-

Notifications

You must be signed in to change notification settings - Fork 1.4k

Home

For enterprises, managing a payments stack is a complex problem. Today’s leading companies have perfected it by developing their own closed source payment kernels. And everyone is developing theirs from scratch, and spending years maintaining their implementations.

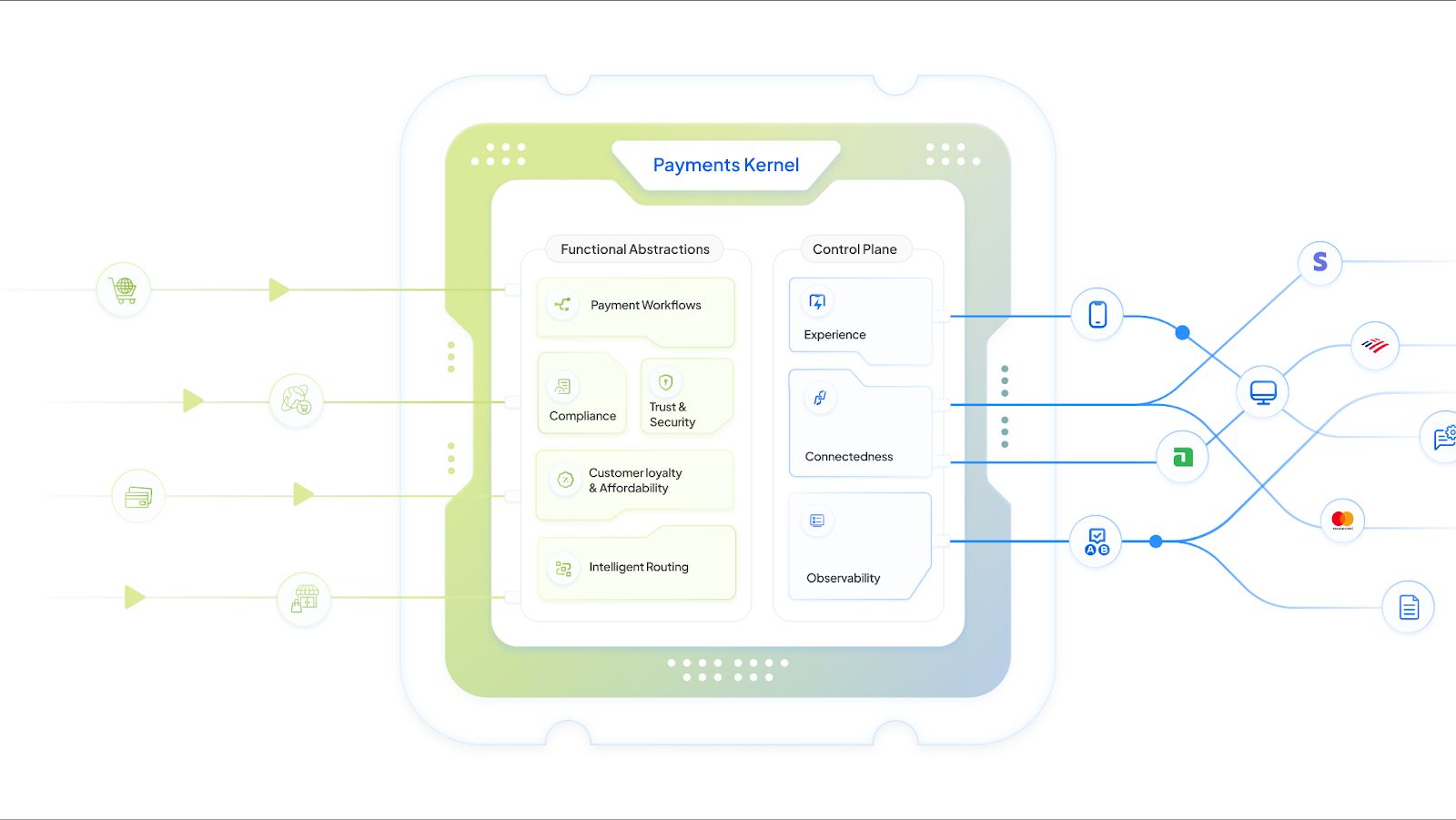

When you look at them closely, all such systems are designed to offer the same core “functional abstractions” and "control plane abstractions".

At the heart is the control plane of the kernel that manages 5 core functions:

- Payment workflows: To control the business logic and lifecycle of the payment

- Intelligent routing: To dynamically switch between processors to tradeoff between auth rates and cost.

- Trust & security: Managing strong customer authentication, reducing fraud and chargeback costs

- Customer loyalty and affordability: To deliver customer benefits, provide incentives, offers and loyalty programs

- Compliance: Quickly adapting to changing regulations, data privacy laws and data residency requirements around the world

A layer below the control plane manages

- Connectedness: The connectedness function of the kernel manages, how the system is connected to the physical layer / the pipes - fraud and risk management blocks, the PSPs, Pay Facs, processors, acquirers, banks, debit networks, card schemes, pay-by-bank rails, BNPL providers and wallets. And finally, a layer above the control plane, that manages the last two core functions

- Experience: The user checkout experience layer which runs across web, mobile, point of sales devices and smart devices. This has a direct impact on the revenues and customer retention.

- Observability: For the payments PMs, and the operators to audit, track and A/B experiment the various functions and optimize payments.

Going back to the early days of high performance computing, tech companies invested heavily in developing their own closed source versions of Unix. At that time it was the only conceivable approach to developing such advanced software. Eventually though, open source Linux gained popularity – initially because developers could modify its code however they wanted, affordably, and over time because it became more secure, more advanced, and attracted a broader ecosystem supporting more capabilities than any closed source Unix.

Today Linux is the standard foundation for the Internet - for both cloud computing and operating systems that run most mobile devices and endpoints – and we all benefit from superior products because of it.

Why isn’t there a common-core for functions that make up Payments - a core so advanced, open, and capable like Linux?

Why do leading tech companies develop them from scratch and spend years maintaining their closed payment implementations, while each reinventing the same things?

Why is open source the best development stack for payments innovators?

It has been an exciting journey since Hyperswitch was open sourced in October 2022. We came across a lot of Architects, CTOs, Payment product managers.

And, we usually hear several themes:

“We need to control our own destiny and not get locked into a single PSP model or a single payment partner”.

Organizations don’t want to depend on singular models that they cannot control themselves, across costs/economics and conversion rates. They don’t want closed model providers to be able to change their processing model, alter their terms of use or even stop serving them entirely. They also don’t want to get locked into a single PSP that has exclusive rights to processing. Open source enables a broad ecosystem of companies, including bank acquirers, with compatible toolchains that you can move between easily

“We need to train, fine-tune and distill our own payment authorization and FRM models. But doing that requires integrating new challenger PSPs (upfront investment) and learning the nuances of how best to configure each new PSP (experimentation investment) for improving authorization rates, and controlling fraud and processing costs”.

Essentially a steep investment that looks insurmountable to payment teams, especially when business is in a hyper-growth phase and breaking payment flows is very expensive for business. A hyper connected open source kernel exactly knows the toolchain and payment data configurations required to just plug-in and configure a new PSP overnight with the right objectives, dynamically route transactions across multiple PSPs, while also offering observability and experimentation as an A/B infrastructure.

“We also want to keep experimenting with new FRM providers, and new customer authentication strategies to progressively reduce our chargeback rates. Integrations and experimentations are time consuming for our engineering. It feels like working with multiple black boxes when we look at the current state of our integration and the last thing we want is for it to break”.

Again, open source enables a broad ecosystem of companies, FRM providers, and authentication flows, that can be added and dropped easily and transparently. It’s like connecting a new type of storage device on a Linux kernel, or a new manufacturer’s Network interface card, where the kernel ensures the semantics of the new interface provider have toolchains compatible to the target objective.

“Our contracts with PSPs, BNPL providers, co-branded card issuers, FRM providers, are all unique to us, and reflect our consumer’s and our business’ needs. We need to protect this”.

Open kernels let you assemble your device yourself, and protect your own data. You talk to open source via configurations and parameters to change the behavior of the toolchains it offers. The number of “ready” configurations open source can offer to you will far surpass what your own hundred or even thousand people payments team can build for you over several years. And eventually the kernel, the toolchains and the semantics it uses are all transparent, modifiable.

Earlier this year Hyperswitch was adopted by an emerging US event ticketing startup, a major French enterprise that specializes in US payment systems for American car parks and public transport operators, and a major Swiss Insurer with global business in the US, Europe, Asia and Latam.

Starting 2025, we expect future Hyperswitch tool chain to become even more advanced and get widely used by major enterprises across the world.

A trustable, open source, hyper-connected payments kernel will be the new path forward in the payments world !!