-

Notifications

You must be signed in to change notification settings - Fork 25

4. Liquidity Pool

A liquidity pool can be set up by anyone (namely liquidity provider) to support trading of selected assets and leverages. Synthetic asset liquidity pools are different from margin trading pools in functionality, and risk mechanisms.

Find out more details on synthetic asset liquidity pools.

Find out more details on margin trading liquidity pools.

Below are simple guidelines for

Synthetic Asset Pools

- Create a pool

- Deposit/withdraw liquidity

- Enable synthetic token for trade

- Set up collateral ratio and spread

Margin Trading Pools

- Create a Pool

- Deposit/withdraw Liquidity

- Enable trading pairs

- Set up spread, swap and other parameters

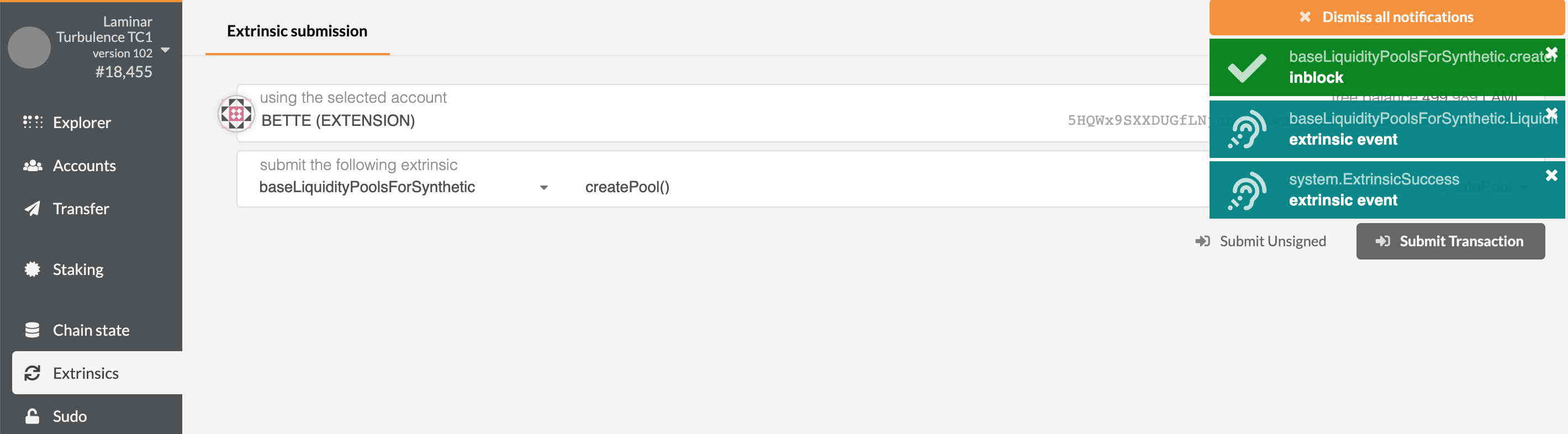

Create a pool

Use Extrinsics call

Use Extrinsics call baseLiquidityPoolsForSynthetic.createPool()

