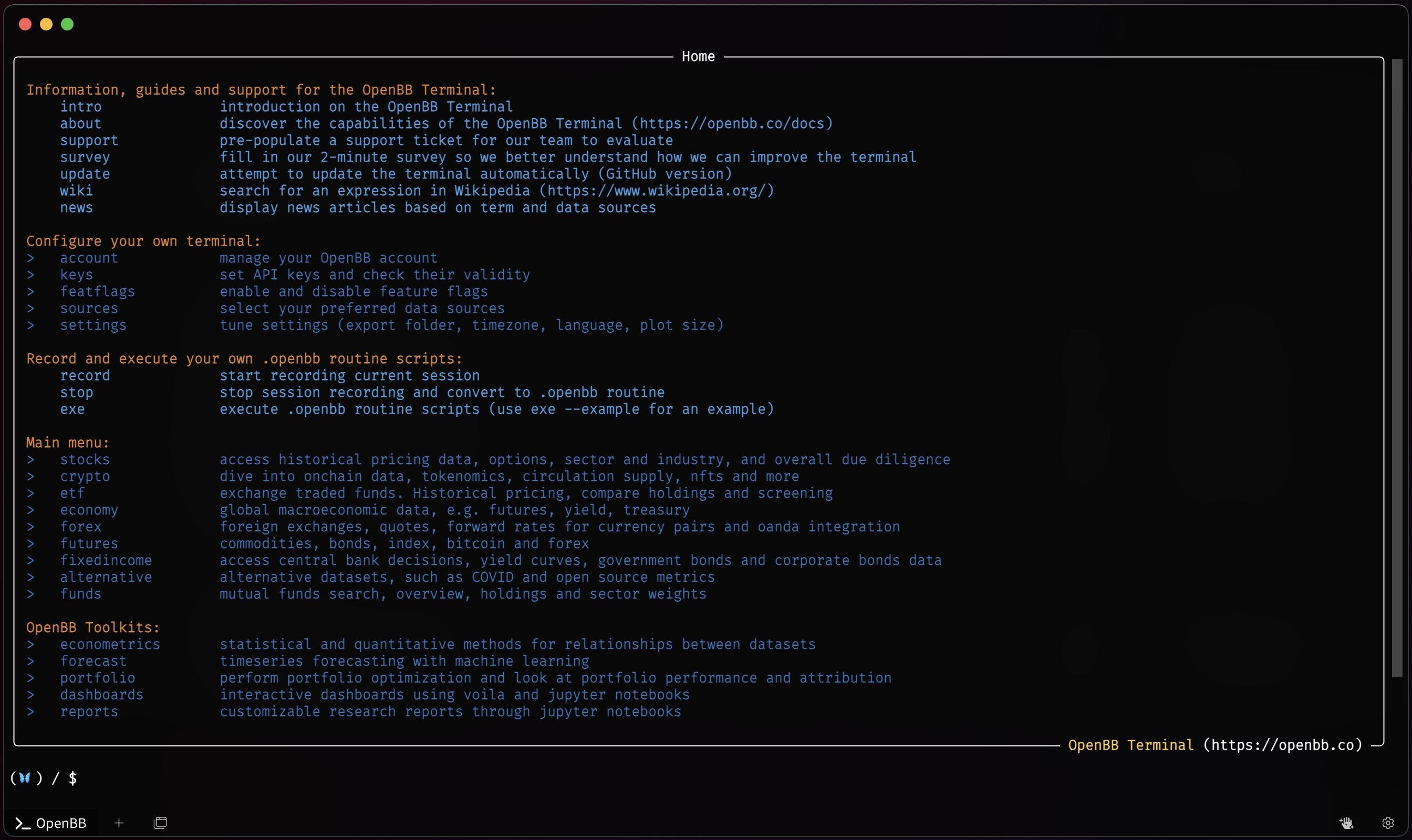

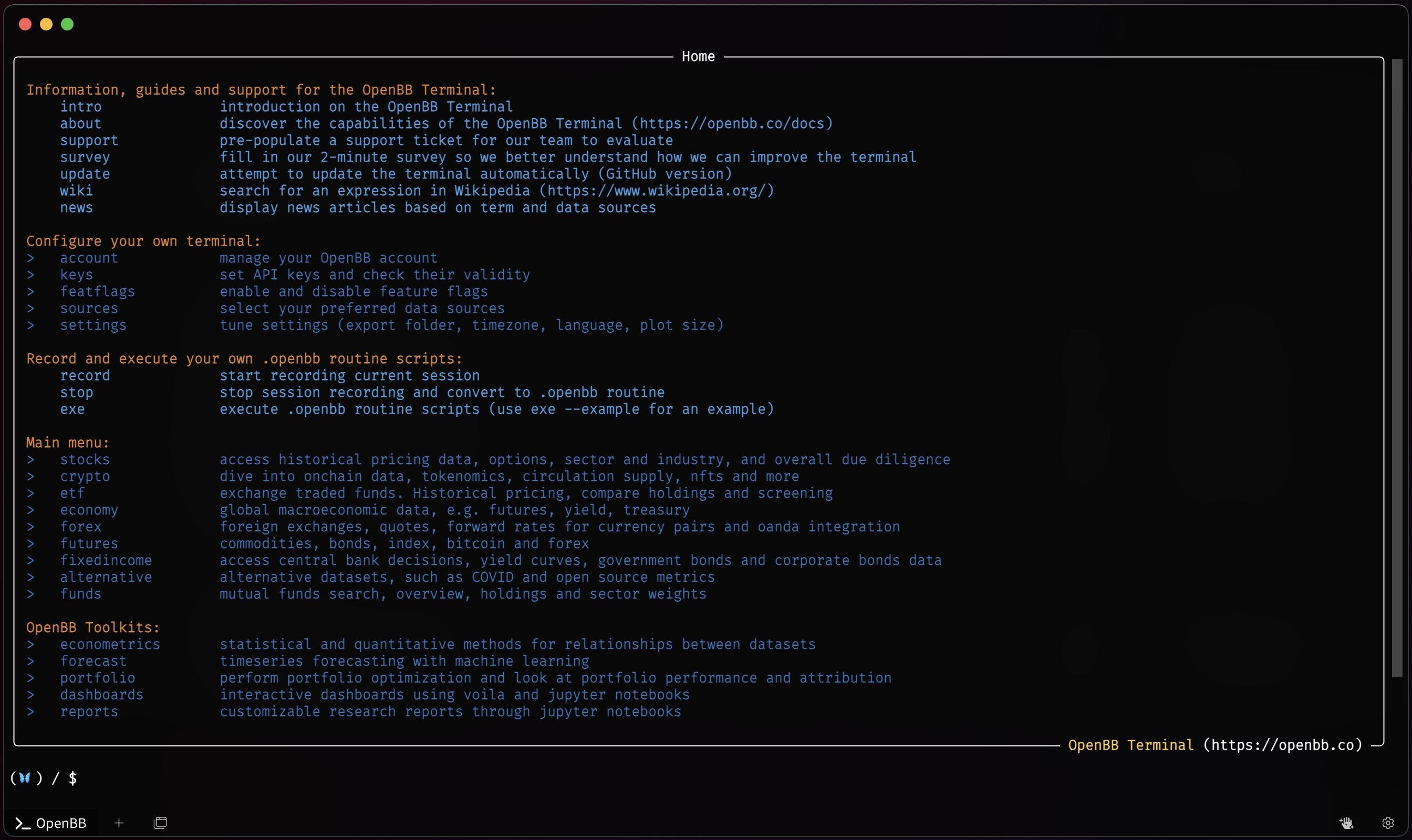

+## Menus

+

+### The Main Menu

+

+The main menu, or the home screen, contains both menus and commands. Some of these commands are global, meaning they can be called from any location within the OpenBB Terminal. Refer to the in-depth introduction guides for each menu, for example, [Forecast](https://docs.openbb.co/terminal/usage/intros/forecast)

+

+| Function Key | Type | Is Global? | Description |

+| :----------- | :------: | :--------: | ------------------------------------------------------------------------------: |

+| about | Function | Yes | Opens a browser page to the documentation pages at the function or menu. |

+| account | Menu | - | Manage your OpenBB account. |

+| alternative | Menu | - | Alternative data sets. |

+| crypto | Menu | - | Digital assets. |

+| econometrics | Menu | - | Econometrics and custom data sets. |

+| economy | Menu | - | The broad economy. |

+| etf | Menu | - | Exchange-Traded Funds. |

+| exe | Function | No | Execute OpenBB Routine Scripts. |

+| featflags | Menu | - | Enable/disable Terminal behaviours. |

+| fixedincome | Menu | - | Central Bank and corporate bond rates and indexes. |

+| forecast | Menu | - | Time series forecasting and machine learning. |

+| forex | Menu | - | Currency pairs. |

+| funds | Menu | - | Mutual funds. |

+| futures | Menu | - | Commodity and financial futures. |

+| keys | Menu | - | Set and test API keys for data sources. |

+| intro | Function | No | An in-Terminal introduction. |

+| news | Function | No | Find news articles by term and source. |

+| portfolio | Menu | - | Portfolio and risk analysis. |

+| record | Function | Yes | Starts recording an OpenBB Routine Script. |

+| settings | Menu | - | Adjust Terminal settings. |

+| sources | Menu | - | Set preferred default sources. |

+| stop | Function | Yes | Stop recording the OpenBB Routine Script and save to the OpenBBUserData folder. |

+| support | Function | Yes | Report a bug or create a support ticket with OpenBB. |

+| survey | Function | No | Take a short user survey to help us improve. |

+| update | Function | No | Attempt to update (**Only for Github cloned repository installations**) |

+| wiki | Function | Yes | Query the Wikipedia API for a term or phrase. |

+

+### Additional Global Commands

+

+The commands listed below are not displayed on any Terminal menu, but are available from any location in the Terminal.

+

+| Function Key | Description |

+| :----------- | ------------------------------------------------: |

+| cls | Clears the Terminal screen. |

+| exit | Quits the Terminal. |

+| help, h, ? | Prints the current menu screen. |

+| quit, q, .. | Navigates back one menu towards Home. |

+| reset, r | Resets the Terminal, opening to the current menu. |

+

+## Data

+

+Many functions will require obtaining (free or subscription) API keys from various data providers. OpenBB provides methods for consuming these data feeds, but has no control over the quality or quantity of data provided to an end-user. **No API Keys are required to get started using the Terminal**. See the list of data providers [here](https://docs.openbb.co/terminal/usage/guides/api-keys), along with instructions for entering the credentials into the OpenBB Terminal. [Request a feature](https://openbb.co/request-a-feature) to let us know what we are missing!

+

+### Default Data Sources

+

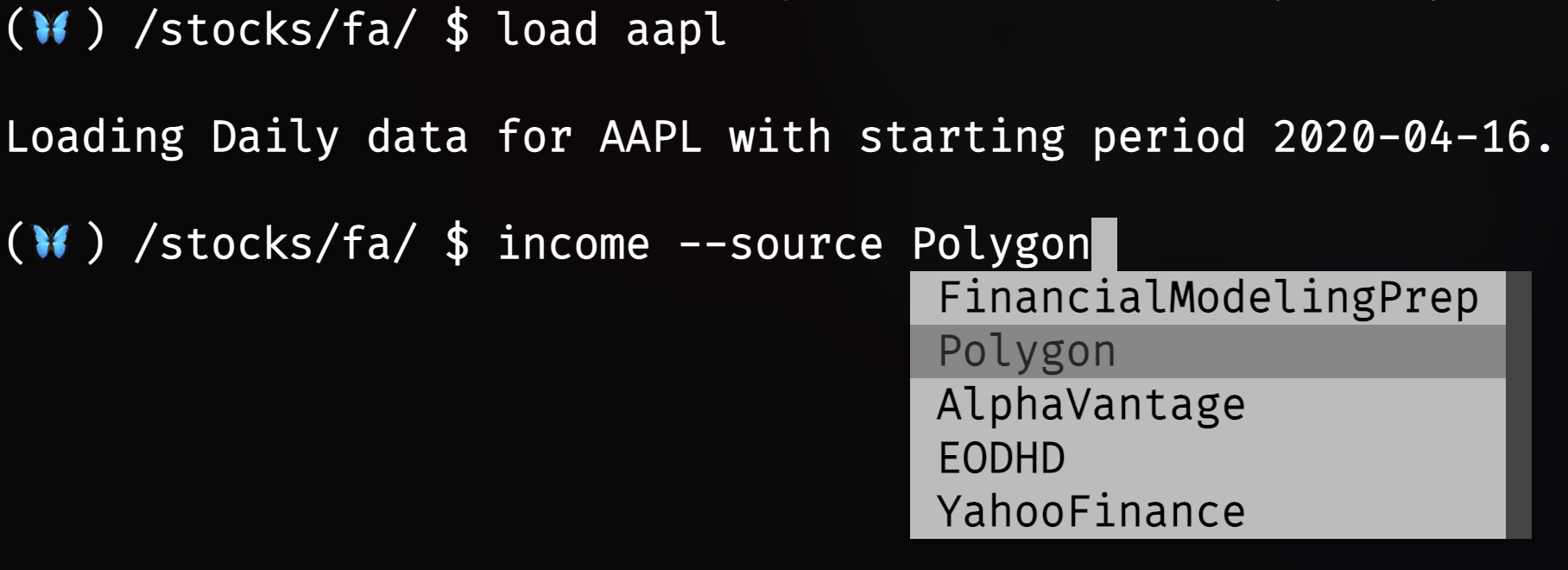

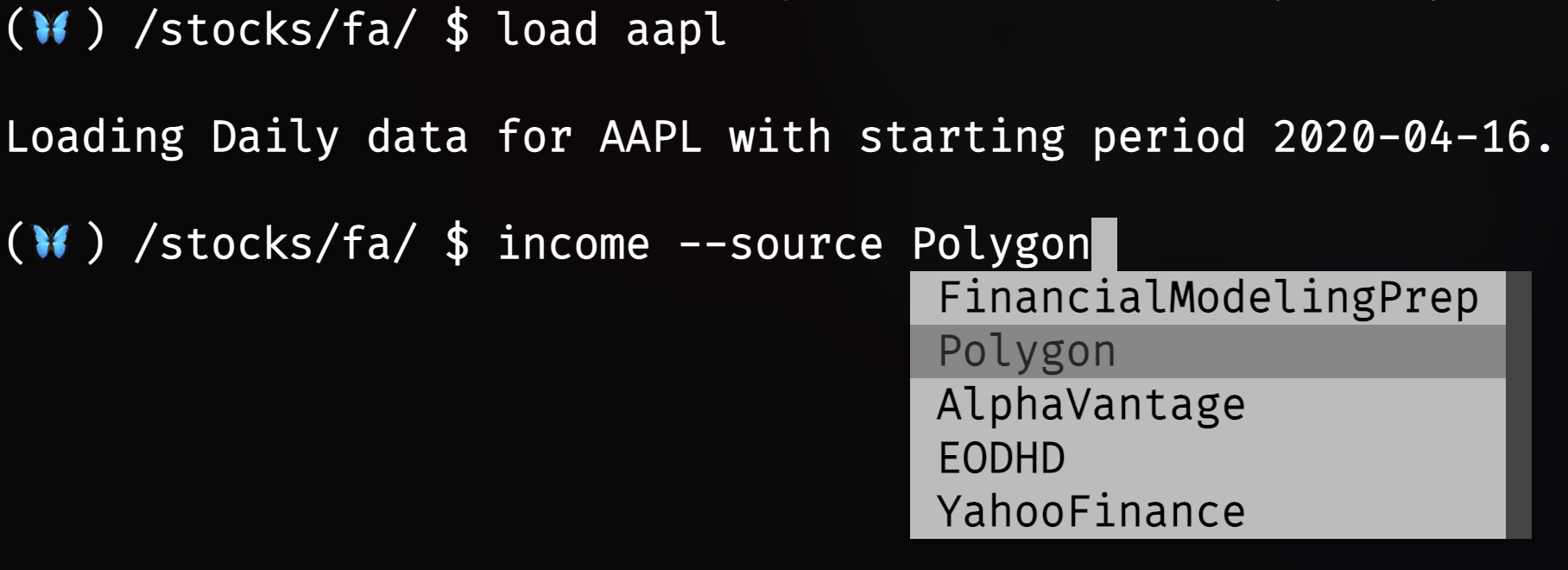

+The default data source for each function (where multiple sources are available) can be defined within the [`/sources` menu](https://docs.openbb.co/terminal/usage/guides/changing-sources). The available sources for each function are displayed on the right of the menu, and they can be distinguished by the square brackets and distinct font color group. Unless a preference for a particular function is defined, the command will prioritize in the order they are displayed, from left-to-right, on the Terminal screen. To override a preference or default source, select one of the other choices by attaching the, `--source`, argument to the command syntax. The available sources for the feature will be populated by auto complete when the `space bar` is pressed after typing `--source`. This information is also printed with the `--help` dialogue of a command.

+

+```console

+/stocks/load AAPL/fa/income --source Polygon

```

-(🦋) /stocks/ $ candle

+

+

+

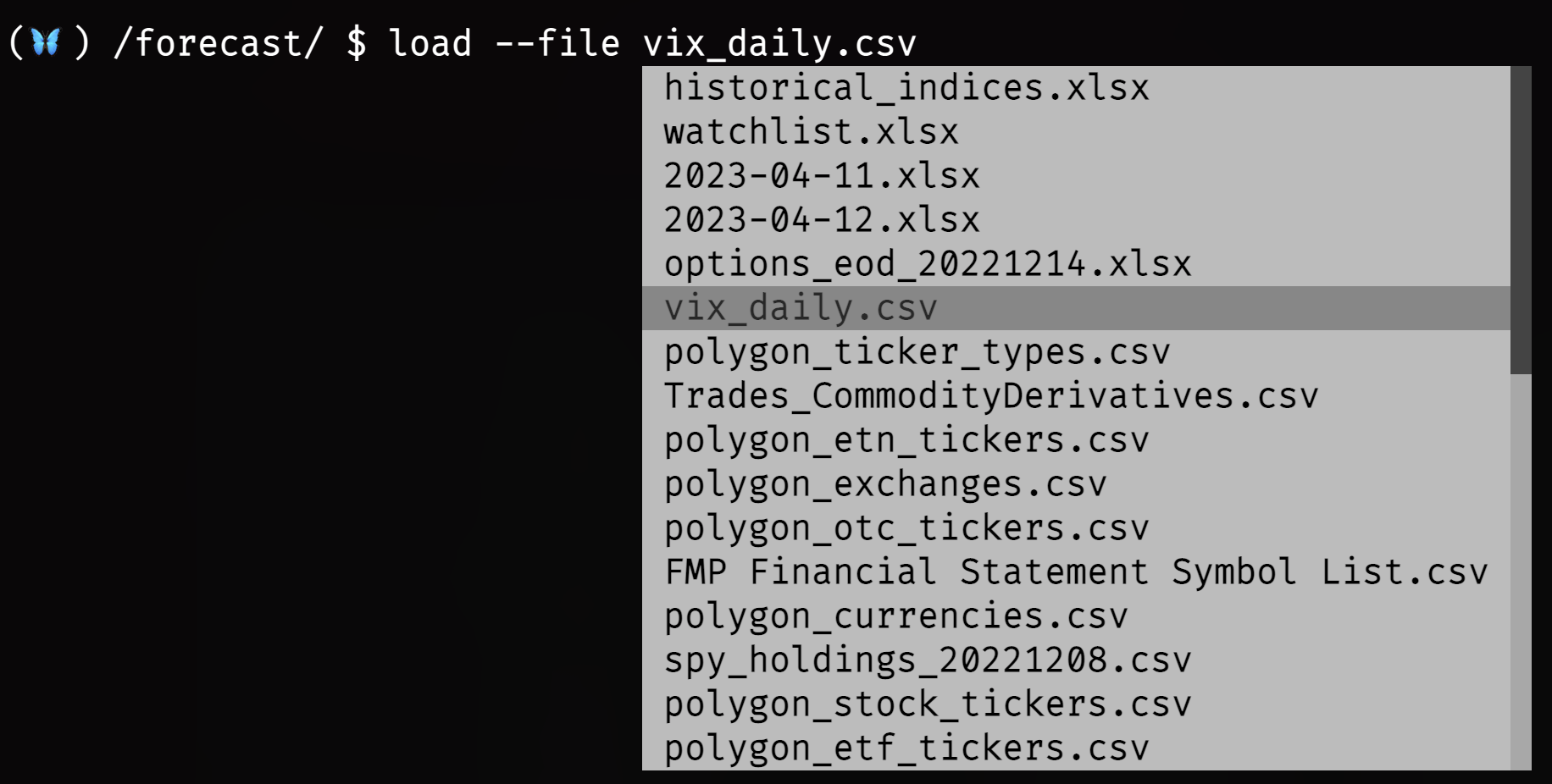

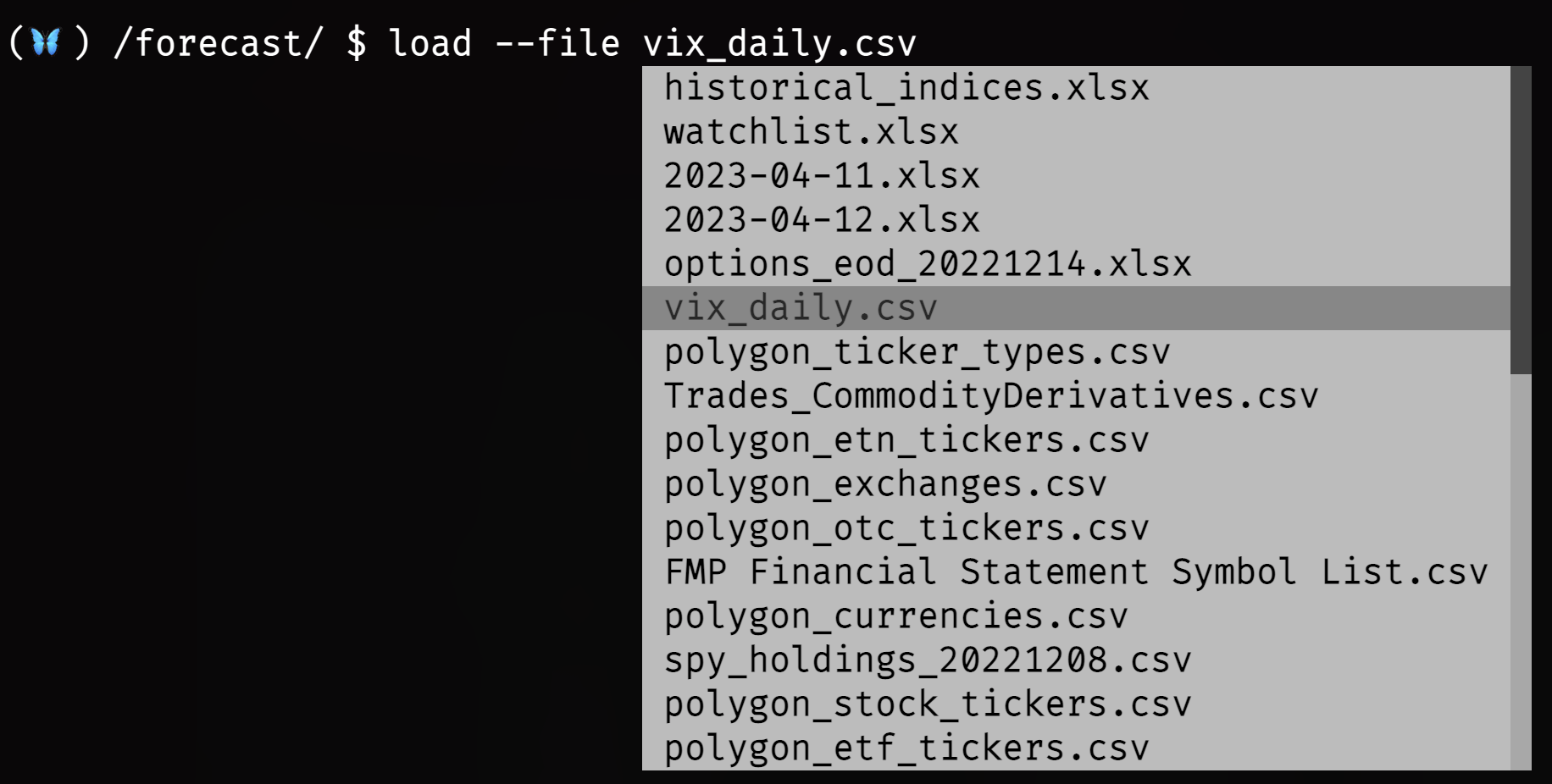

+### Importing and Exporting Data

+

+Most functions provide a method for exporting the raw data as a CSV, JSON, or XLSX file (with a specific sheet name). Exported data and user-supplied files to import are saved to the [OpenBBUserData folder](https://docs.openbb.co/terminal/usage/guides/data). The folder is located at the root of the operating system's User Account folder. Follow the link for a detailed description.

+

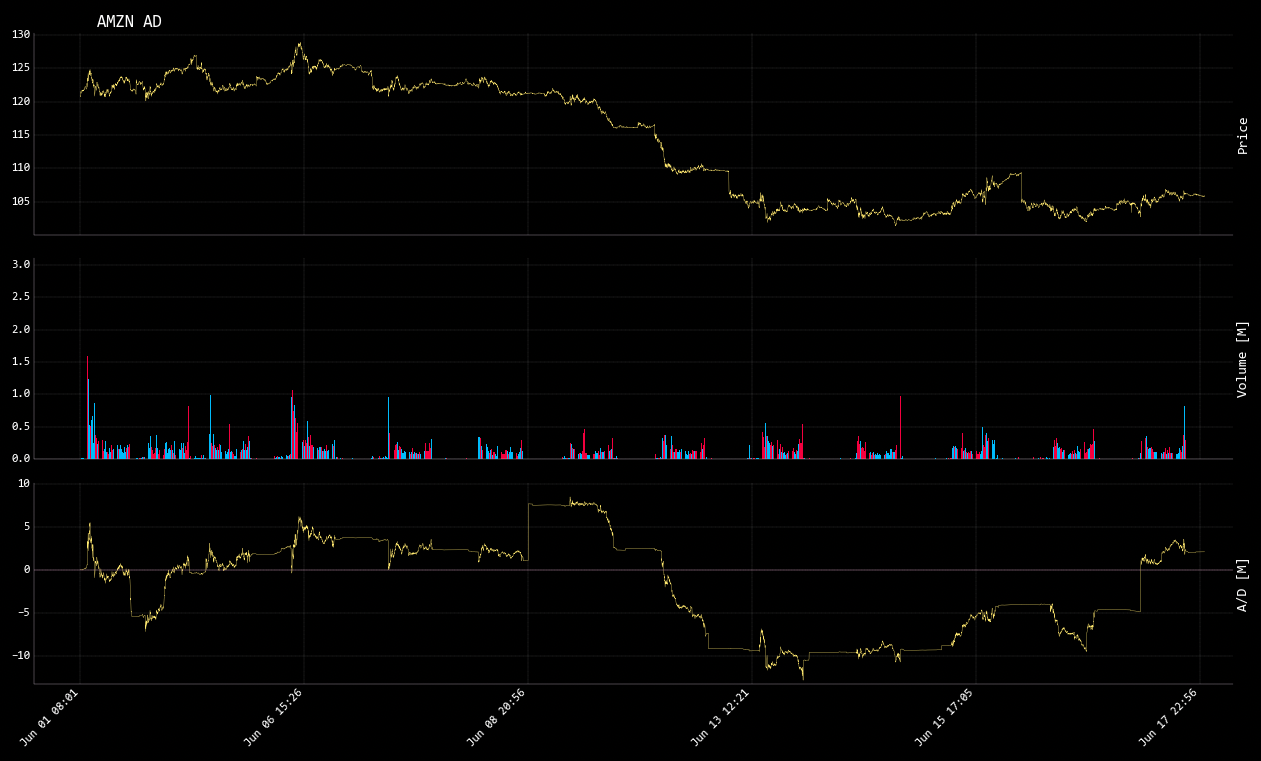

+## Charts

+

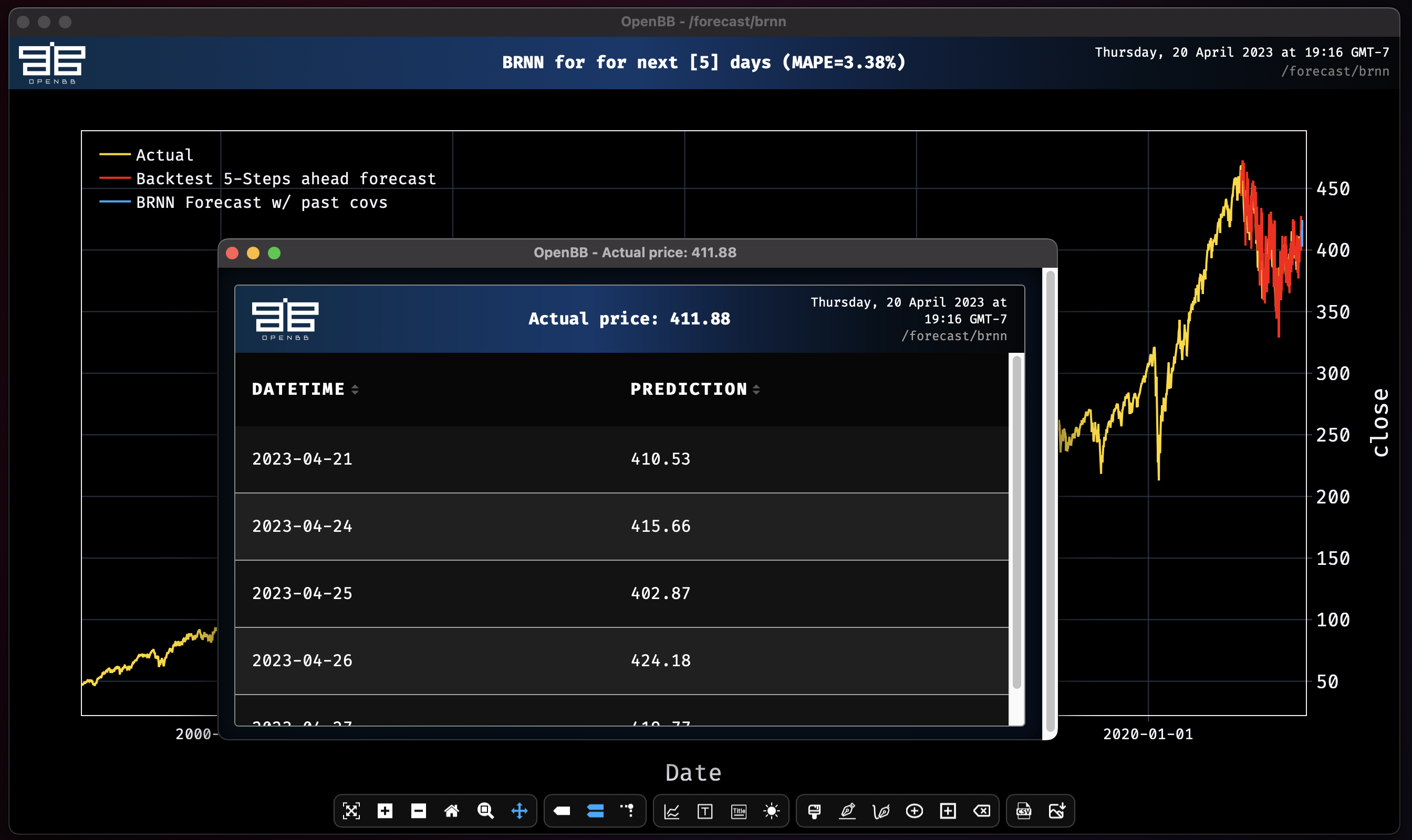

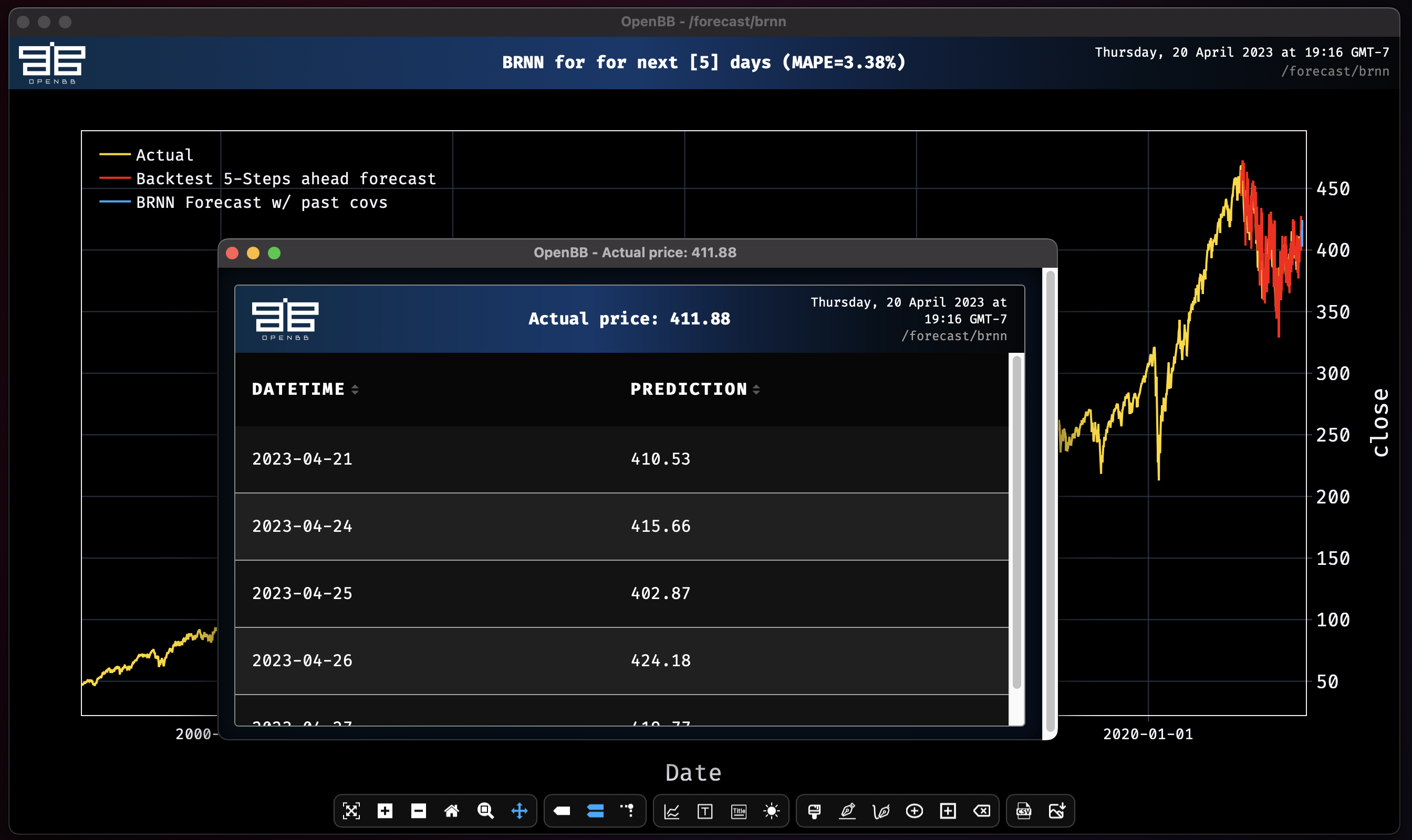

+The OpenBB charting library provides interactive, customizable, charts. Here's an example of displaying weekly candles for AAPL.

+

+```console

+/stocks/load AAPL -w/candle

```

-

+

+

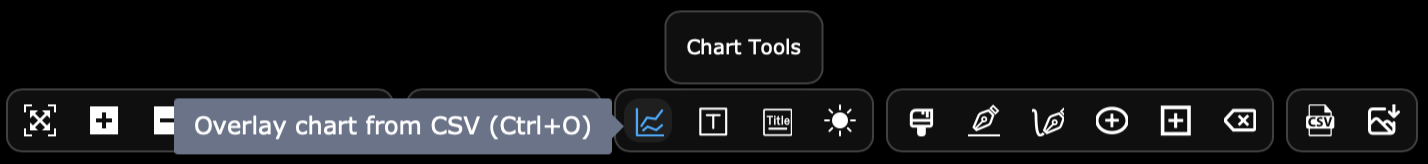

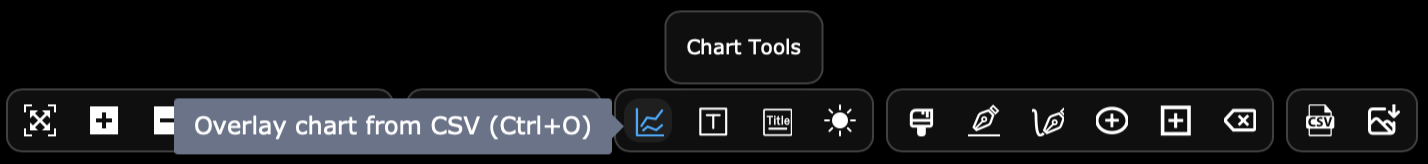

+### Toolbar

+

+The toolbar is located at the bottom of the window, and provides methods for:

+

+- Panning and zooming.

+- Modifying the title and axis labels.

+- Adjusting the hover read out.

+- Toggling light/dark mode.

+- Annotating and drawing.

+- Exporting raw data.

+- Saving the chart as an image.

+- Adding supplementary external data as an overlay.

+

+The label for each tool is displayed by holding the mouse over it.

+

+

+

+Toggle the toolbar's visibility via the keyboard with, `ctrl + h`.

+

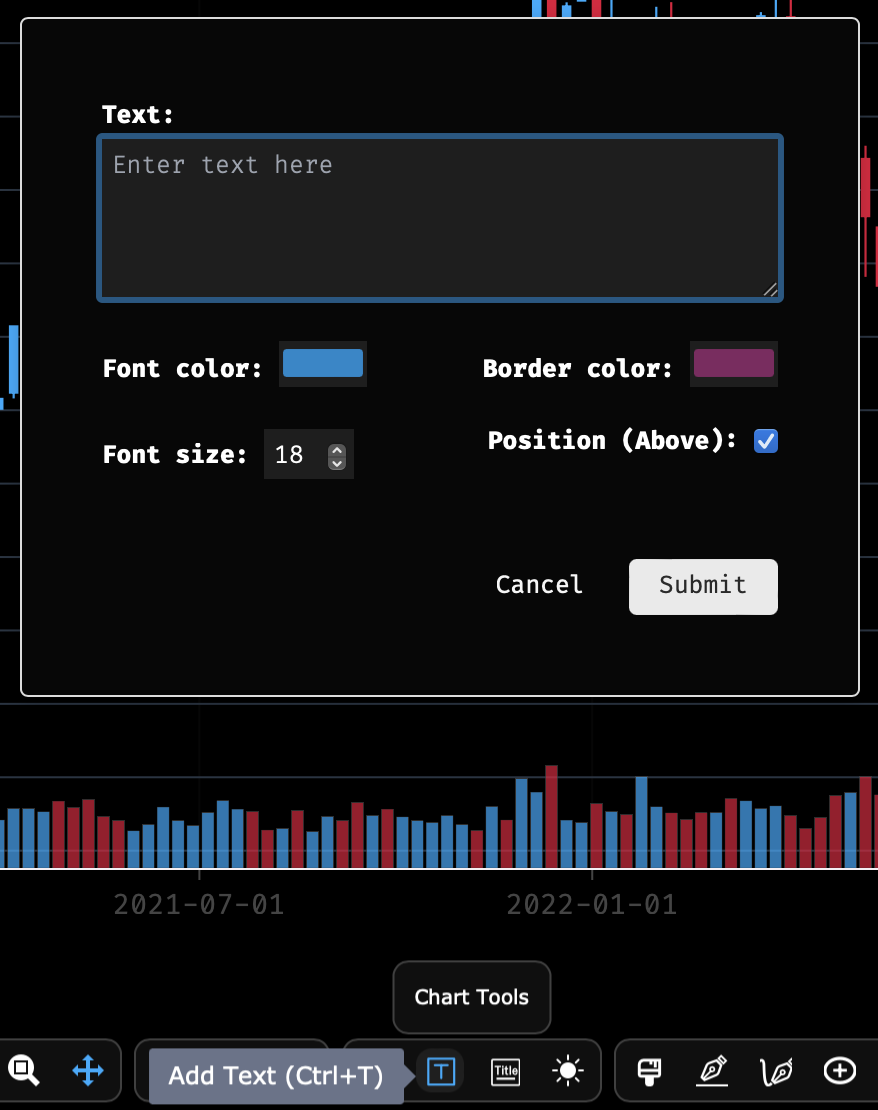

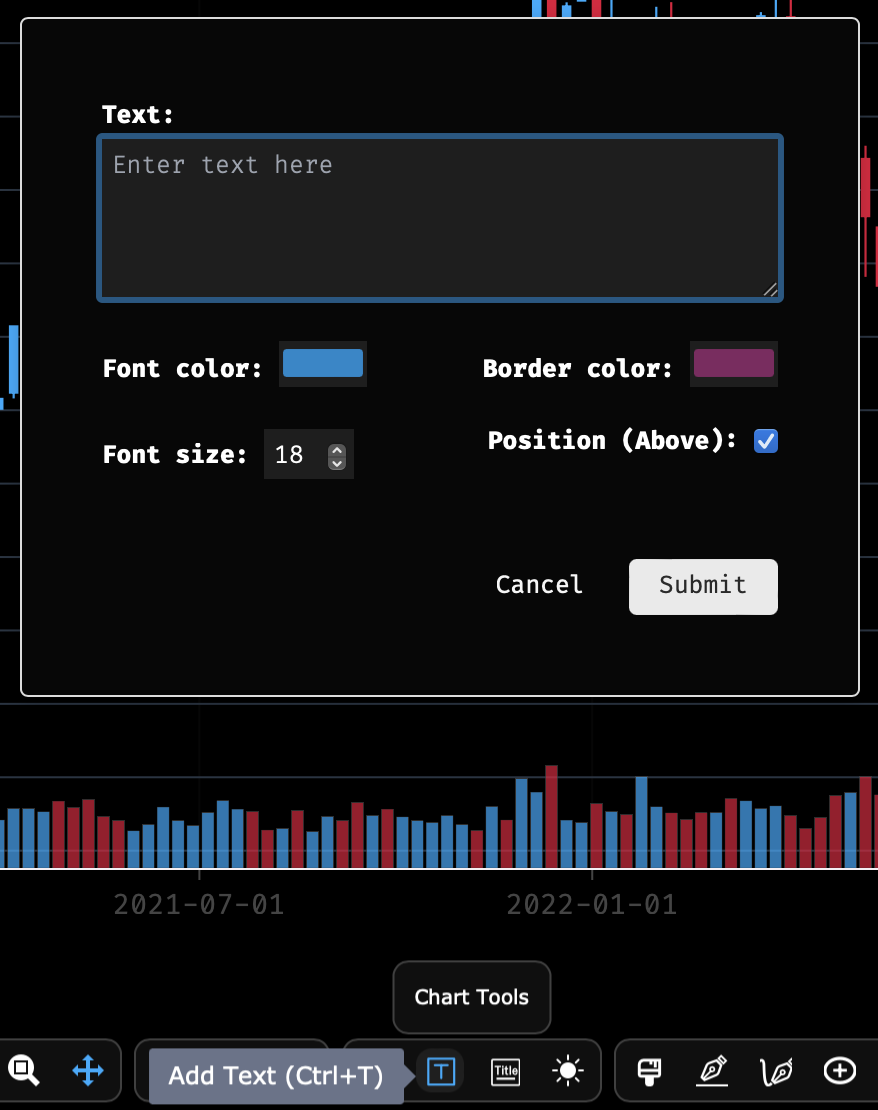

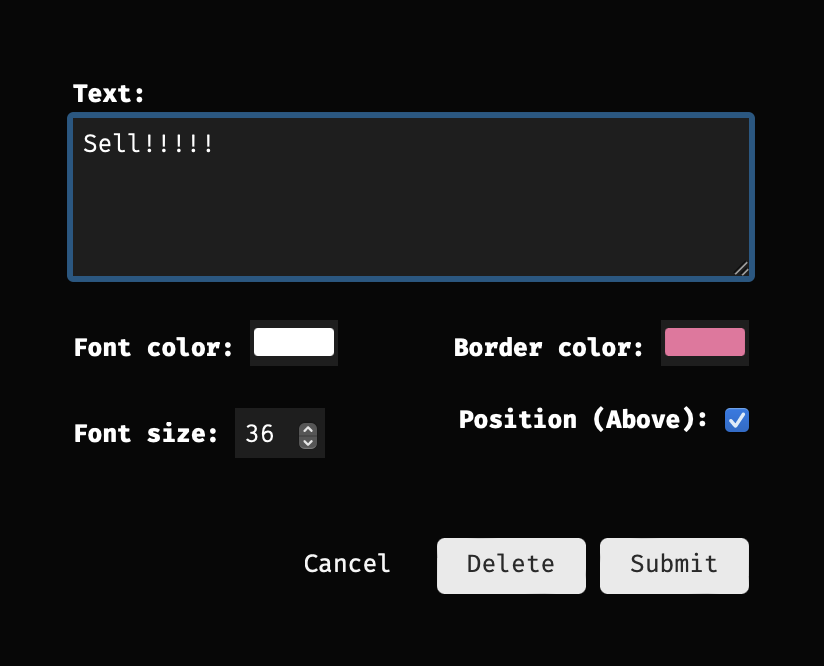

+### Text Tools

+

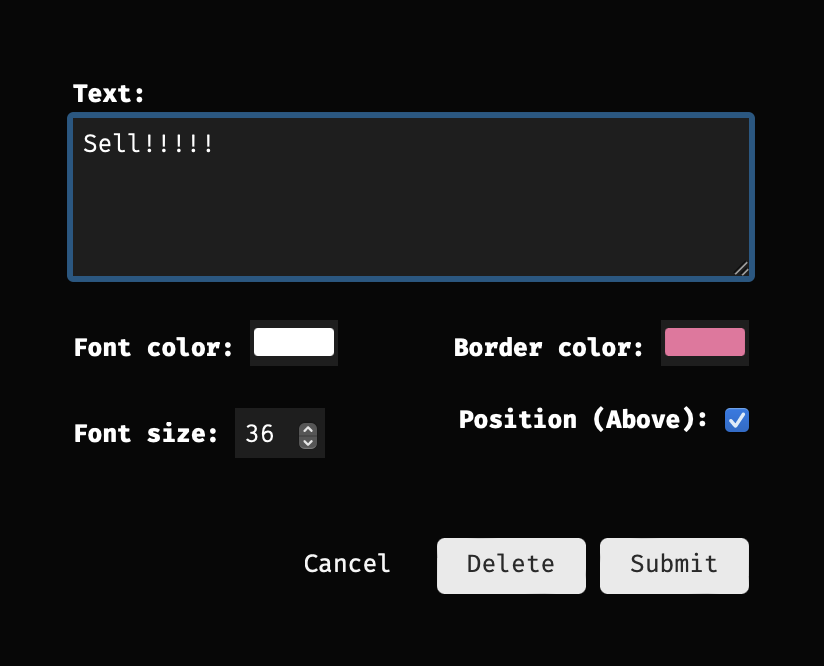

+Annotate a chart by clicking on the `Add Text` button, or with the keyboard, `ctrl + t`.

+

+

+

+Enter some text, make any adjustments to the options, then `submit`. Place the crosshairs over the desired data point and click to place the text.

+

+

+

+After placement, the text can be updated or deleted by clicking on it again.

+

+

+

+The title of the chart is edited by clicking the button, `Change Titles`, near the middle center of the toolbar, immediately to the right of the `Add Text` button.

+

+### Draw Tools

+

+The fourth group of icons on the toolbar are for drawing lines and shapes.

+

+- Edit the colors.

+- Draw a straight line.

+- Draw a freeform line.

+- Draw a circle.

+- Draw a rectangle.

+- Erase a shape.

+

+To draw on the chart, select one of the four drawing buttons and drag the mouse over the desired area. Click on any existing shape to modify it by dragging with the mouse and editing the color, or remove it by clicking the toolbar button, `Erase Active Shape`. The edit colors button will pop up as a floating icon, and clicking on that will display the color palette.

+

+

+

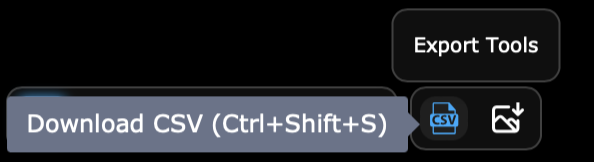

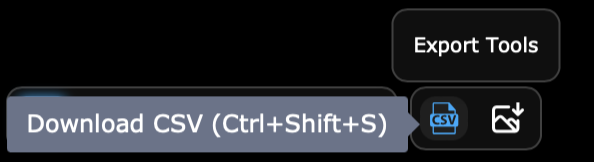

+### Export Tools

+

+The two buttons at the far-right of the toolbar are for saving the raw data or, to save an image file of the chart at the current panned and zoomed view.

+

+

+

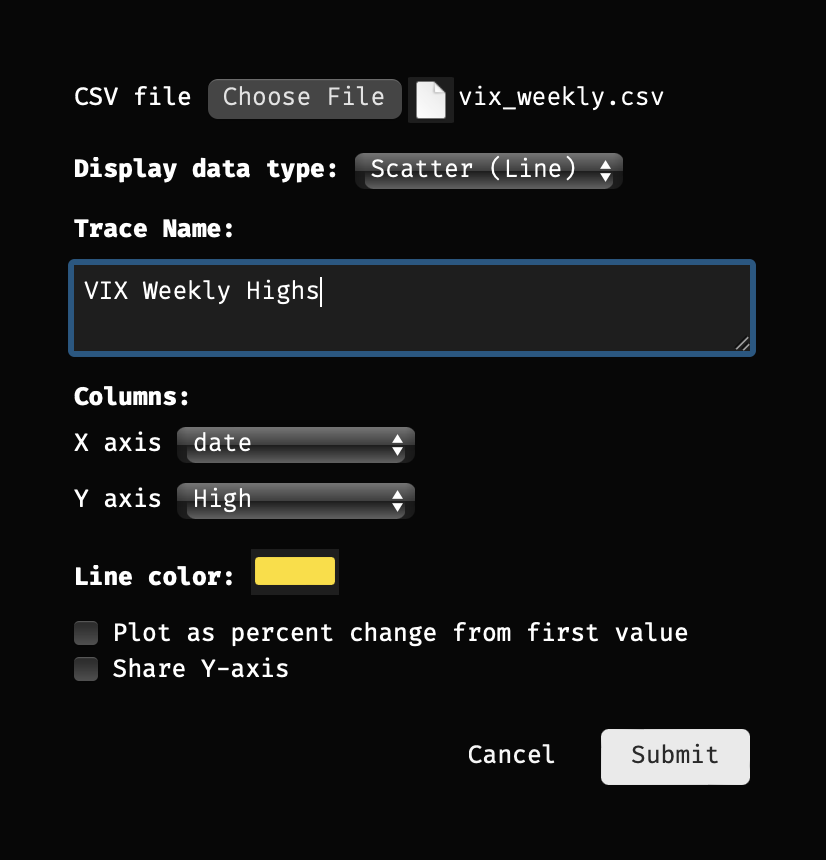

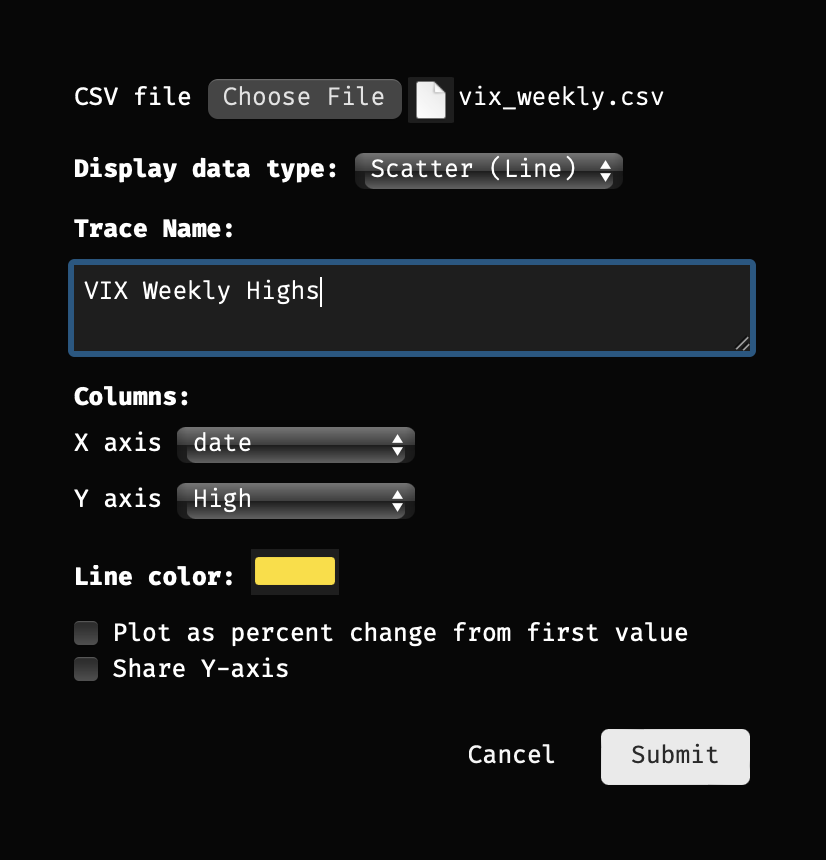

+### Overlay

+

+The button, `Overlay chart from CSV`, provides an easy import method for supplementing a chart with additional data. Clicking on the button opens a pop-up dialogue to select the file, column, and whether the overlay should be a bar, candlestick, or line chart. As a candlestick, the CSV file must contain OHLC data. The import window can also be opened with the keyboard, `ctrl-o`.

+

+

+

+After choosing the file to overlay, select what to show and then click on `Submit`.

+

+

+

+

+

+### Cheat Sheet

+

+The image below can be saved and used as a reference.

+

+

+

+

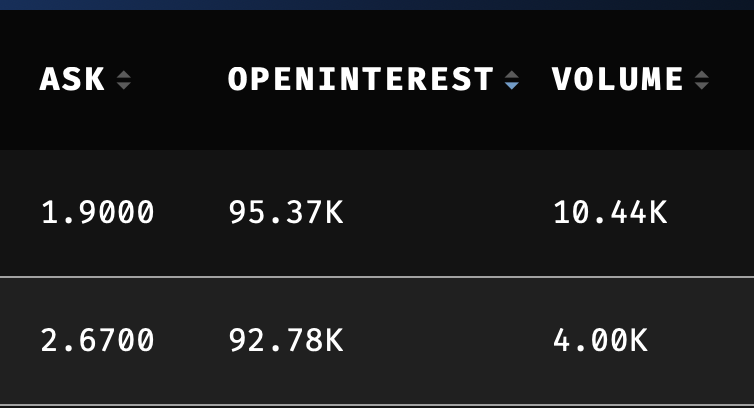

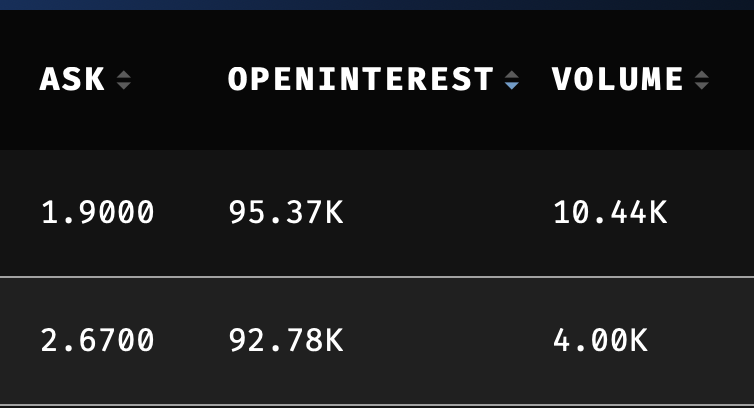

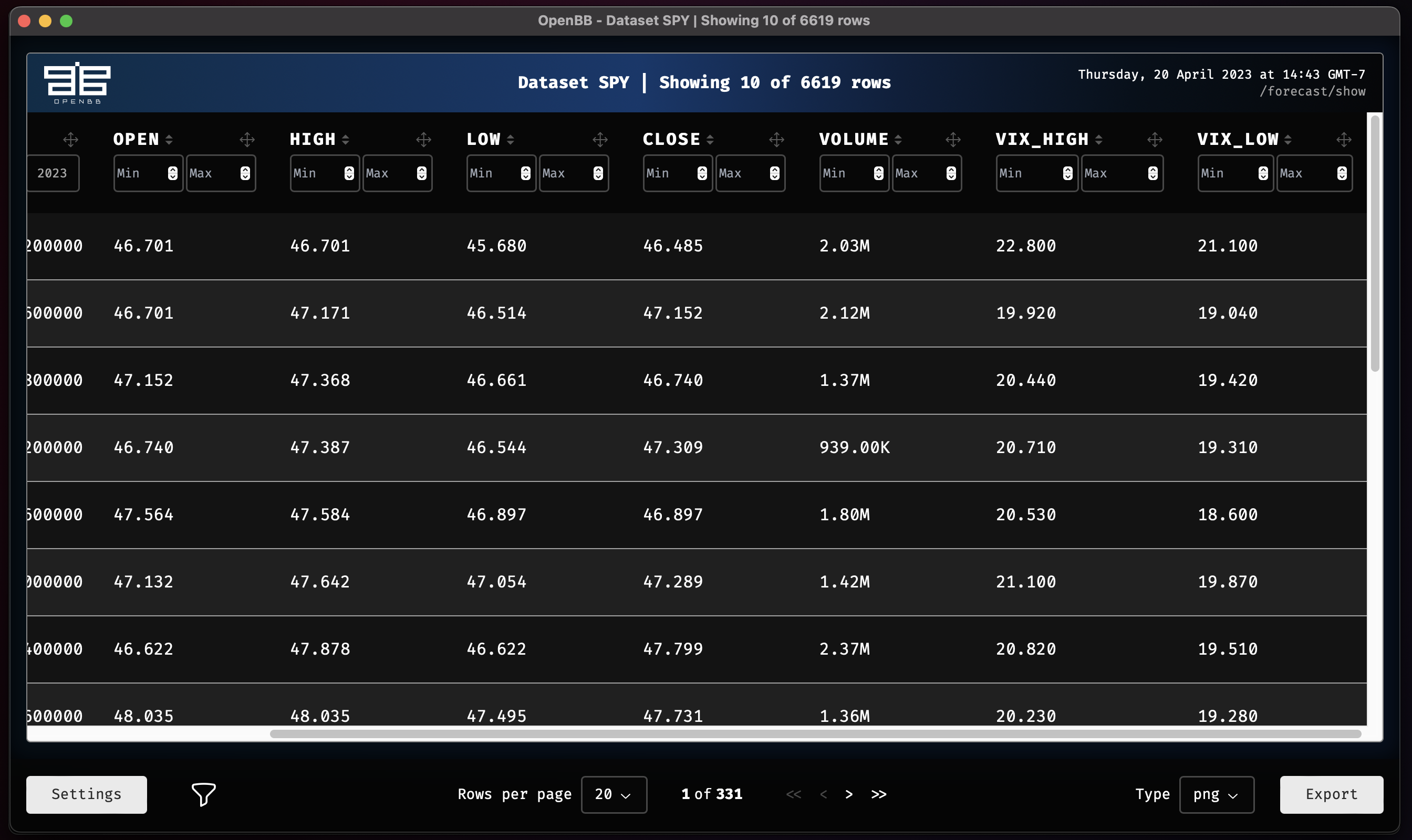

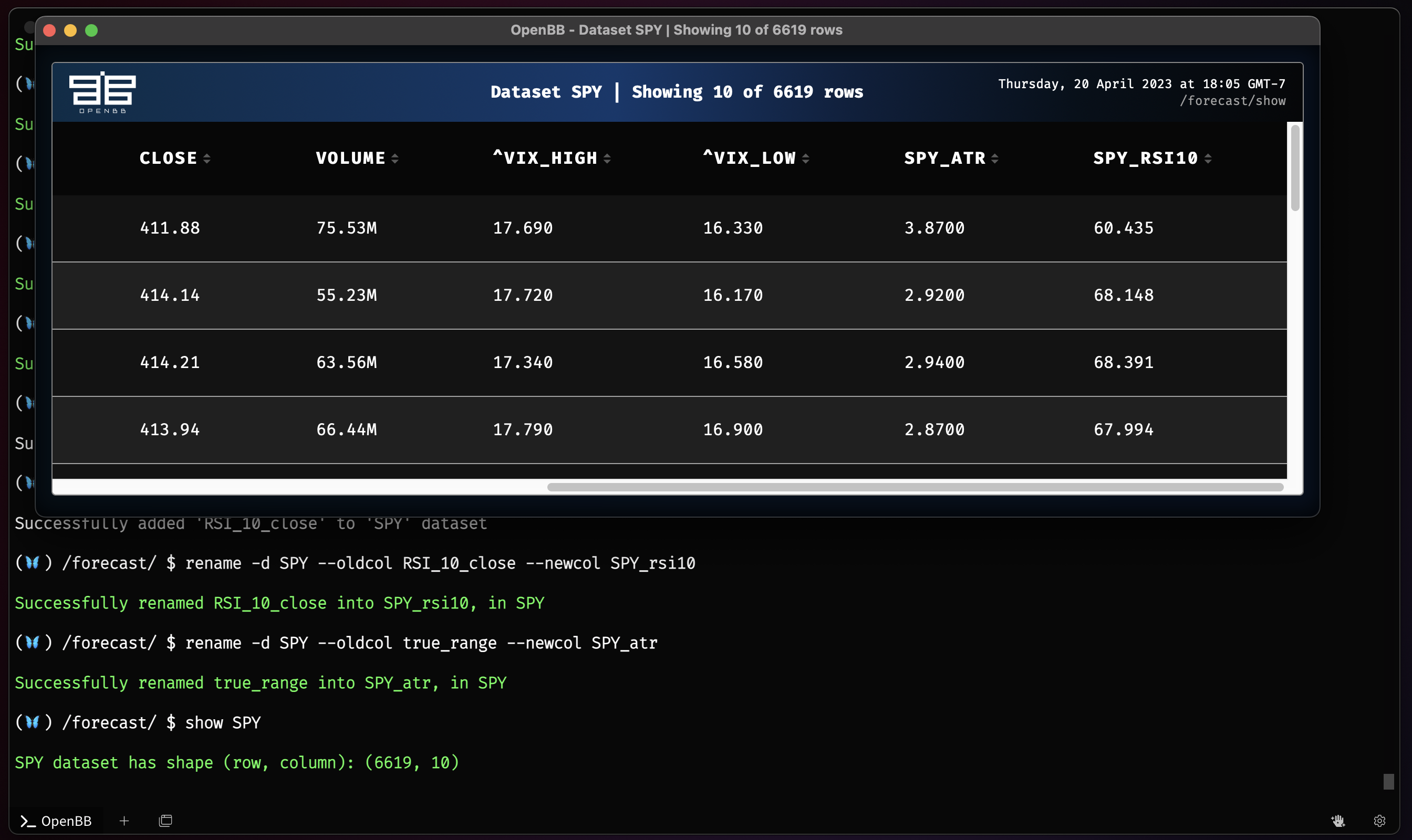

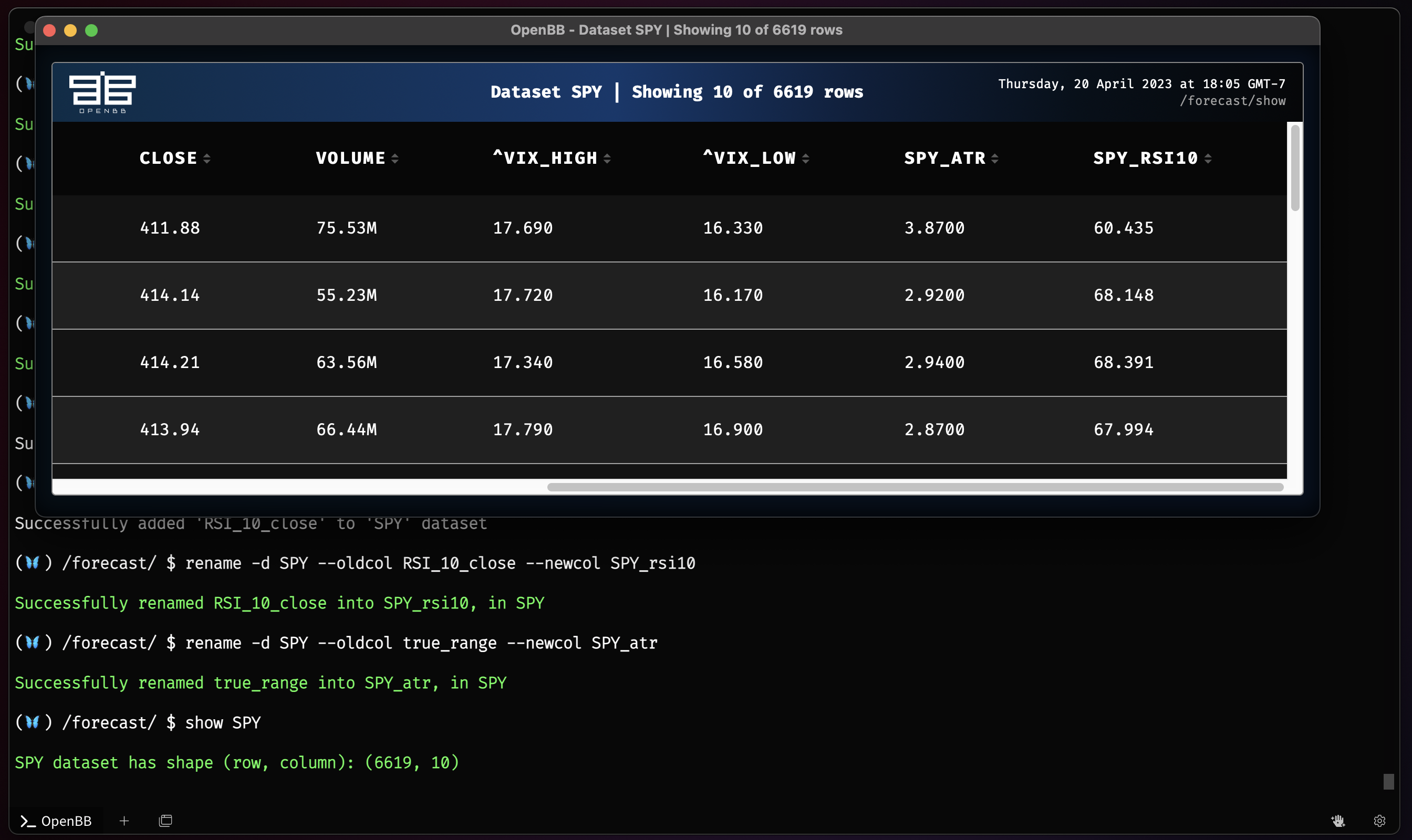

+## Tables

+

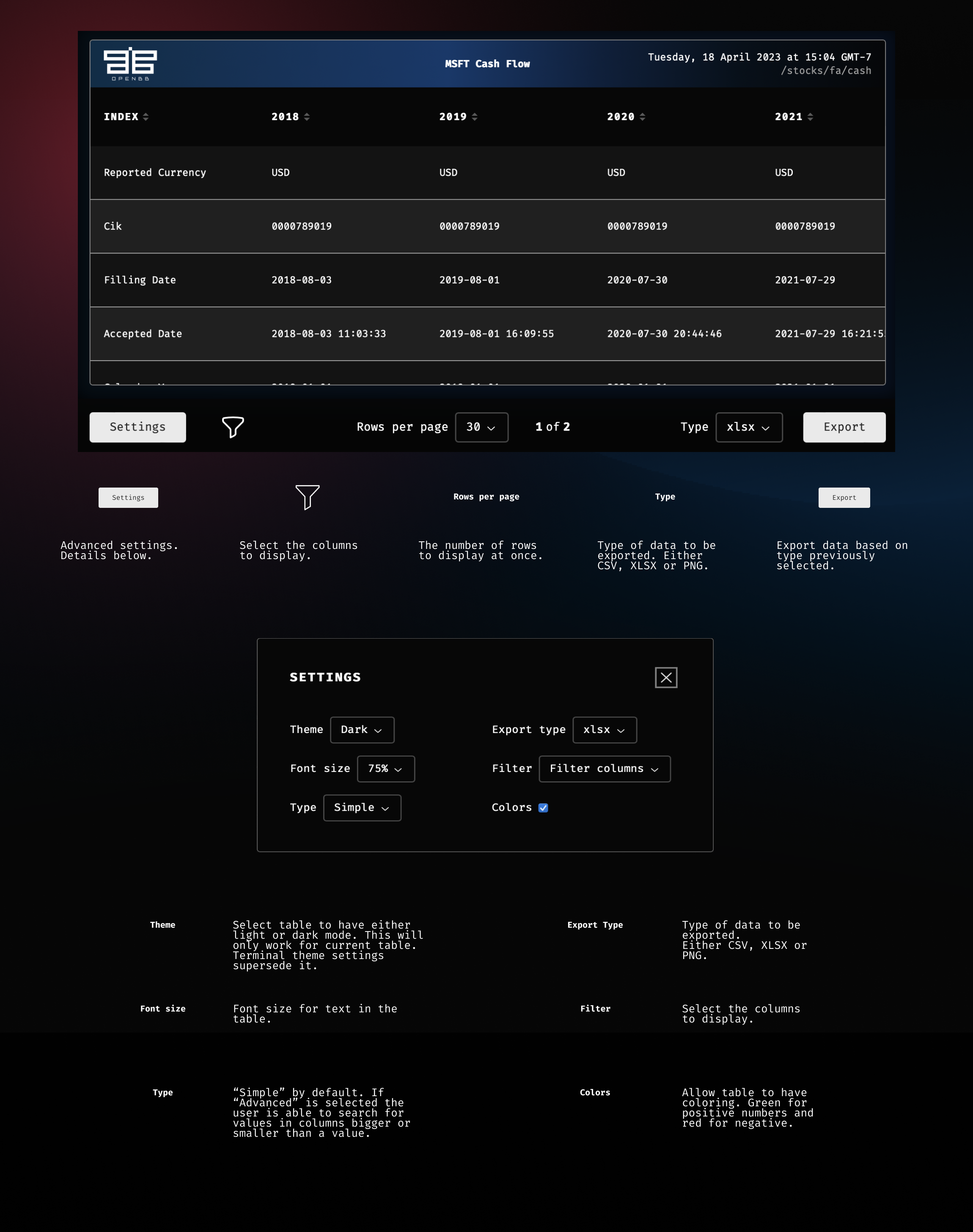

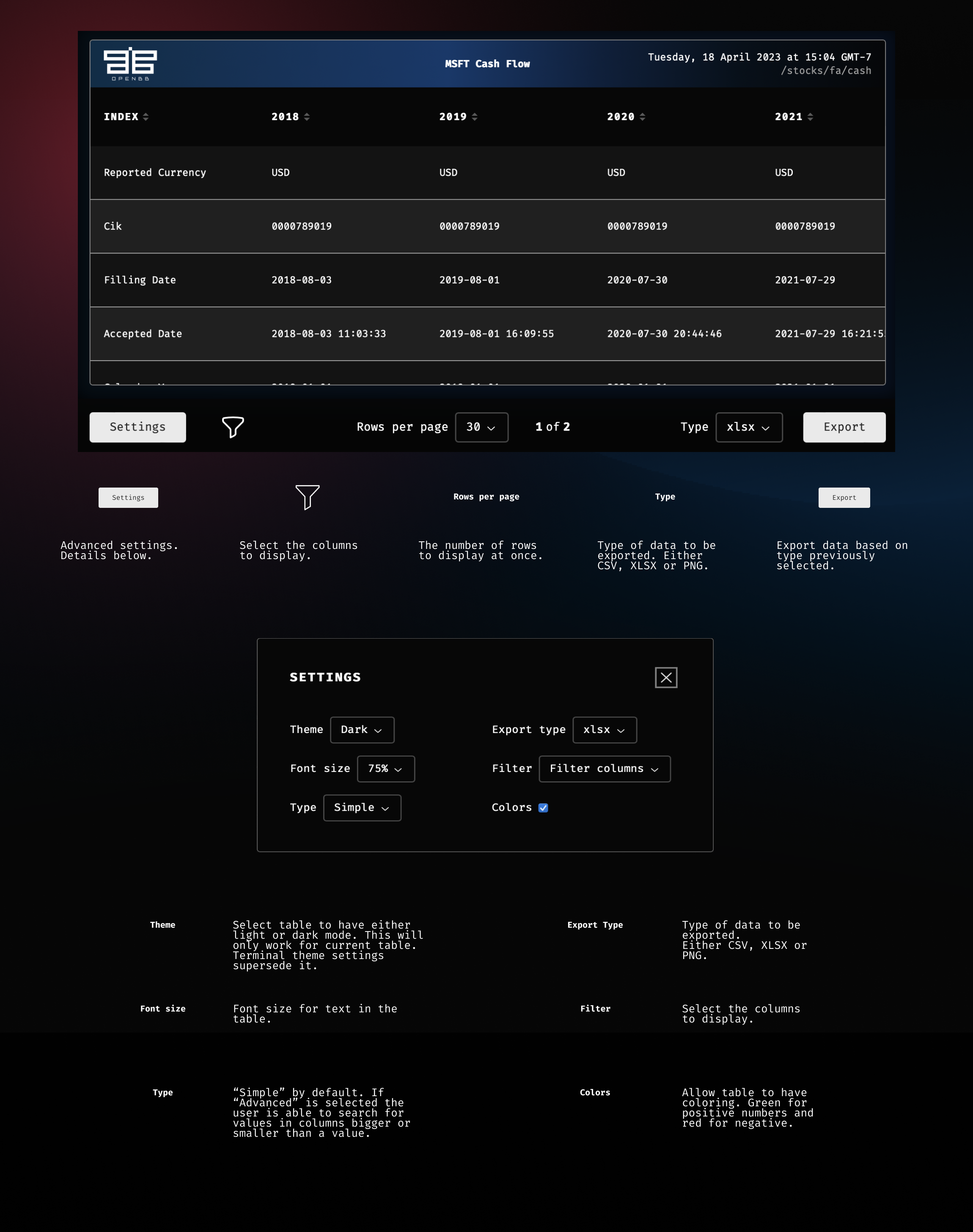

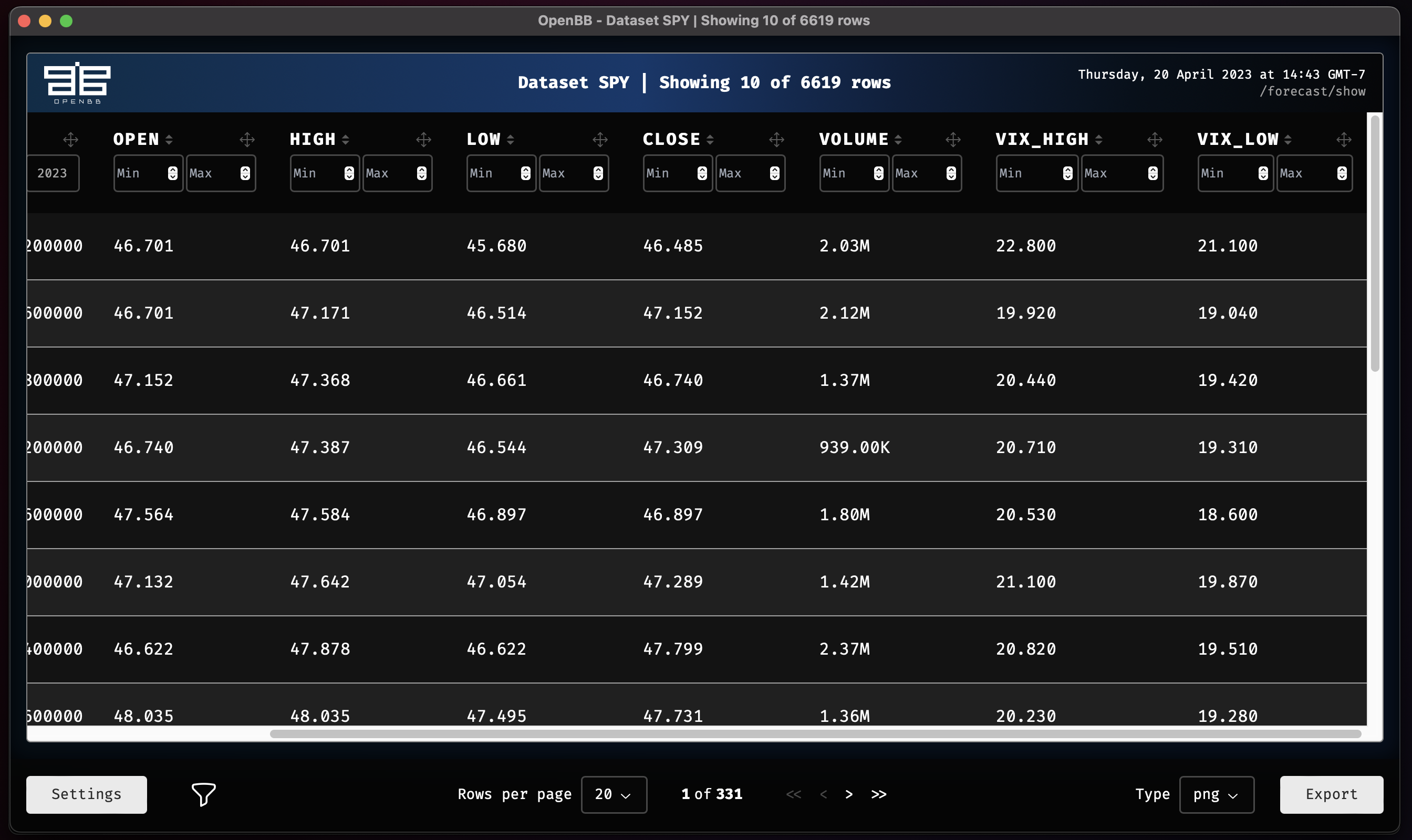

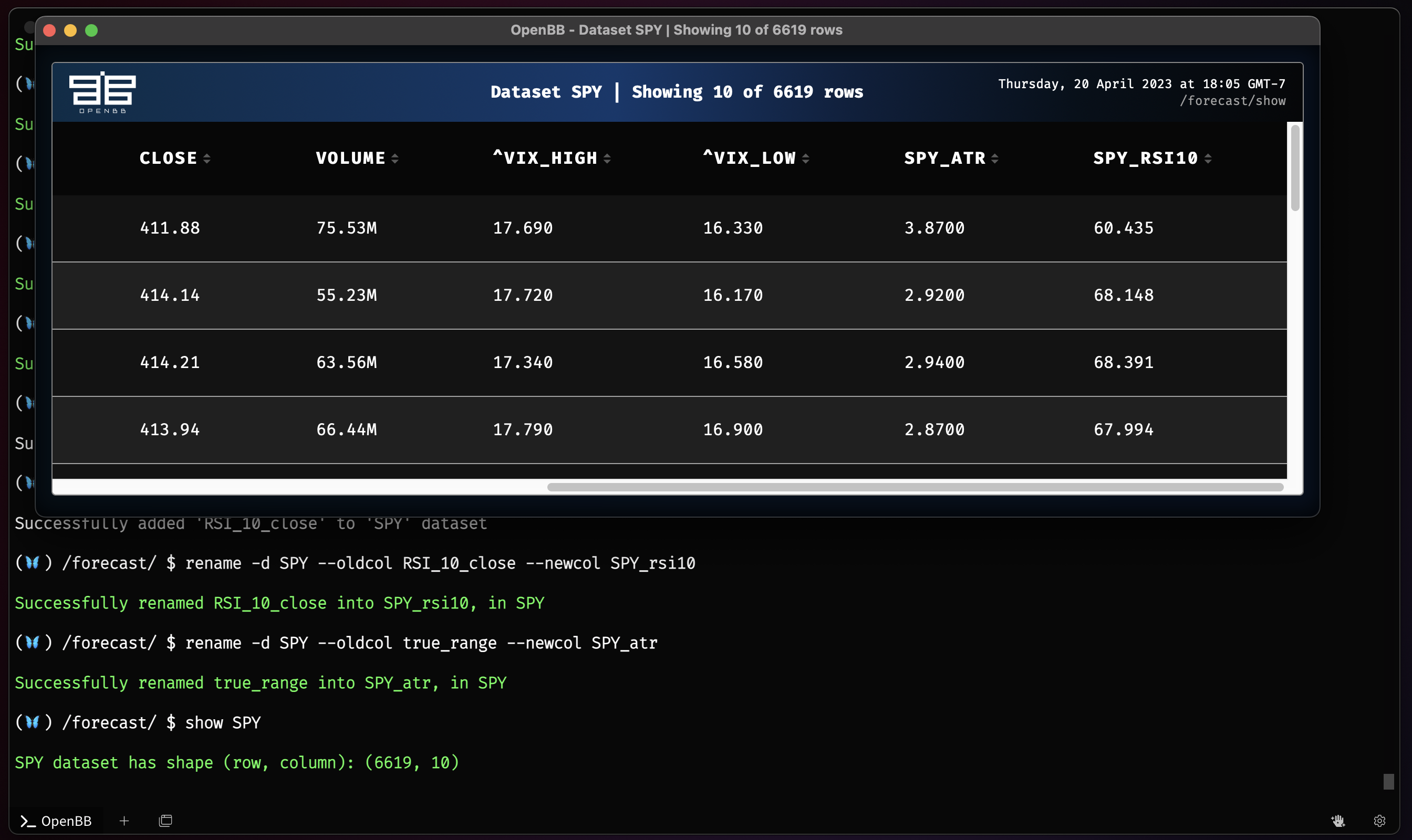

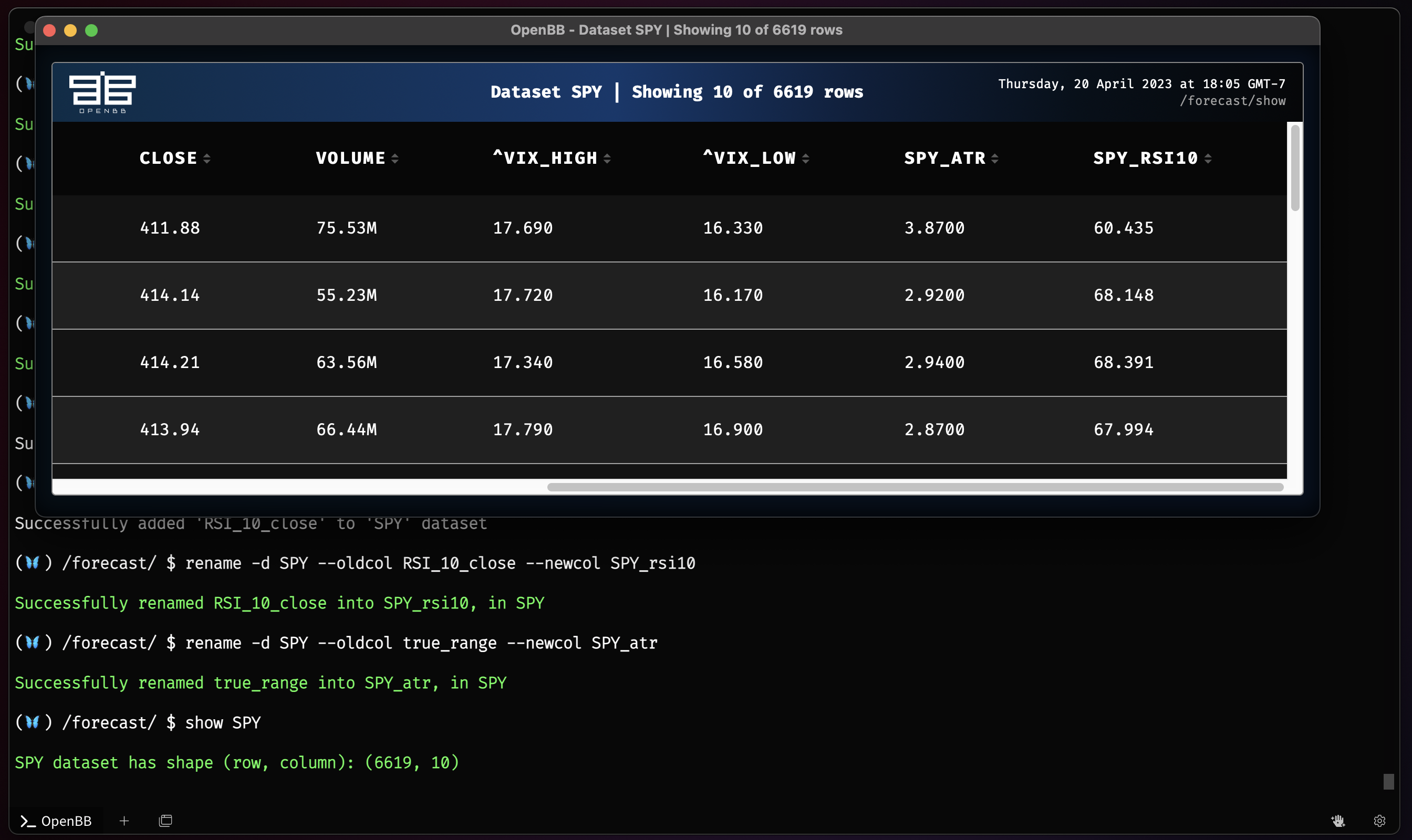

+The OpenBB Terminal sports interactive tables which opens in a separate window. They provide methods for searching, sorting, filtering, and exporting directly within the table. Preferences and settings for the tables can be updated directly on the table.

+

+### Sorting and Filtering

+

+Columns can be sorted ascending/descending/unsorted, by clicking the controls to the right of each header title. The status of the filtering is shown as a blue indicator.

+

+

+

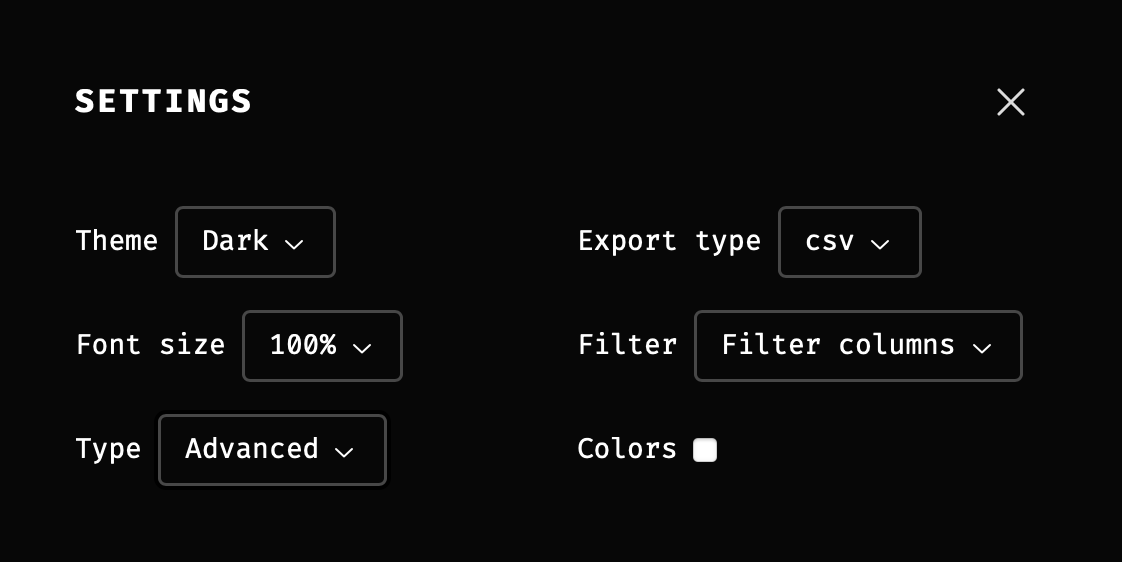

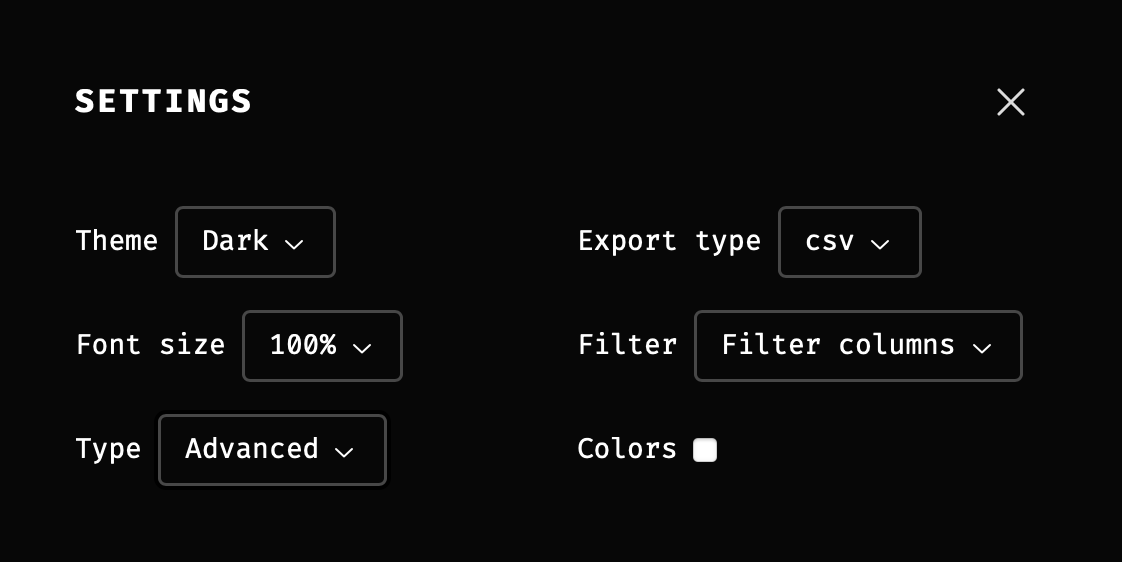

+The settings button, at the lower-left corner, displays choices for customizing the table. By selecting the `Type` to be `Advanced`, columns become filterable.

+

+

+

+The columns can be filtered with min/max values or by letters, depending on the content of each column.

+

+

+

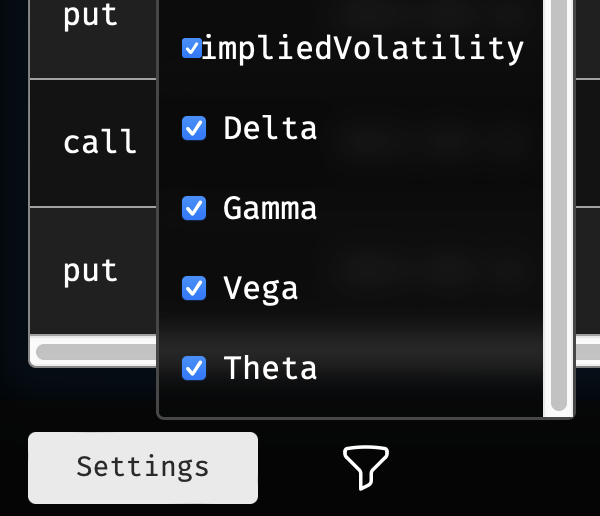

+### Selecting Columns and Rows

+

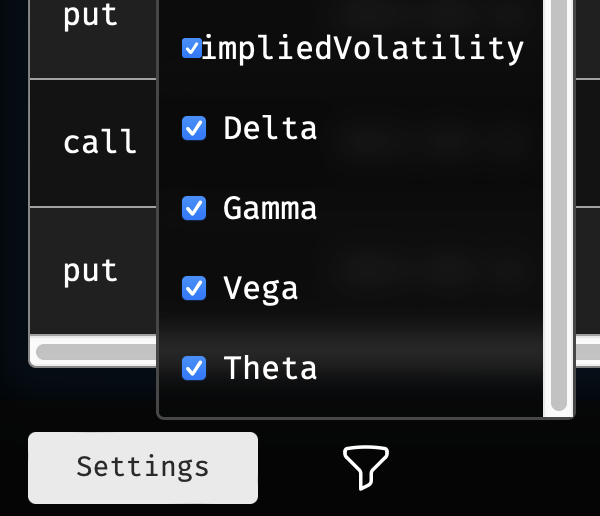

+The table will scroll to the right as far as there are columns. Columns can be removed from the table by clicking the icon to the right of the settings button and unchecking it from the list.

+

+

+

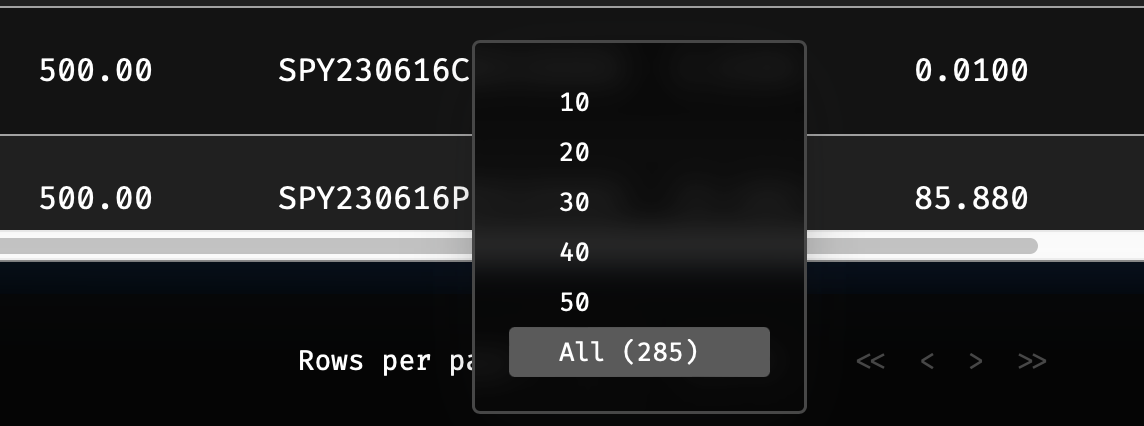

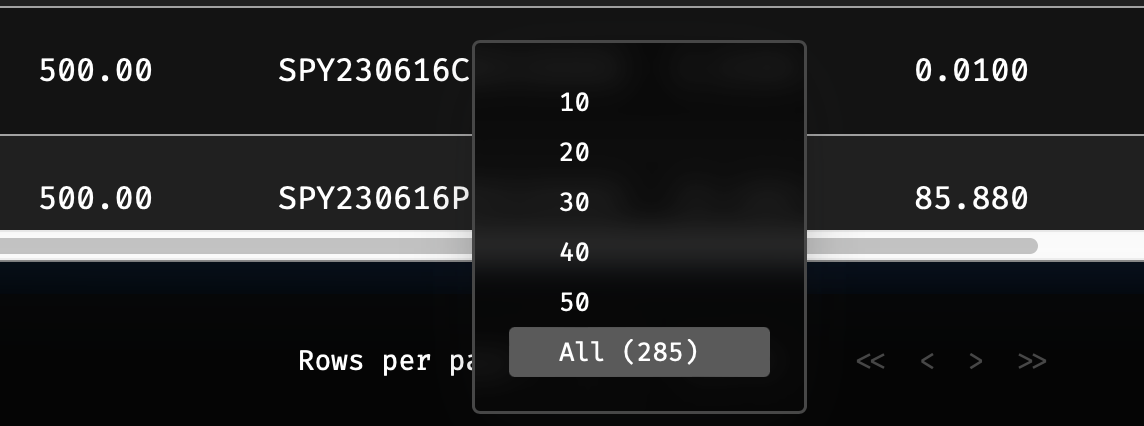

+The number of rows per page is defined in the drop down selection near the center, at the bottom.

+

+

+

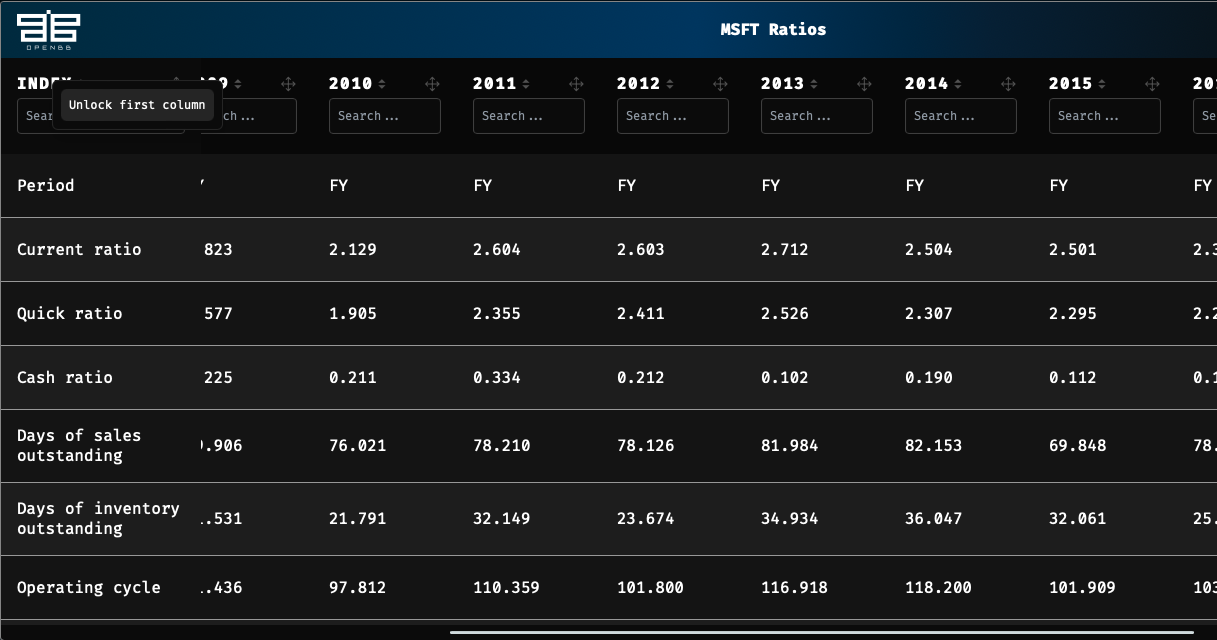

+### Freeze the Index and Column Headers

+

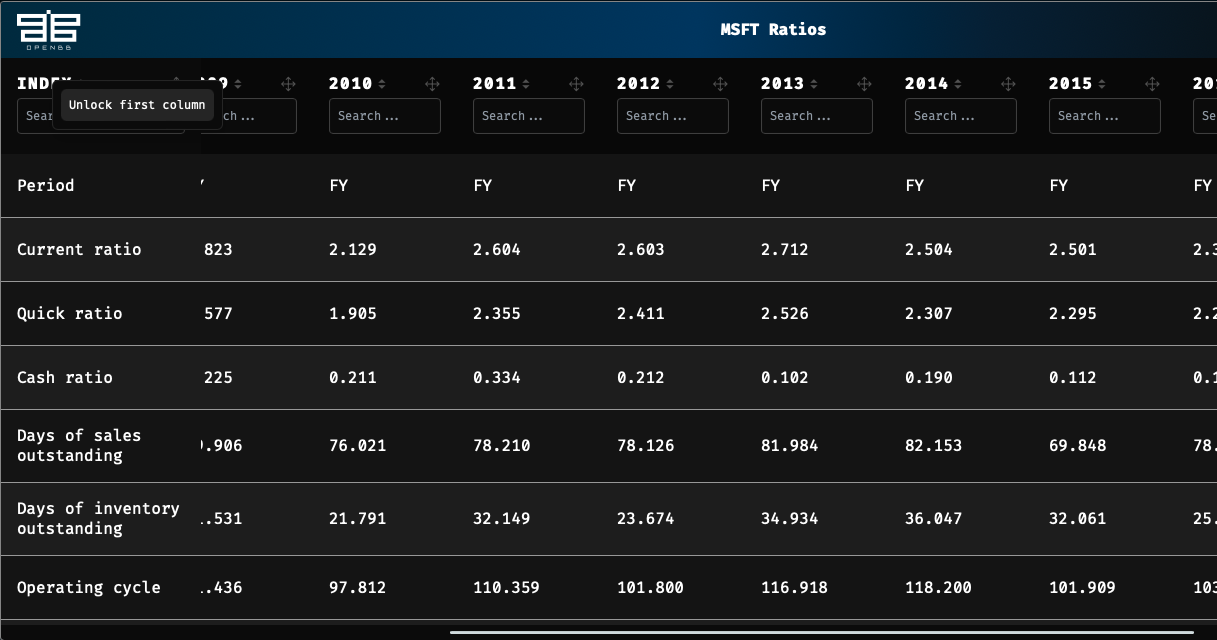

+Right-click on the index name to enable/disable freezing when scrolling to the right. Column headers are frozen by default.

+

+

+

+### Exporting Data

+

+At the bottom-right corner of the table window, there is a button for exporting the data. To the left, the drop down selection for `Type` can be defined as a CSV, XLSX, or PNG file. Exporting the table as a PNG file will create a screenshot of the table at its current view, and data that is not on the screen will not be captured.

+

+

+

+### Cheat Sheet

+

+The image below can be saved and used as a reference.

-As mentioned in the Explanation of Menus, some information also transfers over to other menus and this includes the loaded market data from load. So, if you would visit the `ta` menu (which stands for Technical Analysis) you will see that, by running any command, the selected period above is depicted again. Return to the Stocks menu again by using `q` and use it again to return to the home screen which can be shown with `?`.

+

diff --git a/website/content/terminal/usage/guides/customizing-the-terminal.md b/website/content/terminal/usage/guides/customizing-the-terminal.md

index f578954edf53..6705f61079b4 100644

--- a/website/content/terminal/usage/guides/customizing-the-terminal.md

+++ b/website/content/terminal/usage/guides/customizing-the-terminal.md

@@ -1,63 +1,140 @@

---

sidebar_position: 5

title: Customization

-description: Learn how to customize the look of your OpenBB Terminal. You can adjust the lay-out, settings, terminal behavior, and enable or disable certain functionalities.

-keywords: [settings, featflags, feature flags, lay-out, advanced, customizing, openbb terminal, layout, settings, colors, functionality, features]

+description: The settings and feature flags menus are for altering the behaviour and presentation of the Terminal, both are accessed from the main menu.

+keywords: [settings, featflags, feature flags, lay-out, advanced, customizing, openbb terminal]

---

+The OpenBB Terminal contains two menus for altering the behaviour and presentation of the Terminal, Settings and FeatFlags, both of which are accessed from the main menu.

import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

+## The Settings Menu

-Since the code is open source you are able to adjust anything you like. However, to make it easy for you we have created a settings and featflags menu that include the most requested features that users like to have control over.

-

-## Using the Settings Menu

-

-To adjust the lay-out and settings of the OpenBB Terminal you can access the `settings` menu. This menu allows you to tweak how the terminal behaves.

-

-

+## Help Dialogues

-Depending on the menu you are in, you are presented with a new set of commands and menus you can select. There are interactions in place between each menu. For example, when selecting a company within the `stocks` menu, the terminal will remember your selection when you visit the `fa` or `options` menu. See [Introduction to Stocks](/terminal/usage/intros/stocks).

+### -h or --help

-:::note **About Pipelines**

-You can quickly jump between menus by using a forward slash (`/`). For example, if I want to access the options menu, You can type `/stocks/options` to instantly arrive at this menu. You can do this from any location within the OpenBB Terminal!

-:::

+A help dialogue for any function at the current location is printed to the screen by typing `-h` after the command. The information returned contains a short description of the function and all accepted arguments. For an example, the `/news` function:

-### Explanation of Commands

+```console

+news -h

+```

-Commands, depicted in Light Blue, execute an action or task. For example,

-the commands that you are able to use from any menu in the terminal (see Explanation of Menus) are as follows:

+```console

+usage: news [-t TERM [TERM ...]] [-s SOURCES] [-h] [--export EXPORT] [--sheet-name SHEET_NAME [SHEET_NAME ...]] [-l LIMIT]

-- `cls`: clears the screen, by executing this command you are left with an empty screen.

-- `help`, `h` or `?`: displays the menu that you are currently on.

-- `quit`, `q` or `..`: allows for navigation through the menu. E.g. if you type `stocks` press `ENTER` (⏎) and then

- use `q` and press `ENTER` (⏎) you return to where you started. Validate this by typing `?` and pressing `ENTER` (⏎).

-- `support`: allows you to submit bugs, questions and suggestions.

-- `about`: this opens the related guide, linking to this website. It also has the ability to open a guide to a specific

- command. For example, within the `stocks` menu, `about candle` opens this guide.

-- `wiki`: search for a given expression on the Wikipedia without leaving the terminal.

+display news articles based on term and data sources

-Continuing with the example mentioned at `quit`, revisit the `stocks` menu and look at the commands. At the top you will see a command named load. To understand what this command can do, you can use `load -h` followed by `ENTER` (⏎). The `-h` stands for `help` and every command will have this feature. This will return the following:

+options:

+ -t TERM [TERM ...], --term TERM [TERM ...]

+ search for a term on the news

+ -s SOURCES, --sources SOURCES

+ sources from where to get news from (separated by comma)

+ -h, --help show this help message

+ --export EXPORT Export raw data into csv, json, xlsx

+ --sheet-name SHEET_NAME [SHEET_NAME ...]

+ Name of excel sheet to save data to. Only valid for .xlsx files.

+ -l LIMIT, --limit LIMIT

+ Number of entries to show in data.

+For more information and examples, use 'about news' to access the related guide.

```

-usage: load [-t TICKER] [-s START] [-e END] [-i {1,5,15,30,60}] [-p] [-f FILEPATH] [-m] [-w] [--exchange] [--performance] [-h] [--export EXPORT] [--sheet-name SHEET_NAME [SHEET_NAME ...]]

- [--source {YahooFinance,AlphaVantage,Polygon,EODHD,Intrinio}]

-

-Load stock ticker to perform analysis on. When the data source is yf, an Indian ticker can be loaded by using '.NS' at the end, e.g. 'SBIN.NS'. See available market in https://help.yahoo.com/kb/exchanges-data-

-providers-yahoo-finance-sln2310.html.

-

-optional arguments:

- -t TICKER, --ticker TICKER

- Stock ticker (default: None)

- -s START, --start START

- The starting date (format YYYY-MM-DD) of the stock (default: 2020-02-11)

- -e END, --end END The ending date (format YYYY-MM-DD) of the stock (default: 2023-02-15)

- -i {1,5,15,30,60}, --interval {1,5,15,30,60}

- Intraday stock minutes (default: 1440)

- -p, --prepost Pre/After market hours. Only reflected in 'YahooFinance' intraday data. (default: False)

- -f FILEPATH, --file FILEPATH

- Path to load custom file. (default: None)

- -m, --monthly Load monthly data (default: False)

- -w, --weekly Load weekly data (default: False)

- --exchange Show exchange information. (default: False)

- --performance Show performance information. (default: False)

- -h, --help show this help message (default: False)

- --export EXPORT Export raw data into csv, json, xlsx (default: )

- --sheet-name SHEET_NAME [SHEET_NAME ...]

- Name of excel sheet to save data to. Only valid for .xlsx files. (default: None)

- --source {YahooFinance,AlphaVantage,Polygon,EODHD,Intrinio}

- Data source to select from (default: YahooFinance)

-For more information and examples, use 'about load' to access the related guide.

+To search for news containing the term, "Federal Reserve", try this command:

+```console

+/news --term Federal Reserve

```

-This shows you all **arguments** the command has. These are additional options you can provide to the command. Each default value is also displayed which is used when you do not select this option. For example, if I would use the stock ticker of Amazon (AMZN, which can also be found with `search amazon`), I can use `load AMZN` which will return the following:

+### About

+

+`about` is a global function that opens a browser to the OpenBB documentation pages at the specific command or menu.

+```console

+/about stocks

```

-(🦋) /stocks/ $ load AMZN

-Loading Daily data for AMZN with starting period 2020-02-11.

+The command above will open a browser to [Introduction to the Stocks menu](https://docs.openbb.co/terminal/usage/intros/stocks).

-```

+### Support

-The default values you see within `load -h` have been inputted here. E.g. the starting period is 2020-02-11. I can decide to change these default values by calling the argument and inputting a different value.

+`support` is a global function for submitting a new request for support, a general question, or a bug report. The command will pre-populate a form with key information, like the command or menu name specific to the issue. Use the up and down arrow keys to browse and select the appropriate item for the ticket. Naturally, this command has a help dialogue.

-Whenever you wish to apply an optional argument, you use the related shortcode, e.g. `-s` or `--start`. Then, if there is an additional word behind the argument (in this case there is, which is `START`) it implies the argument expects you to define a value. Within the documentation you can read that the format must be `YYYY-MM-DD` implying that `2010-01-01` will be valid. If there is not an additional word behind it, it is enough to write down `load AMZN -p` (which refers to the prepost optional argument)

+```console

+support -h

+```

-Let's change the starting and ending period of the data that is being loaded in by doing the following:

+```console

+Submit your support request

+options:

+ -c {search,load,quote,tob,candle,news,resources,codes,ta,ba,qa,disc,dps,scr,sia,ins,gov,res,dd,fa,bt,ca,options,th,forecast}, --command {generic,search,load,quote,tob,candle,news,resources,codes,ta,ba,qa,disc,dps,scr,sia,ins,gov,res,dd,fa,bt,ca,options,th,forecast}

+ Command that needs support (default: None)

+ --msg MSG [MSG ...], -m MSG [MSG ...]

+ Message to send. Enclose it with double quotes (default: )

+ --type {bug,suggestion,question,generic}, -t {bug,suggestion,question,generic}

+ Support ticket type (default: generic)

+ -h, --help show this help message (default: False)

```

-(🦋) /stocks/ $ load AMZN -s 2005-01-01 -e 2010-01-01

-Loading Daily data for AMZN with starting period 2005-01-03.

+

+```console

+support search --type question --msg "How do I find stocks from India with OpenBB?"

```

-We can check that this period has changed by looking into the candle chart with `candle`. This, again shares the same `-h` argument. This results in the following which indeed depicts our selected period.

+

+

+The command opens a browser window to a pre-populated form on the OpenBB website. If you are signed-in to the Hub, all that is left to do is click `Submit`.

+

+

+

+**An answer to this question is**: `search --country india --exchange-country india`

+

+:::note

+Tips for submitting a support request:

+- Tell us what version number is installed.

+- Tell us what operating system and version the machine has.

+- What is the installation type? Installer, Source, PyPi, Docker, other?

+- Tell us the command and parameter combination causing the error.

+- Tell us what symbol (ticker) is, or was trying to be, loaded.

+- Show us the complete error message.

+- Let us know any contextual information that will help us replicate and accurately identify the problem.

+:::

+

+## Menus

+

+### The Main Menu

+

+The main menu, or the home screen, contains both menus and commands. Some of these commands are global, meaning they can be called from any location within the OpenBB Terminal. Refer to the in-depth introduction guides for each menu, for example, [Forecast](https://docs.openbb.co/terminal/usage/intros/forecast)

+

+| Function Key | Type | Is Global? | Description |

+| :----------- | :------: | :--------: | ------------------------------------------------------------------------------: |

+| about | Function | Yes | Opens a browser page to the documentation pages at the function or menu. |

+| account | Menu | - | Manage your OpenBB account. |

+| alternative | Menu | - | Alternative data sets. |

+| crypto | Menu | - | Digital assets. |

+| econometrics | Menu | - | Econometrics and custom data sets. |

+| economy | Menu | - | The broad economy. |

+| etf | Menu | - | Exchange-Traded Funds. |

+| exe | Function | No | Execute OpenBB Routine Scripts. |

+| featflags | Menu | - | Enable/disable Terminal behaviours. |

+| fixedincome | Menu | - | Central Bank and corporate bond rates and indexes. |

+| forecast | Menu | - | Time series forecasting and machine learning. |

+| forex | Menu | - | Currency pairs. |

+| funds | Menu | - | Mutual funds. |

+| futures | Menu | - | Commodity and financial futures. |

+| keys | Menu | - | Set and test API keys for data sources. |

+| intro | Function | No | An in-Terminal introduction. |

+| news | Function | No | Find news articles by term and source. |

+| portfolio | Menu | - | Portfolio and risk analysis. |

+| record | Function | Yes | Starts recording an OpenBB Routine Script. |

+| settings | Menu | - | Adjust Terminal settings. |

+| sources | Menu | - | Set preferred default sources. |

+| stop | Function | Yes | Stop recording the OpenBB Routine Script and save to the OpenBBUserData folder. |

+| support | Function | Yes | Report a bug or create a support ticket with OpenBB. |

+| survey | Function | No | Take a short user survey to help us improve. |

+| update | Function | No | Attempt to update (**Only for Github cloned repository installations**) |

+| wiki | Function | Yes | Query the Wikipedia API for a term or phrase. |

+

+### Additional Global Commands

+

+The commands listed below are not displayed on any Terminal menu, but are available from any location in the Terminal.

+

+| Function Key | Description |

+| :----------- | ------------------------------------------------: |

+| cls | Clears the Terminal screen. |

+| exit | Quits the Terminal. |

+| help, h, ? | Prints the current menu screen. |

+| quit, q, .. | Navigates back one menu towards Home. |

+| reset, r | Resets the Terminal, opening to the current menu. |

+

+## Data

+

+Many functions will require obtaining (free or subscription) API keys from various data providers. OpenBB provides methods for consuming these data feeds, but has no control over the quality or quantity of data provided to an end-user. **No API Keys are required to get started using the Terminal**. See the list of data providers [here](https://docs.openbb.co/terminal/usage/guides/api-keys), along with instructions for entering the credentials into the OpenBB Terminal. [Request a feature](https://openbb.co/request-a-feature) to let us know what we are missing!

+

+### Default Data Sources

+

+The default data source for each function (where multiple sources are available) can be defined within the [`/sources` menu](https://docs.openbb.co/terminal/usage/guides/changing-sources). The available sources for each function are displayed on the right of the menu, and they can be distinguished by the square brackets and distinct font color group. Unless a preference for a particular function is defined, the command will prioritize in the order they are displayed, from left-to-right, on the Terminal screen. To override a preference or default source, select one of the other choices by attaching the, `--source`, argument to the command syntax. The available sources for the feature will be populated by auto complete when the `space bar` is pressed after typing `--source`. This information is also printed with the `--help` dialogue of a command.

+

+```console

+/stocks/load AAPL/fa/income --source Polygon

```

-(🦋) /stocks/ $ candle

+

+

+

+### Importing and Exporting Data

+

+Most functions provide a method for exporting the raw data as a CSV, JSON, or XLSX file (with a specific sheet name). Exported data and user-supplied files to import are saved to the [OpenBBUserData folder](https://docs.openbb.co/terminal/usage/guides/data). The folder is located at the root of the operating system's User Account folder. Follow the link for a detailed description.

+

+## Charts

+

+The OpenBB charting library provides interactive, customizable, charts. Here's an example of displaying weekly candles for AAPL.

+

+```console

+/stocks/load AAPL -w/candle

```

-

+

+

+### Toolbar

+

+The toolbar is located at the bottom of the window, and provides methods for:

+

+- Panning and zooming.

+- Modifying the title and axis labels.

+- Adjusting the hover read out.

+- Toggling light/dark mode.

+- Annotating and drawing.

+- Exporting raw data.

+- Saving the chart as an image.

+- Adding supplementary external data as an overlay.

+

+The label for each tool is displayed by holding the mouse over it.

+

+

+

+Toggle the toolbar's visibility via the keyboard with, `ctrl + h`.

+

+### Text Tools

+

+Annotate a chart by clicking on the `Add Text` button, or with the keyboard, `ctrl + t`.

+

+

+

+Enter some text, make any adjustments to the options, then `submit`. Place the crosshairs over the desired data point and click to place the text.

+

+

+

+After placement, the text can be updated or deleted by clicking on it again.

+

+

+

+The title of the chart is edited by clicking the button, `Change Titles`, near the middle center of the toolbar, immediately to the right of the `Add Text` button.

+

+### Draw Tools

+

+The fourth group of icons on the toolbar are for drawing lines and shapes.

+

+- Edit the colors.

+- Draw a straight line.

+- Draw a freeform line.

+- Draw a circle.

+- Draw a rectangle.

+- Erase a shape.

+

+To draw on the chart, select one of the four drawing buttons and drag the mouse over the desired area. Click on any existing shape to modify it by dragging with the mouse and editing the color, or remove it by clicking the toolbar button, `Erase Active Shape`. The edit colors button will pop up as a floating icon, and clicking on that will display the color palette.

+

+

+

+### Export Tools

+

+The two buttons at the far-right of the toolbar are for saving the raw data or, to save an image file of the chart at the current panned and zoomed view.

+

+

+

+### Overlay

+

+The button, `Overlay chart from CSV`, provides an easy import method for supplementing a chart with additional data. Clicking on the button opens a pop-up dialogue to select the file, column, and whether the overlay should be a bar, candlestick, or line chart. As a candlestick, the CSV file must contain OHLC data. The import window can also be opened with the keyboard, `ctrl-o`.

+

+

+

+After choosing the file to overlay, select what to show and then click on `Submit`.

+

+

+

+

+

+### Cheat Sheet

+

+The image below can be saved and used as a reference.

+

+

+

+

+## Tables

+

+The OpenBB Terminal sports interactive tables which opens in a separate window. They provide methods for searching, sorting, filtering, and exporting directly within the table. Preferences and settings for the tables can be updated directly on the table.

+

+### Sorting and Filtering

+

+Columns can be sorted ascending/descending/unsorted, by clicking the controls to the right of each header title. The status of the filtering is shown as a blue indicator.

+

+

+

+The settings button, at the lower-left corner, displays choices for customizing the table. By selecting the `Type` to be `Advanced`, columns become filterable.

+

+

+

+The columns can be filtered with min/max values or by letters, depending on the content of each column.

+

+

+

+### Selecting Columns and Rows

+

+The table will scroll to the right as far as there are columns. Columns can be removed from the table by clicking the icon to the right of the settings button and unchecking it from the list.

+

+

+

+The number of rows per page is defined in the drop down selection near the center, at the bottom.

+

+

+

+### Freeze the Index and Column Headers

+

+Right-click on the index name to enable/disable freezing when scrolling to the right. Column headers are frozen by default.

+

+

+

+### Exporting Data

+

+At the bottom-right corner of the table window, there is a button for exporting the data. To the left, the drop down selection for `Type` can be defined as a CSV, XLSX, or PNG file. Exporting the table as a PNG file will create a screenshot of the table at its current view, and data that is not on the screen will not be captured.

+

+

+

+### Cheat Sheet

+

+The image below can be saved and used as a reference.

-As mentioned in the Explanation of Menus, some information also transfers over to other menus and this includes the loaded market data from load. So, if you would visit the `ta` menu (which stands for Technical Analysis) you will see that, by running any command, the selected period above is depicted again. Return to the Stocks menu again by using `q` and use it again to return to the home screen which can be shown with `?`.

+

diff --git a/website/content/terminal/usage/guides/customizing-the-terminal.md b/website/content/terminal/usage/guides/customizing-the-terminal.md

index f578954edf53..6705f61079b4 100644

--- a/website/content/terminal/usage/guides/customizing-the-terminal.md

+++ b/website/content/terminal/usage/guides/customizing-the-terminal.md

@@ -1,63 +1,140 @@

---

sidebar_position: 5

title: Customization

-description: Learn how to customize the look of your OpenBB Terminal. You can adjust the lay-out, settings, terminal behavior, and enable or disable certain functionalities.

-keywords: [settings, featflags, feature flags, lay-out, advanced, customizing, openbb terminal, layout, settings, colors, functionality, features]

+description: The settings and feature flags menus are for altering the behaviour and presentation of the Terminal, both are accessed from the main menu.

+keywords: [settings, featflags, feature flags, lay-out, advanced, customizing, openbb terminal]

---

+The OpenBB Terminal contains two menus for altering the behaviour and presentation of the Terminal, Settings and FeatFlags, both of which are accessed from the main menu.

import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

+## The Settings Menu

-Since the code is open source you are able to adjust anything you like. However, to make it easy for you we have created a settings and featflags menu that include the most requested features that users like to have control over.

-

-## Using the Settings Menu

-

-To adjust the lay-out and settings of the OpenBB Terminal you can access the `settings` menu. This menu allows you to tweak how the terminal behaves.

-

- -

-This menu includes the following:

-

-- `colors` define the colors you wish to use within the OpenBB Terminal.

-- `dt` adds or removes the datetime from the flair (which is next to the flair).

-- `flair` allows you to change the emoji that is used.

-- `lang` gives the ability to change the terminal language. At this moment, the terminal is only available in English.

-- `userdata` defines the folder you wish to export data you acquire from the terminal. Use quotes for custom locations.

-- `tz` allows you to change the timezone if this is incorrectly displayed for you.

-- `autoscaling` automatically scales plots for you if enabled (when green).

- - if `autoscaling` is enabled:

- - `pheight` sets the percentage height of the plot (graphs) displayed (if autoscaling is enabled).

- - `pwidth` sets the percentage width of the plot (graphs) displayed (if autoscaling is enabled).

- - if `autoscaling` is disabled:

- - `height` sets the height of the plot (graphs) displayed (if autoscaling is disabled).

- - `width` sets the width of the plot (graphs) displayed (if autoscaling is disabled).

-- `dpi` refers to the resolution that is used for the plot (graphs)

-- `backend` allows you to change the backend that is used for the graphs

-- `monitor` choose which monitors to scale the plot (graphs) to if applicable

-- `source` allows you to select a different source file in which the default data sources are written down

-

-## Using the Feature Flags Menu

-

-To enable or disable certain functionalities of the terminal you can use the `featflags` menu.

-

-

-

-This menu includes the following:

-

-- `colors` define the colors you wish to use within the OpenBB Terminal.

-- `dt` adds or removes the datetime from the flair (which is next to the flair).

-- `flair` allows you to change the emoji that is used.

-- `lang` gives the ability to change the terminal language. At this moment, the terminal is only available in English.

-- `userdata` defines the folder you wish to export data you acquire from the terminal. Use quotes for custom locations.

-- `tz` allows you to change the timezone if this is incorrectly displayed for you.

-- `autoscaling` automatically scales plots for you if enabled (when green).

- - if `autoscaling` is enabled:

- - `pheight` sets the percentage height of the plot (graphs) displayed (if autoscaling is enabled).

- - `pwidth` sets the percentage width of the plot (graphs) displayed (if autoscaling is enabled).

- - if `autoscaling` is disabled:

- - `height` sets the height of the plot (graphs) displayed (if autoscaling is disabled).

- - `width` sets the width of the plot (graphs) displayed (if autoscaling is disabled).

-- `dpi` refers to the resolution that is used for the plot (graphs)

-- `backend` allows you to change the backend that is used for the graphs

-- `monitor` choose which monitors to scale the plot (graphs) to if applicable

-- `source` allows you to select a different source file in which the default data sources are written down

-

-## Using the Feature Flags Menu

-

-To enable or disable certain functionalities of the terminal you can use the `featflags` menu.

-

- -

-By entering one of the commands on this page you are able to turn the feature flag on or off. This menu includes the following:

-

-- `retryload` whenever you misspell commands, try to use the `load` command with it first (default is off).

-- `tab` whether to use tabulate to print DataFrames, to prettify these DataFrames (default is on).

-- `cls` whether to clear the command window after each command (default is off).

-- `color` whether to use colors within the terminal (default is on).

-- `promptkit` whether you wish to enable autocomplete and history (default is on).

-- `thoughts` whether to receive a thought of the day (default is off).

-- `reporthtml` whether to open reports as HTML instead of Jupyter Notebooks (default is on).

-- `exithelp` whether to automatically print the help message when you use `q` (default is off).

-- `rcontext` whether to remember loaded tickers and similar while switching menus (default is on).

-- `rich` whether to apply a colorful rich terminal (default is on).

-- `richpanel` whether to apply a colorful rich terminal panel (default is on).

-- `ion` whether to enable interactive mode of MATPLOTLIB (default is on).

-- `watermark` whether to include the watermark of OpenBB Terminal in figures (default is on).

-- `cmdloc` whether the location of the command is displayed in figures (default is on).

-- `tbhint` whether usage hints are displayed in the bottom toolbar (default is on).

-- `overwrite` whether to automatically overwrite Excel files if prompted to (default is off).

+The `/settings` menu provides methods for customizing the look of the Terminal. Enter the menu from anywhere in the Terminal with:

+

+```console

+/settings

+```

+

+| Function Key | Description |

+| :----------- | ---------------------------------------------------------------: |

+| chart | Select the chart style. |

+| colors | Sets the color scheme for Terminal fonts. |

+| dt | Add or remove date and time from the Terminal command line. |

+| flair | Sets the flair emoji to be used. |

+| height | Set the default plot height. |

+| lang | Select the language for the Terminal menus and commands. |

+| source | Use an alternate data sources file. (Not recommended to change.) |

+| table | Select the table style. |

+| tz | Select a timezone. |

+| userdata | Change the local path to the OpenBBUserData folder. |

+| width | Set the default plot width. |

+

+### Examples

+

+#### Styles

+

+Set charts and tables styles as light or dark mode.

+

+```console

+/settings/table -s light

+```

+

+```console

+/settings/chart -s dark

+```

+

+#### tz

+

+Set the local timezone for the Terminal

+

+```console

+

+/settings/tz Africa/Johannesburg

+```

+

+## The Feature Flags Menu

+

+The `/featflags` menu provides methods for altering the behaviour and responses with environment variables. These configurations are on/off, and the status is indicated by the red/green text of each. Each parameter is listed below.

+

+| Function Key | Description |

+| :----------- | ----------------------------------------------------------------------------------------------: |

+| cls | Clear the screen after each command. Default state is off. |

+| exithelp | Automatically print the screen after navigating back one menu. Default state is off. |

+| interactive | Enable/disable interactive tables. Disabling prints the table directly on the Terminal screen. |

+| overwrite | Automatically overwrite exported files with the same name. Default state is off. |

+| promptkit | Enable auto complete and history. Default state is on. |

+| rcontext | Remember loaded tickers while switching menus. Default state is on. |

+| retryload | Retries misspelled commands with the load function first. Default state is off. |

+| reporthtml | Generate reports as HTML files. Default state is on. |

+| richpanel | Displays a border around menus. Default state is on. |

+| tbhint | Display usage hints in the bottom toolbar. Default state is on. |

+| version | Displays the currently installed version number in the bottom right corner. |

+

+### Examples

+

+#### interactive

+

+When it is off, the Terminal displays all tables directly on the screen instead of opening a window.

+

+```console

+(🦋) /stocks/ $ quote spy

+

+ SPY Quote

+┏━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━━━┓

+┃ Info ┃ Value ┃

+┡━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━━━┩

+│ Symbol │ SPY │

+├───────────────────────┼────────────────────────┤

+│ Name │ SPDR S&P 500 ETF Trust │

+├───────────────────────┼────────────────────────┤

+│ Price │ 412.43 │

+├───────────────────────┼────────────────────────┤

+│ Changes percentage │ 0.06 │

+├───────────────────────┼────────────────────────┤

+│ Change │ 0.23 │

+├───────────────────────┼────────────────────────┤

+│ Day low │ 410.60 │

+├───────────────────────┼────────────────────────┤

+│ Day high │ 413.06 │

+├───────────────────────┼────────────────────────┤

+│ Year high │ 431.73 │

+├───────────────────────┼────────────────────────┤

+│ Year low │ 348.11 │

+├───────────────────────┼────────────────────────┤

+│ Market cap │ 378.521 B │

+├───────────────────────┼────────────────────────┤

+│ Price avg50 │ 402.47 │

+├───────────────────────┼────────────────────────┤

+│ Price avg200 │ 394.88 │

+├───────────────────────┼────────────────────────┤

+│ Exchange │ AMEX │

+├───────────────────────┼────────────────────────┤

+│ Volume │ 44.621 M │

+├───────────────────────┼────────────────────────┤

+│ Avg volume │ 89774263 │

+├───────────────────────┼────────────────────────┤

+│ Open │ 411.99 │

+├───────────────────────┼────────────────────────┤

+│ Previous close │ 412.20 │

+├───────────────────────┼────────────────────────┤

+│ Eps │ 19.85 │

+├───────────────────────┼────────────────────────┤

+│ Pe │ 20.78 │

+├───────────────────────┼────────────────────────┤

+│ Earnings announcement │ 2017-11-29 17:00:00 │

+├───────────────────────┼────────────────────────┤

+│ Shares outstanding │ 917.782 M │

+├───────────────────────┼────────────────────────┤

+│ Timestamp │ 2023-04-24 12:34:22 │

+└───────────────────────┴────────────────────────┘

+```

+

+#### overwrite

+

+Enable this feature flag to remove the prompt when exporting a file with the same name. This will only overwrite an existing `XLSX` file if the `--sheet-name` is not defined.

+

+#### exithelp

+

+Enabling this prints the parent menu on the screen when going back from a sub-menu.

diff --git a/website/content/terminal/usage/intros/common/ta.md b/website/content/terminal/usage/intros/common/ta.md

index a0cf8eedd28d..436dbf28e7df 100644

--- a/website/content/terminal/usage/intros/common/ta.md

+++ b/website/content/terminal/usage/intros/common/ta.md

@@ -1,7 +1,7 @@

---

title: Technical Analysis

-keywords: [technical, analysis, ta, t/a, intraday, daily, indicators, signals, average, moving, exponential, rsi, fibonacci, retracement, bollinger, heltner, accumulation, distribution, obv, on-balance, volume, volatility, trend, momentum, overlap, crypto, stocks, funds, etf, etfs, example, how to, how to use, fibonacci]

-description: This guide introduces the Technical Analysis menu, which is common across many sections of the OpenBB Terminal.

+keywords: [technical, analysis, ta, t/a, intraday, daily, indicators, signals, average, moving, exponential, rsi, fibonacci, retracement, bollinger, heltner, accumulation, distribution, obv, on-balance, volume, volatility, trend, momentum, overlap, crypto, stocks, funds, etf, etfs, realized, fx, forex]

+description: An introduction to the Technical Analysis menu of the OpenBB Terminal. This guide provides an overview of the functions and provides examples for use.

---

import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

@@ -10,10 +10,10 @@ import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

The Technical Analysis menu offers the user a suite of tools for analyzing the technical components of an asset's trading history. The menu can be found in most wings of the Terminal:

-- Crypto

-- Stocks

-- ETF

-- Forex

+- [Crypto](https://docs.openbb.co/terminal/usage/intros/crypto)

+- [Stocks](https://docs.openbb.co/terminal/usage/intros/stocks)

+- [ETF](https://docs.openbb.co/terminal/usage/intros/etf)

+- [Forex](https://docs.openbb.co/terminal/usage/intros/forex)

The commands are divided by categories that define their purpose for general-use:

@@ -22,76 +22,235 @@ The commands are divided by categories that define their purpose for general-use

- Trend - Directional strength

- Volatility - Width of the price bands

- Volume - Singling out volume

-- Custom - Fibonacci retracements

+- Custom - Multiple indicators and Fibonacci retracements

-All commands in this menu will rely on the interval and window chosen when loading an asset for analysis. Refer to the directory tree on the left side of the page for information on individual commands. To get a better understanding of what these features are, and the formulas behind them, a number of sources should be consulted; but, a good starting point is Investopedia.

+All commands in this menu will rely on the interval and window chosen when loading an asset for analysis. Refer to the directory tree on the left side of the page, [here](https://docs.openbb.co/terminal/reference), for information on individual commands. To get a better understanding of what these features are, and the formulas behind them, a number of sources should be consulted; but, a good starting point is [Investopedia](https://www.investopedia.com/terms/t/technicalanalysis.asp). The menu employs the [Pandas-TA Library](https://github.com/twopirllc/pandas-ta). Submit a [feature request](https://openbb.co/request-a-feature) to let us know which indicators we should add next!

-### How to use

+### How to Use

-To begin, enter the menu from one of the menus listed above by entering `ta`.

+To begin, enter the menu from one of the menus listed above by entering `ta`. For demonstration purposes, we will use `QQQ` as the ticker. Let's grab some data!

-

-

-By entering one of the commands on this page you are able to turn the feature flag on or off. This menu includes the following:

-

-- `retryload` whenever you misspell commands, try to use the `load` command with it first (default is off).

-- `tab` whether to use tabulate to print DataFrames, to prettify these DataFrames (default is on).

-- `cls` whether to clear the command window after each command (default is off).

-- `color` whether to use colors within the terminal (default is on).

-- `promptkit` whether you wish to enable autocomplete and history (default is on).

-- `thoughts` whether to receive a thought of the day (default is off).

-- `reporthtml` whether to open reports as HTML instead of Jupyter Notebooks (default is on).

-- `exithelp` whether to automatically print the help message when you use `q` (default is off).

-- `rcontext` whether to remember loaded tickers and similar while switching menus (default is on).

-- `rich` whether to apply a colorful rich terminal (default is on).

-- `richpanel` whether to apply a colorful rich terminal panel (default is on).

-- `ion` whether to enable interactive mode of MATPLOTLIB (default is on).

-- `watermark` whether to include the watermark of OpenBB Terminal in figures (default is on).

-- `cmdloc` whether the location of the command is displayed in figures (default is on).

-- `tbhint` whether usage hints are displayed in the bottom toolbar (default is on).

-- `overwrite` whether to automatically overwrite Excel files if prompted to (default is off).

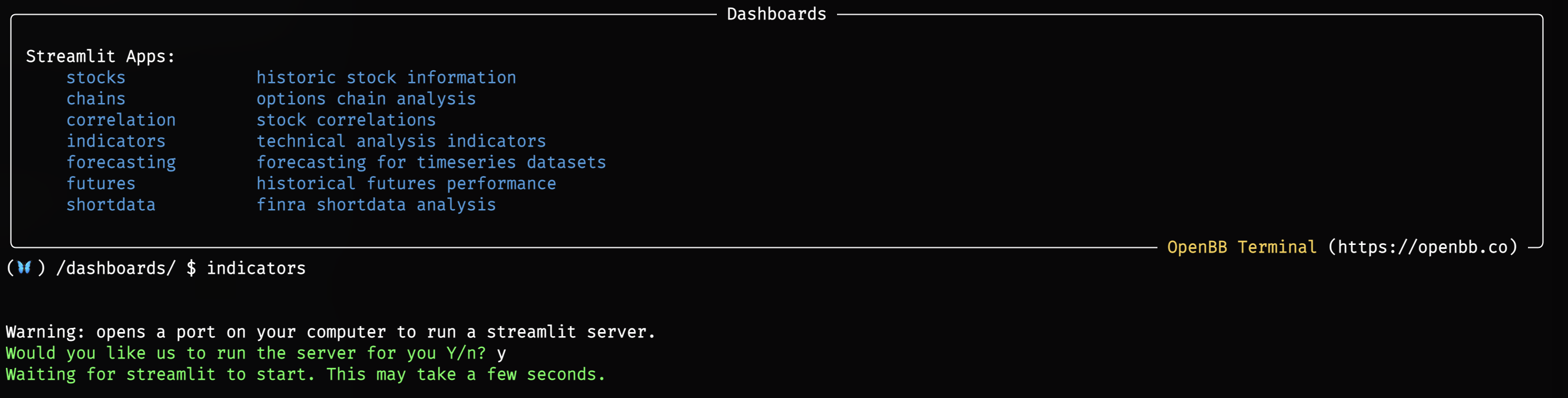

+The `/settings` menu provides methods for customizing the look of the Terminal. Enter the menu from anywhere in the Terminal with:

+

+```console

+/settings

+```

+

+| Function Key | Description |

+| :----------- | ---------------------------------------------------------------: |

+| chart | Select the chart style. |

+| colors | Sets the color scheme for Terminal fonts. |

+| dt | Add or remove date and time from the Terminal command line. |

+| flair | Sets the flair emoji to be used. |

+| height | Set the default plot height. |

+| lang | Select the language for the Terminal menus and commands. |

+| source | Use an alternate data sources file. (Not recommended to change.) |

+| table | Select the table style. |

+| tz | Select a timezone. |

+| userdata | Change the local path to the OpenBBUserData folder. |

+| width | Set the default plot width. |

+

+### Examples

+

+#### Styles

+

+Set charts and tables styles as light or dark mode.

+

+```console

+/settings/table -s light

+```

+

+```console

+/settings/chart -s dark

+```

+

+#### tz

+

+Set the local timezone for the Terminal

+

+```console

+

+/settings/tz Africa/Johannesburg

+```

+

+## The Feature Flags Menu

+

+The `/featflags` menu provides methods for altering the behaviour and responses with environment variables. These configurations are on/off, and the status is indicated by the red/green text of each. Each parameter is listed below.

+

+| Function Key | Description |

+| :----------- | ----------------------------------------------------------------------------------------------: |

+| cls | Clear the screen after each command. Default state is off. |

+| exithelp | Automatically print the screen after navigating back one menu. Default state is off. |

+| interactive | Enable/disable interactive tables. Disabling prints the table directly on the Terminal screen. |

+| overwrite | Automatically overwrite exported files with the same name. Default state is off. |

+| promptkit | Enable auto complete and history. Default state is on. |

+| rcontext | Remember loaded tickers while switching menus. Default state is on. |

+| retryload | Retries misspelled commands with the load function first. Default state is off. |

+| reporthtml | Generate reports as HTML files. Default state is on. |

+| richpanel | Displays a border around menus. Default state is on. |

+| tbhint | Display usage hints in the bottom toolbar. Default state is on. |

+| version | Displays the currently installed version number in the bottom right corner. |

+

+### Examples

+

+#### interactive

+

+When it is off, the Terminal displays all tables directly on the screen instead of opening a window.

+

+```console

+(🦋) /stocks/ $ quote spy

+

+ SPY Quote

+┏━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━━━┓

+┃ Info ┃ Value ┃

+┡━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━━━┩

+│ Symbol │ SPY │

+├───────────────────────┼────────────────────────┤

+│ Name │ SPDR S&P 500 ETF Trust │

+├───────────────────────┼────────────────────────┤

+│ Price │ 412.43 │

+├───────────────────────┼────────────────────────┤

+│ Changes percentage │ 0.06 │

+├───────────────────────┼────────────────────────┤

+│ Change │ 0.23 │

+├───────────────────────┼────────────────────────┤

+│ Day low │ 410.60 │

+├───────────────────────┼────────────────────────┤

+│ Day high │ 413.06 │

+├───────────────────────┼────────────────────────┤

+│ Year high │ 431.73 │

+├───────────────────────┼────────────────────────┤

+│ Year low │ 348.11 │

+├───────────────────────┼────────────────────────┤

+│ Market cap │ 378.521 B │

+├───────────────────────┼────────────────────────┤

+│ Price avg50 │ 402.47 │

+├───────────────────────┼────────────────────────┤

+│ Price avg200 │ 394.88 │

+├───────────────────────┼────────────────────────┤

+│ Exchange │ AMEX │

+├───────────────────────┼────────────────────────┤

+│ Volume │ 44.621 M │

+├───────────────────────┼────────────────────────┤

+│ Avg volume │ 89774263 │

+├───────────────────────┼────────────────────────┤

+│ Open │ 411.99 │

+├───────────────────────┼────────────────────────┤

+│ Previous close │ 412.20 │

+├───────────────────────┼────────────────────────┤

+│ Eps │ 19.85 │

+├───────────────────────┼────────────────────────┤

+│ Pe │ 20.78 │

+├───────────────────────┼────────────────────────┤

+│ Earnings announcement │ 2017-11-29 17:00:00 │

+├───────────────────────┼────────────────────────┤

+│ Shares outstanding │ 917.782 M │

+├───────────────────────┼────────────────────────┤

+│ Timestamp │ 2023-04-24 12:34:22 │

+└───────────────────────┴────────────────────────┘

+```

+

+#### overwrite

+

+Enable this feature flag to remove the prompt when exporting a file with the same name. This will only overwrite an existing `XLSX` file if the `--sheet-name` is not defined.

+

+#### exithelp

+

+Enabling this prints the parent menu on the screen when going back from a sub-menu.

diff --git a/website/content/terminal/usage/intros/common/ta.md b/website/content/terminal/usage/intros/common/ta.md

index a0cf8eedd28d..436dbf28e7df 100644

--- a/website/content/terminal/usage/intros/common/ta.md

+++ b/website/content/terminal/usage/intros/common/ta.md

@@ -1,7 +1,7 @@

---

title: Technical Analysis

-keywords: [technical, analysis, ta, t/a, intraday, daily, indicators, signals, average, moving, exponential, rsi, fibonacci, retracement, bollinger, heltner, accumulation, distribution, obv, on-balance, volume, volatility, trend, momentum, overlap, crypto, stocks, funds, etf, etfs, example, how to, how to use, fibonacci]

-description: This guide introduces the Technical Analysis menu, which is common across many sections of the OpenBB Terminal.

+keywords: [technical, analysis, ta, t/a, intraday, daily, indicators, signals, average, moving, exponential, rsi, fibonacci, retracement, bollinger, heltner, accumulation, distribution, obv, on-balance, volume, volatility, trend, momentum, overlap, crypto, stocks, funds, etf, etfs, realized, fx, forex]

+description: An introduction to the Technical Analysis menu of the OpenBB Terminal. This guide provides an overview of the functions and provides examples for use.

---

import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

@@ -10,10 +10,10 @@ import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

The Technical Analysis menu offers the user a suite of tools for analyzing the technical components of an asset's trading history. The menu can be found in most wings of the Terminal:

-- Crypto

-- Stocks

-- ETF

-- Forex

+- [Crypto](https://docs.openbb.co/terminal/usage/intros/crypto)

+- [Stocks](https://docs.openbb.co/terminal/usage/intros/stocks)

+- [ETF](https://docs.openbb.co/terminal/usage/intros/etf)

+- [Forex](https://docs.openbb.co/terminal/usage/intros/forex)

The commands are divided by categories that define their purpose for general-use:

@@ -22,76 +22,235 @@ The commands are divided by categories that define their purpose for general-use

- Trend - Directional strength

- Volatility - Width of the price bands

- Volume - Singling out volume

-- Custom - Fibonacci retracements

+- Custom - Multiple indicators and Fibonacci retracements

-All commands in this menu will rely on the interval and window chosen when loading an asset for analysis. Refer to the directory tree on the left side of the page for information on individual commands. To get a better understanding of what these features are, and the formulas behind them, a number of sources should be consulted; but, a good starting point is Investopedia.

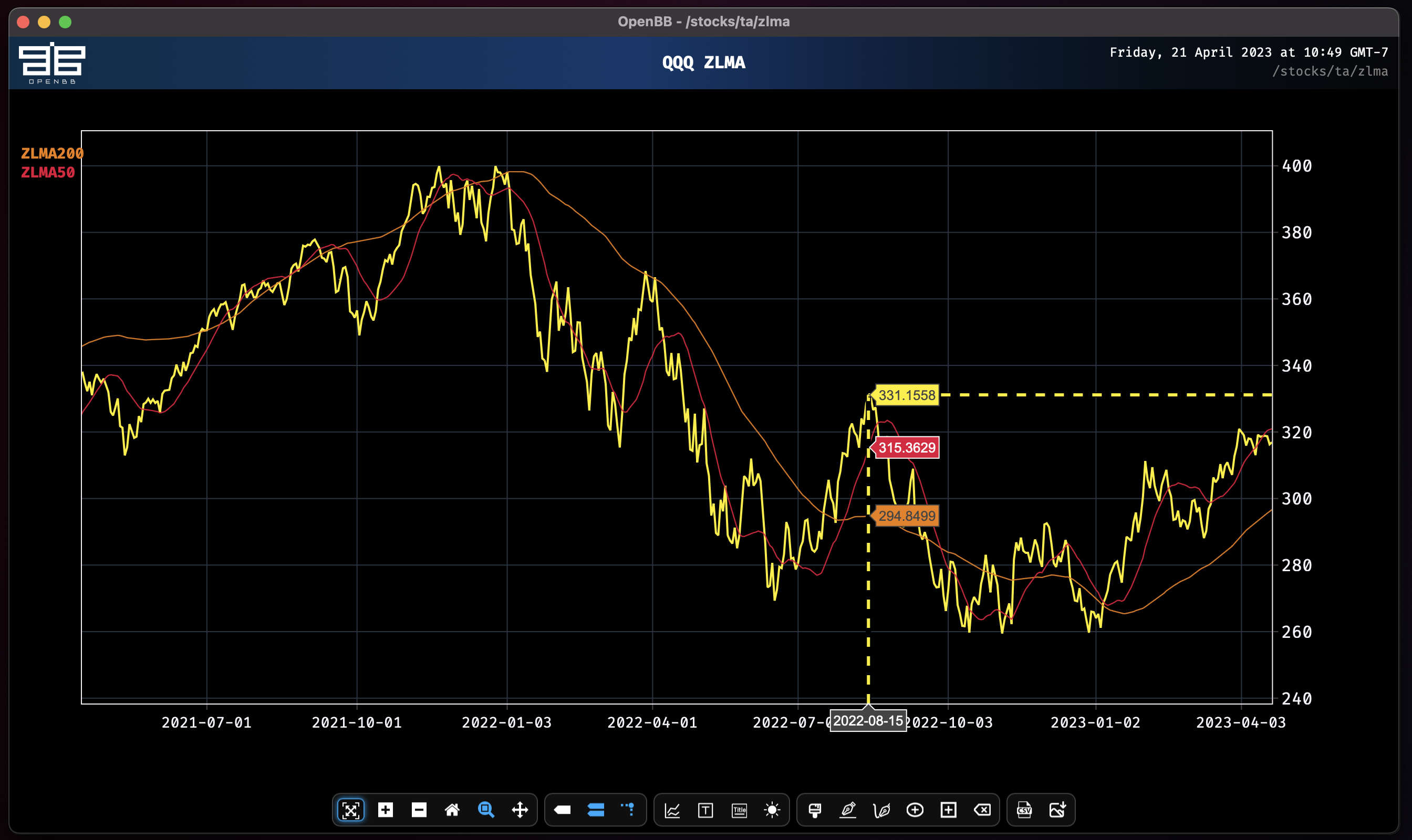

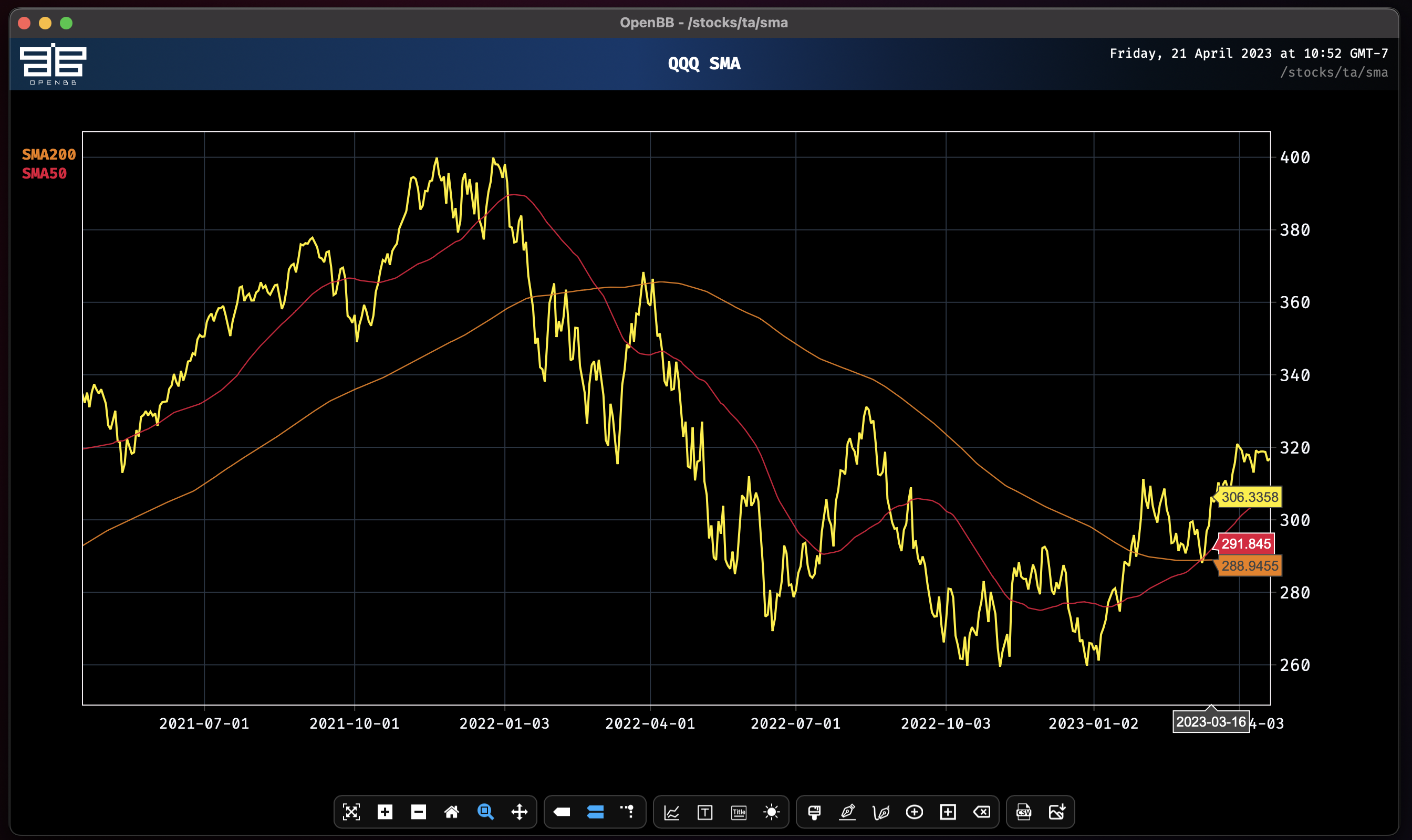

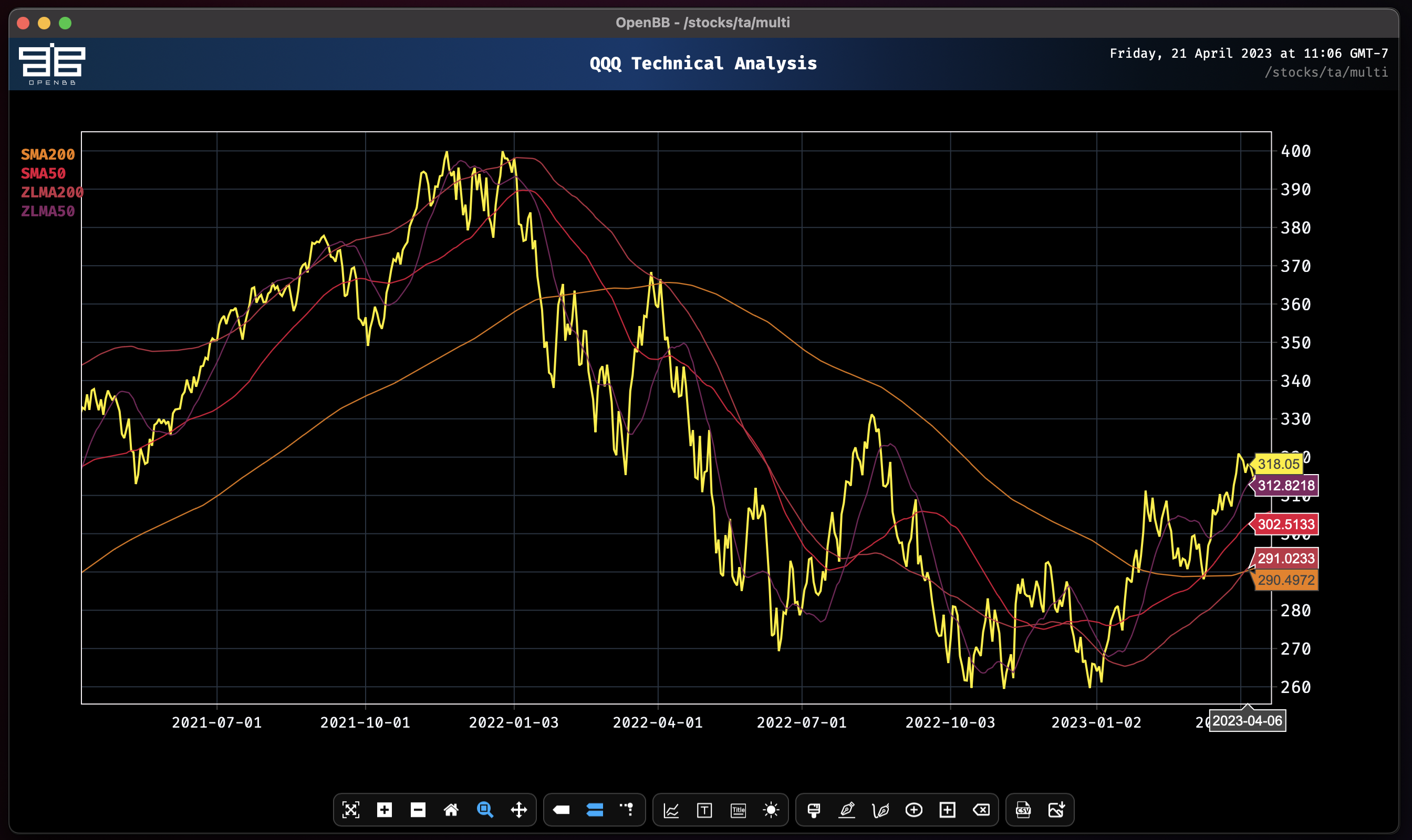

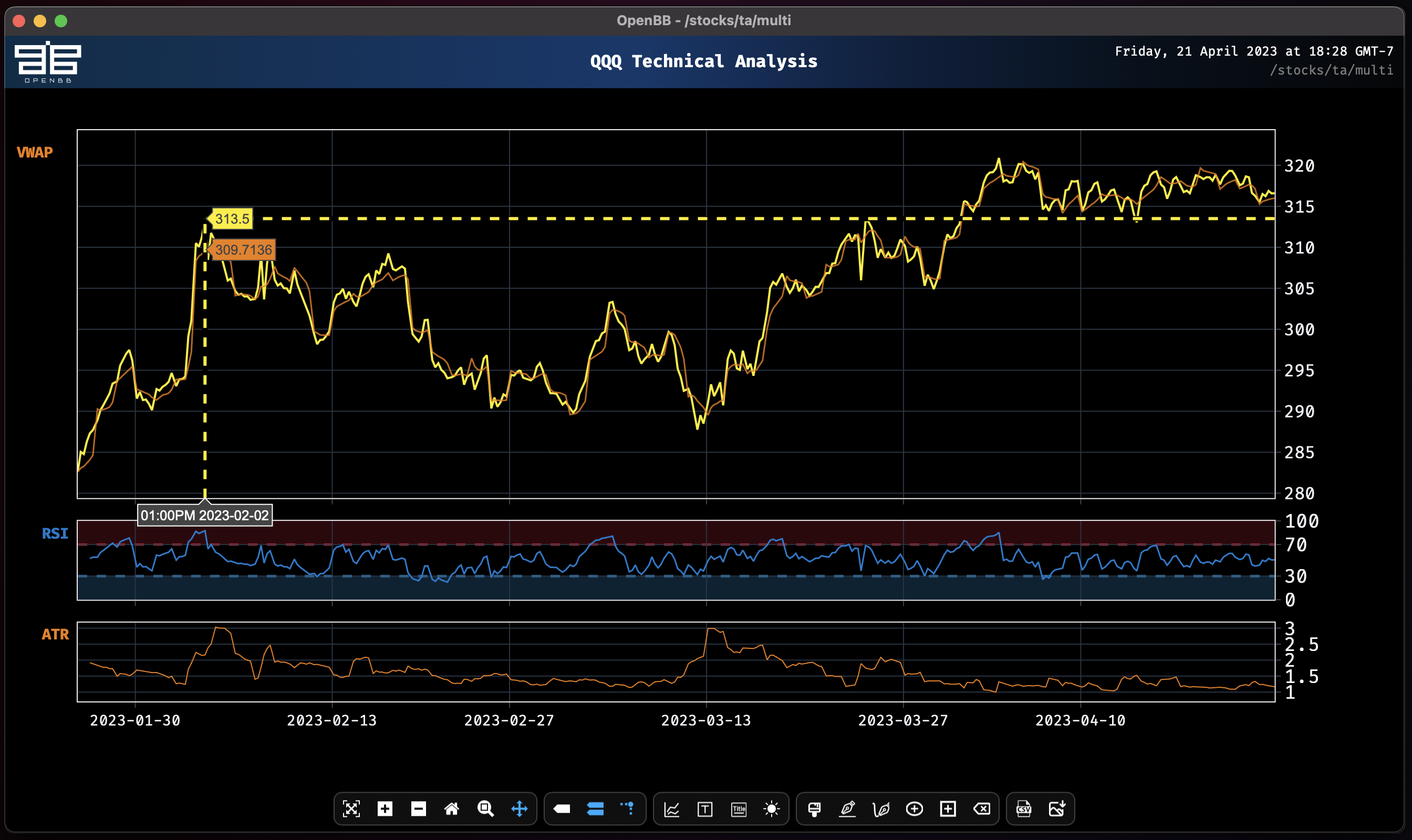

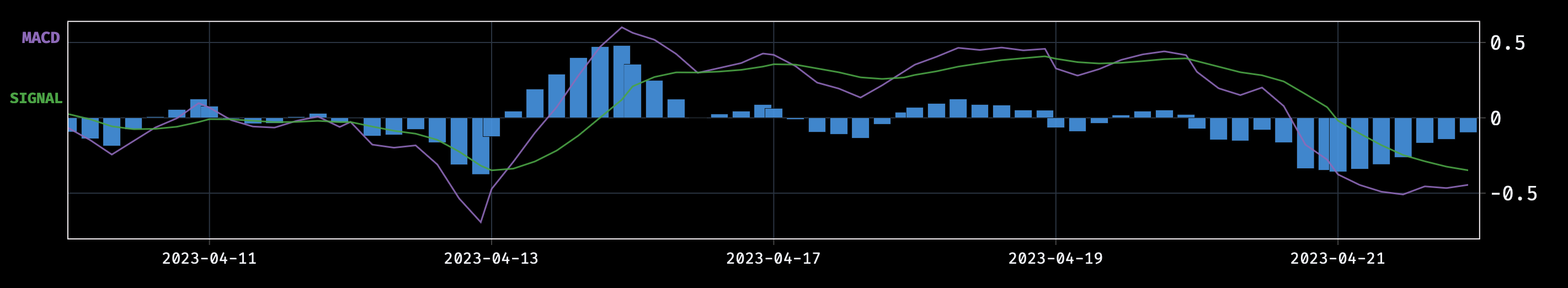

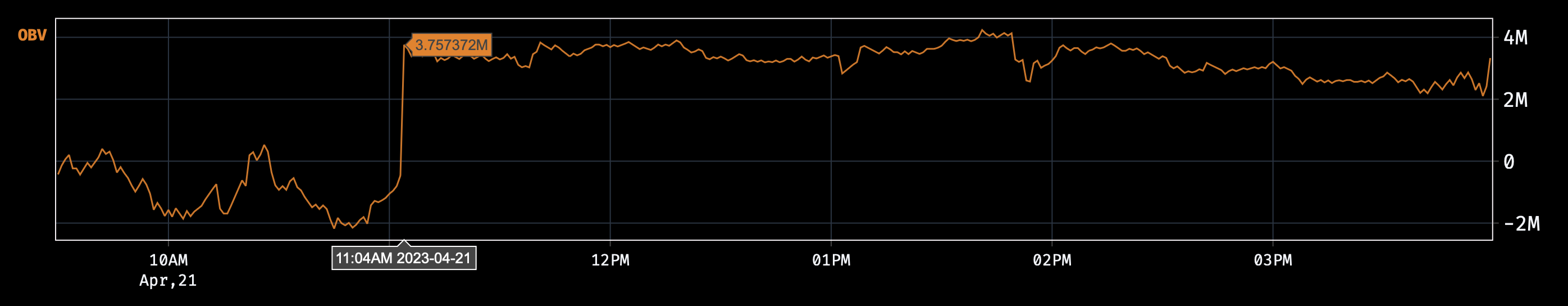

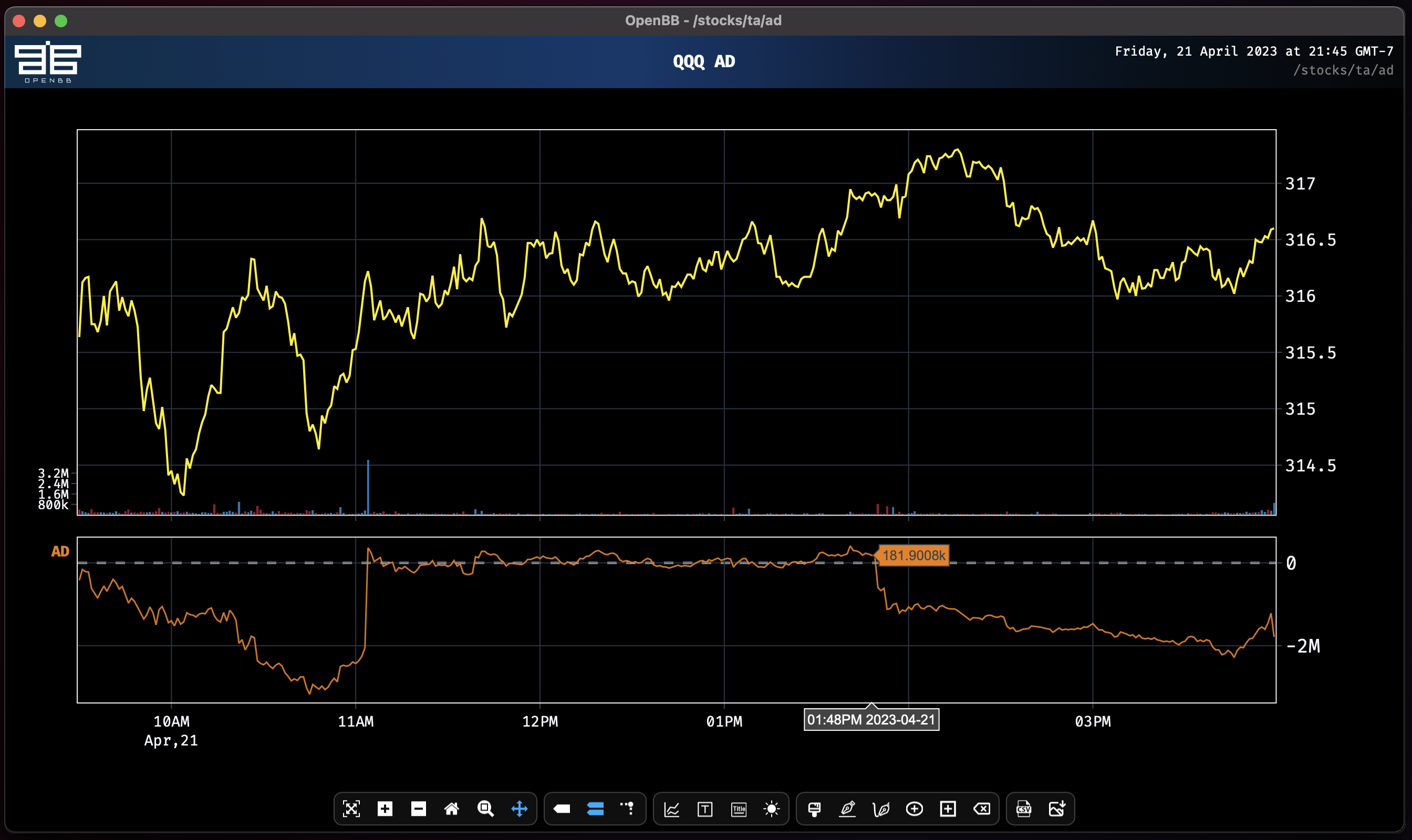

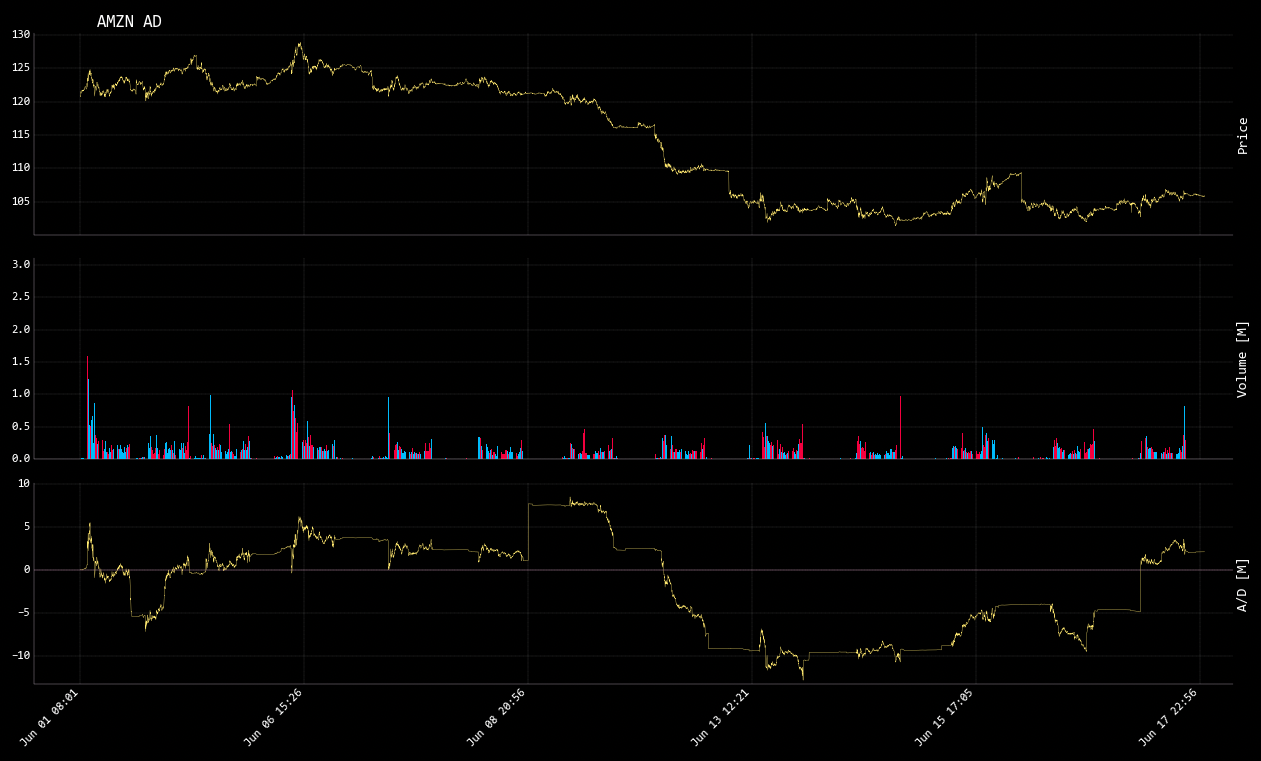

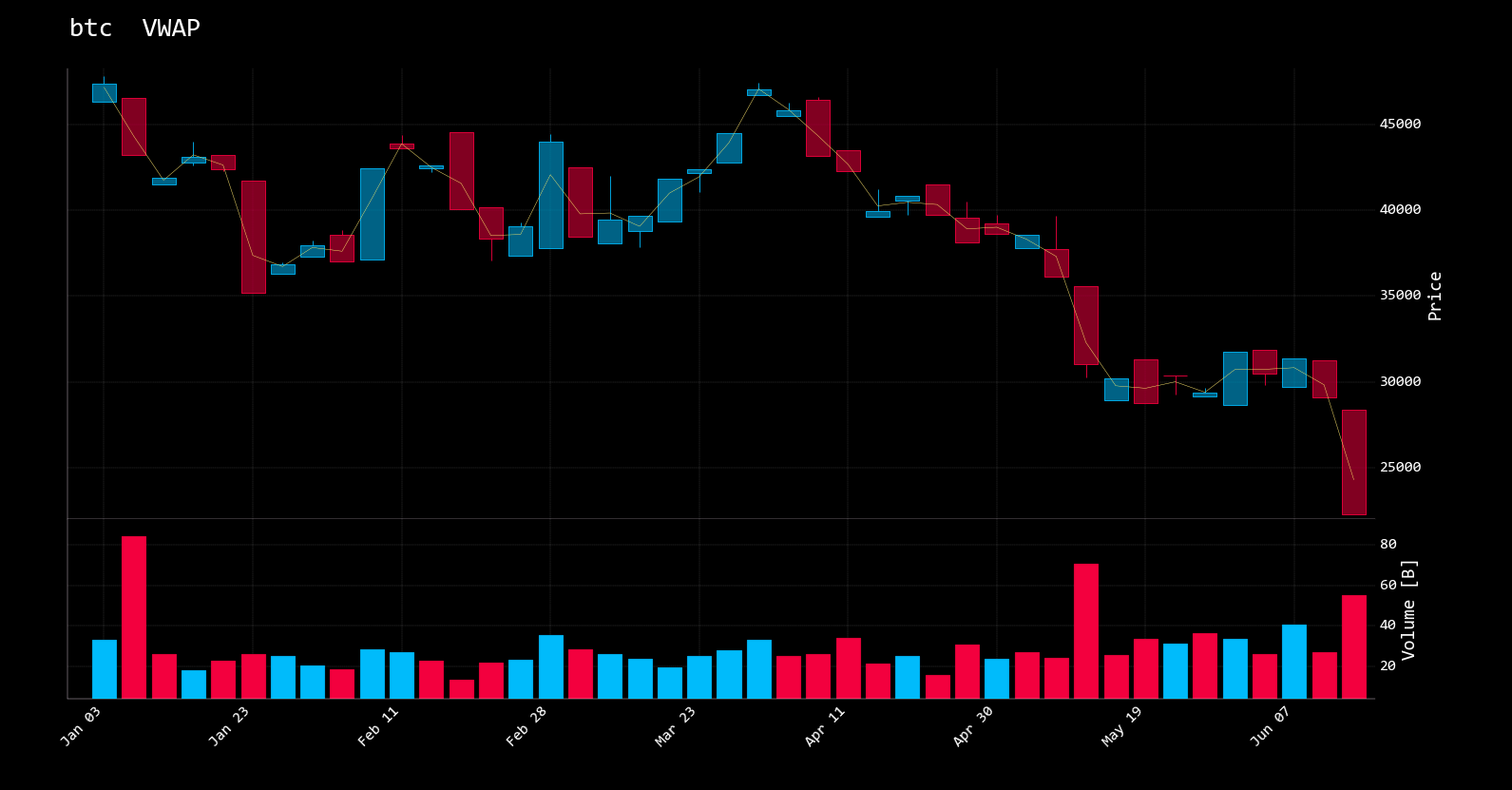

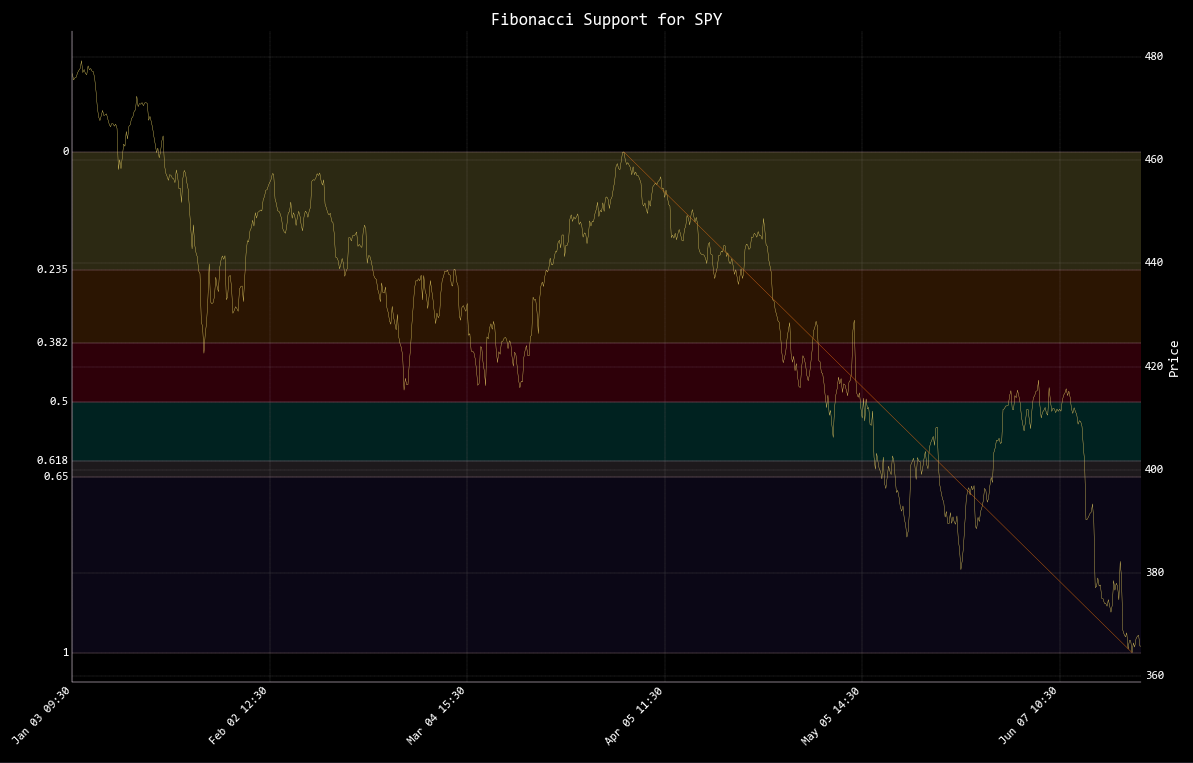

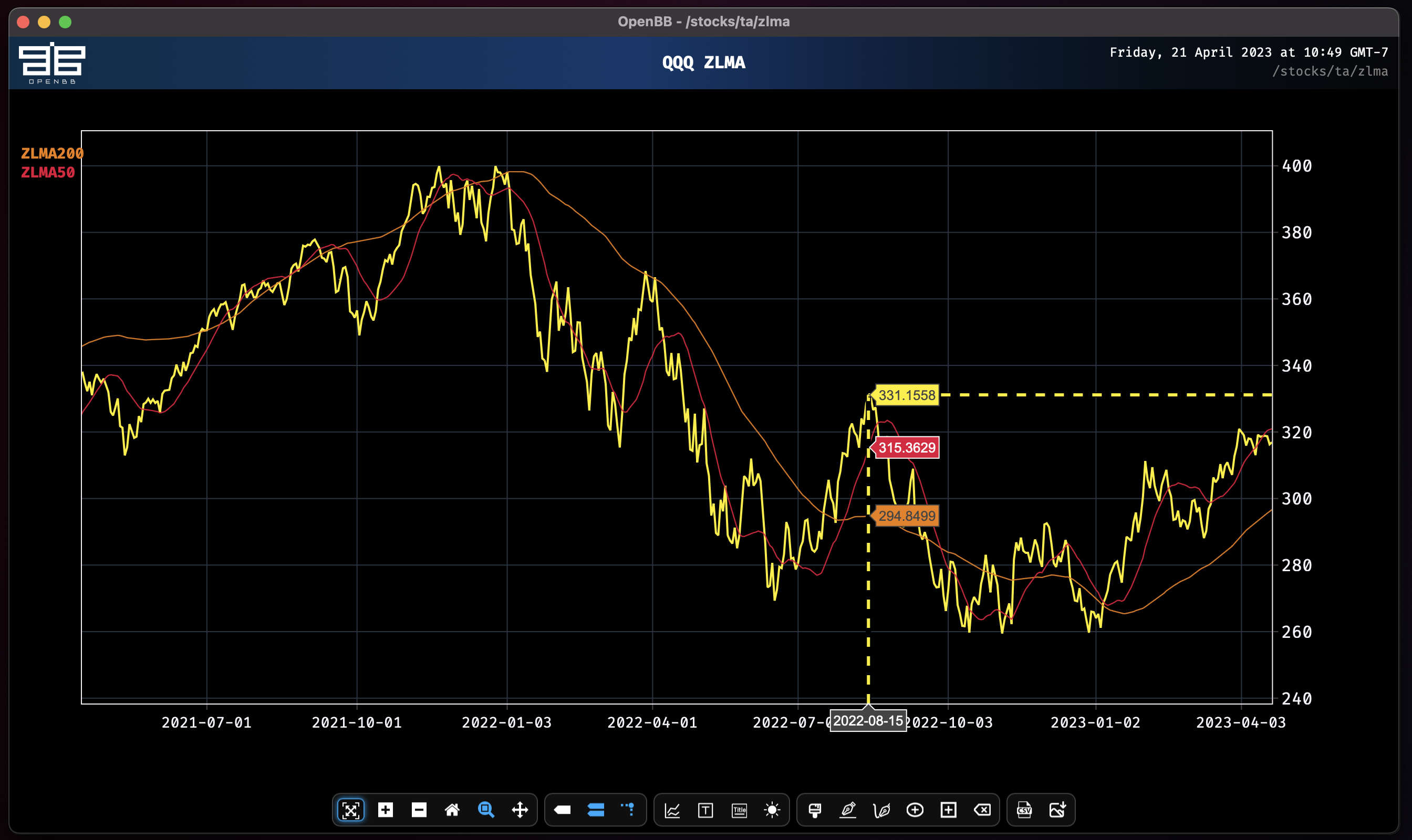

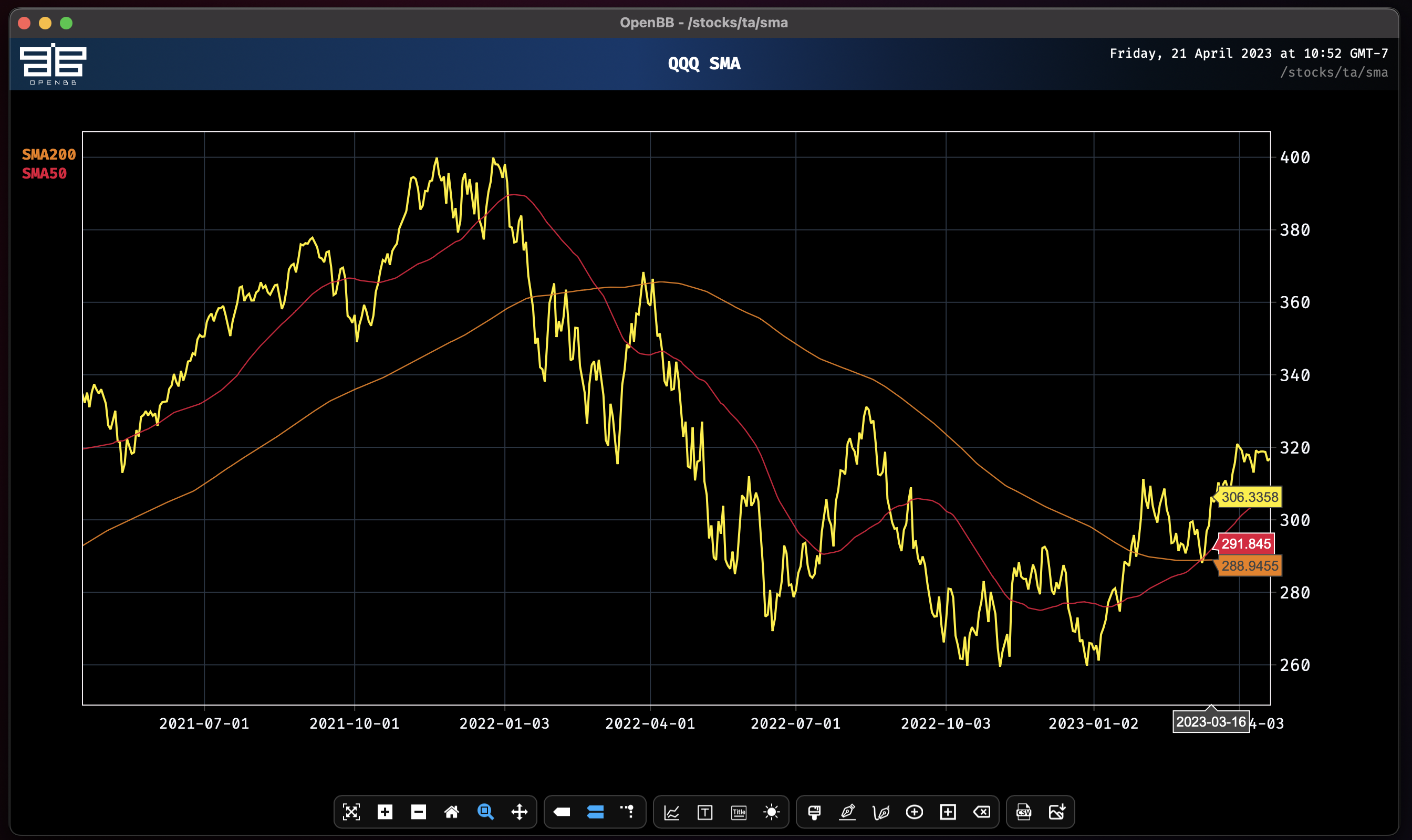

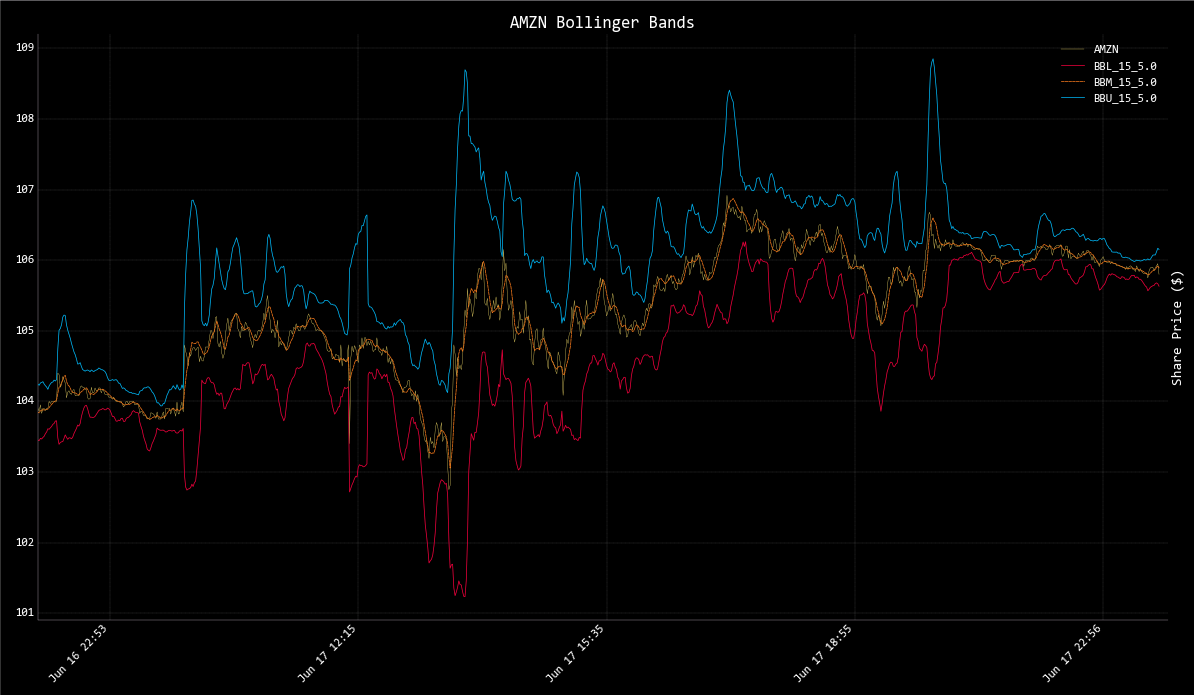

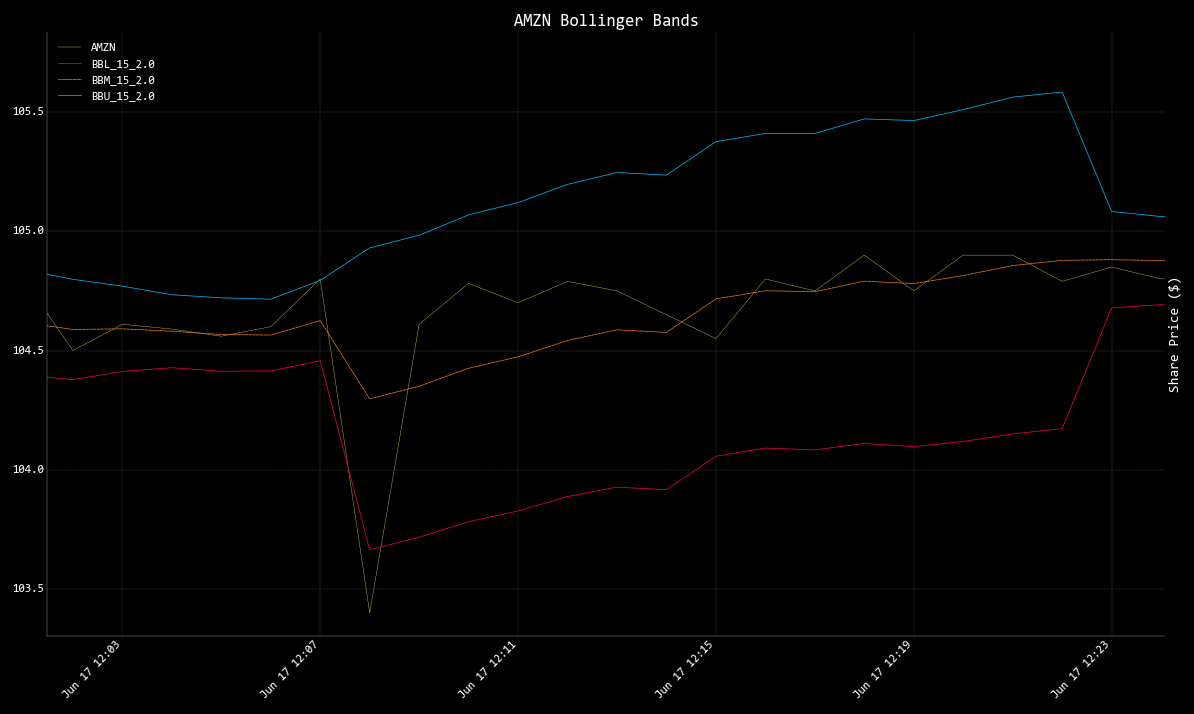

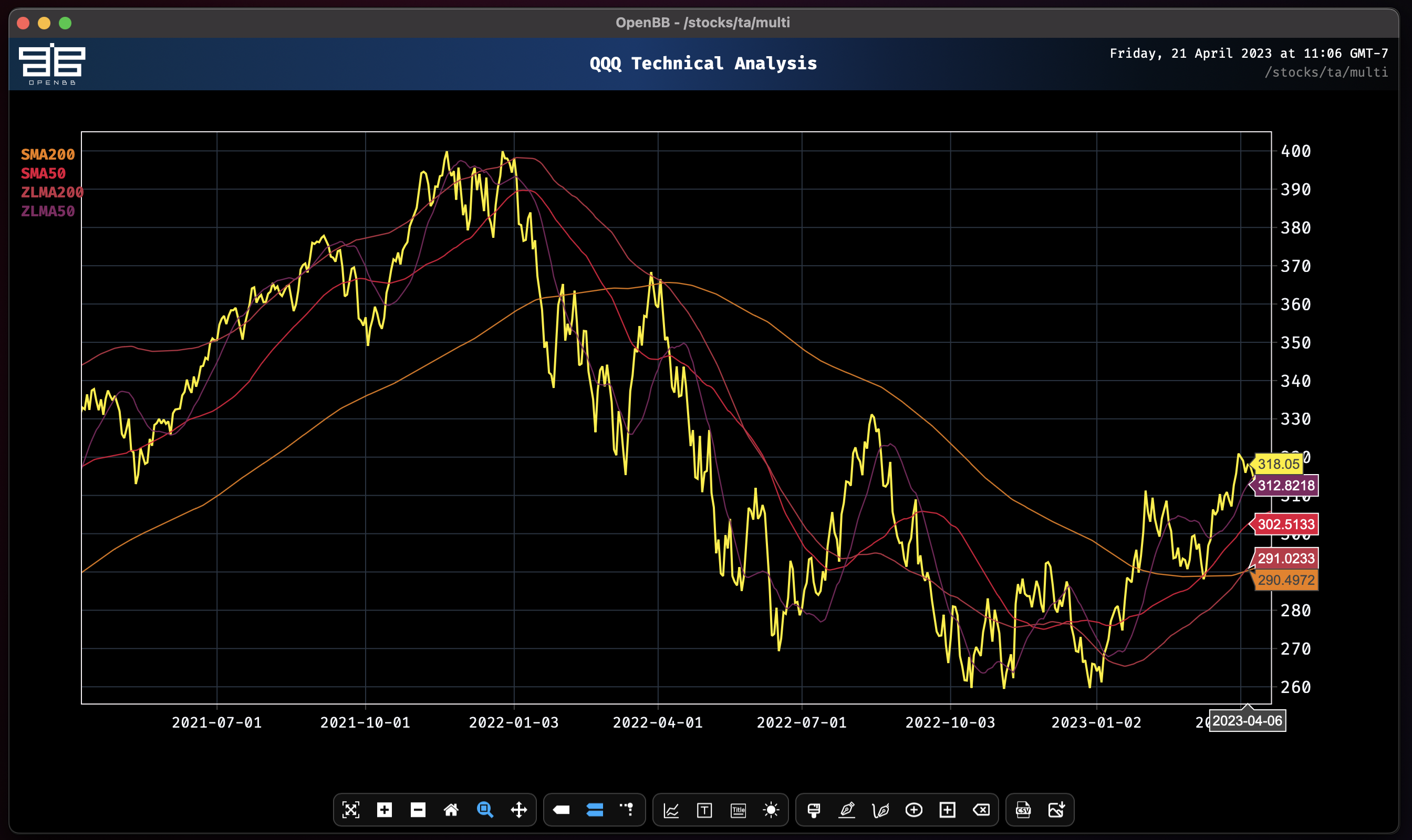

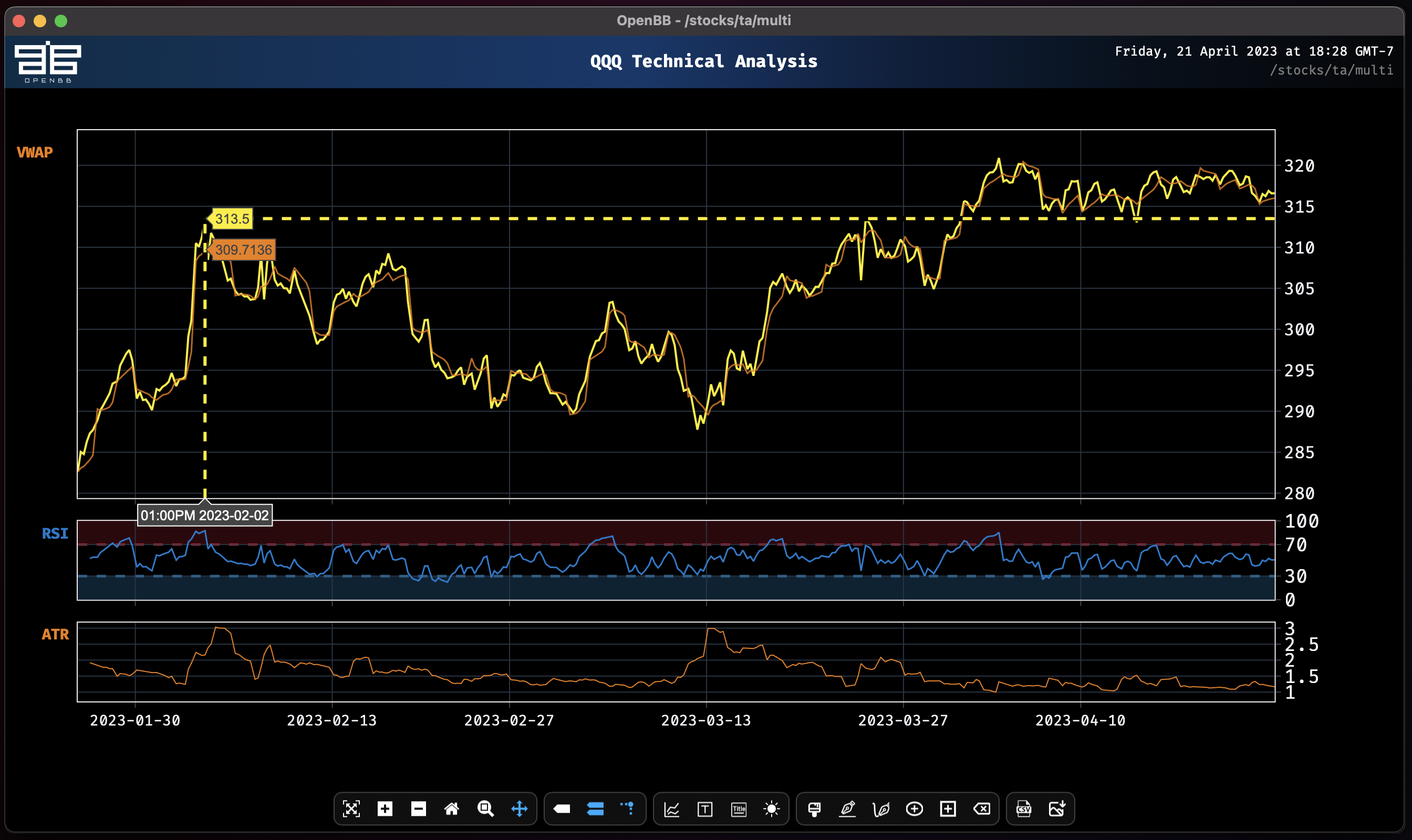

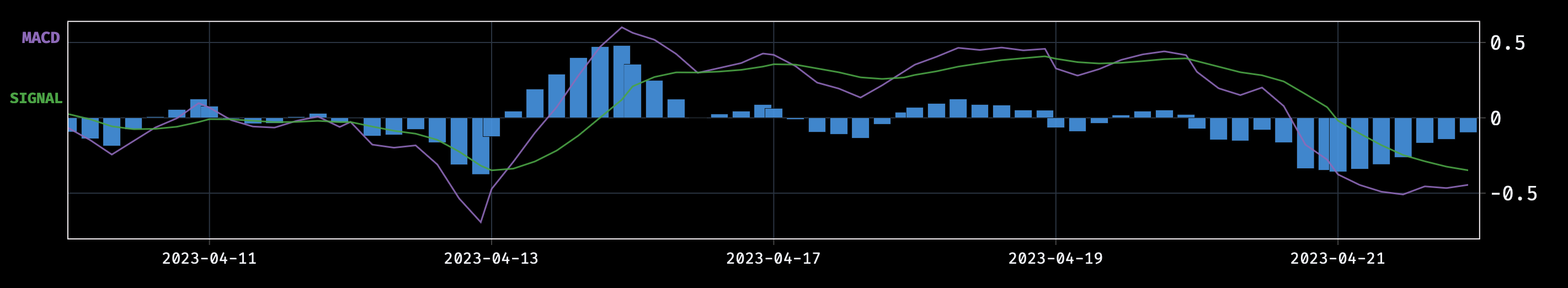

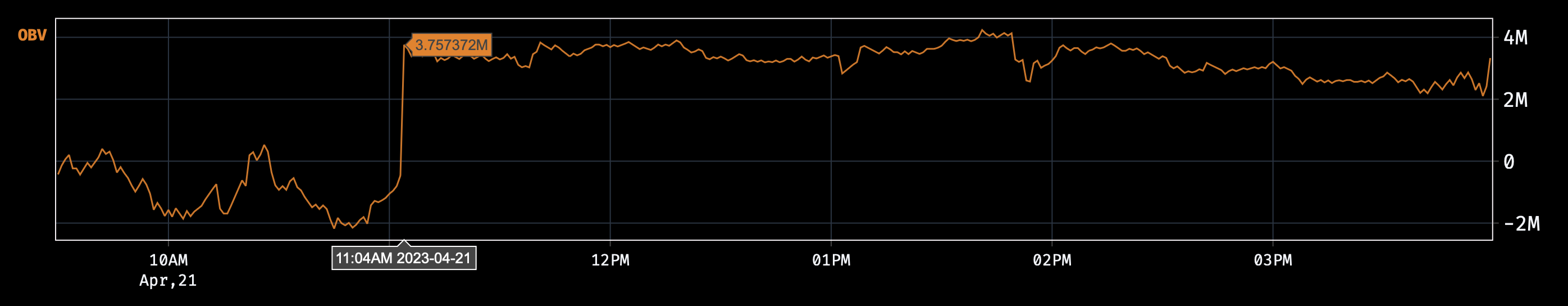

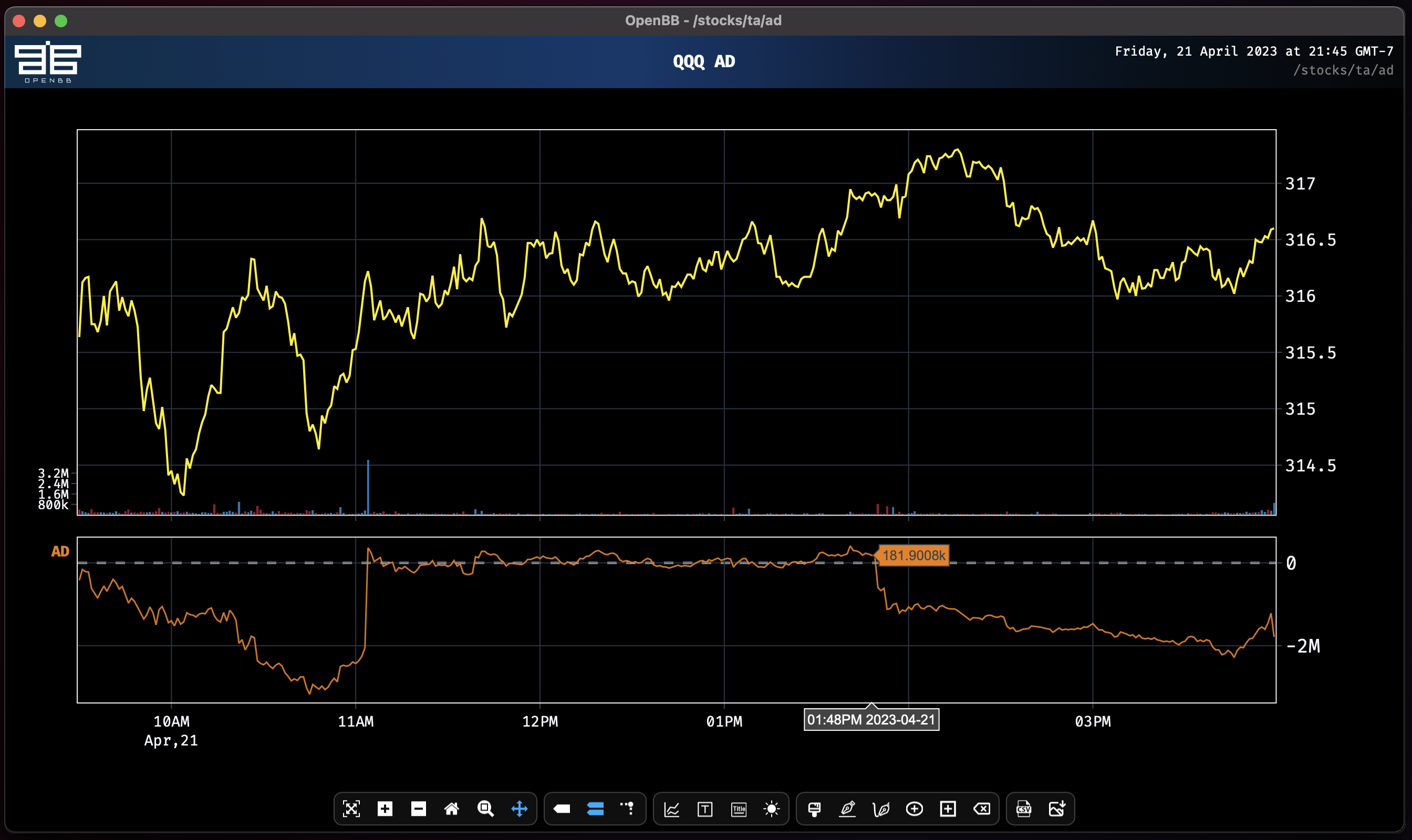

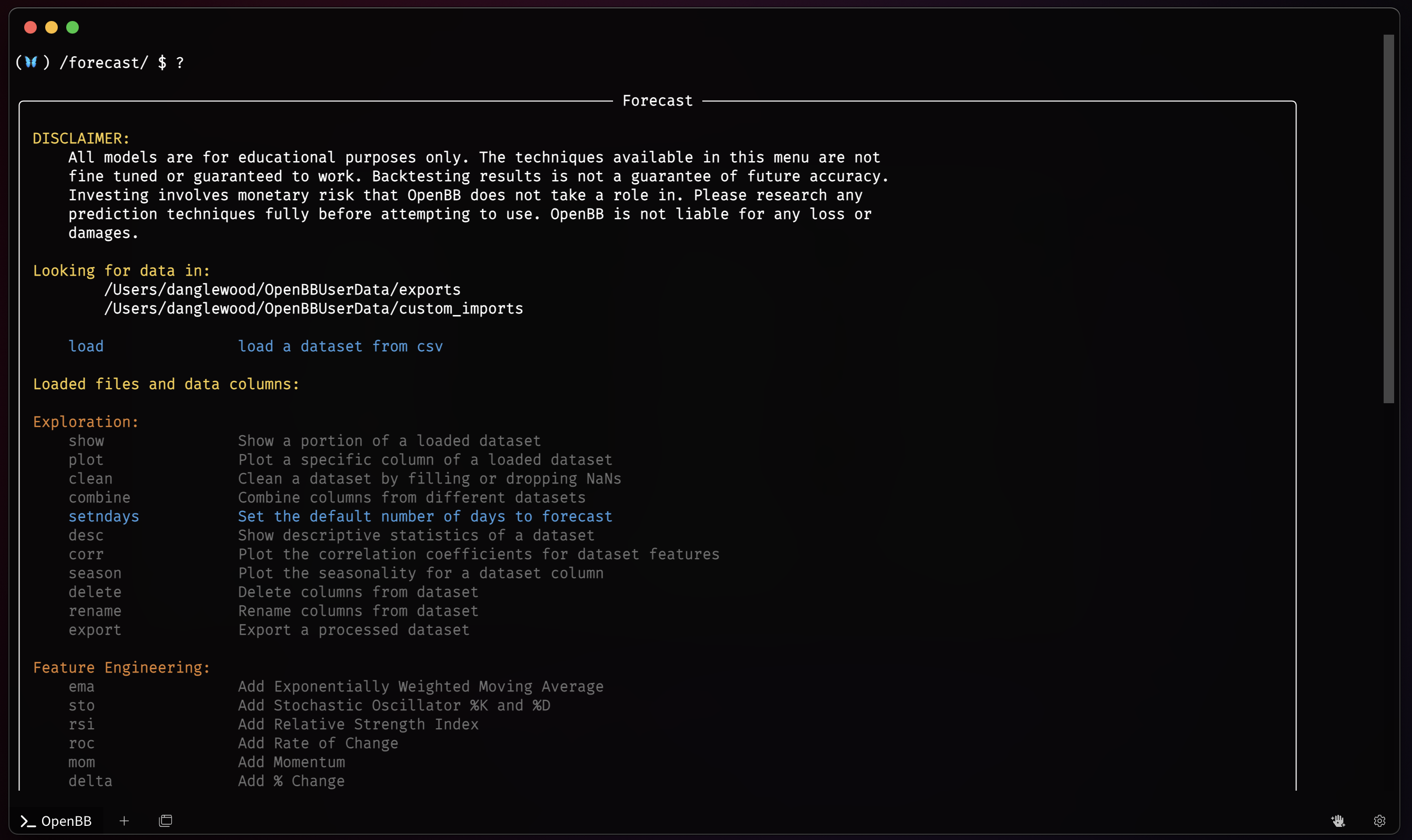

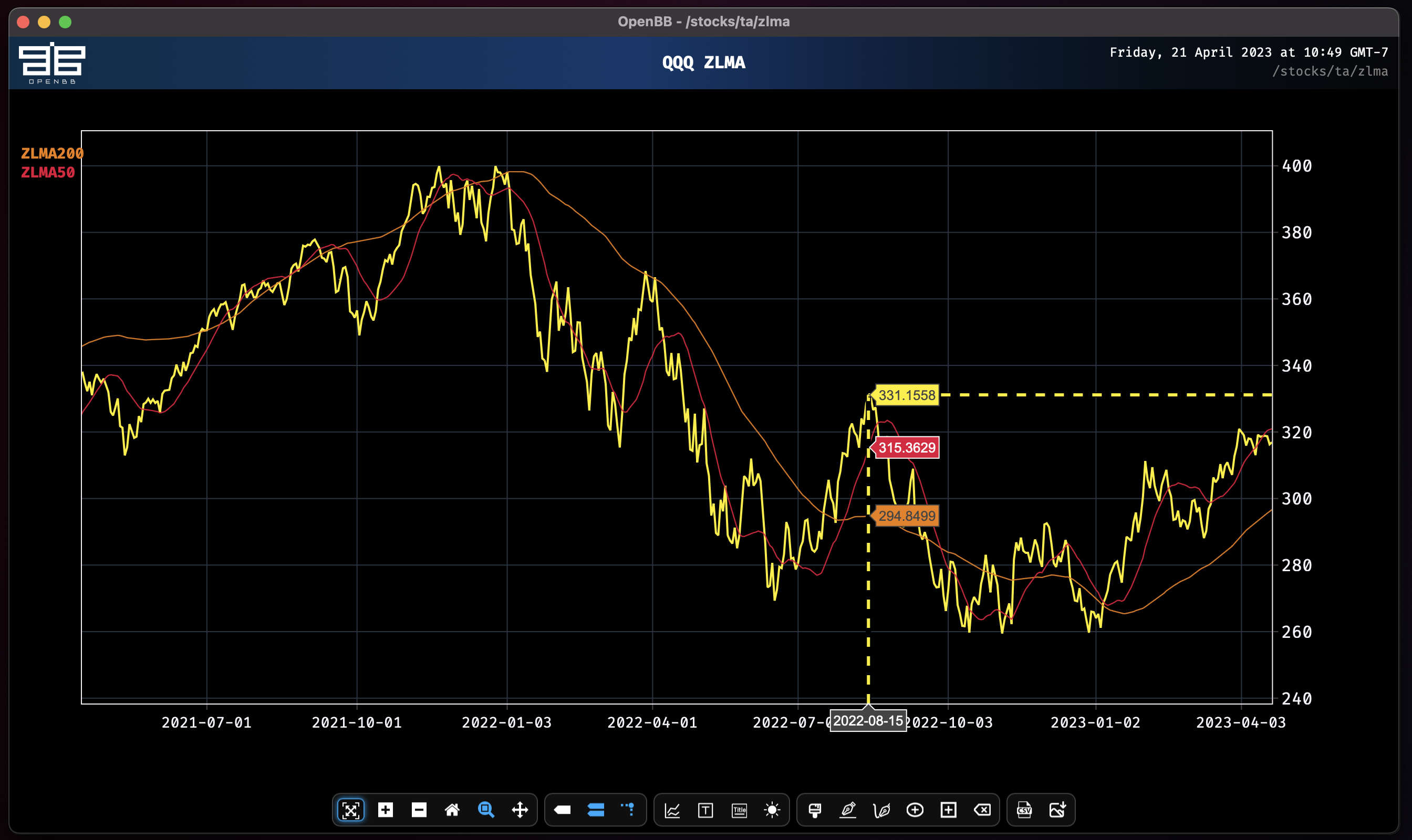

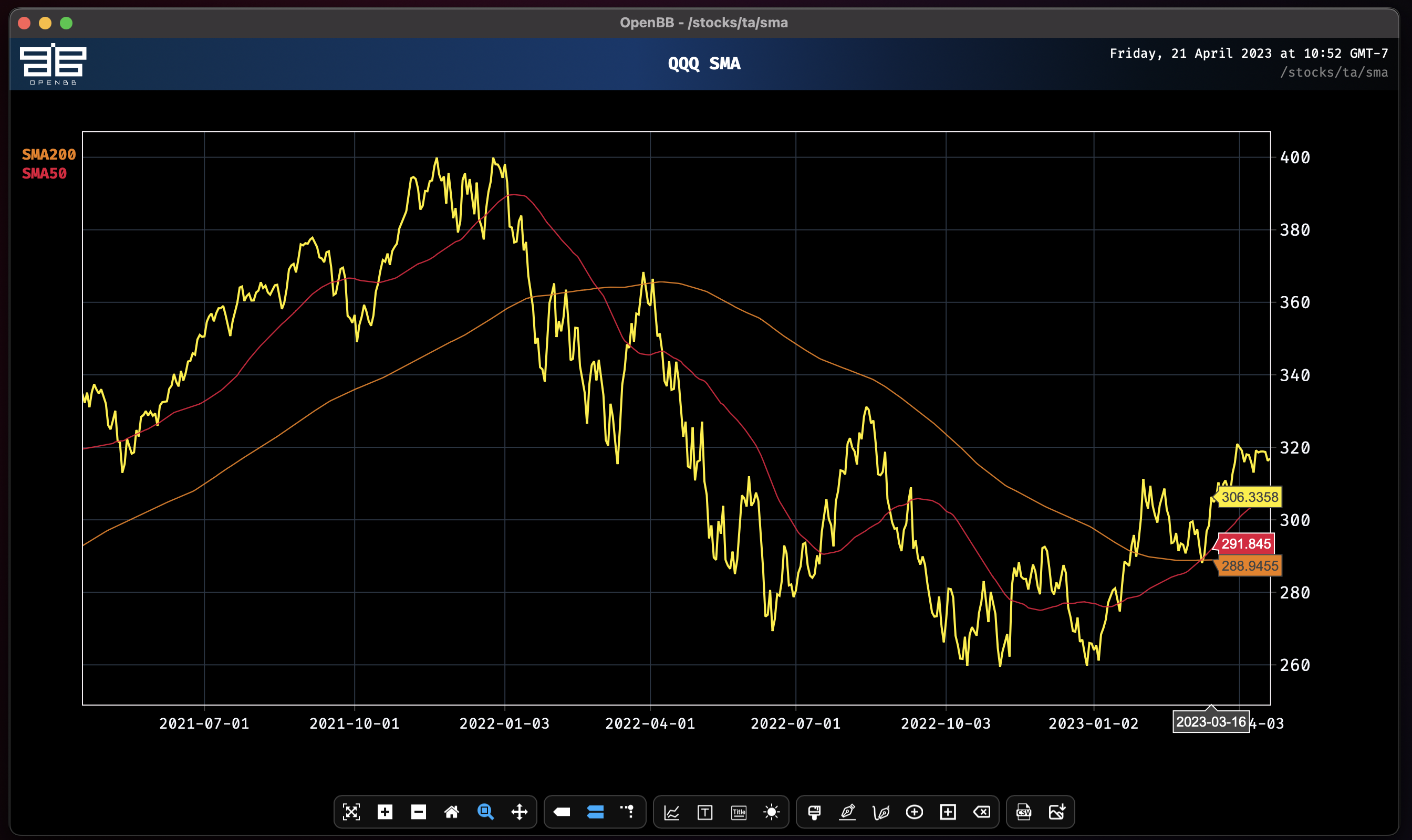

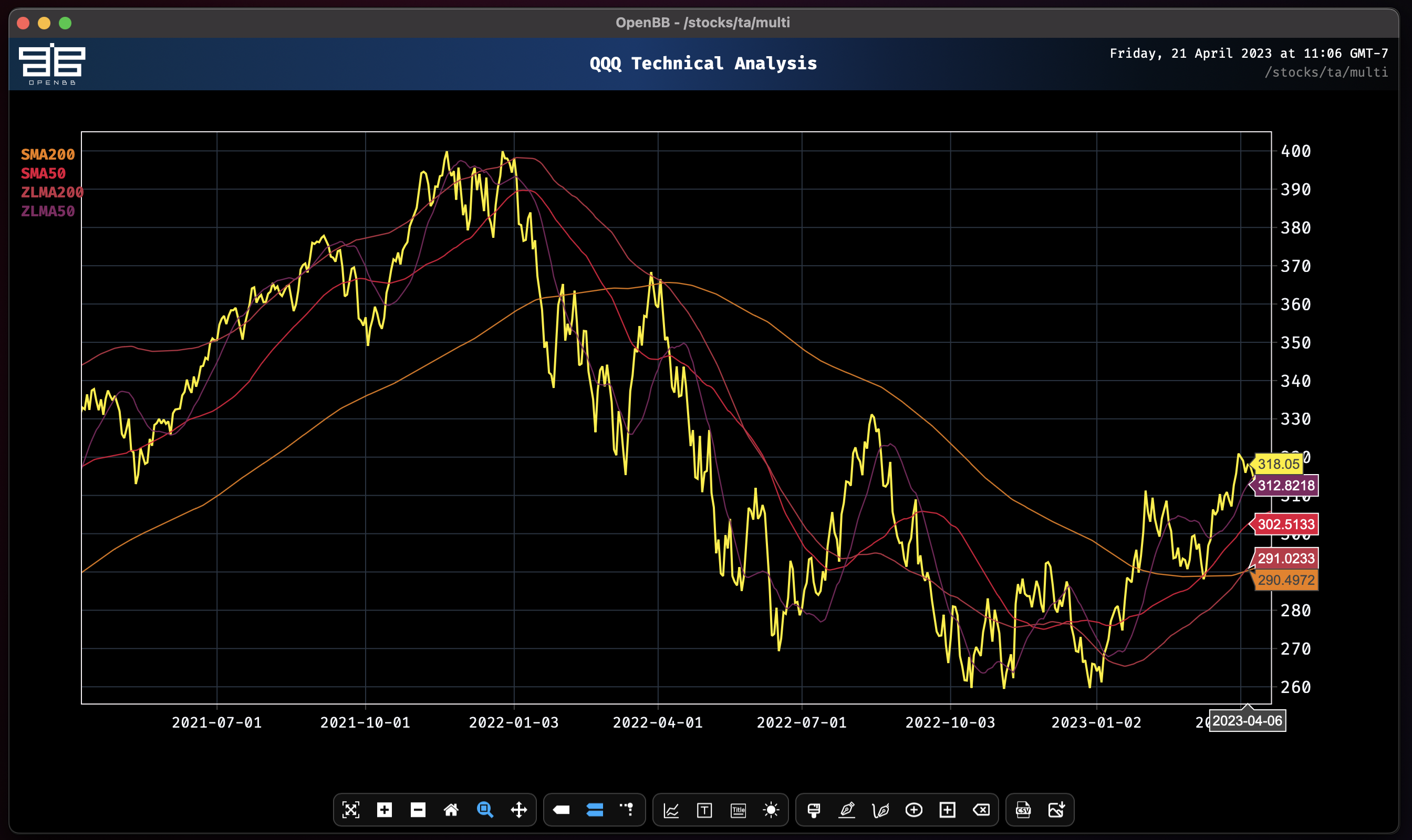

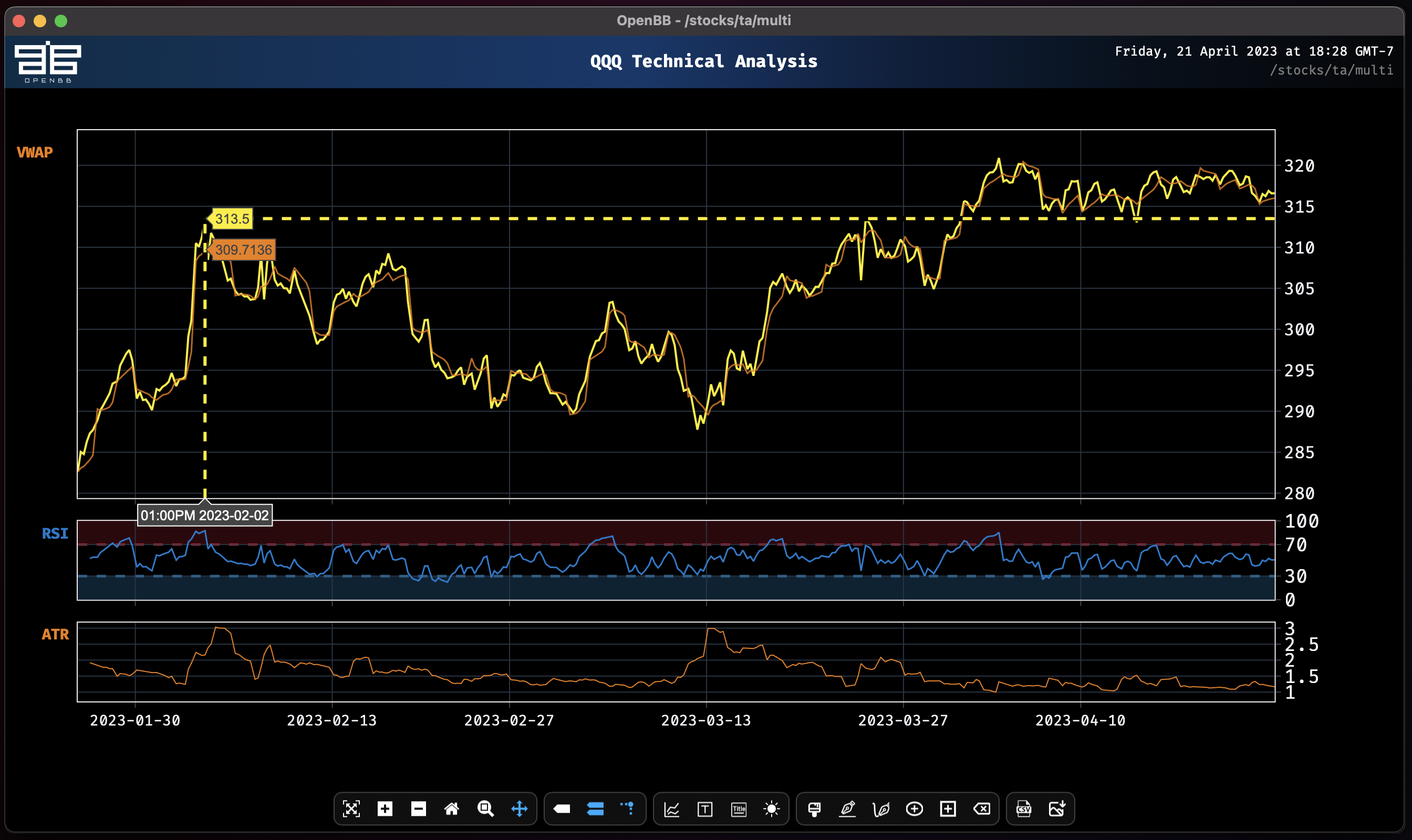

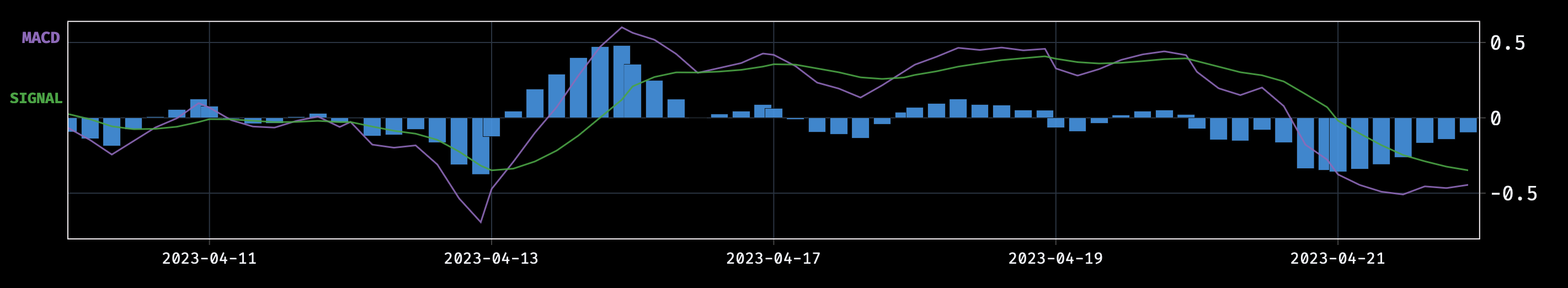

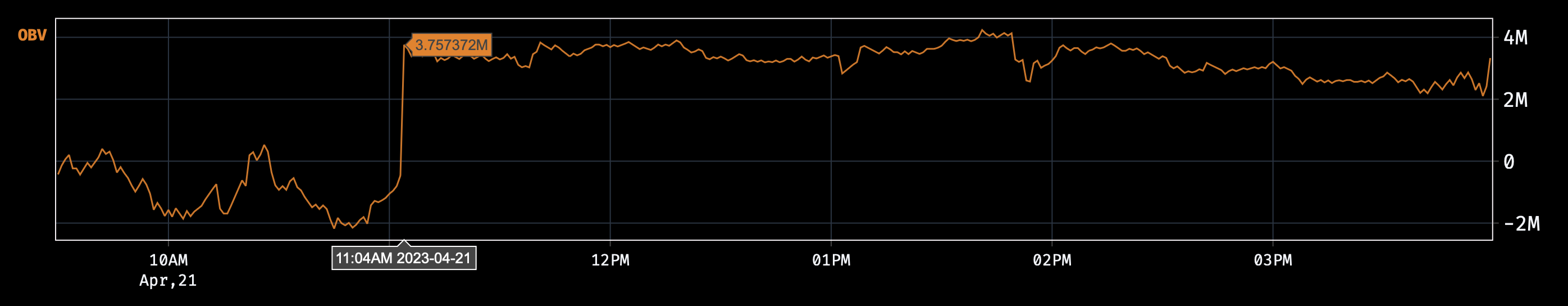

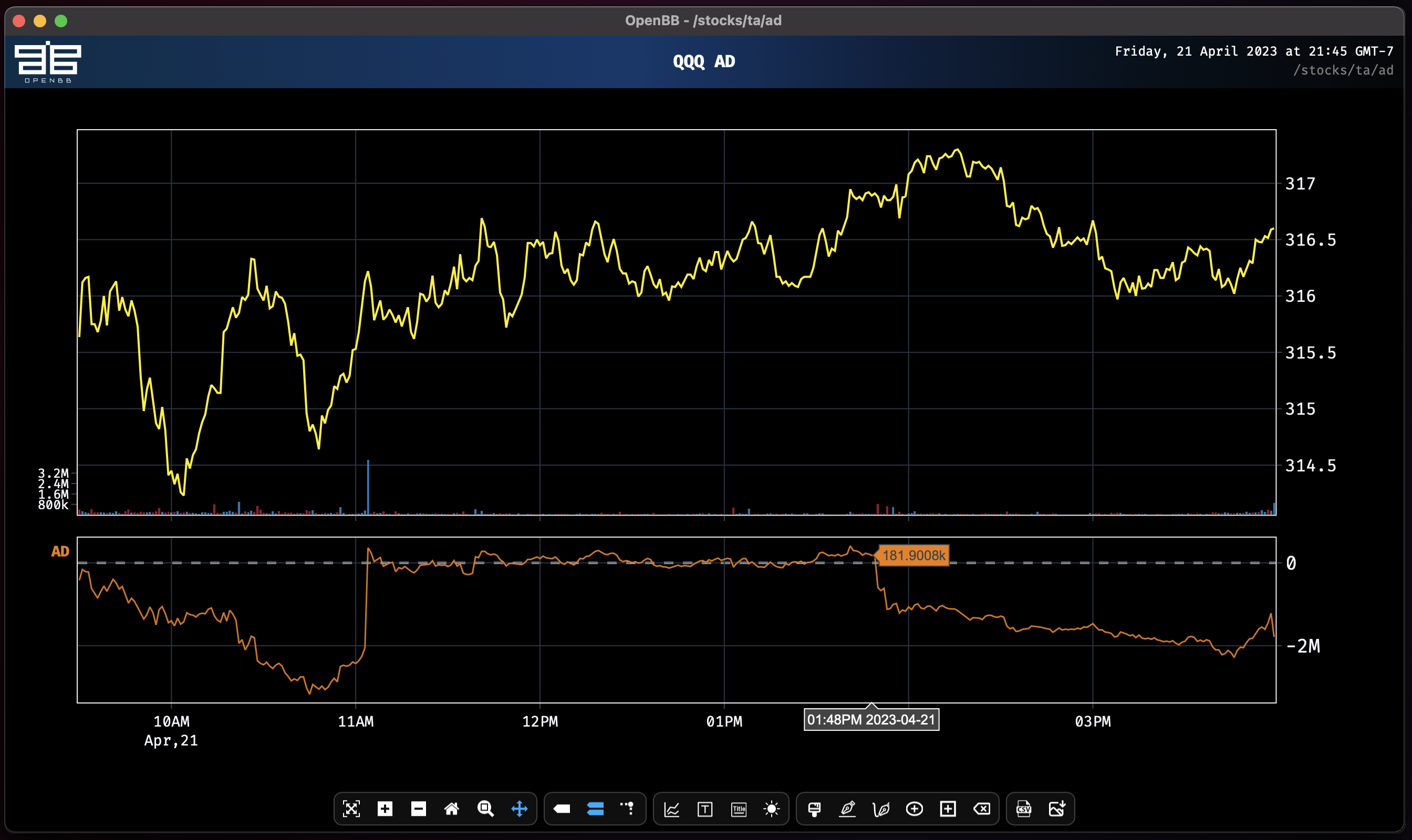

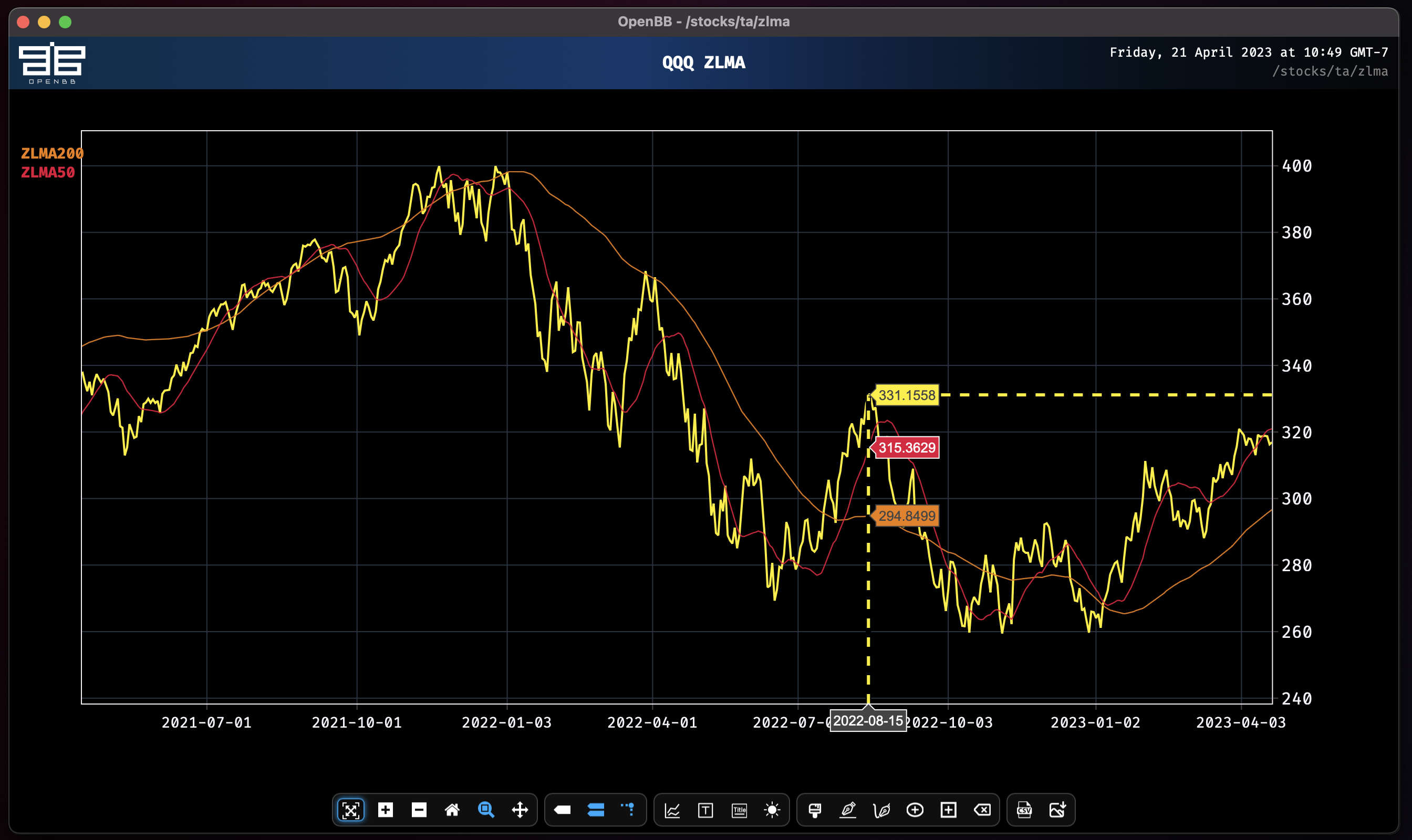

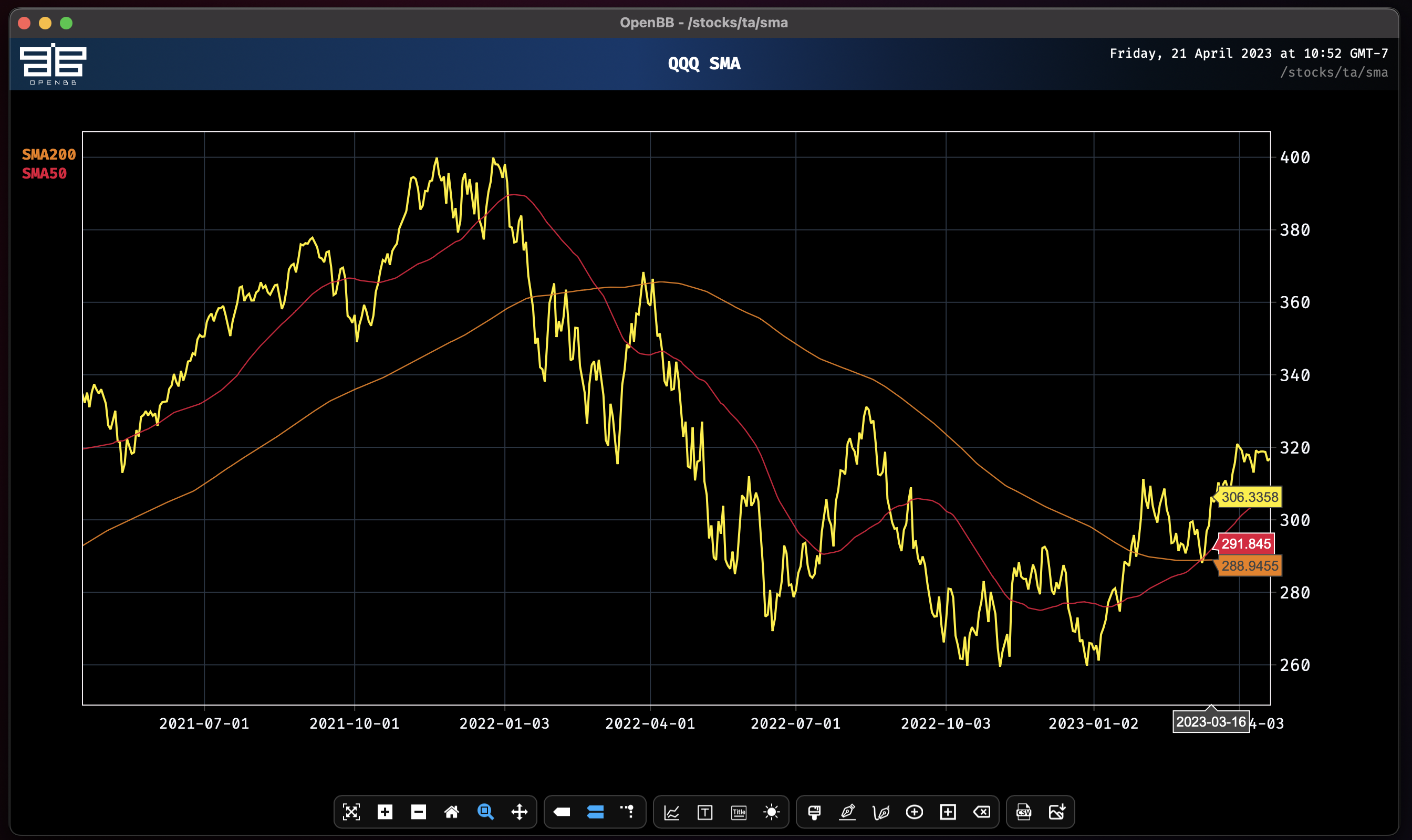

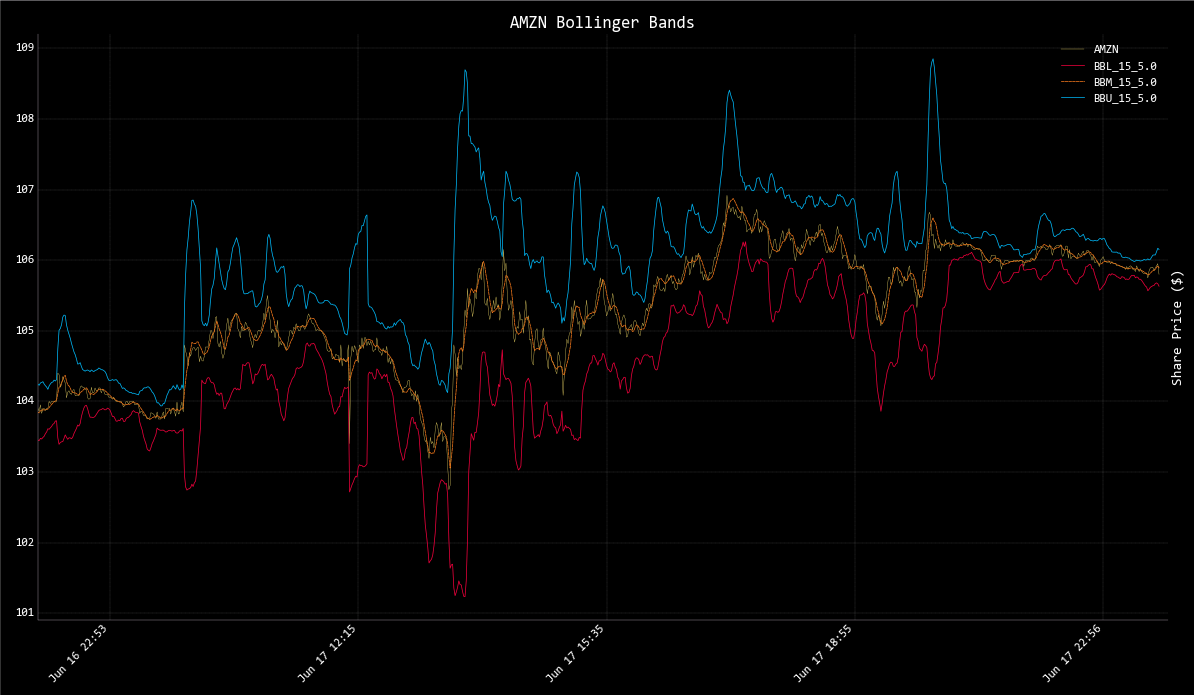

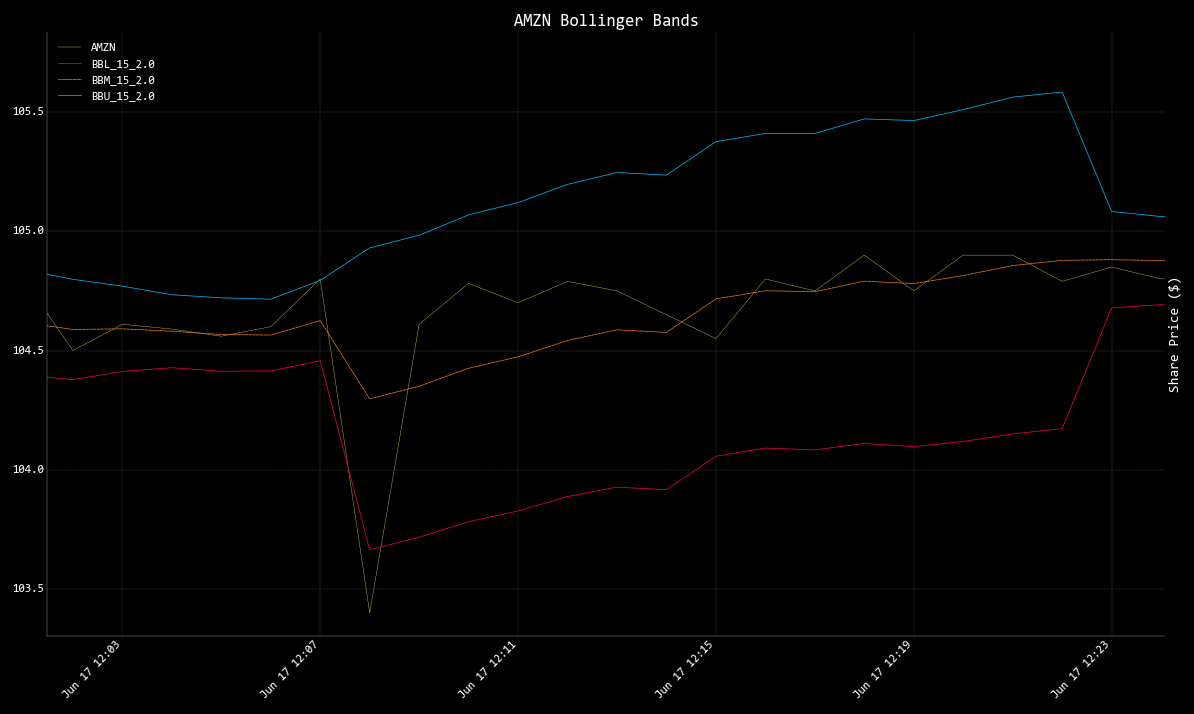

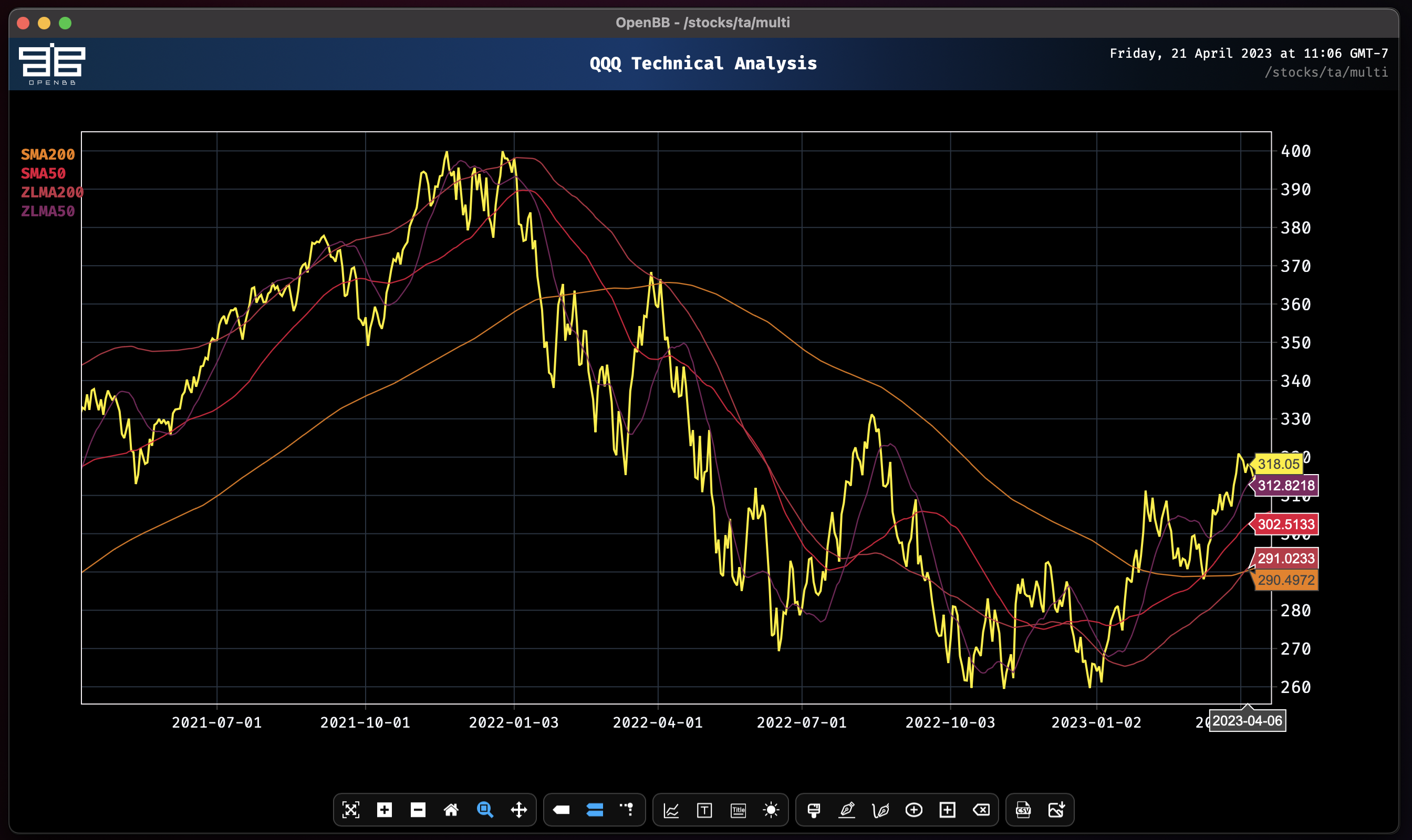

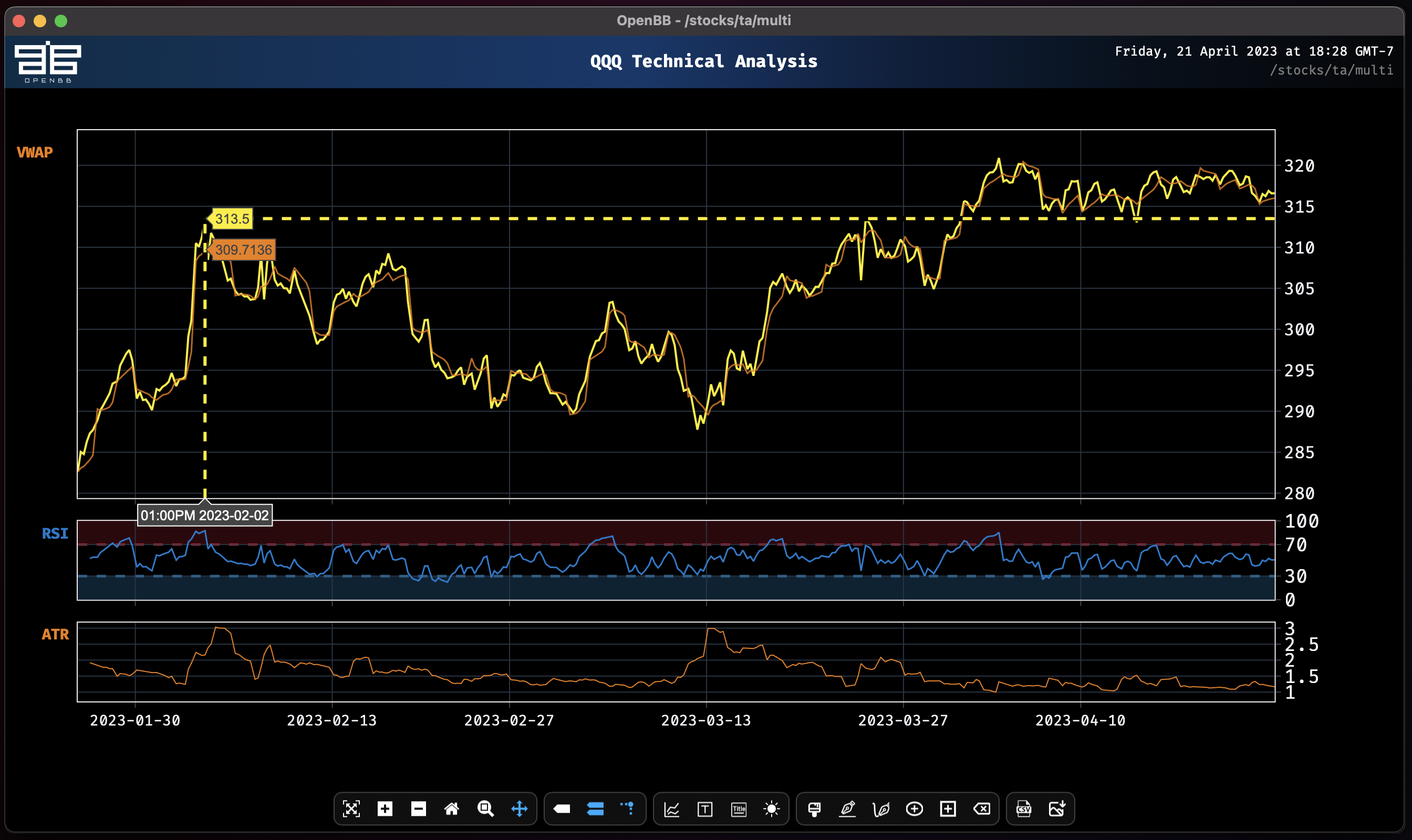

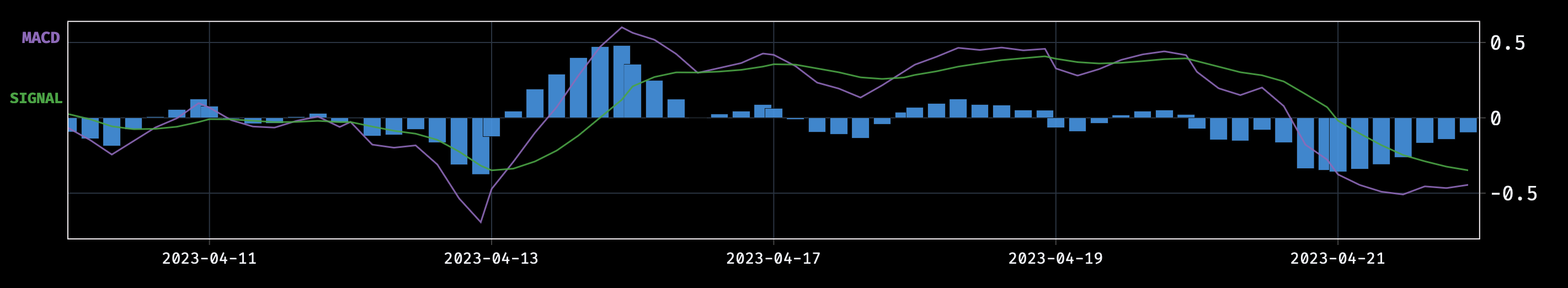

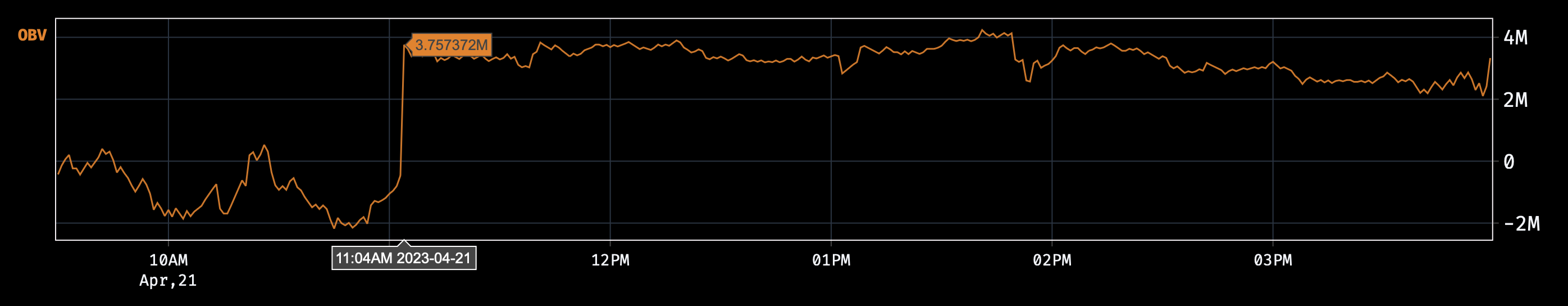

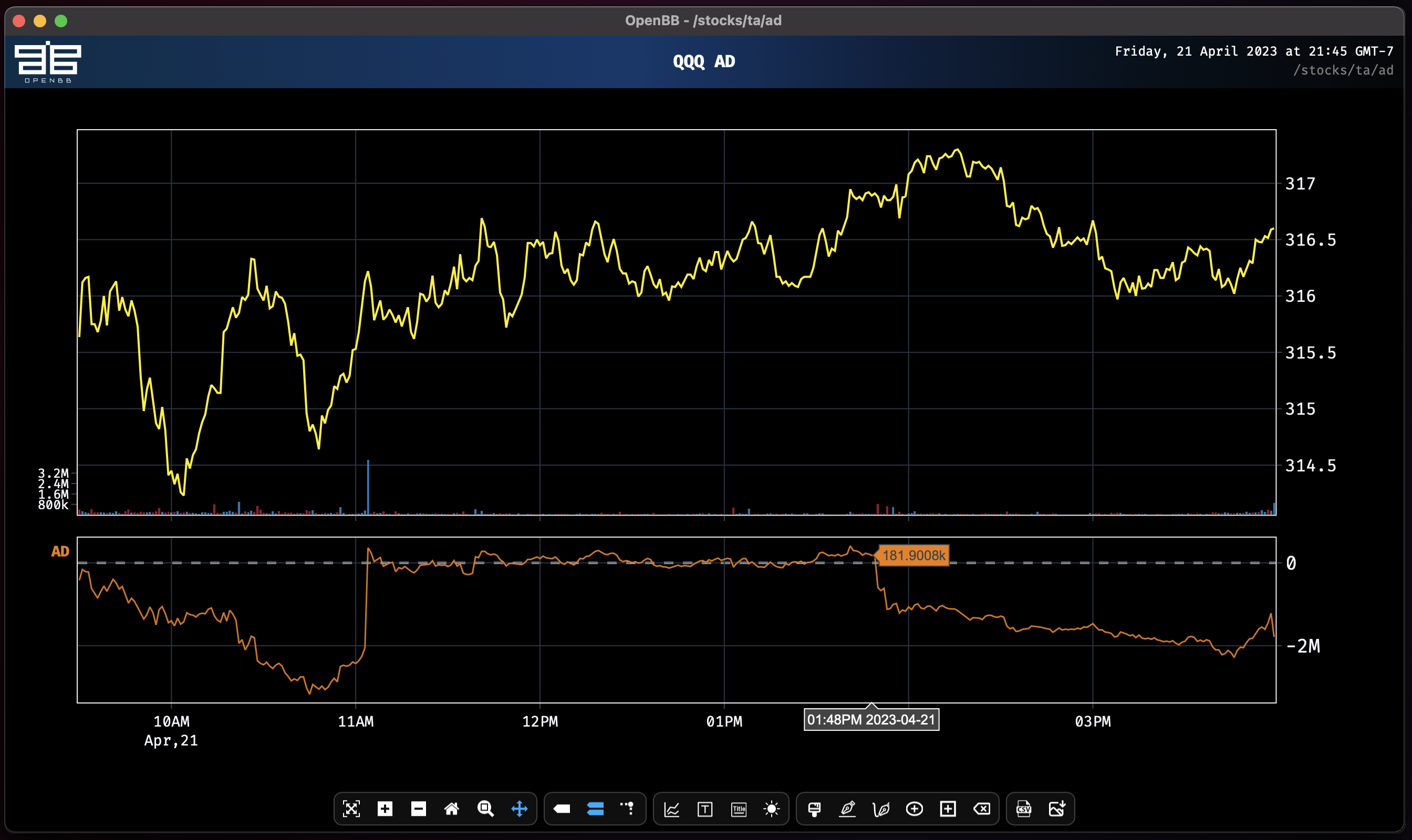

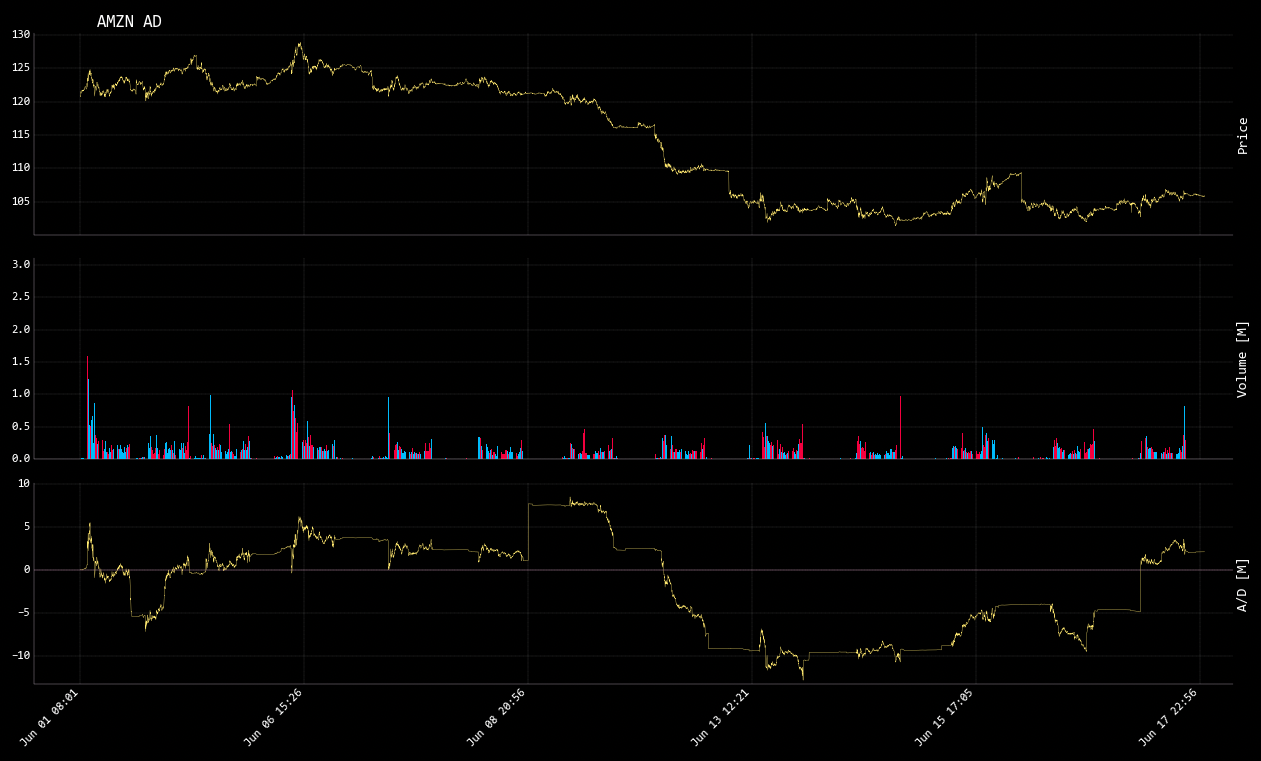

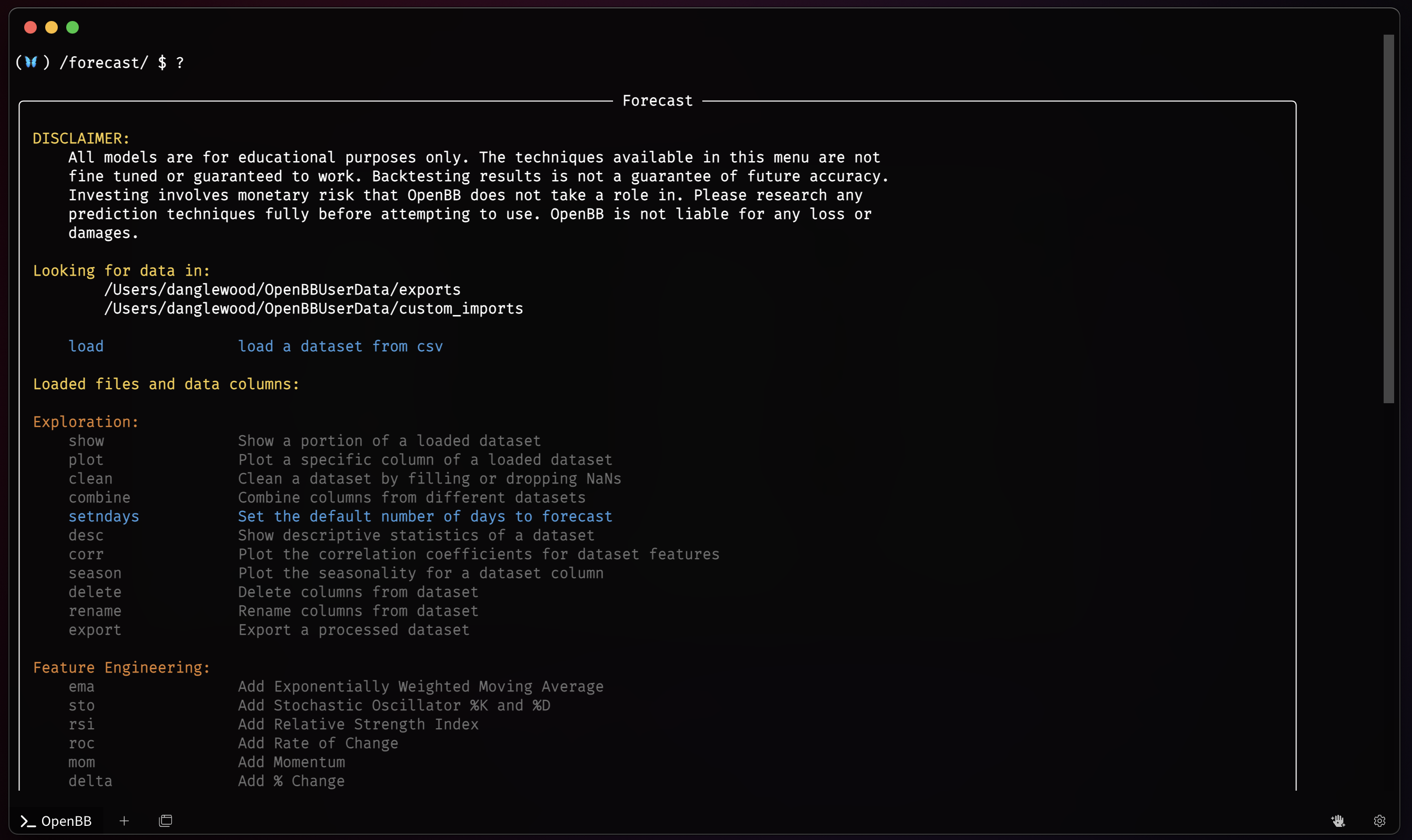

+All commands in this menu will rely on the interval and window chosen when loading an asset for analysis. Refer to the directory tree on the left side of the page, [here](https://docs.openbb.co/terminal/reference), for information on individual commands. To get a better understanding of what these features are, and the formulas behind them, a number of sources should be consulted; but, a good starting point is [Investopedia](https://www.investopedia.com/terms/t/technicalanalysis.asp). The menu employs the [Pandas-TA Library](https://github.com/twopirllc/pandas-ta). Submit a [feature request](https://openbb.co/request-a-feature) to let us know which indicators we should add next!

-### How to use

+### How to Use

-To begin, enter the menu from one of the menus listed above by entering `ta`.

+To begin, enter the menu from one of the menus listed above by entering `ta`. For demonstration purposes, we will use `QQQ` as the ticker. Let's grab some data!

- +```console

+/stocks/load QQQ/ta

+```

+

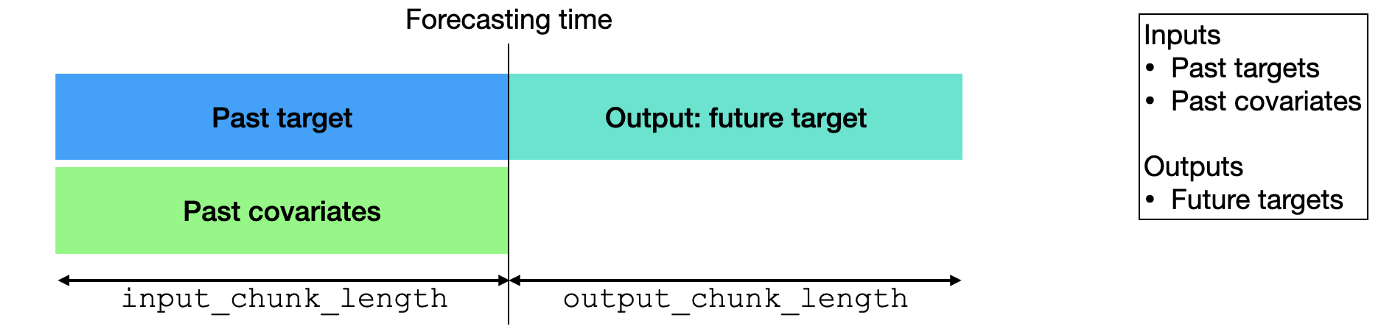

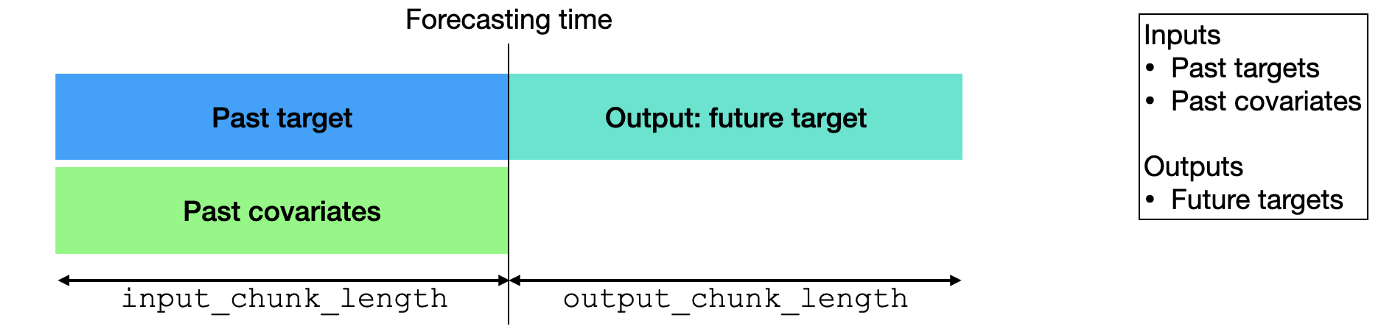

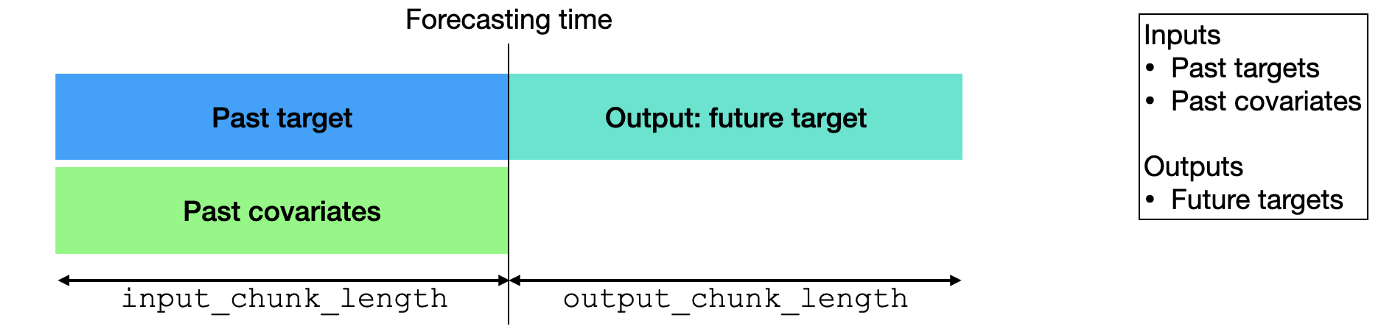

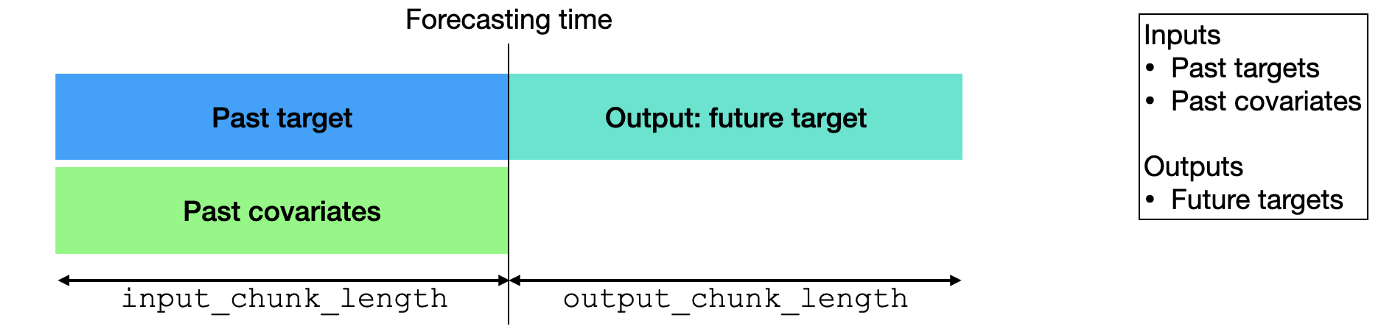

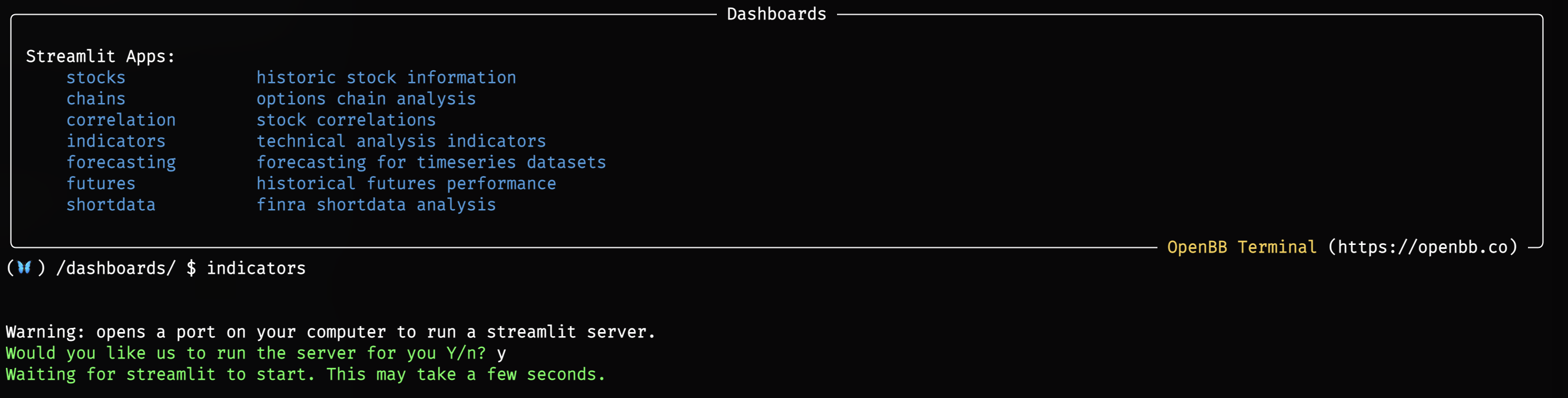

+The block above loads daily QQQ historical prices and volume, then enters the Technical Analysis menu. The table below lists all the available analysis functions.

+

+| Function Key | Type | Description |

+| :----------- | :--------- | ------------------------------------------: |

+| load | - | Load a new ticker for analysis. |

+| ema | Overlap | Exponential Moving Average. |

+| hma | Overlap | Hull Moving Average. |

+| sma | Overlap | Simple Moving Average. |

+| wma | Overlap | Weighted Moving Average. |

+| vwap | Overlap | Volume Weighted Average Price. |

+| zlma | Overlap | Zero-Lag Moving Average. |

+| cci | Momentum | Commodity Channel Index. |

+| cg | Momentum | Center of Gravity. |

+| clenow | Momentum | Clenow Volatility Adjusted Momentum. |

+| demark | Momentum | Tom Demark's Sequential Indicator. |

+| macd | Momentum | Moving Average Convergence/Divergence. |

+| fisher | Momentum | Fisher Transform. |

+| rsi | Momentum | Relative Strength Index. |

+| rsp | Momentum | Relative Strength Percentile. |

+| stoch | Momentum | Stochastic Oscillator. |

+| adx | Trend | Average Directional Movement Index. |

+| aroon | Trend | Aroon Indicator. |