+

{

- if (cleanedPath.startsWith("/terminal")) {

+ if (cleanedPath.startsWith("/terminal") ||

+ cleanedPath.startsWith("/pro")) {

document.documentElement.style.setProperty(

"--ifm-color-primary",

"#669DCB",

@@ -57,6 +58,7 @@ export default function NavbarLayout({ children }) {

"border-b border-grey-600 lg:px-12",

{

header_docs_terminal: cleanedPath.startsWith("/terminal"),

+ header_docs_pro: cleanedPath.startsWith("/pro"),

header_docs_sdk:

cleanedPath.startsWith("/sdk") ||

cleanedPath.startsWith("/platform"),

@@ -65,7 +67,8 @@ export default function NavbarLayout({ children }) {

!cleanedPath.startsWith("/terminal") &&

!cleanedPath.startsWith("/sdk") &&

!cleanedPath.startsWith("/platform") &&

- !cleanedPath.startsWith("/bot"),

+ !cleanedPath.startsWith("/bot") &&

+ !cleanedPath.startsWith("/pro"),

},

"navbar",

"navbar--fixed-top",

diff --git a/website/src/theme/Navbar/Logo/index.js b/website/src/theme/Navbar/Logo/index.js

index 5dafafe38c92..c39bd77149b1 100644

--- a/website/src/theme/Navbar/Logo/index.js

+++ b/website/src/theme/Navbar/Logo/index.js

@@ -1,32 +1,26 @@

import Link from "@docusaurus/Link";

import { useLocation } from "@docusaurus/router";

-import LetteringLogo from "@site/src/components/Icons/LetteringLogo";

+import LetteringDocsLogo from "@site/src/components/Icons/LetteringDocsLogo";

import React from "react";

function getLogo(type) {

- /*

- switch (type) {

- case "terminal":

- return ;

- case "sdk":

- return ;

- case "bot":

- return ;

- default:

- return ;

- }*/

- return ;

+ return ;

}

export default function NavbarLogo() {

const { pathname } = useLocation();

const type = pathname.length > 1 ? pathname.split("/")[1] : "home";

- const version = pathname.length > 1 ? pathname.split("/")[1] : "home";

+

return (

-

+

{getLogo(type)}

+ {type === "sdk" && (

+

+ OpenBB SDK has been deprecated in detriment of the Platform. More details here.

+

+ )}

- On this page

-

-

+ {props?.toc?.some(item => item.level === 1 || item.level === 2 ||item.level === 3) && (

+ <>

+

+ On this page

+

+

+

+ )}

);

}

diff --git a/website/utils/generate_seo_for_documentation.ipynb b/website/utils/generate_seo_for_documentation.ipynb

new file mode 100644

index 000000000000..b3ca0093da99

--- /dev/null

+++ b/website/utils/generate_seo_for_documentation.ipynb

@@ -0,0 +1,293 @@

+{

+ "cells": [

+ {

+ "cell_type": "code",

+ "execution_count": null,

+ "metadata": {},

+ "outputs": [],

+ "source": [

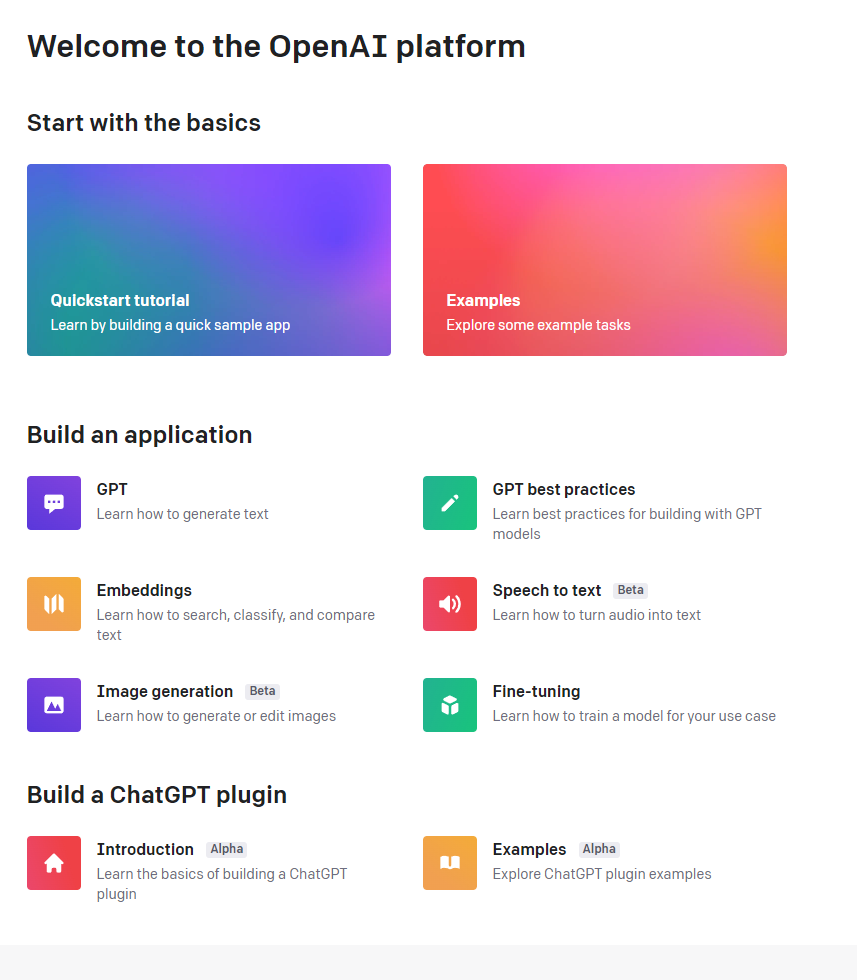

+ "import os\n",

+ "import yaml\n",

+ "from collections import OrderedDict\n",

+ "import openai\n",

+ "import instructor\n",

+ "from typing import List\n",

+ "from pydantic import BaseModel, Field\n",

+ "import os\n",

+ "import fileinput\n",

+ "import re\n",

+ "\n",

+ "openai.api_key = \"

\""

+ ]

+ },

+ {

+ "attachments": {},

+ "cell_type": "markdown",

+ "metadata": {},

+ "source": [

+ "## Generate SEO for each documentation page"

+ ]

+ },

+ {

+ "cell_type": "code",

+ "execution_count": null,

+ "metadata": {},

+ "outputs": [],

+ "source": [

+ "\n",

+ "def parse_front_matter(file_path):\n",

+ " with open(file_path, 'r') as file:\n",

+ " lines = file.readlines()\n",

+ "\n",

+ " front_matter = []\n",

+ " read_front_matter = False\n",

+ "\n",

+ " for line in lines:\n",

+ " if line.strip() == '---':\n",

+ " if read_front_matter:\n",

+ " break\n",

+ " else:\n",

+ " read_front_matter = True\n",

+ " elif read_front_matter:\n",

+ " # Replace tabs with spaces\n",

+ " line = line.replace('\\t', ' ')\n",

+ " front_matter.append(line)\n",

+ "\n",

+ " front_matter = \"\\n\".join(front_matter)\n",

+ " data = yaml.safe_load(front_matter)\n",

+ "\n",

+ " return data\n",

+ "\n",

+ "def represent_ordereddict(dumper, data):\n",

+ " return dumper.represent_mapping(\n",

+ " yaml.resolver.BaseResolver.DEFAULT_MAPPING_TAG,\n",

+ " data.items()\n",

+ " )\n",

+ "\n",

+ "yaml.add_representer(OrderedDict, represent_ordereddict)\n",

+ "\n",

+ "# Define pydantic model to be output from OpenAI when doing a list of keywords\n",

+ "class Keyword(BaseModel):\n",

+ " \"\"\"Keyword for documentation page SEO\"\"\"\n",

+ " keyword: str = Field(..., description=\"Keyword for SEO\")\n",

+ "\n",

+ "class DescriptionAndKeywordsForSEO(BaseModel):\n",

+ " \"\"\"Description and list of keywords for documentation page to improve SEO\"\"\"\n",

+ " keywords: List[Keyword]\n",

+ " description: str = Field(..., description=\"Small description to be used for SEO\")\n",

+ "\n",

+ "instructor.patch()\n",

+ "\n",

+ "for product in [\"../content/pro\"]:\n",

+ " for root, dirs, files in os.walk(product):\n",

+ " for file in files:\n",

+ " if file.endswith(\".md\"):\n",

+ " filename = os.path.join(root, file)\n",

+ " with open(filename, 'r') as f:\n",

+ " lines = f.readlines()\n",

+ " \n",

+ " # Find the second occurrence of '---\\n'\n",

+ " front_matter_end_index = lines.index('---\\n', 1)\n",

+ " # Get the content after the front matter\n",

+ " content = ''.join(lines[front_matter_end_index+1:])\n",

+ " # Get the metadata from the front matter\n",

+ " metadata = parse_front_matter(filename)\n",

+ "\n",

+ " # Print the filename so we know which file we are processing\n",

+ " print(filename)\n",

+ "\n",

+ " # Check if the metadata contains the required fields\n",

+ " if 'title' not in metadata:\n",

+ " print(f\" title not found in {filename}\")\n",

+ " print(\" TITLE MISSING FOR THIS PAGE!\")\n",

+ " if 'sidebar_position' not in metadata:\n",

+ " # Reference documentation doesn't has sidebar missing\n",

+ " if 'reference' not in filename:\n",

+ " print(f\" sidebar_position not found in {filename}\")\n",

+ " print(\" SIDEBAR MISSING FOR THIS PAGE!\")\n",

+ "\n",

+ " success = True\n",

+ " try:\n",

+ " # Use OpenAI to get an optimize description and keywords for SEO\n",

+ " response = openai.ChatCompletion.create(\n",

+ " model=\"gpt-4\",\n",

+ " response_model=DescriptionAndKeywordsForSEO,\n",

+ " max_retries=2,\n",

+ " messages=[\n",

+ " { \"role\": \"system\", \n",

+ " \"content\": \"You are an expert with 20+ years in marketing and SEO. You are required to work on metadata for each docusaurus page to improve SEO based on content written.\"\n",

+ " },\n",

+ " {\n",

+ " \"role\": \"user\", \n",

+ " \"content\": f\"Return a list of keywords and a small description for a marketing website page, taking into account the content of this page: {content}.\"\n",

+ " },\n",

+ " ]\n",

+ " )\n",

+ " except Exception as e:\n",

+ " success = False\n",

+ " print(\" ERROR WITH OPENAI API\")\n",

+ "\n",

+ " # Write the new file\n",

+ " with open(filename, 'w') as f:\n",

+ " f.write('---\\n')\n",

+ "\n",

+ " if success:\n",

+ " # Format the description for Docusaurus\n",

+ " metadata['description'] = response.description.replace('\\n', ' ')\n",

+ " # Format the keywords for Docusaurus, as a list of words\n",

+ " metadata['keywords'] = [item.keyword for item in response.keywords]\n",

+ " else:\n",

+ " metadata['description'] = \"\"\n",

+ " metadata['keywords'] = []\n",

+ "\n",

+ " # Reorder the metadata dictionary\n",

+ " ordered_metadata = OrderedDict()\n",

+ " if \"title\" in metadata:\n",

+ " ordered_metadata['title'] = metadata['title']\n",

+ " if \"sidebar_position\" in metadata:\n",

+ " ordered_metadata['sidebar_position'] = metadata['sidebar_position']\n",

+ " ordered_metadata['description'] = metadata['description'].replace('\\n', ' ')\n",

+ " ordered_metadata['keywords'] = metadata['keywords']\n",

+ "\n",

+ " # Write the metadata to the file\n",

+ " yaml.dump(ordered_metadata, f, default_flow_style=False)\n",

+ "\n",

+ " # Write the end of the front matter\n",

+ " f.write('---\\n')\n",

+ "\n",

+ " # Write the HeadTitle component if it is not the index.md file\n",

+ " '''\n",

+ " if \"index.md\" not in filename.split('/'):\n",

+ " f.write(f\"\"\"\n",

+ "import HeadTitle from '@site/src/components/General/HeadTitle.tsx';\n",

+ "\n",

+ "\n",

+ "\"\"\")\n",

+ " '''\n",

+ " # Write the content after the front matter\n",

+ " f.write(content)"

+ ]

+ },

+ {

+ "attachments": {},

+ "cell_type": "markdown",

+ "metadata": {},

+ "source": [

+ "# Update HeadTitle based on product"

+ ]

+ },

+ {

+ "cell_type": "code",

+ "execution_count": null,

+ "metadata": {},

+ "outputs": [],

+ "source": [

+ "## FOR SDK\n",

+ "\n",

+ "# # Regular expression pattern to match the line\n",

+ "# pattern = r''\n",

+ "# #pattern = r''\n",

+ "# #pattern = r''\n",

+ "\n",

+ "# # Function to generate the replacement string\n",

+ "# def replacement(match):\n",

+ "# # Convert the captured groups to lowercase and form the replacement string\n",

+ "# return ''.format(match.group(2).lower(), match.group(1).lower())\n",

+ "# #return ''.format(match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "# #return ''.format(match.group(4).lower(), match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "\n",

+ "\n",

+ "# FOR PLATFORM\n",

+ "\n",

+ "# # Regular expression pattern to match the line\n",

+ "# #pattern = r''\n",

+ "# pattern = r''\n",

+ "# #pattern = r''\n",

+ "\n",

+ "# Function to generate the replacement string\n",

+ "# def replacement(match):\n",

+ "# # Convert the captured groups to lowercase and form the replacement string\n",

+ "# #return ''.format(match.group(2).lower(), match.group(1).lower())\n",

+ "# return ''.format(match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "# #return ''.format(match.group(4).lower(), match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "\n",

+ "\n",

+ "# FOR TERMINAL\n",

+ "\n",

+ "# # Regular expression pattern to match the line\n",

+ "# #pattern = r''\n",

+ "# #pattern = r''\n",

+ "# pattern = r''\n",

+ "\n",

+ "# # Function to generate the replacement string\n",

+ "# def replacement(match):\n",

+ "# # Convert the captured groups to lowercase and form the replacement string\n",

+ "# #return ''.format(match.group(2).lower(), match.group(1).lower())\n",

+ "# #return ''.format(match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "# return ''.format(match.group(4).lower(), match.group(3).lower(), match.group(2).lower(), match.group(1).lower())\n",

+ "\n",

+ "# BOT DISCORD\n",

+ "\n",

+ "# # Regular expression pattern to match the line\n",

+ "# pattern = r''\n",

+ "\n",

+ "# # Function to generate the replacement string\n",

+ "# def replacement(match):\n",

+ "# # Convert the captured groups to lowercase and form the replacement string\n",

+ "# return ''.format(match.group(2).lower(), match.group(1).lower())\n",

+ "\n",

+ "# BOT TELEGRAM\n",

+ "\n",

+ "# Regular expression pattern to match the line\n",

+ "pattern = r''\n",

+ "\n",

+ "# Function to generate the replacement string\n",

+ "def replacement(match):\n",

+ " # Convert the captured groups to lowercase and form the replacement string\n",

+ " return ''.format(match.group(2).lower(), match.group(1).lower())\n",

+ "\n",

+ "\n",

+ "# Walk through current directory\n",

+ "for dirpath, dirs, files in os.walk('bot/reference/telegram'):\n",

+ " for filename in files:\n",

+ " filepath = os.path.join(dirpath, filename)\n",

+ " # Check if file is a .md file\n",

+ " if filepath.endswith('.md'):\n",

+ " # Read the file\n",

+ " with fileinput.FileInput(filepath, inplace=True) as file:\n",

+ " for line in file:\n",

+ " # Replace the line using regular expression\n",

+ " print(re.sub(pattern, replacement, line), end='')"

+ ]

+ },

+ {

+ "cell_type": "code",

+ "execution_count": null,

+ "metadata": {},

+ "outputs": [],

+ "source": []

+ }

+ ],

+ "metadata": {

+ "kernelspec": {

+ "display_name": "base",

+ "language": "python",

+ "name": "python3"

+ },

+ "language_info": {

+ "codemirror_mode": {

+ "name": "ipython",

+ "version": 3

+ },

+ "file_extension": ".py",

+ "mimetype": "text/x-python",

+ "name": "python",

+ "nbconvert_exporter": "python",

+ "pygments_lexer": "ipython3",

+ "version": "3.11.4"

+ },

+ "orig_nbformat": 4

+ },

+ "nbformat": 4,

+ "nbformat_minor": 2

+}

diff --git a/website/versioned_docs/version-v3/bot/faqs/generic.md b/website/versioned_docs/version-v3/bot/faqs/generic.md

deleted file mode 100644

index b0ea7f3fb163..000000000000

--- a/website/versioned_docs/version-v3/bot/faqs/generic.md

+++ /dev/null

@@ -1,91 +0,0 @@

----

-title: generic

-sidebar_position: 1

-description: Here we answer frequently asked questions about the OpenBB Bot from our users and community.

-keywords:

- [

- installation,

- installer,

- install,

- guide,

- mac,

- windows,

- linux,

- python,

- github,

- macos,

- how to,

- explanation,

- openbb bot,

- ]

----

-

-## Generic

-

-How Do I Link My OpenBB Bot Account?

-

-After you signup for an OpenBB Bot plan you can link your accounts from here

-

-Can I try an OpenBB Bot plan?

-

-You can try a preview of any plan by just running commands on a server that has OpenBB Bot, like OpenBB Discord. We offer a limited amount of daily commands.

-

-Will my OpenBB Bot plan renew at the end of the billing cycle?

-

-Yes, plans renew automatically at the end of the monthly and yearly billing cycles. You can cancel your plan at any time, before the end of the billing cycle, and it will not auto-renew anymore.

-

-Can I get a refund on my OpenBB Bot?

-

-Since we offer a free command tier to try commands we don't offer refunds as you have had ample time to try the service and make a decision.

-

-If I sign up for OpenBB Bot do I get access on all platforms?

-

-Yes! You will have access on Discord, and other platforms as we add support.

-

-If I cancel OpenBB Bot subscription do I still have access?

-

-No, you will lose your access but you get a credit on your account of the prorated amount until the end of your current billing cycle.

-

-What's the difference in an individual plan and server plan on OpenBB Bot?

-

-An individual plan gives your account access to OpenBB Bot while a server plan gives the whole server access. An individual plan carries more perks with it than a server plan, which you can find by clicking on the plan.

-

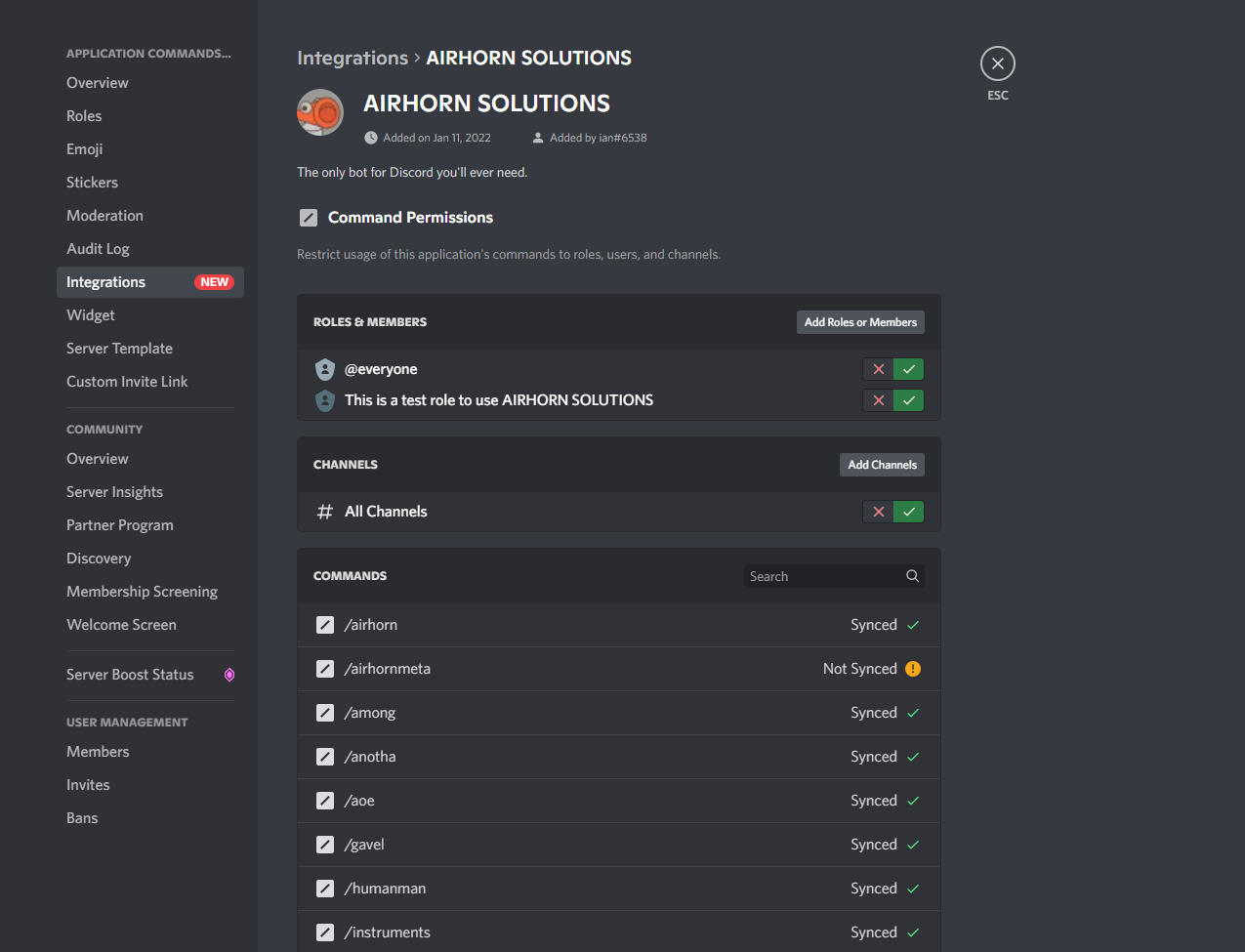

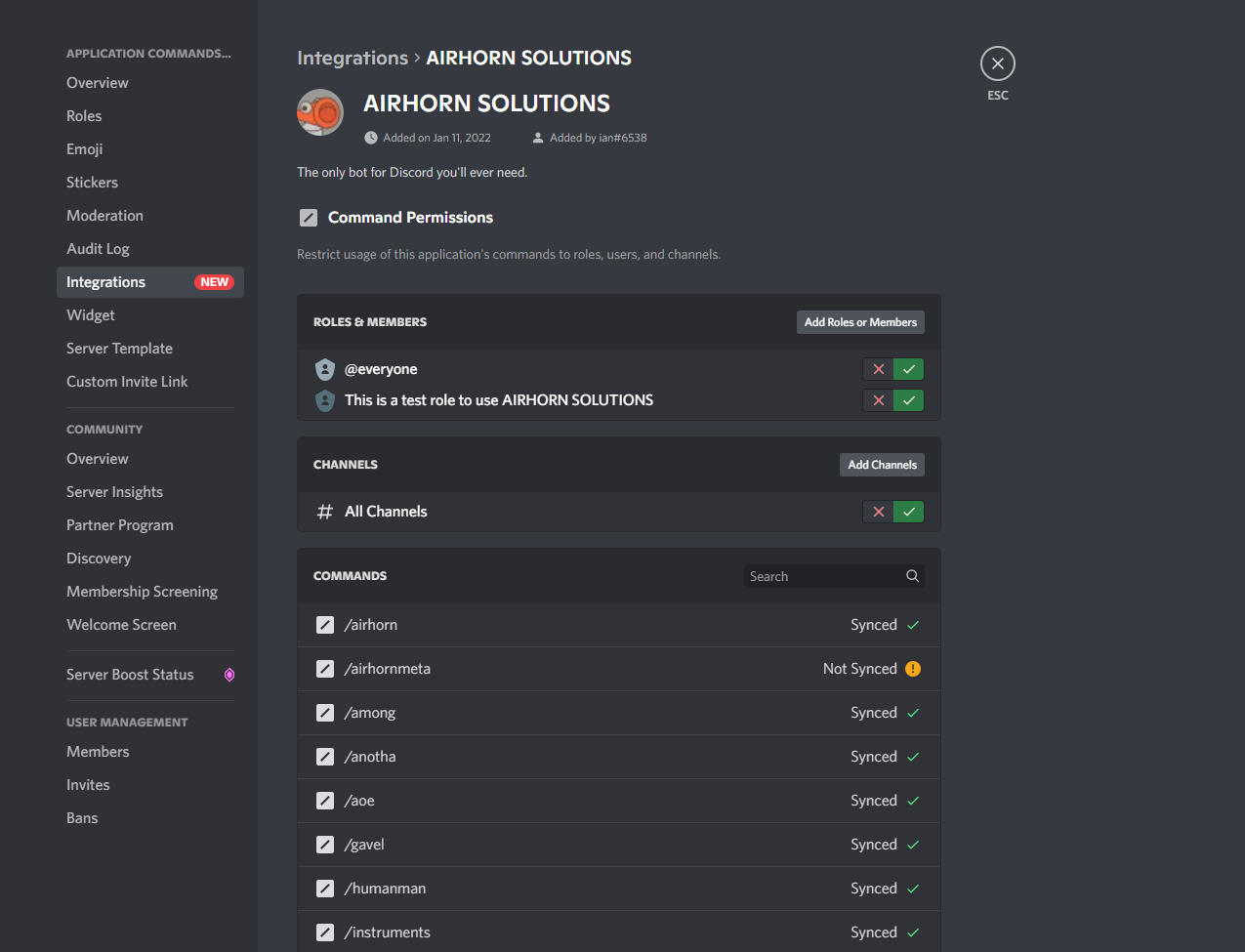

-I added the bot but still don't see slash commands, what do I do?

-

- -

-Just head to Server Settings → Integrations and then click ‘Manage’ next to an app, where you will behold a new, shiny, and dare we say dazzling, new surface.

-

-

-

-Just head to Server Settings → Integrations and then click ‘Manage’ next to an app, where you will behold a new, shiny, and dare we say dazzling, new surface.

-

-

- - Use toggles to modify which members can use commands

- - Use toggles to modify which channels allow commands

-

-

-There’s also a command-specific list, where you can make customized permissions for each command.

-

- - By default, these are all synced to the command permission at the top.

- - You can unsync an individual command to make further customizations.

-

-

-For more information click here.

-

- -

-Once you log in, you’ll see a window asking for permission to access your account. Locate the “Add to Server” drop-down menu and click on it.

-

-

-Once you log in, you’ll see a window asking for permission to access your account. Locate the “Add to Server” drop-down menu and click on it.

- -

-This will open a list of Discord servers where you can add a bot. Select your server and press “Continue”.

-

-Review permissions that the bot requests on your server. Select and deselect based on your needs, we recommend all the default settings in order to experience everything the bot has to offer. Click on “Authorize” when you’re ready.

-

-

-This will open a list of Discord servers where you can add a bot. Select your server and press “Continue”.

-

-Review permissions that the bot requests on your server. Select and deselect based on your needs, we recommend all the default settings in order to experience everything the bot has to offer. Click on “Authorize” when you’re ready.

- -

-Congratulations! You’ve successfully added a bot to your Discord server.

diff --git a/website/versioned_docs/version-v3/bot/installation/index.md b/website/versioned_docs/version-v3/bot/installation/index.md

deleted file mode 100644

index 2746c6191699..000000000000

--- a/website/versioned_docs/version-v3/bot/installation/index.md

+++ /dev/null

@@ -1,41 +0,0 @@

----

-title: Installation

-sidebar_position: 1

-description: How to get started with OpenBB Bot

-keywords: [installation, install, install openbb bot, guide, how to, explanation, openbb bot, openbb, discord, telegram, slack]

----

-

-import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

-

-

-

-import AddBotDialogDiscord from "@site/src/components/General/AddBotDiscord";

-import AddBotDialogTelegram from "@site/src/components/General/AddBotTelegram";

-

-Currently we support [Discord](installation/discord) and [Telegram](installation/telegram) for the OpenBB Bot. More integrations are under way.

-

-In order to use OpenBB Bot in one of these chatting applications you need to either:

-

-

-Congratulations! You’ve successfully added a bot to your Discord server.

diff --git a/website/versioned_docs/version-v3/bot/installation/index.md b/website/versioned_docs/version-v3/bot/installation/index.md

deleted file mode 100644

index 2746c6191699..000000000000

--- a/website/versioned_docs/version-v3/bot/installation/index.md

+++ /dev/null

@@ -1,41 +0,0 @@

----

-title: Installation

-sidebar_position: 1

-description: How to get started with OpenBB Bot

-keywords: [installation, install, install openbb bot, guide, how to, explanation, openbb bot, openbb, discord, telegram, slack]

----

-

-import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

-

-

-

-import AddBotDialogDiscord from "@site/src/components/General/AddBotDiscord";

-import AddBotDialogTelegram from "@site/src/components/General/AddBotTelegram";

-

-Currently we support [Discord](installation/discord) and [Telegram](installation/telegram) for the OpenBB Bot. More integrations are under way.

-

-In order to use OpenBB Bot in one of these chatting applications you need to either:

-

-

- -

- Belong to a server that has already added our bot (INDIVIDUAL)

-

- -

- Own a server and you can easily add our bot (SERVER)

-

-

-

- What are you waiting for?

