-

Notifications

You must be signed in to change notification settings - Fork 13

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Does the Social Security MTR include income limits on benefits (especially SSDI)? #84

Comments

|

Hi just checking in here. |

|

@MaxGhenis Sorry for having this issue slipped through the cracks!! I was buried in finals last week. Anderson is right. Our Social Security Benefit calculation replicates the calculator provided by SSA. The initial 'benefit rates' are positive and later on get reversed for the sake of 'MTR' in tax jargons. Parker, the contractor who did this part work, wrote a more detailed documentation on how the benefits and MTRs are calculated. Among all the assumptions made, one imposes that an individual works until 65. So I guess early withdraw is not considered. The slopes in the chart mainly reflect the step function applied on AIME. Our calculator seems to only take care of retirement benefit, rather than survivor or disability. So SSDI is probably not included in the current version. Speaking of cliffs, I have not read extensively about how assumptions are made. But I imagine it is really about the goal of research and about how to make a contextualized assumption. Medicaid needs a cliff as well, and the MTR cliff really depends on what margin is assumed, if we already have an prior assumption that the 'benefit' amount is the insurance value. When the margin is assumed to be 1 cent, or 1 dollar, or 10 dollar, the resulting MTR would be just different by whatever is implied in the margin. But does that difference actually mean something material when normal MTRs are within 0 and 1? It depends. So..... |

|

Thanks, looking at Parker's PDF are retirement benefits discounted to present-day dollars? I didn't see mention of it, and that'd be pretty important. I'm wondering if that could explain the "implicit marginal benefit rate" in the range of 15%, over double the SS payroll tax rate. I'd expect them to be similar. I asked about calculating MTR given cliffs on Economics Stackexchange, and added some thoughts of options, but haven't heard back. I put SSDI's cliff among the most significant labor response factors in welfare policy, so it'd be useful to model it if possible. |

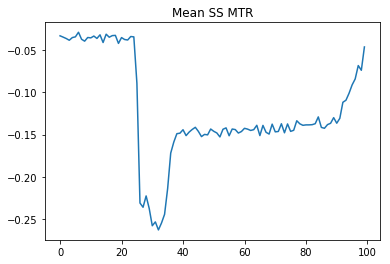

@andersonfrailey shared with me a UBI analysis he's been working on, which included modeling the labor response to MTRs including from benefits. I was surprised to see this chart in it showing that Social Security's MTR is negative:

@andersonfrailey explained that this has to do with earnings adding more benefits down the line, i.e. this is partially a compensating MTR to the payroll tax if it's considered a savings vehicle.

I'm curious if the Social Security MTR also incorporates income limits and phase-outs on benefits received:

@Amy-Xu

The text was updated successfully, but these errors were encountered: