-

Notifications

You must be signed in to change notification settings - Fork 4

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

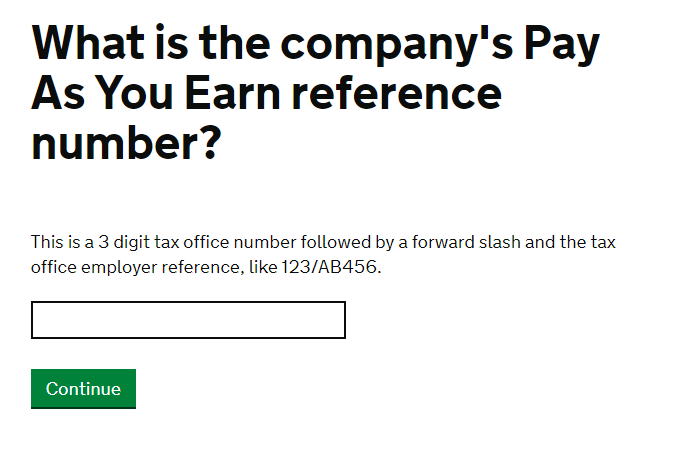

Employer PAYE reference #138

Comments

|

@JenniferClark I think PAYE reference can actually be 14 characters. I was told it is:

This was taken from the RTI specification for employers to send PAYE information to HMRC. |

|

This could be to future proof the reference getting longer?

*Jennifer Clark* | Senior User Researcher (Live Service and A/B

Testing Programme

Lead)

CDIO - Digital Delivery Centre Newcastle | Room BP9001 | Prudhoe House |

Benton Park View | Newcastle upon Tyne | NE99 1ZZ | 03000 572959 |

jennifer.clark@digital.hmrc.gov.uk

…On 27 November 2017 at 10:43, Steven Proctor ***@***.***> wrote:

@JenniferClark <https://github.com/jenniferclark> I think PAYE reference

can actually be 14 characters. I was told it is:

- a 3 digit tax office number

- a slash

- between 1 and 10 characters for the tax office employer reference

This was taken from the RTI specification for employers to send PAYE

information to HMRC.

—

You are receiving this because you were mentioned.

Reply to this email directly, view it on GitHub

<#138 (comment)>,

or mute the thread

<https://github.com/notifications/unsubscribe-auth/AIlLQ0yg6Y2K2iWY34PVx4JHAzDlDU9oks5s6pI_gaJpZM4QpsvL>

.

|

|

From service Apply for the National Minimum Wage social care compliance scheme |

|

@jennifer-hodgson This is from Pension Registrations Scheme prototype. |

|

I'm working on documenting this, as part of the references and identifiers pattern, and I'm wondering whether guidance exists as to whether we refer to this particular reference number as PAYE reference or employer reference number (I note that this varies in the examples above). Due to the ambiguity, this feels like something we should mention within the documentation - @stevenaproctor, @JenniferClark - do you have any thoughts on this? |

|

AFIK the employer reference number is something different - it's the AB456 bit after the slash. The entire number, including the digits before the slash, is the PAYE reference number. Agree there needs to be consistency, but I haven't been involved in designing any services that use the term. |

|

@jennifer-hodgson I did some digging and found a list of defined terms from HMRC's online services. These seemed less detailed than I remembered so I went back to the descriptions from 2009. The employer PAYE reference explains the different parts like @JenniferClark mentioned. Both lists contain information that will help document references and identifiers, including the aliases and alternative names issue. I think we need to add Accounts Office Reference and Company Registration Number and its other names to our list. They are used a lot in business tax services. |

|

This is very useful - thanks folks! @JenniferClark @stevenaproctor |

|

Some of our users have multiple Employer PAYE reference and do not know which to enter in our services. has anyone else seen this before? |

|

Hi, My company was registered in 1994 and the ERN only has digits after the

However I tend to get it rejected on web forms as they are programmed to expect there to be one or more alphabetic characters immediately after the slash. Could the guidance be updated to reflect that the number can be entirely numeric? |

|

Hi, We have an ask in PAYE Income, Allowances, Benefits and Deductions, to ask after the pension provider's PAYE reference. Apparently it's the same format as employers but looking to see if any service has asked for this from the pensions side? If we come up with something, I'll share it here |

PAYE reference number field was recently implemented to validate on 10 characters only, but it can be 11 characters if business was registered after 2001.

See example in national minimum wage social care compliance service: https://www.tax.service.gov.uk/apply-for-social-care-compliance-scheme/capacity-registering

More info:

An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN. It is given to a business when it registers with HMRC as an employer, serving to identify the employer for employee income tax and national insurance purposes.

When it first employs someone, the business must register– typically online- as an employer with HMRC, who will issue a welcome pack that includes the employer reference number.

The employer reference number is in two parts. The first part is 3 digits, which identifies the HMRC office number that deals with the company’s PAYE (e.g. 135). The second part of the reference, which follows a forward slash, is the tax office’s reference for the employer itself. (e.g. AB56789).

A business registered as an employer before 2001 will have an employer reference number in the form 135/A56789. Those registered after that date will take the form 135/AB56789.

The text was updated successfully, but these errors were encountered: