-

Notifications

You must be signed in to change notification settings - Fork 10

Add Transferwise as new multi-currency payment method #243

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Comments

|

As a mediator, I often have cases where trades need to be cancelled due to TransferWise being unable to send SEPA payments. I've never used TransferWise, would this be within TransferWise entirely? i.e. from TransferWIse account to TransferWise account? |

|

It is to any bank account, you can use TransferWise as account as well. It seems that they support in some areas custom IBAN accounts where the user gets its personal IBAN, but as far I used it its the company account and a reference ID to associate the payment to a user. Payment can be done via local or int. bank transfer, debit or credit card (higher fees, abotu 3-4%) and sofort banking or other instant payment methos (i guess those are non-chargebackable). At the receiver you see TransferWise as sender. If you send to a TransferWise account you cannot add the trade ID as reference as the reference is the handle to route the transfer for TransferWise (reference is kind of sub-account number). So not sure if that all works well in Bisq context, but benefits are the multi-currency support. A "friendly" chargeback I guess is not the risk as its a complicate process with little chance of success for a scammer but the stolen cc case might lead to chargeback and further issues for the receiver. If we cannot exclude cc payments it might not be safe to use it and also for now when users are using transferwise we have to consider that as a security risk. |

|

You can send also to another TransferWise user if you know the tel nr and if he has enabled to can be found. |

|

I would be happy to investigate this. Currently I am using TransferWise on Bisq for bank to bank payments. I have not made any TransferWise to TransferWise payments. If this opens up payments to multiple currencies beyond the 7 TransferWise local bank accounts provided it could be a great payment method, assuming low charge-back risks. |

|

I am not so sure about chargeback risk as you can make a payment from a credit card and the receiver does not recognize the source of payment. And cc have lots of scammers. Dont know how they deal with cases where a cc scammer send funds and then a chargeback happens. But as it is not the "friends and family" only policy as Paypal and other but more orientated for businesses as well I assume they might have some better solution to those problems. |

|

I will have a have a look into it. They allow payment with credit / debit cards only if they have 3D security enabled. This would seem to shift liability from any chargeback risk to the card issuer rather than TransferWise. https://en.wikipedia.org/wiki/3-D_Secure The info on TransferWise's about chargebacks sounds promising

https://transferwise.com/help/articles/2565014/i-want-to-cancel-a-transfer-thats-completed |

|

Thanks. Not so sure if that really is good for users. TW might be in a good position but if CC fraud happens the user might be liable. See: |

|

Makes for an interesting read. Cards payments to add additional risks in terms of chargebacks. In the case of 3D Secure being used by TransferWise it would only be the sender of the fiat funds that was required to use it (and only if they chose to pay by card rather than funds available on account, or by bank transfer). If they are a genuine buyer payment would go through fine, if they were a scammer they would be liable for the fiat funds they sent via TranswerWise using a card. |

But if they are scammers they will not get caught. The BTC seller has sent his BTC and received funds from a stolen CC via the scammer. LE will try to get the scammer but will fail as they know how to hide in countries where they cannot access them. Then it's the question if the victim of the CC is held liable, e.g. does not get a refund for his loss or if the banks still try to do a chargeback. If so it is less of a problem for Bisq users. But there might be still an issue if they use such cases for flagging the receiver of the funds. I doubt that they are not doing that if they can. I think it depends on how secure 3D is in reality, e.g. statistics about fraud rate. |

|

Also investigating this. Gent in AUD market using National Bank Account (Transfer wise) in name so you at least know beforehand. I've previously been unaware and was suss on the trade given BSB etc came up different when about to send to seller. Was fine though. Low fees, and opening up to multiple markets would be ace. A real pain it would seem, at the moment you have to create a national Bank account in each market you want to sell in and get signed etc. Liquidity increase across markets FOR SURE. It'd help those in real start up phases and keep new comers around. Since people are already doing it, why not formalise it and remove the national market barriers? I have not sent anything yet. It does seem to require when sending via Web, their phone number and own address. In the app it seems to require their details of address. IBAN if inside Europe, outside it years SWIFT. |

Hi @Conza88 This was likely me. I have been trying to use TransferWise to add liquidity to smaller markets for Bisq. I was not aware the BSB came up as different. TransferWise say the BSB code should be '802985'. Happy to try an make changes or set up a new account so it appears less suss! It has gone well so far with the majority of offers placed taken successfully over a 2 week period. I am thinking of trying the same with the NZ market soon as that is dead as a dodo. I see multi currency accounts as good for both buyers and sellers by opening up new markets for each. |

|

Ah cool. To be clear: I previously engaged a trade with someone they had their bsb details etc for their bank account stated but it was different to the TransferWise account BSB etc. There was a discrepancy. It ended up fine but was super suss.

Your trade was fine and had TransferWise in account name so most should know. And no change in different BSB etc. I gather sending money to it is no problem, AND thus means selling BTC is fine.

But trying to BUY BTC with it isn't great and requires address details etc. Good to see new market creation. You want to sell BTC to other markets, I want to buy BTC from all other markets 😅

…________________________________

From: pazza <notifications@github.com>

Sent: Monday, October 26, 2020 9:55:24 AM

To: bisq-network/proposals <proposals@noreply.github.com>

Cc: Conza <conza_@hotmail.com>; Mention <mention@noreply.github.com>

Subject: Re: [bisq-network/proposals] Add Transferwise as new multi-currency payment method (#243)

Also investigating this. Gent in AUD market using National Bank Account (Transfer wise) in name so you at least know beforehand. I've previously been unaware and was suss on the trade given BSB etc came up different when about to send to seller. Was fine though.

Hi @Conza88<https://github.com/Conza88> This was likely me. I have been trying to use TransferWise to add liquidity to smaller markets for Bisq. I was not aware the BSB came up as different. TransferWise say the BSB code should be '802985'. Happy to try an make changes or set up a new account so it appears less suss!

It has gone well so far with the majority of offers placed taken successfully over a 2 week period. I am thinking of trying the same with the NZ market soon as that is dead as a dodo.

I see multi currency accounts as good for both buyers and sellers by opening up new markets for each.

—

You are receiving this because you were mentioned.

Reply to this email directly, view it on GitHub<#243 (comment)>, or unsubscribe<https://github.com/notifications/unsubscribe-auth/AMMLWYUCEWIRR75JPX4IDUDSMS3GZANCNFSM4P36UE4Q>.

|

|

@Conza88 That is good to know. I have not put any maker offers on the AUD market yet to buy BTC using TransferWise. But was intending to try some to increase liquidity. Why do you need additional address details etc to buy BTC using it? I was not expecting it to be a problem, but have not tried it out yet. Currently I have tried using TransferWise, Revolut, and Uphold as multi currency accounts on Bisq. TransferWise and Revolut have worked well but Uphold has problems as although you can trade in multiple markets with multiple currencies it restricts users from only certain countries depositing fiat into your account. I am also looking into Payoneer as that has similar multi currency account options to TransferWise but the fees are a bit high to make competitive offers, and I am less happy with their T&Cs. If TransferWise could be added as a Payment method it would hopefully make it easier for more users to trade in multiple markets. Currently as you say it is a bit of a faff in adding multiple national currency accounts with it. |

|

Just wanted to link to this other thread here: bisq-network/bisq#4698 There is more information discussed about TransferWise in that thread that would be useful to this one. Specifically TransferWise has recently added a new option to create a real bank account in multiple currencies which changes the viability of using them as a payment method on Bisq drastically. Also the TW to TW method seems to have become even easier only requiring an e-mail address. Looks like TransferWise is focused on continually improving and these 2 new features certainly do that and add a big benefit to Bisq liquidity and adoption I believe. |

|

Relevant links from the TrasferWise website: Multi-Currency accounts TransferWise to TransferWise payments Eligible countries Chargebacks |

|

Yesterday I completed a successful TransferWise to TransferWise payment to @viperperidot and vice versa. During payment I could see the following information about viperperidot's payment

On receipt of payment viperperidot could see the following information about myself:

I was able to fund the trade using any currency supported in TrasnferWise using any of following payment methods:

The payment was deposited in the account viperperidot's nominated bank account that they selected for being the primary receiving for the currency I send payment to. Potential benefits for Bisq of adding TranswerWise to TransferWise Payments: Payment and receipt was immediate

Current limitations: Unfortunately, you can't make transfers to an email address or a primary account when sending

The process required a little bit of a one-time set up on both our ends. This involved:

Issues requiring further investigation: As TransferWise does allow Credit / Debit card payments. This opens up questions with regards chargeback risk. The 3D secure requirement seem to deflect this risk to the card issuer rather than TransferWise so chargeback should not be a risk. Screenshot: When you enter users email address, the name and bank details auto populate. This show full name of account and last 4 bank account details |

So it does support both Credit / Debit card (using 3D secure) and (insecure) Credit / Debit Card ? |

|

No it will only accept cards with 3D secure enabled:

Reference: https://transferwise.com/help/articles/2556723/how-to-pay-by-card |

|

Just to add to what @pazza83 said, the demo trade we did went very smoothly. Basically you just set any of your fiat currency accounts as your 'primary' account and any incoming e-mail transfers will be deposited to that account. When sending all you have to do is input the recipients e-mail address and their banking details are auto-populated. Once the transaction is initiated it takes a few minutes at most and the money is deposited. Best part about it is there are ZERO fees for TW to TW transfers!! Personally I used the TransferWise website which provides a nice UX but they also have a mobile app which some users might like. Like pazza said I think TW is a great alternative to Revolut, offering similar functions but more widely available in different countries. In summary I think TransferWise and Bisq work very well together allowing a user to access virtually any market available on Bisq and does so in a simple way. They also have a good customer support team if any users have issues setting up their account. The TW to TW option basically allows a user to trade in any currency, theoretically you could even have a TransferWise or 'Global' market option on Bisq because it is not limited to any fiat currency. You could have the preferred fiat currency as in input option when creating the payment account on Bisq and then any user could make a payment in that currency because TW allows many conversions on the fly. Just an idea, but also keeping the current fiat markets and just adding it as a payment method would also work too. TransferWise breaks down traditional fiat currency barriers and always a user access to the global market. |

|

Could you provide the needed info for implementation? |

|

Which existing payment method is most similar I have based it on Uphold: Required fields: How to deal with multi currencies Do any currency to any currency work? Some currencies have restictions, either completely or between them that add complexity see those on the 'Currencies requiring further investigation' list Currencies requiring further investigation / Unable to add BRL Brazil Currencies able to add ARS Argentine` Peso Please excuse my formatting. I have not worked out tables yet, and tabs do not appear to work! |

|

@pazza83 Great thanks! Would be good to get USD in as well. I can prepare a PR if no other dev will pick it up first ;-) |

|

So this will be TW <--> TW only. How do we deal with TW -> SEPA? I guess there is no change to current situation, right? |

|

How do we deal with account signing for new payment methods? Or do we not need this new payment method to require signing because there is no chargeback risk? And yes TW --> SEPA works perfect right now as long as the TW user is using the multi-currency account option. If they use the old option then I think there has been some issues in the past but it can still work, however we should encourage TW users to set up a real account and not use the basic 'send money' feature. |

|

@viperperidot good question. I think we should bootstrap a market first. Stolen bank account risk is low if it is an emerging market. @viperperidot @pazza83 Could any of you provide a popup text with hints about TW account setup? What risk level (max trade amount) we should assign? Uphold has like SEPA 0.25 BTC. Probably better to not risk too much as credit card funding is still a bit of a risky terrain. |