-

-

-Over 1.5 Million commands have been run on the OpenBB Bot. Join the community and start using OpenBB Bot today!

-

-Check our user metrics in our [Open page](https://openbb.co/open).

-

-

-

-

diff --git a/website/versioned_docs/version-v3/bot/installation/telegram.md b/website/versioned_docs/version-v3/bot/installation/telegram.md

deleted file mode 100644

index f8d1274be3d4..000000000000

--- a/website/versioned_docs/version-v3/bot/installation/telegram.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-title: Telegram

-sidebar_position: 1

-description: How to get started with OpenBB Bot

-keywords: [installation, install, install openbb bot, guide, how to, explanation, openbb bot, openbb, discord, telegram,]

----

-

-

-import HeadTitle from '@site/src/components/General/HeadTitle.tsx';

-

-

-

-import AddBotDialogTelegram from "@site/src/components/General/AddBotTelegram";

-

-## Telegram Server - First Time Setup

-

-

-

-After clicking on the "Add bot to Telegram" button it should open a chat with our OpenBB Bot.

-

- -

-Go to your Telegram chat and click/tap on the Top Bar of the OpenBB Bot chat window.

-

-

-

-Go to your Telegram chat and click/tap on the Top Bar of the OpenBB Bot chat window.

-

- -

-Then, you need to click on “More” and select "Add to Group or Channel" or just click "Add to Group or Channel" and select the Telegram group you want to add the chatbot to:

-

-

-

-Then, you need to click on “More” and select "Add to Group or Channel" or just click "Add to Group or Channel" and select the Telegram group you want to add the chatbot to:

-

- -

-Now you can verify it has the permissions required, we recommend the ones already selected, and you are ready to go!

-

-

-

-Now you can verify it has the permissions required, we recommend the ones already selected, and you are ready to go!

-

- diff --git a/website/versioned_docs/version-v3/bot/reference/discord/alerts/create.md b/website/versioned_docs/version-v3/bot/reference/discord/alerts/create.md

deleted file mode 100644

index 9c5f13ba39ee..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/alerts/create.md

+++ /dev/null

@@ -1,40 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: create

-description: OpenBB Discord Command

----

-

-# create

-

-This command creates an alert for a given symbol (ex. BTCUSD) that will notify the user when the price is equal to or above the user defined price.

-

-### Usage

-

-```python wordwrap

-/alerts create ticker condition price

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Ticker to set alert for | False | None |

-| condition | Condition to set alert for | False | Equal or Above, Equal or Below |

-| price | Price to set alert for | False | None |

-

-

----

-

-## Examples

-

-```

-/alerts create ticker:BTCUSD condition:Equal or Above price:1000

-```

-

-```

-/alerts create ticker:SPY condition:Equal or Below price:400

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/alerts/delete.md b/website/versioned_docs/version-v3/bot/reference/discord/alerts/delete.md

deleted file mode 100644

index e02a786bf609..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/alerts/delete.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: delete

-description: OpenBB Discord Command

----

-

-# delete

-

-This command allows the user to delete an active alert they have set.

-

-### Usage

-

-```python wordwrap

-/alerts delete alert

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| alert | Alert to delete | False | None |

-

-

----

-

-## Examples

-

-```

-/alerts delete alert:

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/alerts/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/alerts/index.mdx

deleted file mode 100644

index 022b3069ac95..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/alerts/index.mdx

+++ /dev/null

@@ -1,27 +0,0 @@

-# alerts

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/alerts/list.md b/website/versioned_docs/version-v3/bot/reference/discord/alerts/list.md

deleted file mode 100644

index 96cb2752c2fb..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/alerts/list.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: list

-description: OpenBB Discord Command

----

-

-# list

-

-This command allows the user to view a list of all their active alerts. It displays each alert along with its symbol, description, and threshold, giving the user an overview of their active alerts at a glance.

-

-### Usage

-

-```python wordwrap

-/alerts list

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/alerts list

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/alerts/update.md b/website/versioned_docs/version-v3/bot/reference/discord/alerts/update.md

deleted file mode 100644

index f19c8e9cd2fb..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/alerts/update.md

+++ /dev/null

@@ -1,36 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: update

-description: OpenBB Discord Command

----

-

-# update

-

-This command allows the user to update the condition on an active alert, such as changing the value of a price alert. The command will update the alert with the new condition and keep the alert active until it is manually deactivated or the alert's condition is met.

-

-### Usage

-

-```python wordwrap

-/alerts update alerts condition price

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| alerts | Your active alerts | False | None |

-| condition | Update condition for alert | False | Equal or Above (above or equal), Equal or Below (below or equal) |

-| price | Update alert to this price | False | None |

-

-

----

-

-## Examples

-

-```

-/alerts update alerts: condition: price:

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/autopost/add.md b/website/versioned_docs/version-v3/bot/reference/discord/autopost/add.md

deleted file mode 100644

index 69211167f011..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/autopost/add.md

+++ /dev/null

@@ -1,38 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: commands add

-description: OpenBB Discord Command

----

-

-# commands add

-

-This command allows the user to add an autopost command to a channel. It allows the user to receive notifications from OpenBB bot in the channel without having to manually query them. This can be used for all commands that appear in the list when you run "autopost commands add"

-

-### Usage

-

-```python wordwrap

-/autopost commands add cmd interval [start_time] [stop_time]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| cmd | Pick the command you want to assign for autoposting | False | List of commands that allow auto posting |

-| interval | How oftern to post the autopost command | False | 5m, 15m, 30m, 1hr, 2hr, 4hr, 6hr |

-| start_time | Time to start the autopost command - ex. If I want to start at 8am I do 8 | True | 24hr time |

-| stop_time | Time to stop the autopost command - ex. If I want to stop at 6pm I do 18 | True | 24hr time |

-

----

-

-## Examples

-

-```

-/autopost commands add cmd:/cm interval:1 Hour

-```

-

-```

-/autopost commands add cmd: /cm interval: 1 Hour start_time: 9 stop_time: 10

-```

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/autopost/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/autopost/index.mdx

deleted file mode 100644

index de5c3e78ee27..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/autopost/index.mdx

+++ /dev/null

@@ -1,22 +0,0 @@

-# autopost

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/autopost/list.md b/website/versioned_docs/version-v3/bot/reference/discord/autopost/list.md

deleted file mode 100644

index 1c4d55edb7de..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/autopost/list.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: list

-description: OpenBB Discord Command

----

-

-# list

-

-This command allows users to view all webhook feeds associated with a particular channel that have been set up for automatic posting. It produces a list of all webhooks that have been configured to post content to the channel automatically, as well as information such as when they are scheduled.

-

-### Usage

-

-```python wordwrap

-/autopost list

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/autopost list

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/autopost/remove.md b/website/versioned_docs/version-v3/bot/reference/discord/autopost/remove.md

deleted file mode 100644

index f13103ba320e..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/autopost/remove.md

+++ /dev/null

@@ -1,36 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: commands manage

-description: OpenBB Discord Command

----

-

-# commands manage

-

-This command allows the user to remove an autopost webhook feed from the channel. When executed, it will remove the feed from the channel and prevent any further autoposts from being sent.

-

-### Usage

-

-```python wordwrap

-/autopost commands manage action

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| action | Remove, or List your feeds for Discord autoposts | True | Remove, List |

-

----

-

-## Examples

-

-```

-/autopost commands manage action:List

-```

-

-```

-/autopost commands manage action:Remove

-```

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/c15m.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/c15m.md

deleted file mode 100644

index a2a30508fadd..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/c15m.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: c15m

-description: OpenBB Discord Command

----

-

-# c15m

-

-This command allows the user to retrieve a 15-minute intraday chart for a given ticker. The chart will show the price and volume of the stock over the past 3 days in 15 minute intervals. This command is useful for performing technical analysis and tracking short-term price movements.

-

-### Usage

-

-```python wordwrap

-/c15m ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/c15m ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/c3m.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/c3m.md

deleted file mode 100644

index 253d03889ccc..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/c3m.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: c3m

-description: OpenBB Discord Command

----

-

-# c3m

-

-This command allows users to retrieve a 3-minute intraday chart for the given ticker. This chart will display the candlestick chart for the day. It will provide a visual representation of the stock's performance over the current day, making it helpful for short-term investors.

-

-### Usage

-

-```python wordwrap

-/c3m ticker [extended_hours]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| extended_hours | Show Full 4am-8pm ET Trading Hours. Default: False | True | None |

-

-

----

-

-## Examples

-

-```

-/c3m ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/c5m.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/c5m.md

deleted file mode 100644

index 915ae1cb3c7a..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/c5m.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: c5m

-description: OpenBB Discord Command

----

-

-# c5m

-

-This command allows the user to retrieve an intraday 5 minute chart for a given ticker. This chart will display the candlestick chart for the day. It will provide a visual representation of the stock's performance over the current day. This command is useful for performing technical analysis and tracking short-term price movements.

-

-### Usage

-

-```python wordwrap

-/c5m ticker [extended_hours]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| extended_hours | Show Full 4am-8pm ET Trading Hours. Default: False | True | None |

-

-

----

-

-## Examples

-

-```

-/c5m ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/cc.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/cc.md

deleted file mode 100644

index cbfd12fb379f..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/cc.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: cc

-description: OpenBB Discord Command

----

-

-# cc

-

-This command allows the user to retrieve an intraday 5 minute chart for a given ticker, /c5m also has the same effect. This chart will display the candlestick chart for the day. It will provide a visual representation of the stock's performance over the current day. This command is useful for performing technical analysis and tracking short-term price movements.

-

-### Usage

-

-```python wordwrap

-/cc ticker [extended_hours]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| extended_hours | Show Full 4am-8pm ET Trading Hours. Default: False | True | None |

-

-

----

-

-## Examples

-

-```

-/cc ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/cd.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/cd.md

deleted file mode 100644

index 0d27659f6be3..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/cd.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: cd

-description: OpenBB Discord Command

----

-

-# cd

-

-This command allows the user to retrieve a daily candlestick chart for a particular ticker or coin. The candlestick chart provides information about the opening and closing prices of the day, as well as the high and low prices of the day. This data can then be used to analyze the performance of the ticker/coin over time. For example, if the user provides the command "/cd ticker:AMD", the chart will be generated for the ticker AMD.

-

-### Usage

-

-```python wordwrap

-/cd ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/cd ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/chart.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/chart.md

deleted file mode 100644

index 4262e64ff412..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/chart.md

+++ /dev/null

@@ -1,41 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: chart

-description: OpenBB Discord Command

----

-

-# chart

-

-This command will retrieve a candlestick chart for the ticker/interval provided, with data for the past number of days specified. The interval provided must be a valid time interval (e.g. 5 minute, 15 minute, etc.). The chart will be displayed to the user and will contain information such as the opening and closing prices, the high and low, the volume, and any other relevant information.

-

-### Usage

-

-```python wordwrap

-/chart ticker interval [past_days] [extended_hours]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| interval | Chart Interval | False | Daily (1440), Weekly (7200), Monthly (28800), 1 minute (1), 5 minute (5), 10 minute (10), 15 minute (15), 30 minute (30), 1 hour (60) |

-| past_days | Past Days to Display. Default: 0 | True | None |

-| extended_hours | Display Full 4am-8pm ET Trading Hours. Default: False | True | None |

-

-

----

-

-## Examples

-

-```

-/chart ticker:AMD interval:5 minute past_days:0

-```

-

-```

-/chart ticker:AMD interval:Daily

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/chartfib.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/chartfib.md

deleted file mode 100644

index 6879aff4e9c6..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/chartfib.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: chartfib

-description: OpenBB Discord Command

----

-

-# chartfib

-

-This command allows the user to retrieve Fibonacci levels for a given ticker. This data can be used to identify potential support and resistance levels and can be used to identify potential entry and exit points in the stock market.

-

-### Usage

-

-```python wordwrap

-/chartfib ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/chartfib ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/chartsr.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/chartsr.md

deleted file mode 100644

index a678195dfbee..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/chartsr.md

+++ /dev/null

@@ -1,38 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: chartsr

-description: OpenBB Discord Command

----

-

-# chartsr

-

-This command allows the user to retrieve Displays Support and Resistance Levels for the ticker provided. It will display the support and resistance levels of a given ticker on the chart. These levels can help the user in making better trading decisions.

-

-### Usage

-

-```python wordwrap

-/chartsr ticker [interval]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| interval | Chart Interval | True | 5 minute (5), 15 minute (15) |

-

-

----

-

-## Examples

-

-```

-/chartsr ticker:AMC

-```

-```

-/chartsr ticker:AMC interval:5 minute

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/cm.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/cm.md

deleted file mode 100644

index affefc58daf4..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/cm.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: cm

-description: OpenBB Discord Command

----

-

-# cm

-

-This command allows you to view a monthly candlestick chart for a given stock or cryptocurrency. The chart displays the open, close, high and low prices for the selected ticker/coin each month. This command is useful for analyzing the long-term performance of a stock or cryptocurrency.

-

-### Usage

-

-```python wordwrap

-/cm ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/cm ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/cw.md b/website/versioned_docs/version-v3/bot/reference/discord/charts/cw.md

deleted file mode 100644

index 41803493a28c..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/cw.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: cw

-description: OpenBB Discord Command

----

-

-# cw

-

-This command allows the user to retrieve a weekly candlestick chart for the ticker/coin provided. The chart displays the opening and closing prices, the high and low prices, and the trading volume for the week for the specified ticker/coin.

-

-### Usage

-

-```python wordwrap

-/cw ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/cw ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/charts/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/charts/index.mdx

deleted file mode 100644

index b4e0b66bcf11..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/charts/index.mdx

+++ /dev/null

@@ -1,57 +0,0 @@

-# charts

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/bigprints.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/bigprints.md

deleted file mode 100644

index b4076fd698f1..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/bigprints.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: bigprints

-description: OpenBB Discord Command

----

-

-# bigprints

-

-This command allows the user to retrieve the last 15 large prints for a given cryptocurrency pair. The command uses the format "/crypto bigprints coin:BTC-USD" where BTC-USD is the currency pair for which the user wants to retrieve the large prints. This command is useful for analyzing the recent large prints of a given currency pair, which can be used to inform trading decisions.

