-

Notifications

You must be signed in to change notification settings - Fork 3.3k

Commit

This commit does not belong to any branch on this repository, and may belong to a fork outside of the repository.

* Adds Intro Guide to QA menu * Spelling * fixed formatting of bulleted list

- Loading branch information

1 parent

9ff9d12

commit 13c8dd7

Showing

1 changed file

with

138 additions

and

3 deletions.

There are no files selected for viewing

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

| @@ -1,8 +1,143 @@ | ||

| --- | ||

| title: Introduction to the Quantitative Analysis Menu | ||

| keywords: "quantitative, analysis, qa, q/a, daily, indicators, signals, average, summary, normality, line, hist, cdf, bw, acf, qqplot, rolling, spread, quantile, skew, kurtosis, var, es, sh, so, om, raw, decompose, cusum, capm, beta, histogram, auto-correlation, value, median, crypto, forex, fx, cryptocurrency, stocks" | ||

| date: "2022-08-08" | ||

| type: guides | ||

| status: publish | ||

| excerpt: "This guide introduces the Quantitative Analysis menu, which is common across many sections of the OpenBB Terminal, briefly describes the features, and provides examples in context." | ||

| geekdocCollapseSection: true | ||

| --- | ||

|

|

||

| In finance and investment management, **Quantitative Analysis** refers to the application of mathematical and statistical methodologies. Quantitative analysts are those that work in this subject (quants). Quants typically focus on a few topics, such as derivative structure or pricing, risk management, algorithmic trading, and investment management. Industrial mathematics jobs are similar to those in other industries. The procedure usually entails scanning through large databases for patterns, such as correlations between liquid assets or price movement patterns (trend following or mean reversion). High-frequency trading may be used in the resulting strategies. | ||

| <a href = "https://www.investopedia.com/terms/q/quantitativeanalysis.asp" target="_blank">Quantitative analysis (QA)</a> in finance is an approach that emphasizes mathematical and statistical analysis to help determine the value of a financial asset, such as a stock or option. The ultimate goal of financial quantitative analysis is to use quantifiable statistics and metrics to assist investors in making profitable investment decisions. Quantitative analysis is different from qualitative analysis, which looks at factors such as how companies are structured, the makeup of their management teams, and what their strengths and weaknesses are. | ||

|

|

||

| **Available commands** | ||

| {{< toc-tree >}} | ||

| The Quantitative Analysis menu is a common menu to three asset classes: | ||

|

|

||

| <a href = "https://openbb-finance.github.io/OpenBBTerminal/terminal/crypto/" target="_blank">Crypto</a> <br> | ||

| <a href = "https://openbb-finance.github.io/OpenBBTerminal/terminal/forex/" target= "_blank">Forex</a> <br> | ||

| <a href = "https://openbb-finance.github.io/OpenBBTerminal/terminal/stocks/" target = "_blank">Stocks</a> <br> | ||

|

|

||

| <img width="1110" alt="The Quantitative Analysis menu" src="https://user-images.githubusercontent.com/85772166/183483507-a4bef3e8-6603-46fb-a022-424f18af32d6.png"> | ||

|

|

||

| <h2>How to use the Quantitative Analysis Menu</h2> | ||

|

|

||

| Enter the menu, through one of the asset classes listed above, by entering `qa` in the Terminal. The ticker that is loaded before entering the menu will determine the timeframe for the analysis. To alter it, use the `load` function and pick a new `--start` and `--end` for the observation window. The QA functions target a specified column of the data. By default, this is returns. Use the `pick` command to chose a new target column. | ||

|

|

||

| <img width="358" alt="Picking a new target column" src="https://user-images.githubusercontent.com/85772166/183483572-6127eaff-69d2-4d67-8e60-8d7756a043b0.png"> | ||

|

|

||

| The menu is divided into five categories of functions: | ||

| - Statistics | ||

| - Plots | ||

| - Rolling Metrics | ||

| - Risk | ||

| - Other | ||

|

|

||

| A summary of exportable statistics is displayed with the command, `summary`. The example here shows $APPL. | ||

|

|

||

| <img width="1109" alt="QA summary for Apple" src="https://user-images.githubusercontent.com/85772166/183483647-3414adae-c4de-4b1e-81a5-04a4d8a51e19.png"> | ||

|

|

||

| A simple line chart for the target column as a time-series is called with the `line` command. | ||

|

|

||

|  | ||

|

|

||

| Optional arguments to this command allows the user to draw and annotate on the chart. | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 12:14 /stocks/qa/ $ line -h | ||

| usage: line [--log] [-d] [--ml ML] [--ms MS] [-h] [--export EXPORT] | ||

| Show line plot of selected data and allow to draw lines or highlight specific datetimes. | ||

| options: | ||

| --log Plot with y on log scale (default: False) | ||

| -d, --draw Draw lines and annotate on the plot (default: False) | ||

| --ml ML Draw vertical line markers to highlight certain events (default: ) | ||

| --ms MS Draw scatter markers to highlight certain events (default: ) | ||

| -h, --help show this help message (default: False) | ||

| --export EXPORT Export figure into png, jpg, pdf, svg (default: ) | ||

| For more information and examples, use 'about line' to access the related guide. | ||

| 2022 Aug 08, 12:20 /stocks/qa/ $ pick high | ||

| 2022 Aug 08, 12:20 /stocks/qa/ $ line --draw | ||

| Click twice for annotation. | ||

| Close window to keep using terminal. | ||

| Annotation: Lower Highs | ||

| ```` | ||

|

|

||

|  | ||

|

|

||

| Compare the beta between the loaded asset and another, using the `-r` flag to deviate from the defaulted comparison, $SPY. | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 12:34 /stocks/qa/ $ beta -r MSFT | ||

| Loading Daily MSFT stock with starting period 2019-08-05 for analysis. | ||

| ```` | ||

|

|

||

| <img width="762" alt="Beta of $AAPL relative to $MSFT" src="https://user-images.githubusercontent.com/85772166/183483898-dac417a8-0afe-46d2-b8e9-e855e8752fc8.png"> | ||

|

|

||

| Most outputs are equipped with an `--export` flag, allowing the user to save the tables as a CSV, JSON, or XLSX file. The exports can then be imported into other menus like <a href="https://openbb-finance.github.io/OpenBBTerminal/terminal/econometrics/" target="_blank"> Econometrics</a>. Additional information on each specific command is displayed by attaching `-h` to it. | ||

|

|

||

| <h2>Examples</h2> | ||

|

|

||

| Box and Whisker plots for monthly and yearly scales: | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 12:47 /stocks/qa/ $ bw | ||

| ```` | ||

|

|

||

|  | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 12:47 /stocks/qa/ $ bw -y | ||

| ```` | ||

|

|

||

|  | ||

|

|

||

| Pick `logret` for rate of change to the returns of the asset: | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 12:47 /stocks/qa/ $ pick logret | ||

| 2022 Aug 08, 12:51 /stocks/qa/ $ bw -y | ||

| ```` | ||

|

|

||

|  | ||

|

|

||

| `decompose` shows a visual representation of trend and seasonality. | ||

|

|

||

|  | ||

|

|

||

| `skew` shows the asymmetric distribution over a specified window (default of 14). | ||

|

|

||

|  | ||

|

|

||

| `skew -w 5` Changing the window to five takes out some of the smoothness: | ||

|

|

||

|  | ||

|

|

||

| Sharpe Ratio over time, `sh`: | ||

|

|

||

|  | ||

|

|

||

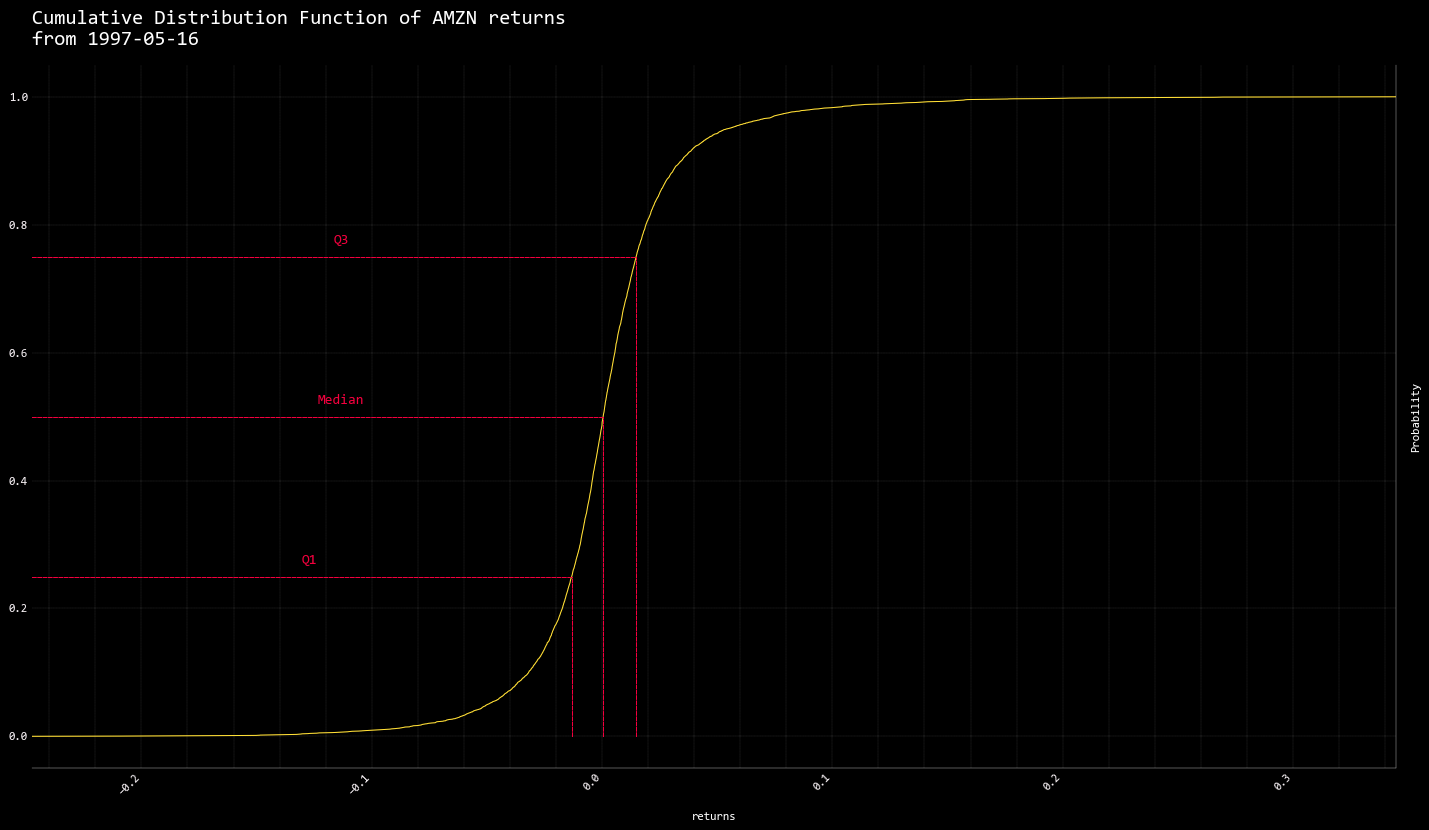

| `cdf` calls the cumulative distribution function. Apple over the long term exhibits a steep curve. | ||

|

|

||

|  | ||

|

|

||

| Compared with Apple, Amazon is a more gently sloping s-curve. | ||

|

|

||

|  | ||

|

|

||

| `capm` shows the stock's risk against the market's. $AAPL carries the risk of whatever happens to the markets, happens to the stock. | ||

|

|

||

| ```` | ||

| 2022 Aug 08, 13:51 /stocks/qa/ $ capm | ||

| Beta: 1.15 | ||

| Systematic Risk: 46.40% | ||

| Unsystematic Risk: 53.60% | ||

| ```` | ||

| Read more about this subject on Wikipedia: https://en.wikipedia.org/wiki/Quantitative_analysis_(finance) | ||

|

|

||

| Back to the <a href = "https://openbb-finance.github.io/OpenBBTerminal/" target="_blank">Getting Started Guide</a> |