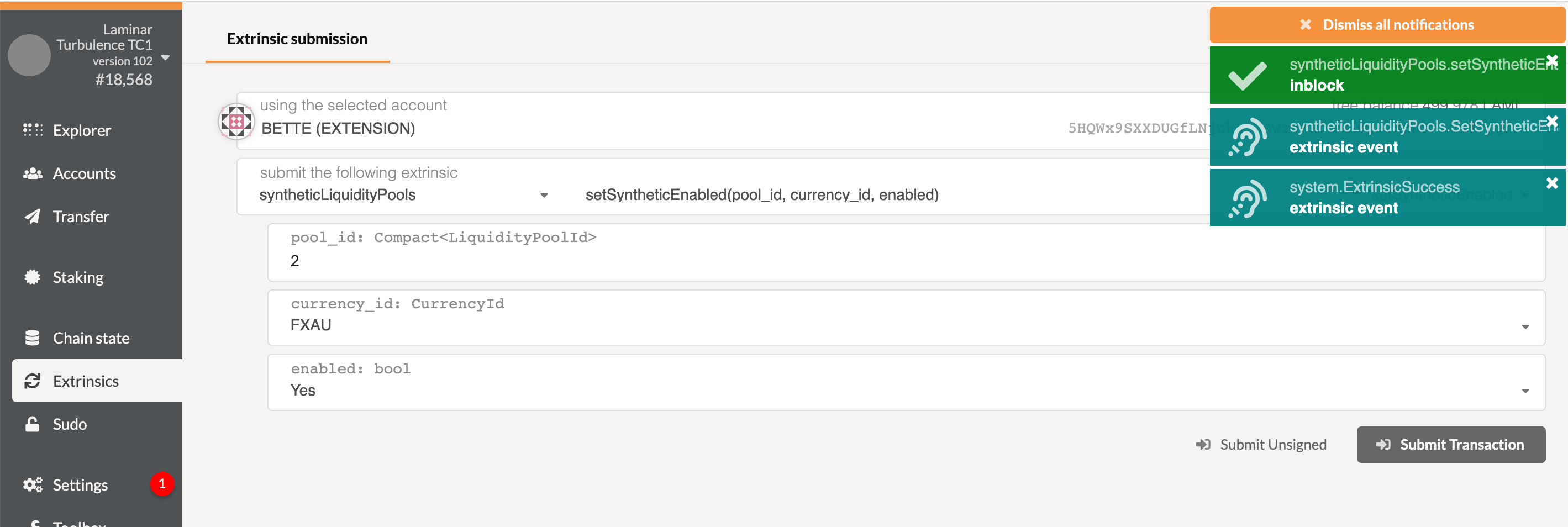

Enable Trades

Use Extrinsics call

Use Extrinsics call syntheticLiquidityPools.setSyntheticEnabled(pool_id, currency_id, enabled)

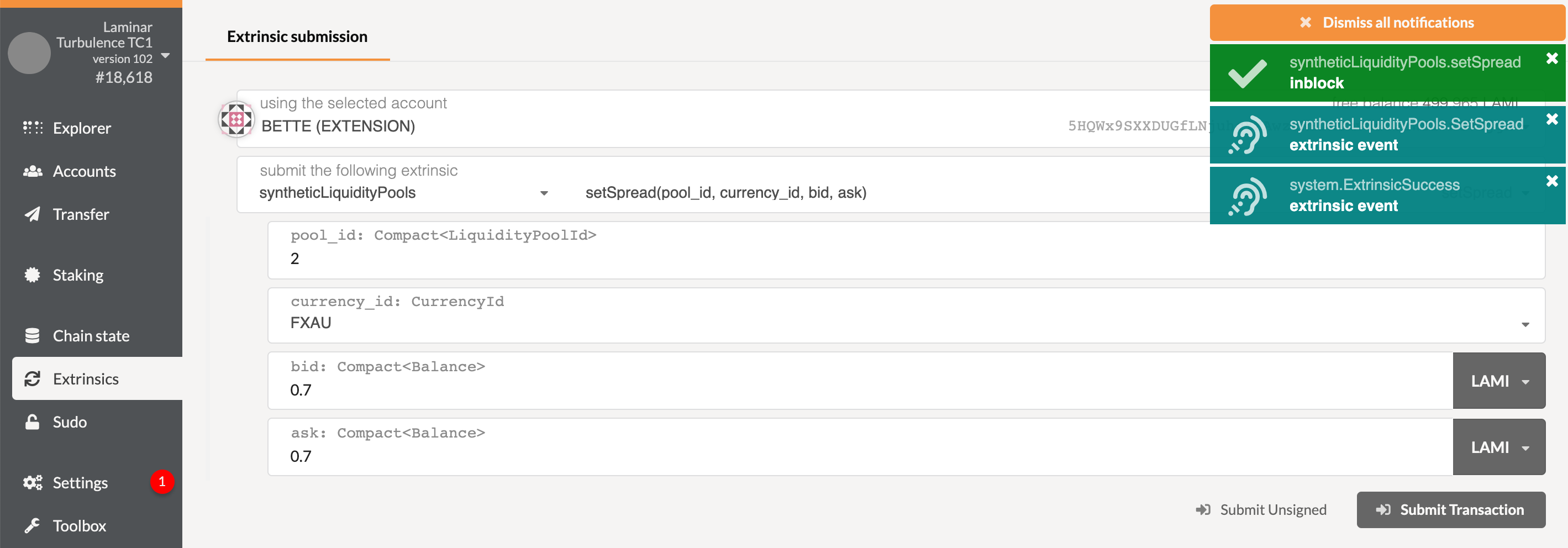

Set Spread

Use Extrinsics call

Use Extrinsics call syntheticLiquidityPools.setSpread(pool_id, currency_id, bid, ask)

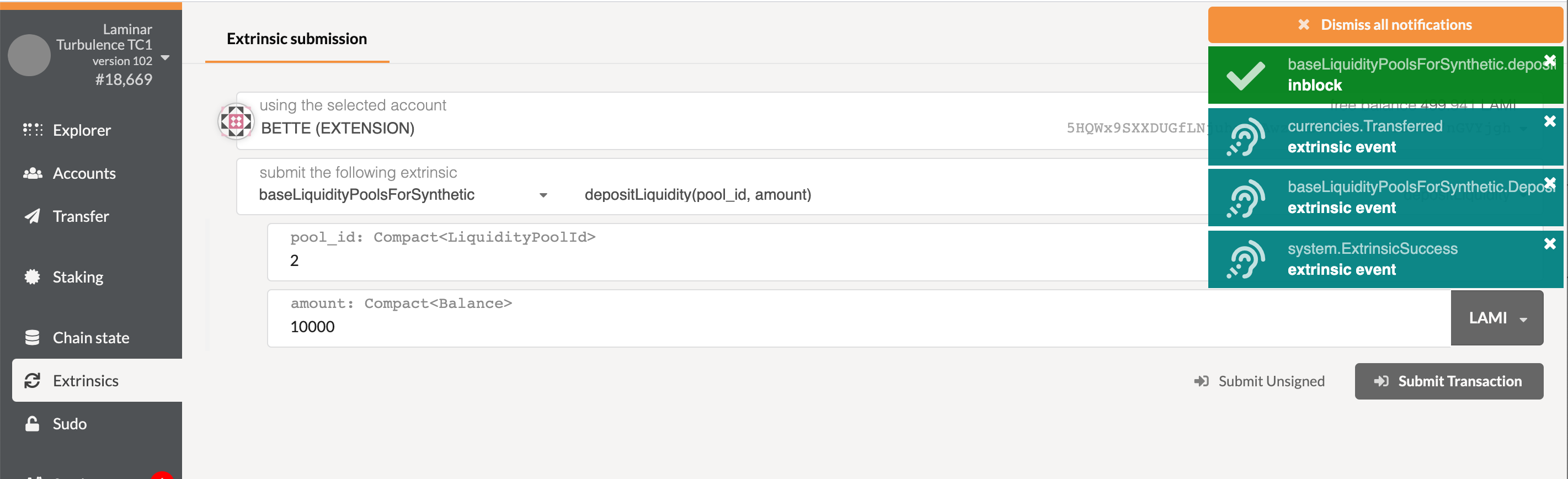

Deposit

Use Extrinsics call

Use Extrinsics call baseLiquidityPoolsForSynthetic.depositLiquidity(pool_id, amount)

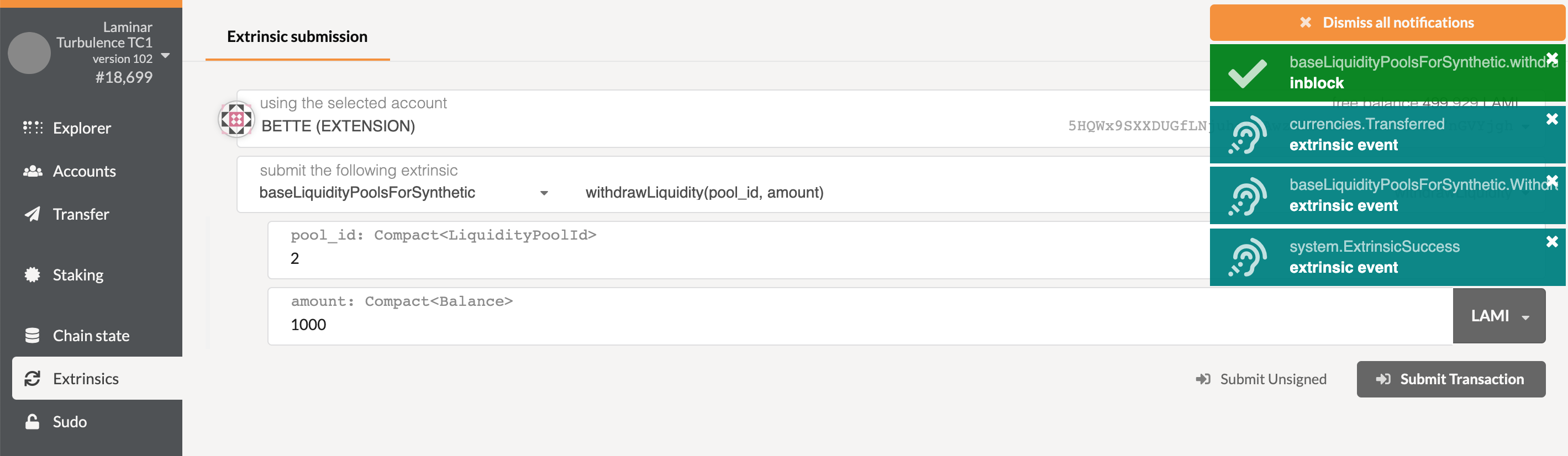

Withdraw

Use Extrinsics call

Use Extrinsics call baseLiquidityPoolsForSynthetic.withdrawLiquidity(pool_id, amount)

Pools have a default

Pools have a default additional collateral ratio say 0.1 - meaning that for a $100 fEUR swap, users would put up $100 dollar worth of collateral to mint fEUR, while the synthetic asset pool will put up an additional 10% to counter price fluctuation. But this value can be overridden by individual pools, using Extrinsic call syntheticLiquidityPools.setAdditionalCollateralRatio(pool_id, currency_id, ratio)

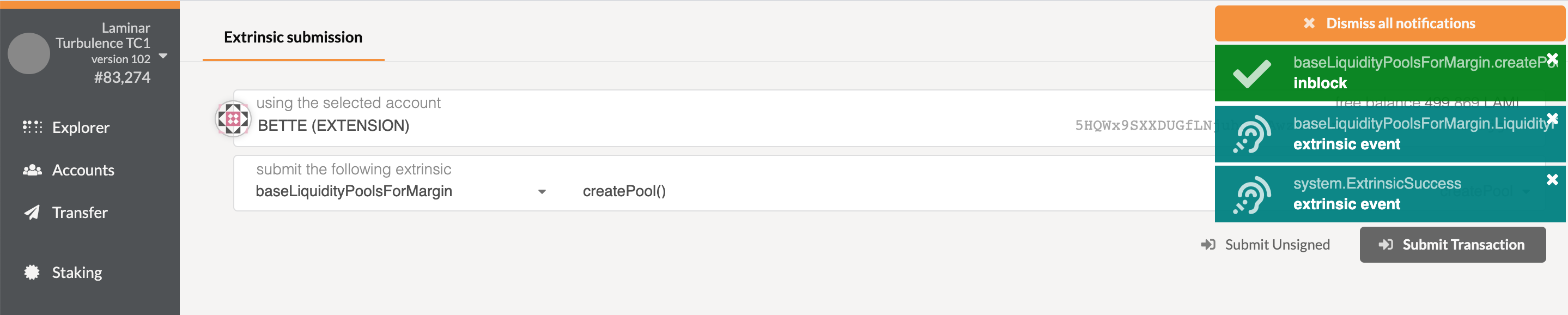

Use Extrinsics call

Use Extrinsics call baseLiquidityPoolsForMargin.createPool()

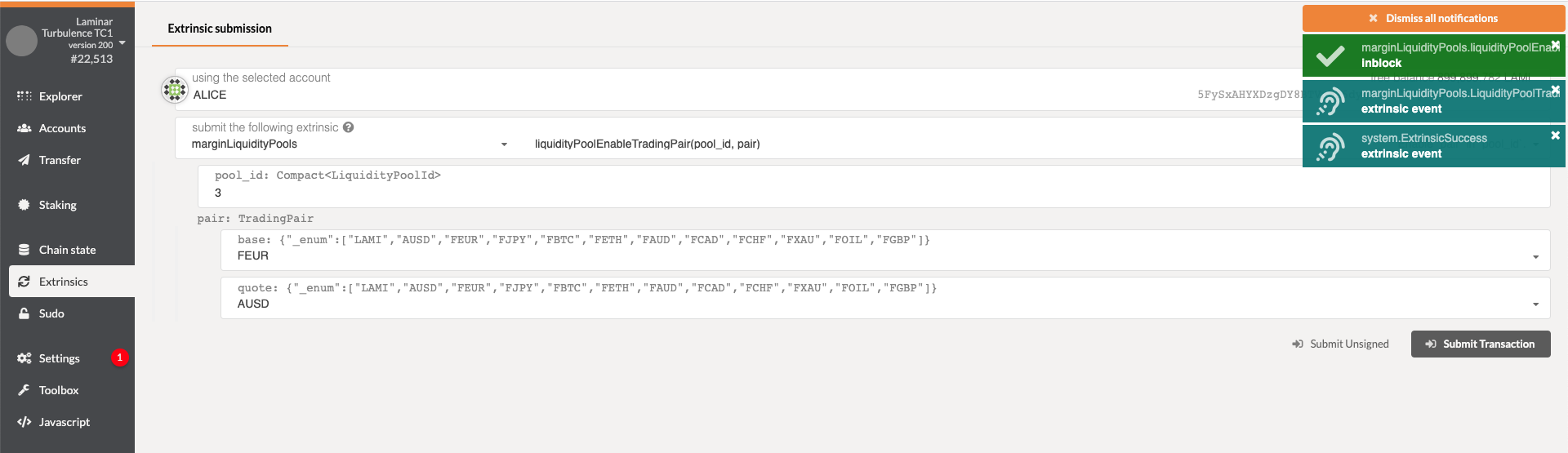

Enable trading pairs

Use Extrinsics call

Use Extrinsics call marginLiquidityPools.liquidityPoolEnableTradingPair(pool_id, pair)