-

-### Usage

-

-```python wordwrap

-/crypto bigprints coin [days]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| coin | Coin from the list of supported coins | False | ADA-USD, AVAX-USD, BTC-USD, DAI-USD, DOGE-USD, DOT-USD, ETH-USD, LTC-USD, MATIC-USD, SHIB-USD, SOL-USD, TRX-USD, USDC-USD, USDT-USD, WBTC-USD, XRP-USD |

-| days | Number of days to look back. Default is 10. | True | None |

-

-

----

-

-## Examples

-

-```

-/crypto bigprints coin:BTC-USD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/bio.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/bio.md

deleted file mode 100644

index 147fdf41b635..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/bio.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: bio

-description: OpenBB Discord Command

----

-

-# bio

-

-This command allows the user to retrieve fundamental information about a crypto, such as its current price, 24-hour trading volume, market cap, and other key metrics, by entering a specific crypto symbol (e.g. "BTC") as an argument.

-

-### Usage

-

-```python wordwrap

-/crypto bio symbol

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| symbol | Crypto symbol to check information (e.g., BTC) | False | None |

-

-

----

-

-## Examples

-

-```

-/crypto bio symbol: btc

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/compfees.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/compfees.md

deleted file mode 100644

index 164b734473c9..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/compfees.md

+++ /dev/null

@@ -1,38 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: compfees

-description: OpenBB Discord Command

----

-

-# compfees

-

-This command allows users to retrieve the Protocol fees over time for the given project.

-

-### Usage

-

-```python wordwrap

-/crypto compfees projects

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| projects | Comma separated list of protocols (e.g., btc,eth) | False | None |

-

-

----

-

-## Examples

-

-```

-/crypto compfees projects: doge

-```

-

-```

-/crypto compfees projects: btc,eth

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/chart.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/chart.md

deleted file mode 100644

index 2e18bd892a22..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/chart.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: chart

-description: OpenBB Discord Command

----

-

-# chart

-

-This command will retrieve a chart of the top DeFi protocols by market capitalization. It will provide a visual representation of the relative size of each protocol, as well as an overview of the total DeFi market size. This will enable users to get a better understanding of the current DeFi landscape and identify which protocols are leading the way.

-

-### Usage

-

-```python wordwrap

-/crypto defi chart

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| sortby | Column to sort data by (e.g., Total Value Locked) | True | Market Cap (MCap), Total Value Locked (TVL) |

-| chain | Chain to filter by (e.g., ethereum) | True | None |

-| reverse | Reverse the sort order | True | Yes |

-

-

----

-

-## Examples

-

-```

-/crypto defi chart

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/index.mdx

deleted file mode 100644

index 150a106da5b8..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/index.mdx

+++ /dev/null

@@ -1,17 +0,0 @@

-# defi

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/table.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/table.md

deleted file mode 100644

index 33c22153382f..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/defi/table.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: table

-description: OpenBB Discord Command

----

-

-# table

-

-This command allows the user to view a table of the top DeFi protocols and their associated information, such as the total value locked, 24 hour volume, and price. The table is sorted in descending order, with the top DeFi protocols at the top.

-

-### Usage

-

-```python wordwrap

-/crypto defi table [sortby] [chain] [reverse]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| sortby | Column to sort data by (e.g., Total Value Locked) | True | Market Cap (MCap), Total Value Locked (TVL) |

-| chain | Chain to filter by (e.g., ethereum) | True | None |

-| reverse | Reverse the sort order | True | Yes |

-

-

----

-

-## Examples

-

-```

-/crypto defi table

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/fees.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/fees.md

deleted file mode 100644

index f1dbbbe8226b..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/fees.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: fees

-description: OpenBB Discord Command

----

-

-# fees

-

-This will provide the user with the fee rate of the top crypto protocols on a specified date, allowing the user to compare different protocols' fees and make an informed decision.

-

-### Usage

-

-```python wordwrap

-/crypto fees date

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| date | Date to get fees for (e.g., 2022-01-01) | False | None |

-

-

----

-

-## Examples

-

-```

-/crypto fees date: 2022-09-19

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/crypto/index.mdx

deleted file mode 100644

index 699b20dca51f..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/index.mdx

+++ /dev/null

@@ -1,52 +0,0 @@

-# crypto

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/ir.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/ir.md

deleted file mode 100644

index 40ee9c2e34af..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/ir.md

+++ /dev/null

@@ -1,33 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: ir

-description: OpenBB Discord Command

----

-

-# ir

-

-This command allows the user to retrieve the issuance rate of the top crypto protocols. The issuance rate is the amount of new tokens that are generated by the protocol over a given period of time. It is a useful metric for understanding the supply dynamics of crypto protocols and is used to inform investment decisions.

-

-### Usage

-

-```python wordwrap

-/crypto ir

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/crypto ir

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/prints.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/prints.md

deleted file mode 100644

index 61161acb1541..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/prints.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: prints

-description: OpenBB Discord Command

----

-

-# prints

-

-This command allows the user to retrieve the Last 15 Crypto Prints over the last 24 hours for the specified coin. The command will provide information on the price, volume, size, and other metrics associated with the prints.

-

-### Usage

-

-```python wordwrap

-/crypto prints coin

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| coin | Coin from the list of supported coins | False | ADA-USD, AVAX-USD, BTC-USD, DAI-USD, DOGE-USD, DOT-USD, ETH-USD, LTC-USD, MATIC-USD, SHIB-USD, SOL-USD, TRX-USD, USDC-USD, USDT-USD, WBTC-USD, XRP-USD |

-

-

----

-

-## Examples

-

-```

-/crypto prints coin:BTC-USD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/top.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/top.md

deleted file mode 100644

index 84cff07f89e9..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/top.md

+++ /dev/null

@@ -1,39 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: top

-description: OpenBB Discord Command

----

-

-# top

-

-This command will retrieve the top cryptocurrencies, ranked by market capitalization, allowing the user to quickly get a snapshot of the current market.

-

-### Usage

-

-```python wordwrap

-/crypto top [sortby] [category] [reverse]

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| sortby | Column to sort data by (e.g., Market Cap) | True | Market Cap (MCap) |

-| category | Category to filter by (e.g., stablecoins) | True | None |

-| reverse | Reverse the sort order | True | Yes |

-

-

----

-

-## Examples

-

-```

-/crypto top

-```

-

-```

-/crypto top sortby: Market Cap category: manufacturing

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/crypto/tvl.md b/website/versioned_docs/version-v3/bot/reference/discord/crypto/tvl.md

deleted file mode 100644

index 61cc1ca1f6e3..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/crypto/tvl.md

+++ /dev/null

@@ -1,38 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: tvl

-description: OpenBB Discord Command

----

-

-# tvl

-

-This command allows users to retrieve historical TVL (Total Value Locked) data for any given protocol. It provides a snapshot of the total amount of capital that is currently locked in the protocol, allowing users to easily compare the metrics between different protocols and track their growth over time.

-

-### Usage

-

-```python wordwrap

-/crypto tvl protocols

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| protocols | comma separated list of protocols (e.g., curve,makerdao) | False | None |

-

-

----

-

-## Examples

-

-```

-/crypto tvl

-```

-

-```

-/crypto tvl protocols: curve

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allblocks.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allblocks.md

deleted file mode 100644

index fc41ba78ca6e..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allblocks.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: allblocks

-description: OpenBB Discord Command

----

-

-# allblocks

-

-The command allows the user to retrieve the last 15 block trades of a given security. This command will provide a summary of the last 15 block trades, including the time, price, quantity, and total gross value of each trade.

-

-### Usage

-

-```python wordwrap

-/dp allblocks ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/dp topsum

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/alldp.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/alldp.md

deleted file mode 100644

index 5c6af6cd3403..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/alldp.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: alldp

-description: OpenBB Discord Command

----

-

-# alldp

-

-This command allows the user to retrieve the last 15 darkpool trades for the specified stock ticker. A darkpool is a private stock trading system that allows large trades to take place without affecting the public market, providing access to larger and more efficient trades.

-

-### Usage

-

-```python wordwrap

-/dp alldp ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/dp alldp ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allprints.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allprints.md

deleted file mode 100644

index 80d3ae632a16..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/allprints.md

+++ /dev/null

@@ -1,34 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: allprints

-description: OpenBB Discord Command

----

-

-# allprints

-

-This command retrieves the Last 15 Combination of Dark Pool and Blocks for a given ticker symbol. This can be used to view the most recent reported trades that involve Dark Pool and Blocks in the stock market. The results of this command will show the date, time, price, and volume of the trades.

-

-### Usage

-

-```python wordwrap

-/dp allprints ticker

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-

-

----

-

-## Examples

-

-```

-/dp allprints ticker:AMD

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/bigprints.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/bigprints.md

deleted file mode 100644

index 2091af45fca1..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/bigprints.md

+++ /dev/null

@@ -1,33 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: bigprints

-description: OpenBB Discord Command

----

-

-# bigprints

-

-This command will retrieve the largest combination of dark pool and block trades over a specified amount of days. It will provide a comprehensive view of the biggest dark pool and block trades over the specified number of days and give the user an idea of the market activity over that period.

-

-### Usage

-

-```python wordwrap

-/dp bigprints days

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| days | Number of days to look back | False | None |

-

-

----

-

-## Examples

-

-```

-/dp bigprints days:6

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/index.mdx b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/index.mdx

deleted file mode 100644

index 999aef994477..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/index.mdx

+++ /dev/null

@@ -1,47 +0,0 @@

-# darkpool

-

-import ReferenceCard from "@site/src/components/General/ReferenceCard";

-

-

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/levels.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/levels.md

deleted file mode 100644

index d5d4d34d619e..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/levels.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: levels

-description: OpenBB Discord Command

----

-

-# levels

-

-This command allows the user to retrieve the Biggest Levels for All Prints over the last x days for the given ticker. This information is useful in assessing the overall performance of the stock, as it provides information on the largest levels of prints over the last x days.

-

-### Usage

-

-```python wordwrap

-/dp levels ticker days

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| ticker | Stock Ticker | False | None |

-| days | Number of days to look back | False | None |

-

-

----

-

-## Examples

-

-```

-/dp levels ticker:TSLA days:10

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/sectors.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/sectors.md

deleted file mode 100644

index db2e4fda4709..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/sectors.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: sectors

-description: OpenBB Discord Command

----

-

-# sectors

-

-This command allows the user to retrieve a summary of all prints by % of MarketCap by Sector over the last x days. The user will be able to view the sector's market cap divided by total darkpool activity to see possible accumulation.

-

-### Usage

-

-```python wordwrap

-/dp sectors days sector

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| days | Number of days to look back | False | None |

-| sector | Sector to filter by | False | Basic Materials (BM), Energy (E), Communication Services (CS), Consumer Cyclical (CC), Consumer Defensive (CD), Financial (F), Healthcare (H), Industrials (I), Real Estate (RE), Technology (T), Utilities (U) |

-

-

----

-

-## Examples

-

-```

-/dp sectors days:5 sector:Basic Materials

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/summary.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/summary.md

deleted file mode 100644

index 7612a09ffd32..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/summary.md

+++ /dev/null

@@ -1,35 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: summary

-description: OpenBB Discord Command

----

-

-# summary

-

-This command retrieves a summary of all the prints by percentage of MarketCap over the last x days, sorted by MarketCap. The summary includes the total number of prints and their total percentage of MarketCap, as well as the float and short percentage.

-

-### Usage

-

-```python wordwrap

-/dp summary days sort

-```

-

----

-

-## Parameters

-

-| Name | Description | Optional | Choices |

-| ---- | ----------- | -------- | ------- |

-| days | Number of days to look back | False | None |

-| sort | Sort by MarketCap, Float, Total, or Short Percentage | False | MarketCap (mc), Float (float), Total (sum), Short Percentage (short) |

-

-

----

-

-## Examples

-

-```

-/dp summary days:10 sort:MarketCap

-```

-

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/topsum.md b/website/versioned_docs/version-v3/bot/reference/discord/darkpool/topsum.md

deleted file mode 100644

index b464be2f8fd4..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/darkpool/topsum.md

+++ /dev/null

@@ -1,31 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: topsum

-description: OpenBB Discord Command

----

-

-# topsum

-

-This command allows the user to retrieve total block and dark pool data summary. It sums all darkpool prints and gives a table of the largest by symbol as well as a graph for comparison.

-

-### Usage

-

-```python wordwrap

-/dp topsum

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

----

-

-## Examples

-

-```

-/dp topsum

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/discovery/arktrades.md b/website/versioned_docs/version-v3/bot/reference/discord/discovery/arktrades.md

deleted file mode 100644

index eb69b0e2e97b..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/discovery/arktrades.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: arktrades

-description: OpenBB Discord Command

----

-

-# arktrades

-

-This command allows the user to retrieve a list of all trades made by ARK, including the time and amount of each trade. The data is presented in an easy-to-read table format so that the user can quickly analyze the trades made by ARK.

-

-### Usage

-

-```python wordwrap

-/disc arktrades

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/disc arktrades

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/discovery/contracts.md b/website/versioned_docs/version-v3/bot/reference/discord/discovery/contracts.md

deleted file mode 100644

index e95aea69515c..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/discovery/contracts.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: contracts

-description: OpenBB Discord Command

----

-

-# contracts

-

-This command allows the user to retrieve the Top 15 Government contracts by amount for all tickers. This is a helpful tool for those who want to quickly get an overview of the total value of Government contracts awarded to various companies. The data is retrieved from a database of contracts and can be used to gain valuable insights into the financial health of those companies.

-

-### Usage

-

-```python wordwrap

-/disc contracts

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/disc contracts

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/discovery/fgindex.md b/website/versioned_docs/version-v3/bot/reference/discord/discovery/fgindex.md

deleted file mode 100644

index d5c374f651c0..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/discovery/fgindex.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: fgindex

-description: OpenBB Discord Command

----

-

-# fgindex

-

-This command allows the user to retrieve the Fear & Greed Index, which is an investor sentiment indicator published by CNNMoney. The index measures the levels of fear and greed of the investors in the stock market by observing the momentum, sentiment and volume of stock trading. The index ranges from 0 to 100, with 0 being the most fearful and 100 being the most greedy.

-

-### Usage

-

-```python wordwrap

-/disc fgindex

-```

-

----

-

-## Parameters

-

-This command has no parameters

-

-

-

----

-

-## Examples

-

-```

-/disc fgindex

-```

----

diff --git a/website/versioned_docs/version-v3/bot/reference/discord/discovery/halts.md b/website/versioned_docs/version-v3/bot/reference/discord/discovery/halts.md

deleted file mode 100644

index cdbb69369223..000000000000

--- a/website/versioned_docs/version-v3/bot/reference/discord/discovery/halts.md

+++ /dev/null

@@ -1,32 +0,0 @@

----

-########### THIS FILE IS AUTO GENERATED - ANY CHANGES WILL BE VOID ###########

-title: halts

-description: OpenBB Discord Command

----

-

-# halts

-

-This command allows the user to retrieve the time and halt code of stocks in the market, excluding penny stocks. The output of this command provides the user with the time and halt code of stock that is currently halted or in the process of being halted by the exchange.

-

-### Usage

-

-```python wordwrap

-/disc halts