Correct TW <--> TW only TW -> SEPA is no change it is effectively SEPA -> SEPA Same for: TW -> SEPA Instant |

|

@chimp1984 I would be willing to lock up BSQ if it meant I did not have to pay BTC security deposits. The amount of BSQ I would be willing to lock up would be approximately the maximum security deposit amount I have locked in offers at anyone time. I have 100+ offers with 0.06 BTC so that is at a minimum 0.6 BTC effectively 'reserved in offers'. At a maximum I will have 10 open offers at any one time so that is 0.06 BTC 'locked in offers' Maybe BSQ amount locked could be equivalent to BTC locked. Eg 0.06 BTC is approx 1000 BSQ. |

|

A BSQ bond would have a bit different flavour than a security deposit. The sec. deposit can be moved to the counterparty rather easily as it is part of the deposit tx. A BSQ bond can only be confiscated which should be an exceptional case and requires very high vote weight to succeed. So I think the direction to replace sec. deposit with BSQ bond would make things more complicate and would add more responsibility/weight on the DAO. |

|

I agree with you @chimp1984 that I think most people would probably not want to lock up a significant amount of funds and would not utilize this feature. One idea I had was that we could have a set amount, say $100 USD, that you can choose to lock up in a BSQ bond. If you do that you get some kind of indication on your Onion profile that you are a 'Bisq Supporter' or something of that nature. This could give some takers a bit more confidence when trading because it demonstrates that the person has a fairly good understanding of how Bisq works (by being able to buy BSQ and place it into a bond) and also that they have some amount of value invested into Bisq. By buying BSQ and locking it up in a bond you are supporting the developers. If we made this 'Bisq supporter' option a set amount of BSQ then that would eliminate the privacy concerns because all Bisq supporters would have the same amount. I think keeping it to a reasonable amount like around $100 in BSQ would encourage more people to use it and would be easy to verify I believe. If we can also fix the privacy issue of displaying someones Onion address that would be awesome as well. |

|

Yes such a "investors/supporters badge" would be nice, but I fear the added value would not justify the effort to implement it (the verification part). Still looking primarily for tools which can help to lift the amount limits as I think that is a major hurdle for trade volume and usage. Maybe adding chargeback safe payment methods is the best way we can do atm... |

|

Btw. TW got merged to master. It does not use account age signing. If there are strong reasons to add it please discuss further. |

You're probably right, I would like little things like that because I think it is cool but it would take a lot of effort and maybe would not have much adoption. I think adding TransferWise should encourage adoption and growth if people are aware about it, you can trade in almost any currency and also have zero chargeback risk with no signing limits. Pretty good option for someone who wants to come onto Bisq and start trading right away. |

@m52go Do you have any idea how we can promote Transferwise a bit more for next release? |

|

I will create some marketing material for this (Amazon and PayID) and have a think about how we can promote new payment methods in general. |

|

Closing as approved. Payment method included in v1.5 |

|

Is there a reason why one can’t create a Transferwise account in Bisq using the phone number in place of email? Transferwise’s “Send money to friends” heavily rely on phone contacts synced to the app. Why Bisq doesn’t allow to use the phone as, e.g. with Zelle payment method? |

|

Hi @leshik Thanks for the question.

Email was chosen over phone number for privacy reasons.

You can send payment by email within both the phone app and web app. Is there anything you are looking to do my phone number that cannot be done by email? |

|

@pazza83 I can't see how I could send money to email address in the mobile application. Phone numbers are just synced from phone contacts, but there's no option to send using an email address. Besides that, you can't attach more than one email address to the Transferwise account. As they require full KYC, usually the well known address is used, likely one containing the first and/or last name, which is bad for privacy. OTOH, the phone number is just a set of digits. |

|

Full KYC required in Australia etc to get mobile numbers. So no interest using that over email.

…________________________________

From: Alexey Zagarin <notifications@github.com>

Sent: Friday, December 11, 2020 11:26:05 PM

To: bisq-network/proposals <proposals@noreply.github.com>

Cc: Conza <conza_@hotmail.com>; Mention <mention@noreply.github.com>

Subject: Re: [bisq-network/proposals] Add Transferwise as new multi-currency payment method (#243)

@pazza83<https://github.com/pazza83> I can't see how I could send money to email address in the mobile application. Phone numbers are just synced from phone contacts, but there's no option to send using an email address.

Besides that, you can't attach more than one email address to the Transferwise account. As they require full KYC, usually the well known address is used, likely one containing the first and/or last name, which is bad for privacy. OTOH, the phone number is just a set of digits.

—

You are receiving this because you were mentioned.

Reply to this email directly, view it on GitHub<#243 (comment)>, or unsubscribe<https://github.com/notifications/unsubscribe-auth/AMMLWYS33YP577DGBQLDJCDSUIMW3ANCNFSM4P36UE4Q>.

|

Payments can be sent via email within the app.

The above is based on iOS

This is correct. You can set your email to whatever you like. For example I could have mine as 1346keudht@protonmai.com You can make payments by phone number also. What put me off this was that anyone with your phone number could see your account details on Transferwise. This is true with email but setting up a new email, at least for me, takes mins compared to getting a new burner phone |

|

@pazza83 this is what I see when I add someone else: Email is optional, but account details are required. Am I missing something? |

|

Once putting in email, if the user is already on TransferWise, it grabs their bank details automatically. The user has to have marked their primary account.

…________________________________

From: Alexey Zagarin <notifications@github.com>

Sent: Saturday, December 12, 2020 10:46:14 AM

To: bisq-network/proposals <proposals@noreply.github.com>

Cc: Conza <conza_@hotmail.com>; Mention <mention@noreply.github.com>

Subject: Re: [bisq-network/proposals] Add Transferwise as new multi-currency payment method (#243)

@pazza83<https://github.com/pazza83> this is what I see when I add someone else:

[image]<https://user-images.githubusercontent.com/443678/101967612-c8909900-3c4d-11eb-9b78-506df9f3e043.jpeg>

Email is optional, but account details are required. Am I missing something?

—

You are receiving this because you were mentioned.

Reply to this email directly, view it on GitHub<#243 (comment)>, or unsubscribe<https://github.com/notifications/unsubscribe-auth/AMMLWYWPEHJFVBPYNYQHAM3SUK4NNANCNFSM4P36UE4Q>.

|

|

Enter their email. If they have a 'Primary account' set up for that currency you will see their bank details and name. https://transferwise.com/help/articles/2932129/nominating-a-primary-account |

|

It is not so much disallowing phone numbers. It is only providing the information needed. You could add more info, but Bisq principles would be minimal amount information needed only. I can currently trade multiple currencies on TW without revealing my phone number. I would prefer not to add my phone number for privacy reasons. |

|

@pazza83 This could be implemented same way as with Zelle - same field but users are free to either put an email there or the phone. No need to enter both. |

|

Email would be the preferred option. Accessible on app and web. Phone number only accessible via app. |

|

You can enter the phone on web same way as email. Why to limit users options? |

|

That is great. I did not know that was possible. How do you send to a mobile number on the website? |

|

Personally I would choose to give out an e-mail over phone number 100% of the time. I think most people using Bisq are fairly privacy conscious and would choose the same option. Like @pazza83 said it is easy to create a dedicated TransferWise e-mail but more difficult to create a burner phone number. And I would never give my real phone number to people I trade with, but I would give my real e-mail although I still think it is good to create a dedicated one. From a security prescriptive e-mail is much better as well so you don't open yourself up to the rare but possible sim swap attack, TW itself only allows for 2FA over SMS and not authenticator apps. I'm not against having phone number as an option if people still want this feature but I would hope that users who only offer an e-mail could still take trades with the phone number people. |

|

@pazza83 hm, you're right – it's not possible now. I haven't checked before and thought it would work, very strange they don't allow this. So the rationale is we don't allow phones as this can't be used on the web. Makes sense then. |

|

Ok, yes that was the reason behind it. Otherwise it would be good to let people have the option to choose email or phone number. |

Uh oh!

There was an error while loading. Please reload this page.

Transferwise was often used in Bisq but it also often caused disputes as the IBAN could not be verified by the receiver. They use their bank(s) an use a reference ID to assign the payment to the users.

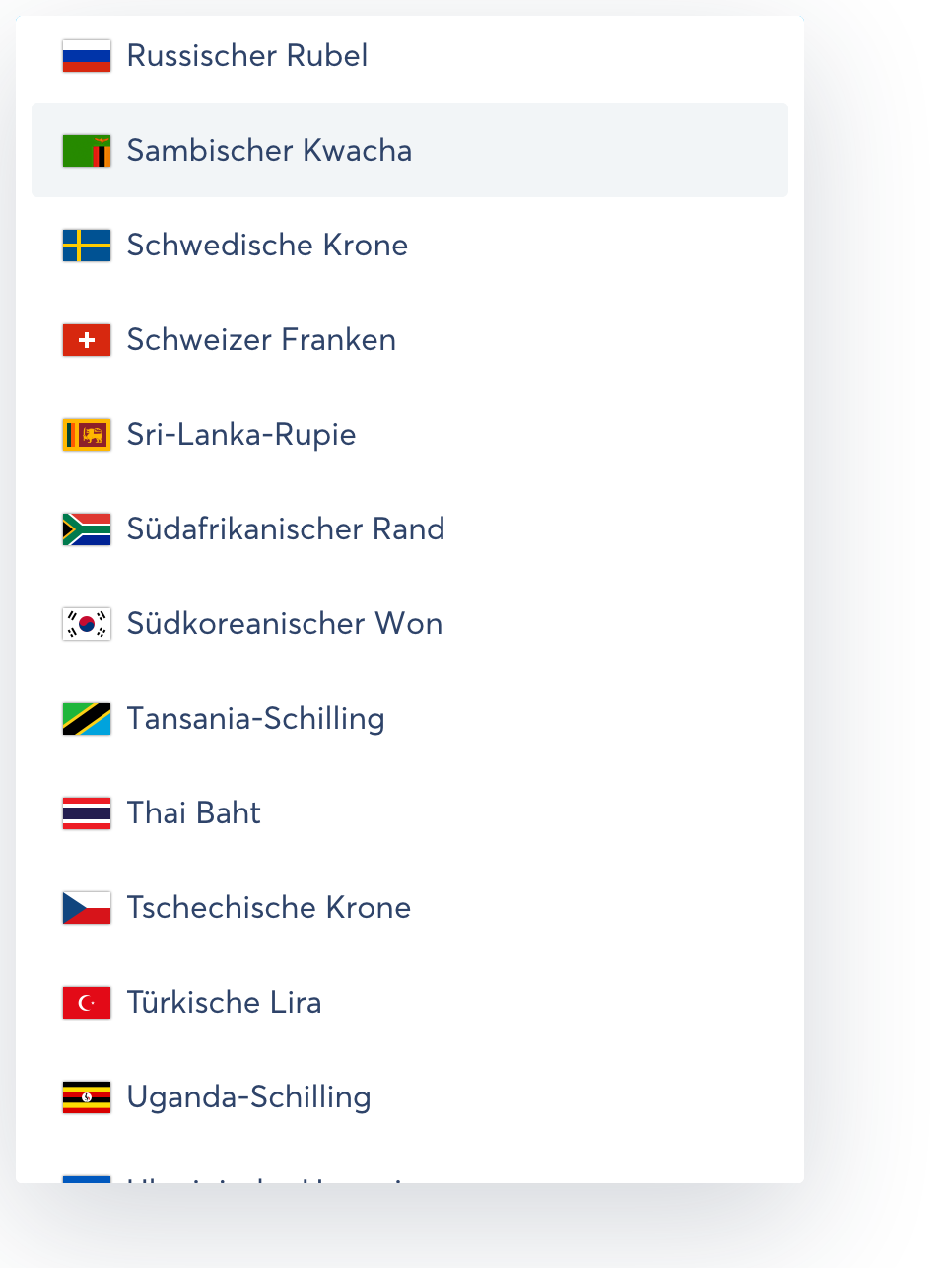

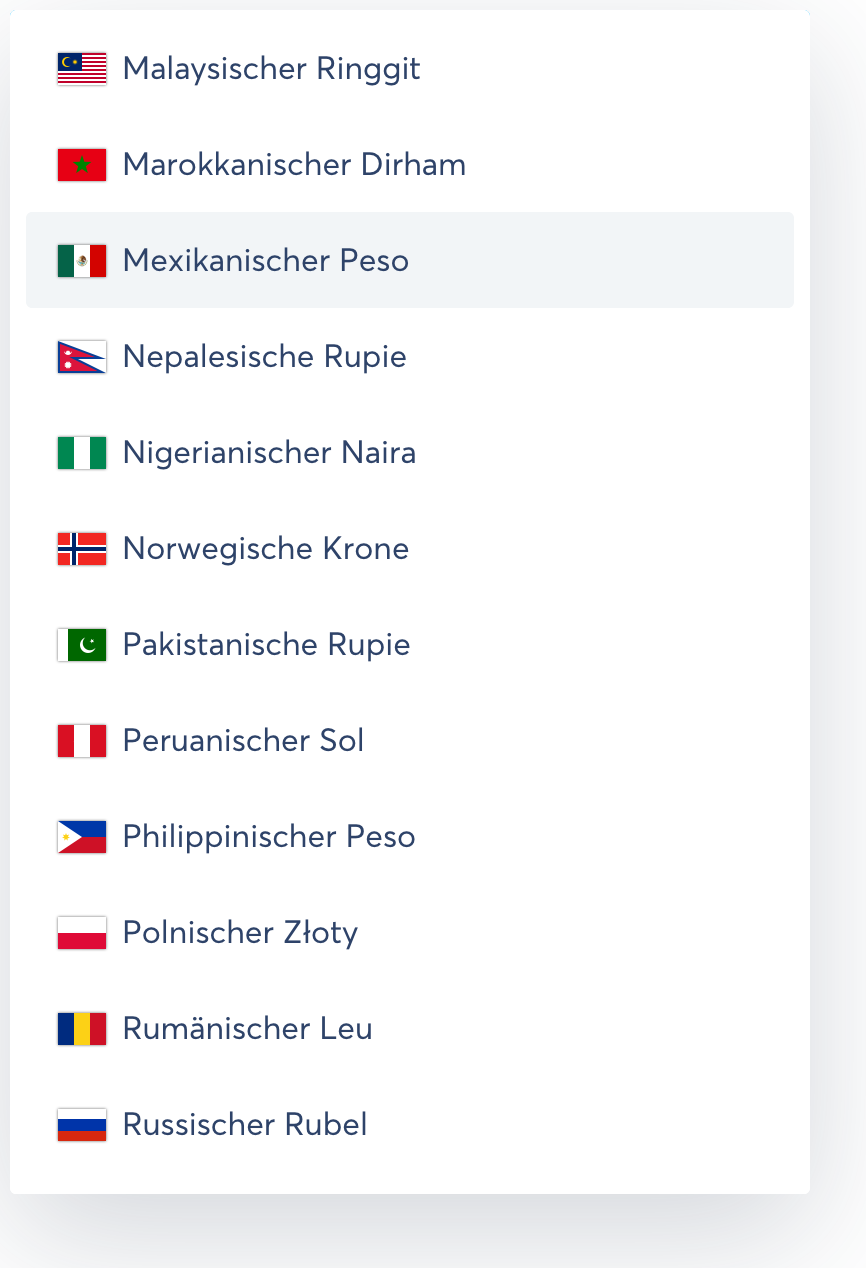

They offer lots of currencies (I will post screenshots of their currency list), so users could trade cross currency similar as it was the case with OkPay.

I gues that could boost trade volume as markets are not limited to the currencies anymore and it is a very modern and convenient payment provider.

Mandatory fields (for EUR, other currencies need to be tested):

They offer payment by credit card, which carries chargeback risk (risk of cashing out stolen creditcards).

https://transferwise.com/gb/blog/filing-chargeback-with-transferwise

Currency list:

The text was updated successfully, but these errors were encountered: