GoTrade is a FIX protocol electronic trading and order management system written in Golang, structured for typical multi-asset instituional use

This project is currently more of a proof of concept. It is no where near in completeness of a commerical product. This public repo serves as mostly for the purpose of experimenting and share of ideas.

$ go get -u github.com/cyanly/gotrade

- Trade in real-time via FIX through the broker-neutral API.

- Normalized FIX order flow behavior across multiple FIX versions and asset classes.

- Pure Go.

- Platform neutral: write once, build for any operating systems and arch (Linux/Windows/OSX etc).

- Native code performance.

- Ease of deployment.

- Lack of OOP verbosity, works for small and big teams.

- Protobuf.

- Binary encoding format, efficient yet extensible.

- Easy Language Interoperability (C++, Python, Java, C#, Javascript, etc).

- Protocol backward compatibility.

└─ gotrade/

├─ core/ -> The low-level API that gives consumers all the knobs they need

│ ├─ order/

│ │ └─ execution/

│ ├─ service/

└─ proto/... -> Protobuf messaging protocol of various entities

└─ services/ -> Core services managing multi-asset order flow

│ ├─ orderrouter/ -> Centralized management facility for multi-asset global order flow

│ ├─ marketconnectors/ -> Managing FIX connection to each trading venue, also performs pre-trade risk checks

│

└─cmd/... -> Command-line executables, binary build targets

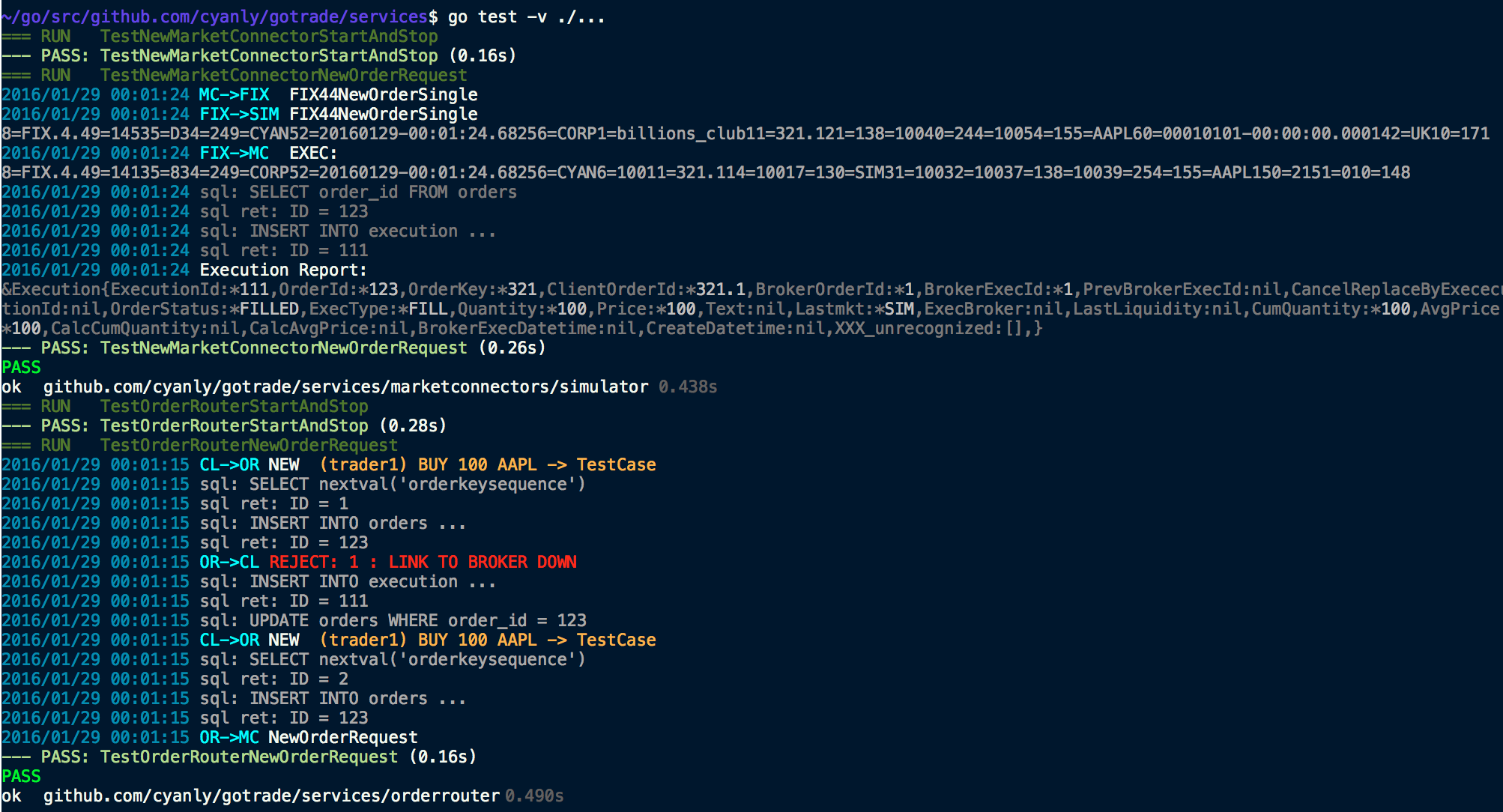

The best way to see goTrade in action is to take a look at tests (see Benchmark section below):

Pre-Requisites:

- Go 1.4 or higher

- get dependencies:

$ cd $GOPATH/src/github.com/cyanly/gotrade

$ go get -u -t ./...

OrderRouter and MarketConnector test cases will mock a testdb and messaging bus for end-to-end, message to message test.

$ cd $GOPATH/src/github.com/cyanly/gotrade/services/orderrouter

$ go test -v

$ cd $GOPATH/src/github.com/cyanly/gotrade/services/marketconnectors/simulator

$ go test -v

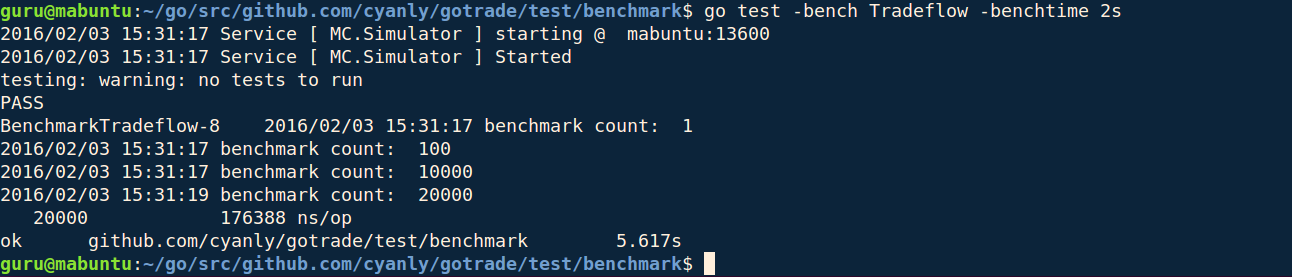

Machine: Intel Core i5 CPU @ 2.80GHz + Ubuntu 14.04 Desktop x86_64

test/benchmark/client2fix_test.go- CL ⇒ OR:

Client send order protobuf to OrderRouter(OR) - OR ⇒ MC:

OrderRouter process order and dispatch persisted order entity to target MarketConnector - MC ⇒ FIX:

MarketConnector translate into NewOrderSingle FIX message based on the session with its counterparty - FIX ⇒ MC:

MarketConnector received FIX message on its order, here Simulator sending a fully FILL execution - EXE ⇒ CL:

MarketConnector publish processed and persisted Execution onto messaging bus, here our Client will listen to

Included:

- from order to FIX to a fully fill execution message to execution protobuf published back

- serialsing/deserialsing mock order into protobuf messages

- Request/Publish and Response/Subscribe via NATS.io message bus

- Time spent in the Linux TCP/IP stack

- Decode FIX messages and reply by a simulated broker

Excluded:

- Database transaction time (hard-wired to an inline mock DB driver)

Result:

0.176ms per op, 5670 order+fill pairs per sec

GoTrade © 2016+, Chao Yan. Released under the GNU General Public License.

Authored and maintained by Chao Yan with help from contributors (list).

Contributions are welcome.