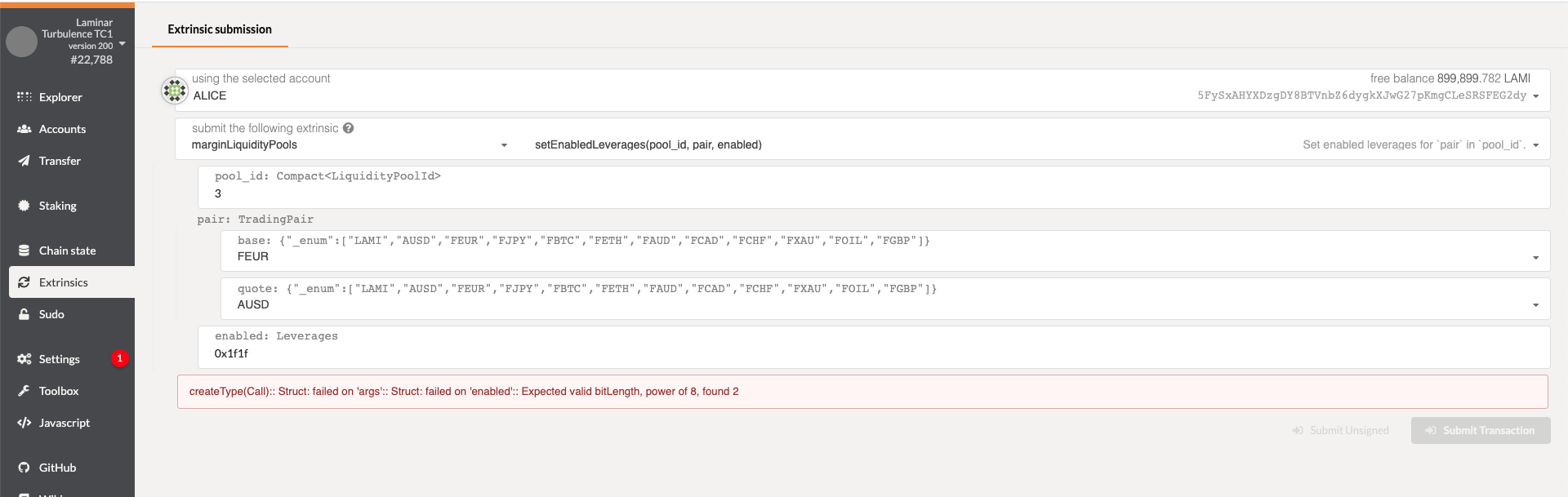

Enable leverage

Use Extrinsics call

Use Extrinsics call marginLiquidityPools.setEnabledLeverages(pool_id, pair, enabled)

[Note] currently there's an issue with Polkadot{js}, but this can be done via Laminar's sdk with something like marginLiquidityPools.setEnabledLeverages(3, ['FEUR', 'AUSD'], 0x1f1f)

Note that the leverage field is a bit mask represented in hex 0x1f1f as 0b0001111100011111 to support 2, 3, 5, 10 and 20 times long and short margin trading.

See more details on leverage bit mask here

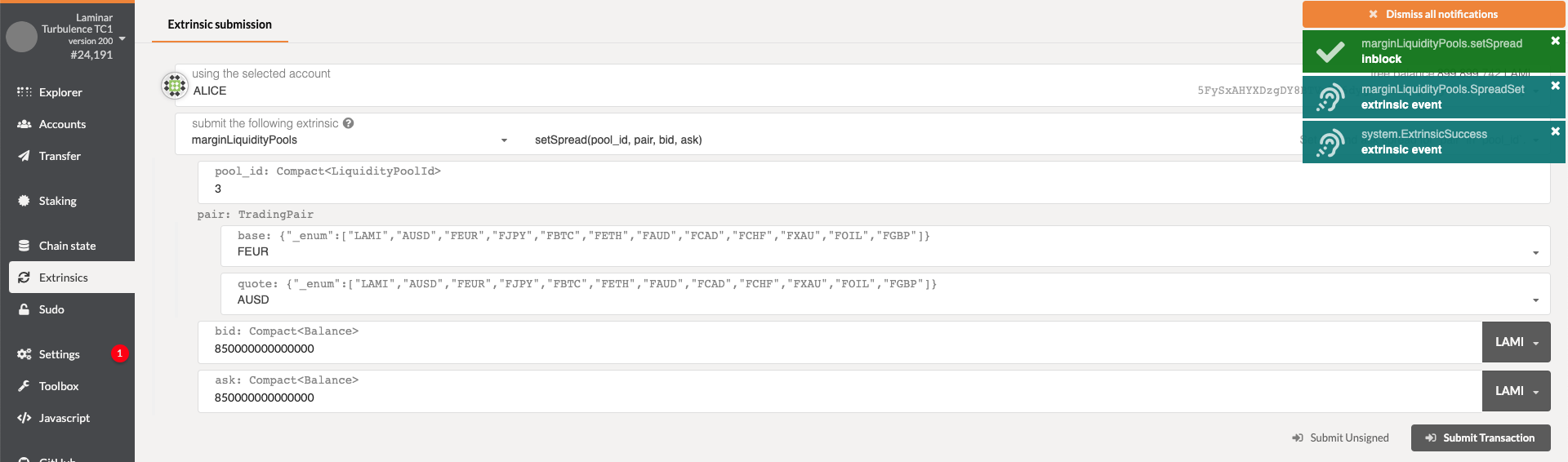

Set up spread, swap and other parameters

Use Extrinsics call

Use Extrinsics call marginLiquidityPools.setSpread(pool_id, pair, bid, ask)

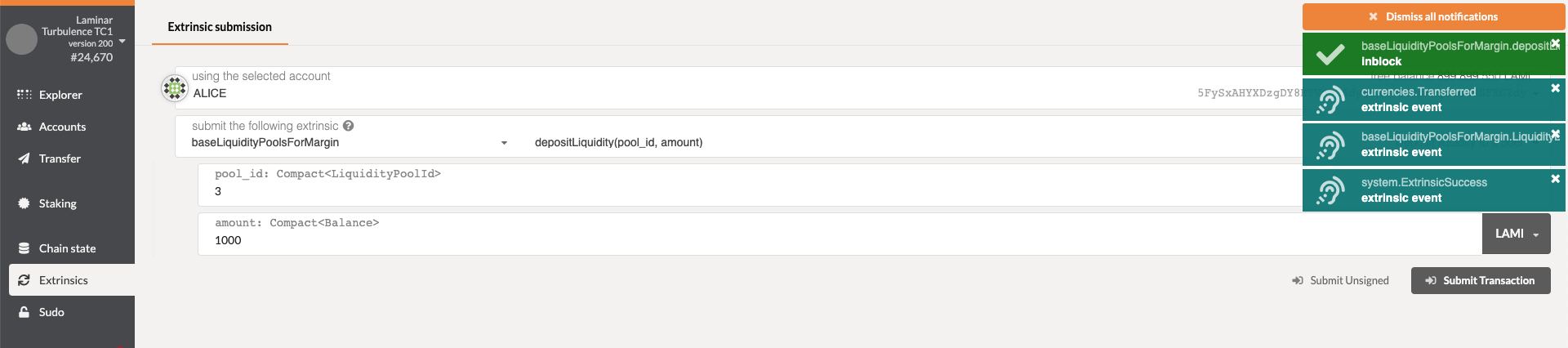

Deposit

Use Extrinsics call

Use Extrinsics call marginLiquidityPools.depositLiquidity(pool_id, amount)

Liquidity pool will require initial deposit for it to be operational.

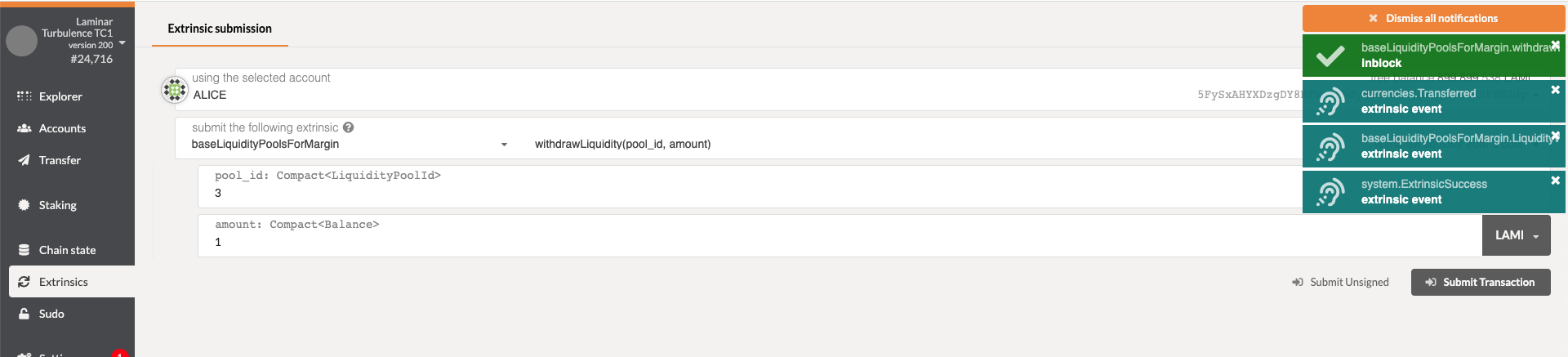

Withdraw

Use Extrinsics call

Use Extrinsics call marginLiquidityPools.depositLiquidity(pool_id, amount)

Only the amounts that are not used as collateral can be withdrawn.

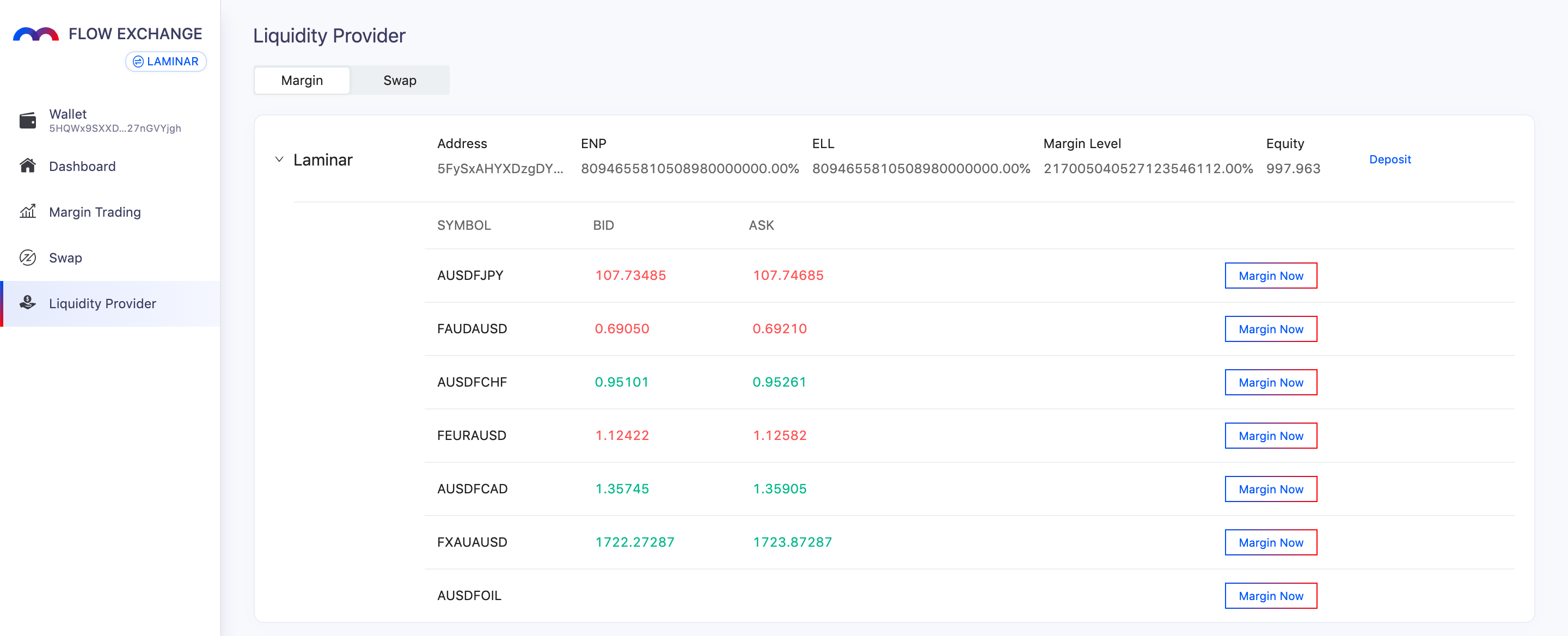

Navigate to the Liquidity Pool page to see all pools available, their respective supported trading pairs and spreads, and also trade from there.

We do not provide a user interface for creating and setting up a pool at this stage. If you'd like to become a liquidity provider, please get in touch.