Bringing financial and business analysis to the tidyverse

Our short introduction to tidyquant on

YouTube.

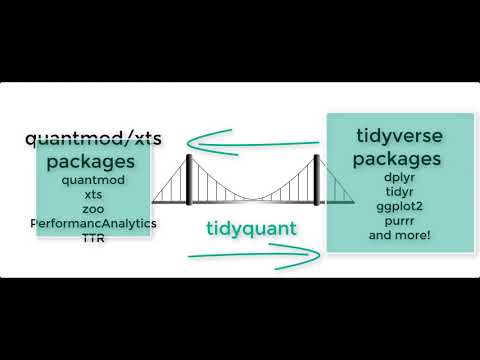

tidyquant integrates the best resources for collecting and analyzing

financial data using zoo, xts, quantmod, TTR, and

PerformanceAnalytics, with the tidy data infrastructure of the

tidyverse allows for seamless interaction between each. You can now

perform complete financial analyses in the tidyverse.

- A few core functions with a lot of power

- Integrates the quantitative analysis functionality of

zoo,xts,quantmod,TTR, and nowPerformanceAnalytics - Designed for modeling and scaling analyses using the

tidyversetools in R for Data Science - Implements

ggplot2functionality for beautiful and meaningful financial visualizations - User-friendly documentation to get you up to speed quickly!

- Excel in R - Pivot Tables, VLOOKUPs, and more: Details on the Excel integrations are covered in the blog article.

With tidyquant, all the benefits add up to one thing: a one-stop shop

for serious financial analysis!

-

Getting Financial Data from the web:

tq_get(). This is a one-stop shop for getting web-based financial data in a “tidy” data frame format. Get data for daily stock prices (historical), key statistics (real-time), key ratios (historical), financial statements, dividends, splits, economic data from the FRED, FOREX rates from Oanda. -

Manipulating Financial Data:

tq_transmute()andtq_mutate(). Integration for many financial functions fromxts,zoo,quantmod,TTRandPerformanceAnalyticspackages.tq_mutate()is used to add a column to the data frame, andtq_transmute()is used to return a new data frame which is necessary for periodicity changes. -

Performance Analysis and Portfolio Analysis:

tq_performance()andtq_portfolio(). The newest additions to thetidyquantfamily integratePerformanceAnalyticsfunctions.tq_performance()converts investment returns into performance metrics.tq_portfolio()aggregates a group (or multiple groups) of asset returns into one or more portfolios.

Visualizing the stock price volatility of four stocks side-by-side is quick and easy…

What about stock performance? Quickly visualize how a $10,000 investment in various stocks would perform.

Ok, stocks are too easy. What about portfolios? With the

PerformanceAnalytics integration, visualizing blended portfolios is

easy too!

- Portfolio 1: 50% FB, 25% AMZN, 25% NFLX, 0% GOOG

- Portfolio 2: 0% FB, 50% AMZN, 25% NFLX, 25% GOOG

- Portfolio 3: 25% FB, 0% AMZN, 50% NFLX, 25% GOOG

- Portfolio 4: 25% FB, 25% AMZN, 0% NFLX, 50% GOOG

This just scratches the surface of tidyquant. Here’s how to install to

get started.

Development Version with Latest Features:

# install.packages("devtools")

devtools::install_github("business-science/tidyquant")CRAN Approved Version:

install.packages("tidyquant")The tidyquant package includes several vignettes to help users get up

to speed quickly:

- TQ00 - Introduction to

tidyquant - TQ01 - Core Functions in

tidyquant - TQ02 - R Quantitative Analysis Package Integrations in

tidyquant - TQ03 - Scaling and Modeling with

tidyquant - TQ04 - Charting with

tidyquant - TQ05 - Performance Analysis with

tidyquant - Blog Article: Excel in R - PivotTables, VLOOKUPs, and more!

-

- Performance Analysis & Portfolio Optimization with

tidyquant- A 1-hour course ontidyquantin Learning Labs PRO

- Performance Analysis & Portfolio Optimization with

-

- Building an API with

plumber- Build a stock optimization API withplumberandtidyquant

- Building an API with

-

- Stock Portfolio Optimization and Nonlinear Programming - Use the

ROIpackage withtidyquantto calculate optimal minimum variance portfolios and develop an efficient frontier.

- Stock Portfolio Optimization and Nonlinear Programming - Use the

-

- Shiny Financial Analysis with Tidyquant API & Excel Pivot Tables - Learn how to use the new Excel Functionality to make Pivot Tables, VLOOKUPs, SUMIFs, and more!